Tax Freedom Day Report Flawed

| View PDF version of this factsheet View HTML of full report View PDF of full report If you cannot access the file through the link, right-click on the underlined text, click "Save Link As," download to your directory, and open the document in Adobe Acrobat Reader. |

Washington D.C. — The Tax Foundation today issued a report stating that "the average American taxpayer is shouldering a heavier tax burden than he ever has before." According to Iris Lav, Deputy Director of the Center on Budget and Policy Priorities, "the Tax Foundation report presents a misleading picture of the tax burden middle-income families face." (For a more complete analysis, see the Center report Tax Foundation Figures Lead to Inaccurate Impression of Middle-Income Tax Burdens, available on the Center's website at https://www.cbpp.org/4-11-01tax.htm.)

Lav pointed out that "the Tax Foundation approach substantially exaggerates the amount of taxes that middle-income families pay. Because of the progressive structure of the federal income tax, the tax burden of middle-income families is substantially less than the 'average' tax burden calculated by the Tax Foundation."

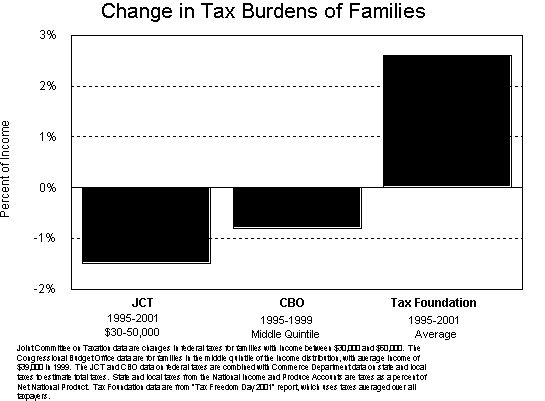

The Congressional Budget Office and the Joint Committee on Taxation, the two leading sources of tax information for Congress, find that taxes on families in the middle of the income spectrum are substantially lower than the taxes the Tax Foundation claims Americans pay on average. Furthermore, taxes on middle-income families have been declining in recent years, not rising as the Tax Foundation report would lead the public to believe.

- The Tax Foundation's approach focuses on average taxes, dividing total tax payments by total income. To illustrate the problems with this approach, suppose four families with $25,000 incomes each pay five percent of their income ($1,250) in income tax, while one family with $500,000 in income pays 25 percent of its income ($125,000) in income tax. On average, these five families pay 22 percent of income in income taxes (total tax payments of $130,000 divided by total income of $600,000 equals 22 percent). But the income tax rate for the four moderate-income families is five percent, not 22 percent.

- Thus, under the methods the Tax Foundation uses, increased tax payments solely by high-income taxpayers increase the taxes that "Americans" pay and thereby advance "Tax Freedom Day" to later in the year.

The Tax Foundation methodology produces particularly sharp distortions given that, in recent years, high-income people have experienced strong income growth, due primarily to large increases in capital gains income and executive salaries, and therefore have paid more in taxes. (Despite the increase in their tax bills, the after-tax incomes of these high-income people have still grown far more than the incomes of the bulk of the population. Indeed, IRS data show that the after-tax incomes of tax filers in the top one percent of the income spectrum grew by 40 percent between 1989 and 1998, compared to only 5 percent for the bottom 90 percent of families.)

Middle-Income Tax Burden Declining in Recent Years

The Tax Foundation's claim that Americans' tax burdens have reached a new high each year since 1993 is untrue for most taxpayers. In fact, federal taxes have been declining for families in the middle of the income spectrum. According to the Joint Committee on Taxation, middle-income taxpayers — those with incomes between $30,000 and $50,000 — will pay a lower share of their incomes in federal taxes in 2001 than they did in 1995. Congressional Budget Office data are also at odds with the Tax Foundation's claim of growing middle-income tax burdens (see chart below). Similarly, a Treasury Department study found that a married couple with two children that earns the median income paid a smaller percentage of its income in federal income and payroll taxes in 1999 than in any year since 1978.

Nor have taxes been rising at the state and local level. Commerce Department data show that state and local taxes as a percentage of Net National Product have been remarkably stable over time; they were at about the same level in 2000 as in 1977.

