Without Reductions in

Discretionary Programs,

There Would Be Little Budget Surplus Outside Social Security

In Effect, Tax Cut Proposals are Financed

by Cutting Discretionary Programs

by Sam Elkin

In fiscal year 1998, the federal government as a whole ran its first surplus in decades. Current projections suggest that without any major changes in law, the government will continue to run substantial surpluses for a number of years.

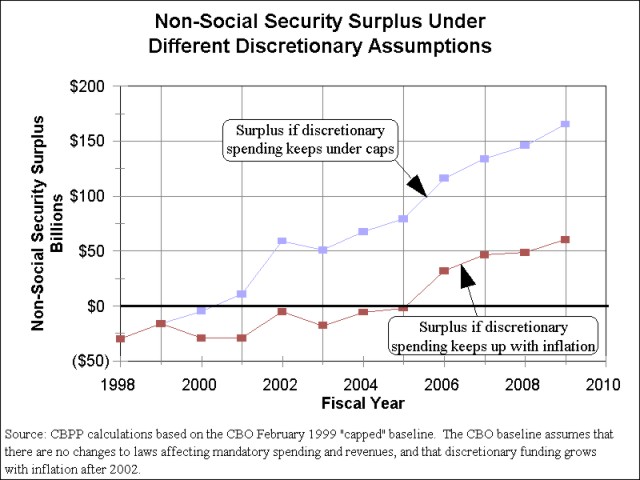

A large portion of the projected surplus is due to the build-up of Social Security reserves. What has received less attention is that the vast majority of the remaining (i.e., non-Social Security) surplus depends on planned, although as-yet-unspecified, reductions in discretionary programs (i.e., non-entitlement programs). If discretionary programs were maintained at current levels (as adjusted for inflation) rather than reduced, there would be little surplus in the non-Social Security budget.

- The latest Congressional Budget Office projections show that under current law, the federal government will begin to run surpluses in the non-Social Security budget in fiscal year 2001. Over the next 10 years, CBO projects a net non-Social Security surplus of $824 billion.

- In making these projections, CBO assumes that total discretionary spending will remain within the stringent limits or "caps" that the 1997 budget agreement established for years through 2002. CBO also assumes that after 2002, overall discretionary spending will be limited to the level of the discretionary spending cap for 2002, adjusted only for inflation. These assumptions result in CBO estimates that discretionary spending will be held over the next 10 years to levels $580 billion below current (i.e., FY 1999) levels, adjusted for inflation.

- Reducing government expenditures results in lower levels of debt; the $580 billion in discretionary program savings assumed in the CBO baseline are projected to generate $146 billion in additional savings through lower interest payments on the debt. Consequently, the reductions in discretionary programs that CBO assumes in the baseline result in a total of $726 billion in savings over the next 10 years and increase the projected budget surplus by that amount.

- These $726 billion in savings account for all of the non-Social Security surplus through 2006 and 88 percent of the non-Social Security surplus projected over the next 10 years. About nine of every 10 dollars of the non-Social Security surpluses that CBO projects from fiscal year 2000 through 2009 result from reductions in discretionary programs.

Discretionary

Spending Cuts and the Surplus |

||

| 5-year 2000 - 2004 |

10-year 2000 - 2009 |

|

| Non-Social Security surplus under CBO projection and current caps | $184 |

$824 |

| Non-Social Security surplus if discretionary programs keep up with inflation | -$87 |

$98 |

| Percent of non-Social Security surplus that depend on discretionary cuts | More than the entire surplus | 88% |

| Source: CBPP calculations based on CBO February 1999 data | ||

These discretionary program reductions are likely to come largely — and probably entirely — from non-defense discretionary programs. If funding for the defense budget is maintained through 2002 at its current level, adjusted for inflation, and the caps on discretionary spending are adhered to, overall expenditures for non-defense discretionary programs must be reduced 18 percent by 2002, after adjusting for inflation.(1)

Under the budget resolutions the Senate and House Budget Committees passed the week of March 15, overall expenditures for non-defense discretionary programs would, in fact, be cut 18 percent by 2002, after adjustment for inflation. The cuts would deepen to 28 percent to 29 percent by 2009, as the budget resolutions would continue to hold non-defense discretionary spending below inflation over that period. Since some areas of non-defense spending would be spared from deep cuts, other discretionary programs would have to be cut still more deeply than this.

The budget resolutions would use the vast majority of the non-Social Security surplus to finance large tax cuts. Without reductions in discretionary programs, however, there would be no non-Social Security surplus until 2006 and little total surplus over the next 10 years. The conclusion thus is clear — the proposed tax cuts would effectively be paid for by deep reductions in non-defense discretionary programs.

