Is the Clinton Budget a "Big Government"

Proposal?

Spending as a Share of The Economy Would Fall to Lowest Level since 1956

by

| View PDF version here. |

The budget President Clinton submitted February 7 includes a number of initiatives that will increase expenditures over the next decade above the levels needed to maintain current policies. Inevitably, some critics will attack the President's budget as a "tax and spend" budget or a "big government" budget.

In fact, under this budget, government expenditures would fall to their lowest level as a share of the economy in nearly half a century. Total federal expenditures would decline from 18.7 percent of the economy last year to 16.7 percent in 2010, under the Administration's estimates. This would be a lower level than in any year since 1956, in the middle of the Eisenhower Administration. (Note: on March 9 the Congressional Budget Office issued an analysis fo the Clinton budget which estimated that expenditures would drop to 16.9 percent of the economy in 2010 under that budget. That still would be the lowest level since 1956.)

Government spending would increase over the levels needed to maintain current policies by just one percent over the next 10 years, with nearly all of this rather modest increase in overall expenditures accounted for by proposals to extend health insurance to more people and to broaden the insurance that Medicare provides. Outside of these health insurance proposals, the budget provides only a very small net spending increase of about $20 billion over 10 years.(1)

All of the net spending increase outside the health insurance area is accounted for by proposals to expand or establish refundable tax credits for low and moderate-income working families. The budget does, of course, contain increases in a range of other programs, but those increases are fully balanced out by decreases in other programs.

Whether to characterize the refundable tax credit proposals as tax cuts or spending increases can be debated. On the one hand, they are tax credits; on the other hand, the refundable portions of tax credits are "scored" as outlays. In any event, outside of the improvements in health insurance and these refundable tax credits, there is no net spending increase in the budget over the next 10 years. To the contrary, there is a small net decrease.

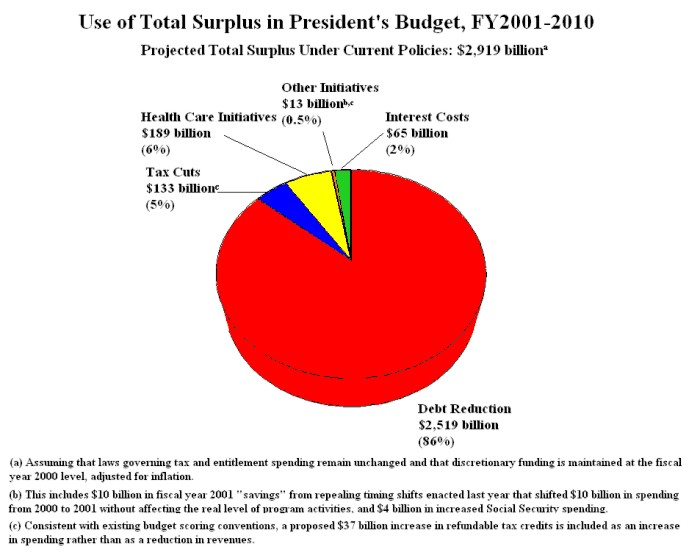

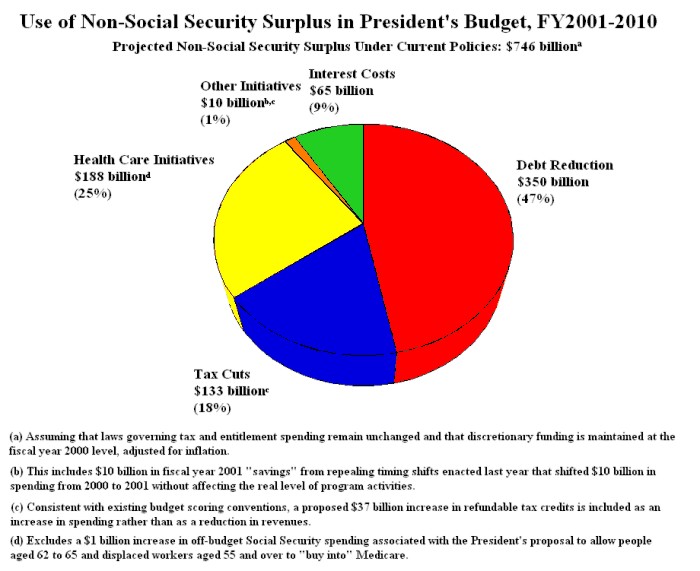

The dominant feature in the budget is neither program increases nor tax cuts; it is debt reduction. The budget would devote 47 percent of the non-Social Security surplus — about $350 billion out of a projected $746 billion surplus — to debt reduction, as well as virtually all of the $2.2 trillion projected Social Security surplus. Some 86 percent of the projected total budget surplus — $2.5 trillion of $2.9 trillion — would go for debt reduction.

