|

March 22, 2006

TESTIMONY

BEFORE THE PENNSYLVANIA HOUSE OF REPRESENTATIVES FINANCE COMMITTEE ON STATE

EARNED INCOME TAX CREDITS

Nicholas Johnson, Director, State

Fiscal Project

Center on Budget and Policy Priorities

Chairman Leh, Chairman Levdansky and members of

the committee:

Thank you for the opportunity to testify today

about the Earned Income Tax Credit, or EITC. My name is Nicholas Johnson. I am

Director of the State Fiscal Project at the Center on Budget and Policy

Priorities. The Center is a non-profit, non-partisan research institute in

Washington. Our policy work addresses a range of government policies, with a

particular focus on their impacts on low- and moderate-income families. My work

for the last ten years has focused on state tax and budget policies. A major

area of concentration for me has been the design and implementation of state tax

policies that are targeted to poor families, particularly working-poor families.

My remarks today focus on three areas:

- I will describe the federal EITC and the state

EITCs that have been enacted in 19 states.

- I will explain how a Pennsylvania state EITC

might operate and who would benefit.

- I will place the possibility of a Pennsylvania

state EITC in the context of current discussions of an increase in the state

minimum wage.

Federal and State EITCs

The Earned Income Tax Credit addresses a

fundamental problem: many working families do not earn enough to live on.

Their wages are low and the costs of supporting a family — food, clothing,

housing, transportation, job-related costs, health care and so on — are

substantial. Some of those costs may be defrayed through various forms of

public programs. But most low-income families who are working receive only

limited help from public programs.

In Pennsylvania in 2003, there were about 163,000

working families with children whose incomes fell below the federal poverty

line. (The federal poverty line varies by family size and is adjusted each year

for inflation; in 2006 dollars, the poverty line for a family of four is roughly

$20,000.) Several hundred thousand more working families in Pennsylvania have

incomes slightly above the federal poverty line but still have difficulty making

ends meet.

One cost that low-income Pennsylvania families

face to a greater extent than families in other states is state and local

taxes. I should note that Pennsylvania no longer levies income tax on

low-income families, because of the “tax forgiveness” credit which is claimed on

Schedule SP of the Pennsylvania income tax form. This credit has been expanded

substantially since the mid-1990s; it now eliminates income tax liability for a

family of four with income up to $32,000.

However, Pennsylvania families – particularly

working families with relatively low incomes – pay substantial amounts of other

state and local taxes. These include general sales taxes, excise taxes,

property taxes, and local wage taxes, among others. The Institute on Taxation

and Economic Policy estimates that the lowest-income 20 percent of Pennsylvania

households in 2002 paid, on average, 11.4 percent of their incomes in state and

local taxes, a higher share than any other income group.

The Federal EITC

The Earned Income Tax Credit is a wage supplement

for low- and moderate-income working families, administered through the income

tax. The federal Earned Income Tax Credit was enacted in 1975, and major

expansions were enacted in 1986, 1990, and 1993. Today it is widely recognized

as the single most important public source of income support for working

families with children.

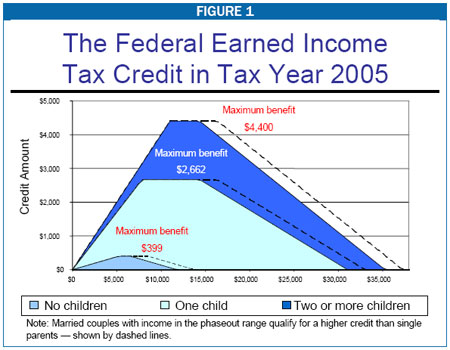

The EITC is available, by design, only to working

families. The maximum EITC benefit for the 2006 tax year is $4,520 for families

with two or more children and $2,737 for families with one child. The greater

EITC benefit for larger families reflects recognition that larger families face

higher living expenses than smaller families.

The EITC benefit that an eligible family receives

depends on the family’s income. For families with very low earnings, the value

of the EITC increases as earnings rise. A family with two or more children, for

example, receives an EITC equal to 40 cents for each dollar earned if their

earnings are $11,000 or less. The rate is slightly lower, 34 cents, for

one-child families. In this way, the EITC acts as a wage subsidy.

The maximum credit is available to single-parent

families with incomes up to $14,760, or two-parent families with incomes up to

$16,760. Above those income levels, the EITC gradually phases out, so that

families with incomes as high as $37,000 may receive some benefit from the

credit.