Federal revenue has increased as a share of the economy in recent years. But this largely reflects the increased taxes collected from high-income individuals as a result of substantial increases in their capital gains income and salaries and bonuses; it does not reflect an increase in ordinary families' tax burdens. For example, a January 2001 analysis by the Congressional Budget Office found that capital gains realizations nearly tripled between 1994 and 1998, accounting for roughly 30 percent of the increase in tax collections relative to GDP. CBO also reported that a significant share of the remaining increase could be attributed to income growth at the top of the income distribution.

Burden of Federal Individual Income Taxes Small for Middle-Income Families

The Tax Foundation's release of its study around the income tax filing date may lead people to think federal income taxes are the main cause of the high tax burdens that the Tax Foundation pictures the average family as facing. In fact, the Joint Committee on Taxation estimates that families in the middle of the income spectrum will pay just 5.9 percent of income in federal individual income tax in 2001. In the Tax Foundation's terms, that means it took only until January 21 for middle-income families to pay their federal income taxes.

The Tax

Foundation's Average Tax Measure Each year around April 15, the Tax Foundation issues a report about what it calls "Tax Freedom Day." This year, the Tax Foundation claim that "the nation's taxpayers" must work until May 3rd to pay their taxes for 2001. In making this claim, the Tax Foundation relies on a measure of average taxes; the Foundation takes what it says is the total amount paid in federal, state, and local taxes and simply divides this amount by its estimate of the total amount of income in the nation. It calls this figure the taxes that Americans pay on average. For a number of reasons, the Tax Foundation calculation is a deeply flawed measure of the percentage of income that most Americans pay in taxes. Moreover, the Tax Foundation's presentation of these figures invites middle-income taxpayers to believe that they pay considerably more of their income in taxes than the data show to be the case. Average tax figure misleading. The average tax burden for the population as a whole is a figure that misleads many people and is frequently misused. This figure is described by the Tax Foundation, and often is cited by policymakers and pundits, as reflecting what the average or typical middle-income family pays in taxes. But middle-income families do not pay the average tax burden; they pay substantially less than that. This is a result of the progressive structure of the federal income tax, under which the wealthy pay a substantially higher percentage of income in federal taxes than the middle class or the poor do. While the typical middle-income family is in the 15 percent federal income tax bracket, high-income families are in brackets with marginal rates more than twice that high and pay much higher percentages of income in federal income tax than middle-income families do. Using averages for the whole population when talking about tax burdens for the average middle-income family produces skewed results. It ascribes to middle-income families average amounts of such taxes as the estate tax and the corporate income tax. These taxes, however, are paid solely or primarily by taxpayers at considerably higher income levels than the average middle-income taxpayer. The Congressional Budget Office and the Joint Committee on Taxation find that average federal tax burdens for the middle fifth of the population are substantially lower than the federal tax burdens in the Tax Foundation report. The Tax Foundation estimates for 2001 are between one-fourth to two-fifths higher than the estimates of average tax burdens for families in the middle of the income spectrum made by these respected sources of analysis for Congress. That is because the CBO and Joint Tax Committee figures are not distorted by the taxes that high-income families pay. (Note that the CBO data are for 1999, the latest year available.) Non-tax items counted. In making its calculation, the Tax Foundation counts as taxes items that are not taxes. These include: optional Medicare premiums that older Americans pay if they wish to receive coverage for physicians' services under Medicare; intra-governmental transfers that are solely bookkeeping devices and not taxes; and rental payments that individuals or businesses pay to state or local governments to rent property those governments own. Taxes counted, but taxed income not counted. The tax measure the Tax Foundation uses in its "Tax Freedom Day" report counts capital gains taxes as part of the taxes people pay, but fails to count as part of people's income the capital gains income on which these taxes are levied. Counting taxes while failing to count the income on which the taxes are paid makes taxes appear larger as a percentage of income than they truly are. In addition, in a period such as the present when capital gains income and hence taxes on such income are rising rapidly, the Tax Foundation procedure makes even average tax burdens appear to be growing faster than they actually are growing. These flaws in measurement of taxes and income have led the Tax Foundation to show that taxes are rising, when data from authoritative sources show tax burdens on typical middle-income families are falling. |