Background on the Discretionary Caps

Discretionary spending covers virtually all government activities other than entitlement programs. It includes the Pentagon, international programs, NASA, environmental programs, national parks, community and economic development, education, job training, Head Start, public health programs, housing, veterans hospitals, law enforcement, rural programs, general government operations, highways, and energy, agricultural and biomedical research, among others.

The Balanced Budget Act of 1997 established annual, fixed dollar limits, known as "discretionary caps," on total discretionary spending for each fiscal year from 1998 through 2002. These caps were designed to yield substantial savings, with the savings concentrated in the years from 2000 to 2002. In those years, there would be fewer resources each year, in inflation-adjusted terms, for the activities, projects, and programs that discretionary spending funds.

By 2002, total resources for discretionary programs must be reduced 10 percent below the 1999 level, after adjusting for inflation, to fit within the caps.(2) If defense programs are "held harmless" by allowing military spending to keep pace with inflation, overall expenditures for other discretionary programs must be cut 18 percent by 2002. If defense spending is increased and rises more rapidly than inflation, non-defense discretionary spending must be cut by a still-larger amount.

The 1997 balanced budget agreement does not specify which discretionary programs should be cut. It leaves to appropriators in future years the unpopular decisions concerning where the ax should fall. Many budget experts and Members of Congress have expressed doubts that cuts of the magnitude the caps require are feasible politically.

Projections of large surpluses in the non-Social Security budget assume, however, that such cuts will be made and that policymakers will adhere to the discretionary caps.(3) If policymakers are unable to agree on such cuts, discretionary spending will be higher than is assumed in the CBO projections, and the non-Social Security surplus will be smaller.

Spending Cuts Would Pay for Tax Cut Proposals

The budget resolutions the House and Senate Budget Committee have approved use the vast majority of the projected non-Social Security surpluses to finance large tax cuts. As the foregoing discussion indicates, nearly all of the financing for the tax cuts effectively comes from the reductions in discretionary programs. For there to be a sufficient surplus available to fund these tax cuts, policymakers would have to make cuts of unprecedented depth in the discretionary part of the budget.

Moreover, the budget resolutions the House and Senate Budget Committees have passed assume still-deeper reductions in discretionary programs than those CBO assumed when projecting the budget surplus. The budget resolutions add about $200 billion in additional discretionary cuts in the years from 2003 to 2009; they do so by placing funding for non-defense discretionary programs in those years below the level of the discretionary spending cap for 2002, as adjusted for inflation. By 2009, these additional reductions bring the overall depth of the cuts in non-defense discretionary programs to 28 percent to 29 percent below current levels, after adjusting for inflation. Since funding for some program areas — such as highways, mass transit, elementary and secondary education, crime programs, veterans health programs, and NIH research — would be protected from cuts under the budget proposals and in some cases increased, the rest of the non-defense discretionary budget would have to be sliced 35 percent to 40 percent below current levels, adjusted for inflation, by 2009.(4)

Non-defense discretionary spending now stands at 3.4 percent of the Gross Domestic Product, which ties for its lowest level as a share of the U.S. economy since 1962.(5) Under the pending budget resolutions, it would fall much further. Under both the House and Senate resolutions, expenditures for non-defense discretionary programs would drop to 2.1 percent of GDP by 2009, a level only about three-fifths the share of GDP that non-defense discretionary programs constituted back in 1962.

End Notes:

1. The FY 1999 level used here as a point of reference excludes emergency spending.

2. The Omnibus Appropriations Bill for fiscal year 1999 included a relatively large amount of emergency spending. This figure assumes that the emergency spending will not be repeated in subsequent years and compares spending levels for future years to the 1999 level exclusive of emergency spending. If the emergency spending is included, by 2002, the caps would require a reduction of 12 percent in the real resources available to discretionary programs.

3. The CBO projections assume discretionary spending will remain within the caps in each year for which there is a cap in place. After 2002, the last year for which a cap has been set, the projections assume that funding for discretionary programs will equal the level of the cap for 2002, adjusted for inflation.

4. For a further discussion of these issues see Robert Greenstein, "The Republican Budget Proposals," Center on Budget and Policy Priorities, March 19, 1999.

5. In fiscal years 1962, 1989, and 1998, non-defense discretionary spending was also at 3.4 percent of GDP. In all other years since 1962, the level was higher than that, equaling or exceeding four percent of GDP in every year but two from 1966 through 1985 and reaching 5.2 percent of GDP in 1980. 1962 is the earliest year for which data on non-defense discretionary spending are available.

Related reports:

|