Workers without a qualifying child also may

receive an EITC, but the maximum credit for individuals or couples without

children is $411 in 2006, much lower than the credit for families with children,

and the income eligibility range is much smaller.

The effectiveness of the federal EITC both in

supporting work and in alleviating child poverty has been confirmed by a number

of recent studies.

- The EITC now lifts more than 4 million people

— roughly half of them children — out of poverty each year; it is the nation’s

most effective antipoverty program for working families.

- A substantial body of academic research now

shows that the credit has contributed to a significant increase in labor force

participation among single mothers.

- Interviews with EITC recipients show that many

use their EITC refunds to make the kinds of investments — paying off debt,

investing in education, securing decent housing — that enhance economic

security and promote economic opportunity.

State EITCs

Since the late 1980s, some 19 states have enacted

EITCs of their own. State EITCs have received broad support. EITCs have been

enacted in states led by Republicans, in states led by Democrats, and in states

with bipartisan leadership. The credits typically are supported by business

groups, social service advocates, faith-based groups, labor unions, and others.

State EITCs are very simple. They are nearly

always set at a flat percentage of the federal credit. In other words, a

family’s state EITC equals its federal credit multiplied by a given percentage

rate — for example, 30 percent in New York, 20 percent in New Jersey, 6 percent

in Indiana, 15 percent in Kansas. A New York family that receives a $3,000

federal EITC, for example, would qualify for a $900 New York State EITC.

