Delaware |

|

| Delaware's 1999 income tax threshold — the income level at which families begin paying income tax: | Ranking among 42 states with income taxes |

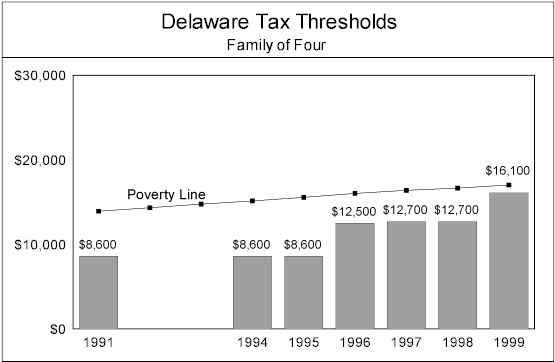

| For two-parent families of four: $16,100. | 19th lowest |

| For single-parent families of three: $13,400. | 19th lowest |

Delaware's 1999 income tax on working-poor and near-poor families: |

|

| For families of four with incomes at the poverty line ($17,028): $50. | 17th highest |

| No tax on families of three with incomes at the poverty line ($13,290). | |

| For families of four with incomes at 125% of the poverty line ($21,285): $271. | 16th highest |

| For families of three with incomes at 125% of the poverty line ($16,613): $169. | 16th highest |

Despite progress, Delaware continues to tax families with incomes at the poverty line.

|

|