It thus would be inaccurate to characterize this as a "big government" or "big spending" budget. It is a restrained budget that places major emphasis on debt reduction and features relatively modest program initiatives focused on improving health insurance coverage along with modest tax cuts.

In fact, if the expansions of refundable tax credits are considered as tax cuts, the budget contains $170 billion in net tax cuts over 10 years and $172 billion in spending increases, essentially equal amounts. (In computing these amounts, we subtracted the proposals for tobacco revenues, reinstatement of expired environmental taxes, and other small revenue measures from the Administration's $256 billion net tax cut figure. That is the approach the Congressional Budget Office is expected to follow.)

Alternatively, if the expansions in refundable tax credits are classified as spending increases, the budget contains $133 billion in net tax cuts and $209 billion in net spending increases. Thus, depending on how the refundable credit proposals are characterized, the net tax cuts are either about the same size or nearly two-thirds the size of the net spending increases. Even with the refundable credits counted as a spending increase, the net tax cuts are nearly seven times the size of the $20 billion net spending increase outside the health insurance area.

The budget includes the following features:

- It would increase total federal spending by $209 billion over 10 years, counting the refundable tax credit expansions.(2) This is an increase in spending of about one percent over the current policy level (i.e., over the level of mandatory spending that would occur under current law for mandatory programs, plus current spending levels for discretionary programs, adjusted for inflation).

- In the health insurance area, where nearly all of the spending increase occurs, the budget proposes to add a prescription drug benefit to Medicare, extend health insurance to substantial numbers of low-income working parents and children who are uninsured, and establish a Medicare component under which people aged 62 to 64 and displaced workers 55 and over can "buy into" Medicare. The budget also contains some Medicare and Medicaid savings proposals that would offset a portion of the cost of these health insurance expansions. The net cost of the health insurance proposals is $189 billion over 10 years, with $98 billion of the cost occurring in Medicare and $91 billion in Medicaid and health insurance block grants to states.

- The refundable portion of several tax credits would increase by $37 billion over 10 years, primarily as a result of a proposed expansion of the Earned Income Tax Credit and the proposed addition of a refundable component to the Child and Dependent Care tax credit. There also would be a small refundable component to certain other tax credits.

How the Budget

Would Use the |

|

| Projected Surplus, 2001-2010 | $746 |

| Debt reduction | 350 |

| Net tax cut, exclusive of increases in refundable portion of tax credits | 133 |

| Health insurance expansions | 189 |

| Other mandatory spending, exclusive of refundable tax cuts | -6 |

| Increases in refundable tax credits | 37 |

| Discretionary spending | -12 |

| Undoing timing shift gimmick enacted in 1999 | -10 |

| Interest payments on the debt | 64 |

| Total | $746 |

- Overall spending for mandatory programs other than health insurance programs and refundable tax credits would not increase. The budget proposes increases in some mandatory programs but offsets them with decreases in other mandatory programs, for a net savings in these programs of $6 billion over 10 years. If the refundable credit expansions are counted in the total for mandatory programs, the increase in mandatory programs other than health insurance programs is $31 billion over 10 years.

- The budget contains a slight reduction in discretionary programs totaling $12 billion over the next 10 years, compared to fiscal year 2000 levels, adjusted for inflation.(3) (The 2000 level adjusted for inflation, which is often referred to as the "current services" level, is the level needed to maintain the current levels of goods and services that the discretionary programs provide.) Discretionary appropriations provide funding for a wide array of government activities, including defense, health and science research, veterans medical care, environmental programs, highway construction, Head Start, low-income housing, the Federal Bureau of Investigation, and the National Park Service.