|

TABLE 1: RECEIPT OF FEDERAL EITC

IN PENNSYLVANIA (TY2002) |

County |

Number of Tax Filers Receiving EITC |

Total EITC Amounts Received ($) |

County |

Number of Tax Filers Receiving EITC |

Total EITC Amounts Received ($) |

Adams |

4,708 |

7,357,774 |

Continued from previous column |

Allegheny |

67,613 |

105,396,379 |

Lackawanna |

12,477 |

19,652,328 |

Armstrong |

4,390 |

6,850,350 |

Lancaster |

23,672 |

38,317,465 |

Beaver |

9,942 |

15,373,804 |

Lawrence |

6,470 |

10,341,358 |

Bedford |

3,605 |

5,728,388 |

Lebanon |

6,755 |

10,713,828 |

Berks |

22,080 |

35,755,109 |

Lehigh |

18,554 |

31,163,838 |

Blair |

9,173 |

14,520,607 |

Luzerne |

18,535 |

28,937,675 |

Bradford |

4,631 |

7,459,643 |

Lycoming |

8,373 |

13,544,104 |

Bucks |

19,654 |

28,405,078 |

McKean |

3,128 |

5,182,892 |

Butler |

8,626 |

12,849,342 |

Mercer |

7,624 |

12,663,395 |

Cambria |

10,242 |

15,935,878 |

Mifflin |

2,996 |

4,606,777 |

Cameron |

407 |

659,060 |

Monroe |

8,448 |

13,792,214 |

Carbon |

3,711 |

5,874,061 |

Montgomery |

22,604 |

32,647,095 |

Centre |

5,100 |

7,385,921 |

Montour |

976 |

1,519,949 |

Chester |

12,656 |

18,842,811 |

Northampton |

14,205 |

22,599,474 |

Clarion |

2,570 |

3,942,024 |

Northumberland |

6,131 |

9,779,044 |

Clearfield |

5,938 |

9,226,476 |

Perry |

2,511 |

3,835,987 |

Clinton |

2,259 |

3,675,681 |

Philadelphia |

156,733 |

280,901,522 |

Columbia |

3,963 |

6,124,371 |

Pike |

2,256 |

3,774,596 |

Crawford |

6,178 |

10,033,961 |

Potter |

1,331 |

2,162,004 |

Cumberland |

8,366 |

12,436,617 |

Schuylkill |

8,758 |

13,265,045 |

Dauphin |

17,014 |

27,532,522 |

Snyder |

2,264 |

3,472,962 |

Delaware |

28,424 |

45,945,558 |

Somerset |

5,583 |

8,632,496 |

Elk |

1,900 |

2,761,754 |

Sullivan |

428 |

634,833 |

Erie |

20,584 |

34,426,825 |

Susquehanna |

3,099 |

5,128,733 |

Fayette |

11,962 |

19,855,856 |

Tioga |

3,249 |

5,448,765 |

Forest |

413 |

648,502 |

Union |

1,862 |

2,862,935 |

Franklin |

7,525 |

11,665,370 |

Venango |

4,104 |

6,665,931 |

Fulton |

1,036 |

1,507,073 |

Warren |

2,855 |

4,619,663 |

Greene |

2,917 |

4,916,657 |

Washington |

11,512 |

17,813,377 |

Huntingdon |

3,009 |

4,783,770 |

Wayne |

3,726 |

5,995,425 |

Indiana |

5,230 |

8,000,115 |

Westmoreland |

19,863 |

30,233,082 |

Jefferson |

3,376 |

5,319,284 |

Wyoming |

2,125 |

3,479,579 |

Juniata |

1,350 |

2,076,395 |

York |

21,359 |

33,985,583 |

|

|

|

All counties, total |

735,118 |

1,191,646,970 |

|

Source: The Brookings Institution,

Metropolitan Policy Program, Earned Income Tax Credit data from Internal

Revenue Service, TY2002; Center on Budget and Policy Priorities.

|

Because it is administered through the income

tax, compliance and administrative costs of the EITC are quite low.

Administrative costs for the federal EITC are less than 1 percent of total cost,

much lower than the costs of other federally funded income support programs such

as Food Stamps. For states, the administrative cost of an EITC is even lower

because the Internal Revenue Service does much of the work. For instance, the

federal government uses mechanisms such as large databases of social security

numbers to screen for ineligible EITC applicants and reject their claims.

States, in effect, piggyback on these federal enforcement mechanisms.

Fifteen of the existing 19 state EITCs follow

federal practice of offering credits that are refundable. This means a family

receives the full amount of its credit even if the credit amount is greater than

its income tax liability. The amount by which the credit exceeds annual income

taxes is paid as a refund. If a family has no income tax liability, the family

receives the entire EITC as a refund. This enables the EITC to operate as a

wage subsidy and an offset to all state and local taxes, not simply an offset to

state income tax liability.

Among Pennsylvania’s neighbors, New York, New

Jersey, and Maryland offer refundable EITCs, while Delaware offers a

non-refundable EITC. Among 20 Northeastern, Mid-Atlantic and Great Lakes

states, Pennsylvania is among only six that do not offer an EITC.

A Pennsylvania EITC

More than 700,000 Pennsylvania tax filers each

year benefit from the federal EITC and therefore would receive a Pennsylvania

EITC. Table 1 lists the number of Pennsylvania tax filers receiving the credit

by county.

|

TABLE 2: WHICH STATES HAVE EITCS AND/OR MINIMUM WAGE

HIGHER THAN FEDERAL? |

Both Minimum Wage Higher than Federal and State EITC |

Minimum Wage Higher than Federal Only |

State EITC Only |

Delaware |

Alaska |

Colorado* |

District of Columbia |

California |

Indiana |

Illinois |

Connecticut |

Iowa |

Maine |

Florida |

Kansas |

Maryland |

Hawaii |

Oklahoma |

Massachusetts |

Washington |

Virginia |

Minnesota |

|

|

New Jersey |

|

|

New York |

|

|

Oregon |

|

|

Rhode Island |

|

|

Vermont |

|

|

Wisconsin |

|

|

|

|

|

|

*Colorado EITC is presently

suspended.

Sources: U.S. Department of Labor, Employment

Standards

Administration, Wage and Hour Division; Center on

Budget and Policy Priorities

|

I noted earlier that Pennsylvania already offers

a tax credit, known as “tax forgiveness,” that eliminates income tax liability

for families with incomes below specific thresholds. Unlike the federal EITC

and most state EITCs, however, tax forgiveness is not refundable, and so it does

not function as a wage subsidy or offset other taxes. It merely eliminates

income tax liability, an important but limited feature. In addition, the top

income at which a family benefits from tax forgiveness tend to be slightly lower

than for the EITC. (Example: for a two-parent, two-child family, the income

cut-off is $34,250 for tax forgiveness but about $38,000 for the EITC.)

A Pennsylvania state EITC would augment the tax

forgiveness credit by providing a refund to many families with children.

For families that qualify for both full tax

forgiveness and the EITC, the EITC most likely would be structured as a refund

to be applied after tax forgiveness is applied to the income tax. Tax

forgiveness would eliminate income tax liability; the EITC then would provide a

refund.

For families for whom tax forgiveness reduces but

does not eliminate income tax liability, or for those who do not qualify for tax

forgiveness, the EITC would count against remaining tax liability.[1]

Pennsylvania

EITC refunds could be used to offset the burden of other state and local taxes,

such as sales, excise or property taxes, or to meet other costs associated with

working such as transportation, child care, and so on.

