Ways And Means Committee Tax Cut Would

Cost at Least

$2.8 Trillion in Second 10 Years

by Iris J. Lav

| While the Archer bill has been modified to reduce its cost over the first ten years from $864 billion to $792 billion, the cost in the second 10 years would nevertheless be $2.8 trillion. All but a minor amount of the cost reduction in the first 10 years is accomplished by slowing down the phase-in of several provisions; this analysis shows that the long-term cost would not be significantly reduced. |

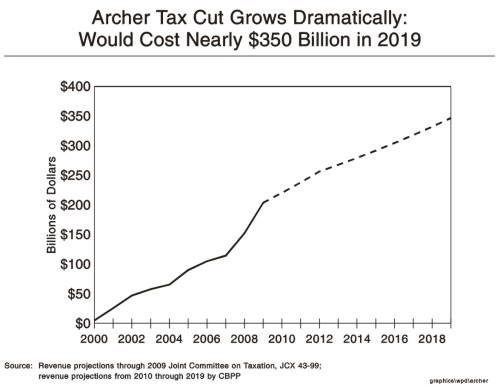

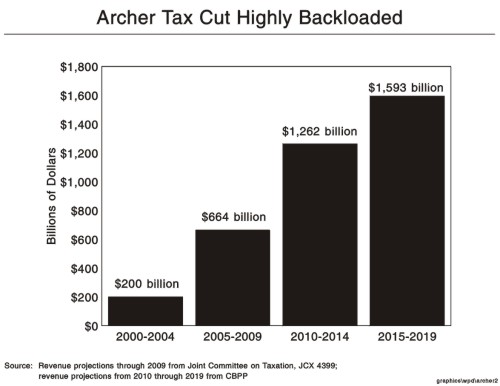

The tax cut package that the House Ways and Means Committee has approved costs $864 billion over the ten-year period from 2000 through 2009. Most of this cost is loaded into the second five years of the period; according to the Joint Committee on Taxation, the cost is $200 billion from 2000 to 2004, rising to $664 billion from 2005 to 2009. By 2009, the annual cost reaches $203 billion. (It jumps from $152 billion to $203 billion in a single year between 2008 and 2009.)

After the initial 10-year period, the costs of the tax-cut package would explode. Using conservative assumptions concerning the package’s cost in the second 10 years — from 2010 to 2019 — shows the following:

- From 2010 to 2019, when all of the provisions are fully in effect, the tax cut package would cost at least $2.8 trillion.1 (Note: The Treasury Department’s estimate is similar — $3.0 trillion over this period.)

- This is more than three times the $864 billion cost shown for the package over the first 10 years. (See graphs below.)

These mammoth costs would occur at the same period of time when the baby boom generation will begin to retire and non-Social Security surpluses are expected to level off and ultimately to decline.

The cost grows sharply over time because many of the provisions of the proposal phase in gradually. The phased-in provisions, most of which are not fully effective until 2008 or 2009, include: the rate cut; the repeal of the individual and corporate Alternative Minimum Tax; the new deductions for health insurance and long-term care insurance; and the repeal of the estate tax. (Much of the effect of the costly estate tax repeal, which becomes effective for people who die in 2009, would be felt only after the end of the 10-year period reflected in the Joint Tax estimate, because there is a time lag in the settlement of estates and thus in the payment of tax.)

End Notes:

1. Costs for years after 2009 were projected as follows: The 2009 cost was increased at the same rate as CBO projects that GDP will be growing at the end of the 10-year period, a nominal rate of 4.4 percent per year. Additional adjustments were made to reflect the full phase-in of the estate tax repeal. JCT estimates show that under current law, the estate tax will bring in $40 billion in revenue in 2008. As a result, repealing it ultimately would cost $40 billion. Because of the phase-in of the estate tax repeal, the JCT estimates show the repeal costing only $15 billion in 2009. To reflect the cost of the full phase-in of the repeal, an additional $24 billion in revenue losses was added, on a phased-in basis, over the three-year period from 2010 through 2012.