The Health Insurance Proposals in Brief The budget would provide prescription drug coverage for Medicare beneficiaries and allow people aged 62 to 65 and displaced workers aged 55 to 65 to pay premiums to "buy into" Medicare, at a combined cost of $168 billion over 10 years. The budget also includes various Medicare savings provisions that lower the net cost of the Medicare proposals to $98 billion over 10 years.a The budget would expand health care coverage to low-income working parents by providing additional funds and authority to states for this purpose, at a cost of $76 billion over 10 years. Currently 42 percent of working poor parents (working parents with incomes below the poverty line) are uninsured. The budget also includes initiatives to facilitate the enrollment in health insurance programs of low- and moderate-income children who are eligible for Medicaid or separate state child health insurance programs but are not enrolled in these programs, as well as proposals to enable more legal immigrant children, pregnant women, and disabled people to regain eligibility for Medicaid they lost under the 1996 welfare law. These proposals would cost $20 billion over 10 years. Proposals that would produce $5.5 billion in Medicaid savings would lower the net costs of this group of proposals to $91 billion over 10 years. The budget's health insurance expansions thus would carry an overall price tag of $189 billion. The Administration's budget also would transfer $299 billion over 10 years from the general fund to the Medicare Hospital Insurance trust fund. This transfer does not increase Medicare expenditures; it is a transfer from one government account to another account for the purpose of boosting the assets in the Medicare trust fund. The amount transferred would be used to pay down the debt, not to increase federal spending. ___________________________________ |

- Total federal expenditures would fall from 18.7 percent of the economy last year to 16.7 percent in 2010. As noted, this would be the lowest level since 1956. Expenditures would decline substantially as a share of the Gross Domestic Product (the basic measure of the size of the economy) both under current policies and under the Administration's budget.

The decline in discretionary spending as a share of GDP is of particular note. Under the budget, discretionary spending, now 6.5 percent of GDP, would decline to 5.1 percent of GDP by 2010. That would be a level lower than in any year for which historical data on discretionary spending are available. (These data are available back to 1962.) By comparison, in1986, discretionary spending equaled 10 percent of GDP.

Tax Proposals in Brief The President's budget proposes a net reduction in revenues of $133 billion to $170 billion over the next 10 years, depending on how the increases in the refundable credits are treated. The budget contains proposals that would cut taxes by $314 billion over 10 years ($351 billion counting the increases in the refundable credits). This reduction would be partially offset by other provisions that would increase revenues by $181 billion over the same period, primarily by closing or narrowing tax shelters and loopholes, raising taxes on tobacco products, and reinstating expired environmental taxes. Among the major proposals that would reduce revenues are:

|

- Revenues would decline from 20.3 percent of the economy this year to

19.1 percent of the economy in 2010, under the Administration's estimates. By historical

standards, federal taxes still would be somewhat above the average level as a percentage

of the economy. But that would not be because the government was spending excessively. It

would partly reflect a policy choice to continue taking in levels of Social Security

payroll tax revenues that substantially exceed current Social Security benefit payments,

in order to bolster the assets of the Social Security trust fund and pay down a sizeable

amount of debt. (4)

Furthermore, although revenues have been at a relatively high level historically as a share of GDP in recent years, the typical middle-class family is not paying a historically high level of its income in taxes. As CBO has noted in past reports, the high level of revenues as a percentage of GDP reflects, in substantial part, the large increases in the stock market and the growth in income on the higher rungs of the income scale, where income is taxed at higher rates.

Conclusion

Neither the spending path nor the revenue path under the budget, both of which would decline relative to the size of the economy, indicate a movement toward "big government." To the contrary, under this budget, the overall amount the federal government spends would decline significantly in relation to the economy over the next 10 years and would increase only about one percent when compared to the amounts needed to maintain current policies.

End Notes:

1. This $20 billion figure excludes $10 billion in savings in 2001 from undoing timing shifts enacted last year and in 1997 that moved $10 billion in spending from 2000 to 2001. If these $10 billion in savings are counted (from moving these expenditures back into 2000), the net spending increase (apart from the health insurance proposals) is $10 billion over 10 years.

2. This figure includes $20 billion in increased outlays resulting from proposals to expand the Earned Income Tax Credit and $17 billion in increased outlays from proposals to expand the Child and Dependent Care Tax Credit and make it "refundable" (that is, to provide for a payment to the taxpayer equal to the amount of the credit, if any, that exceeds the taxpayer's income tax liability) as well as proposals to include a small refundable component in a few other credits. Under existing budget "scoring" conventions, the amount of the credit that offsets income tax liability is shown in the budget as a reduction in revenues, while the amount in excess of tax liability is shown as an outlay.

3. The budget shows a reduction of $32 billion in discretionary spending over 10 years. This is because it proposes to include in appropriations bills some $20 billion in mandatory savings or revenue-raising measures. These $20 billion in savings would offset an equivalent amount of discretionary spending. The $12 billion reduction we use here reflects the change in spending levels for discretionary programs, including the $20 billion in discretionary spending these offsets would finance.

4. Revenues other than Social Security payroll taxes would equal 14.2 percent of the economy in 2010, under the budget. This is slightly below the average percentage of the economy that non-Social Security revenues constituted from 1947-2000.