Taxpayers that do not qualify for an EITC, of

course, still would be fully eligible for tax forgiveness as under current law.

EITCs and the Minimum Wage

An Earned Income Tax Credit and a minimum wage

are complementary policies, not alternatives to each other.

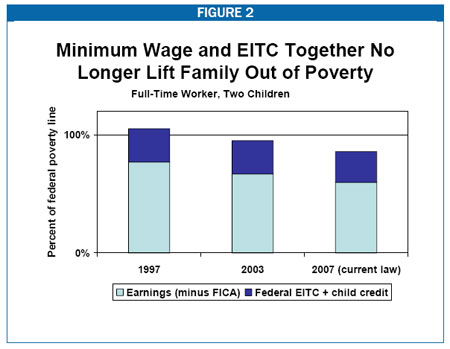

At the federal level, at least until just a few

years ago, the EITC and the minimum wage worked together to lift families out of

poverty. As recently as 1997, a full-time, year-round job at the minimum wage,

combined with the federal EITC, was sufficient to lift a family’s after-tax

income above the federal poverty line for a family of three.

But with the erosion of the minimum wage over the

last eight years, it is no longer the case that a minimum-wage job lifts a

family out of poverty. Since 1997, the federal minimum wage has been frozen at

a nominal level of $5.15 per hour. In inflation-adjusted terms, it has

declined. (See Figure 2.)

A further problem is that a full-time worker at

the federal minimum wage with two or more children no longer earns enough to

qualify for the maximum EITC. This is because the parameters of the EITC are

indexed for inflation; the minimum wage is not.

As a result, the combined effect of net wages and

the EITC now fall substantially short of the federal poverty line for a family

of three.

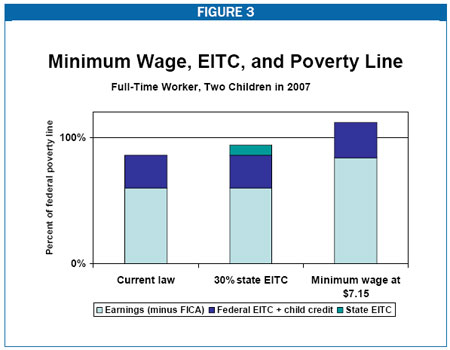

A state EITC, by itself, does not solve this

fundamental problem caused by the eroding minimum wage. Figure 3 shows that

increasing the minimum wage to $7.15 per hour in 2007, as has been proposed,

would restore a full-time worker’s after-tax income to roughly what it was in

1997. A state EITC set at 30 percent of the federal EITC – which would be among

the nation's largest – by itself would go only about halfway to lifting income

above the poverty line.

In addition to providing different amounts of

benefits to a full-time minimum-wage worker, an EITC and an increased minimum

wage differ in other important ways.

A somewhat larger number of families benefit from

a state EITC than a minimum wage increase, for example. The Economic Policy

Institute estimates that a $7.25 minimum wage in 2004 would have aided some

366,000 Pennsylvania workers. This number is roughly half the number of tax

filers benefiting from an EITC.

The policies differ also in the types of families

that are helped the most. Minimum wage increases assist the lowest-wage

workers regardless of family structure. An EITC almost exclusively benefits

families with children.

Another difference between the policies is that a

state EITC is paid in a lump sum at the end of the year, when families file

their tax returns. The benefits of minimum wage increases show up directly in

families’ paychecks and can be used to pay bills throughout the year.

One reasonable strategy pursued by many states is

to enact both a minimum wage increase and a state EITC. Thirteen states –

including a majority of Northeastern, Mid-Atlantic and Great Lakes states – now

have both a state EITC and a state minimum wage above the federal minimum. In

fact, the number of states nationwide that have enacted both policies is greater

than the number of states that have adopted only one or the other.

The increasingly widespread embrace of both EITCs

and increased minimum wages suggests growing consensus that making work pay for

low-income families should not be the responsibility of the private sector

alone, nor the responsibility of the public sector alone. Rather, lifting

working families out of poverty and toward the middle class should be a shared

responsibility of employers, the government, and — of course — the working

families themselves.

To conclude, the Earned Income Tax Credit is an

administratively straightforward mechanism that has proven successful in

supporting work and lifting low-income working families out of poverty. I

welcome your questions.

End Note:

[1] An alternative approach would provide a state EITC benefit

only to the extent that the benefit exceeds a family’s tax forgiveness. This

would reduce the EITC’s benefit for most families as well as the overall fiscal

cost to the state. |