| NEWS RELEASE __________ |

|

|||

| 820 First

Street, NE Suite 510 Washington, DC 20002 Tel: 202-408-1080 Fax: 202-408-1056 [email protected] www.cbpp.org

Robert Greenstein Iris J. Lav Board of Directors

David de Ferranti, Chair John R. Kramer, Vice Chair Henry J. Aaron Ken Apfel Barbara B. Blum Marian Wright Edelman James O. Gibson Beatrix Hamburg, M.D. Frank Mankiewicz Richard P. Nathan Marion Pines Sol Price Robert D. Reischauer Audrey Rowe Susan Sechler Juan Sepulveda, Jr. William Julius Wilson |

STATE ESTATE TAXES AFFECT VERY FEW ESTATES

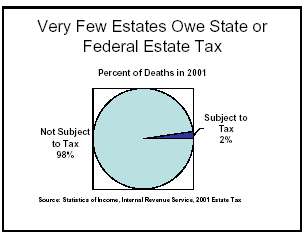

The decision by many states to retain their own estate tax despite the phaseout of the federal estate tax will not affect the vast majority of Americans, according to a new Center report. Only the largest 2 percent of estates owe any estate tax at all, and four-fifths of the estates that are large enough to owe state estate taxes will pay an effective tax rate of just 3 to 5 percent in those states that retain a state estate tax. The Center’s report responds to several recent news reports about state estate taxes, which create the false impression that they impose a heavy and growing burden on large numbers of families and thus should be a major factor in an elderly person’s decision of where to live. “Unless your estate is worth $2.5 million or more, which would make it one of the largest 9,000 estates in the country, it will owe either zero estate tax or a tax of less than 5 percent,” states Elizabeth McNichol, the report’s author. This rate generally is not significant enough to prompt major life style changes such as moving to another state. McNichol also notes that anyone is free to pass their estate on to a spouse without paying estate tax. “Opponents like to call the estate tax the ‘death tax,’ but unlike death and some other taxes that are universal, the estate tax only affects a small number of people,” McNichol adds. Only Largest 2 Percent of Estates Face Any Estate Tax

Overall Estate Tax Will Fall in All States as Federal Tax Phases Out

The 2001 federal tax cut, which phases out the federal estate tax completely

by 2010, also effectively repeals by 2005 the state “pickup” taxes through

which states share in federal estate tax collections. States can

prevent this loss of revenue by “decoupling” from the federal change.

To date, 17 states plus the

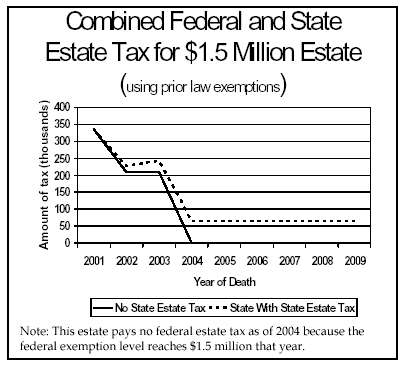

Even in those states that retain a state estate tax, the total estate tax is declining sharply as the federal tax is phased out, as the chart below shows. (Some reports have incorrectly implied that estate taxes are rising in these states.)

Most Estates That Face Estate Taxes Pay Tax of 3-4 Percent The tax rate for the state estate tax rises with the value of the estate. The top marginal rate of 16 percent, often incorrectly cited as applying to all taxable estates, in fact only applies to the very largest of them: estates of more than $10 million. In contrast, 83 percent of the estates that are large enough to owe estate taxes pay an effective rate of 3 to 5 percent. Moreover, the revenue a state retains by not eliminating its estate tax will help pay for public services (nurses and state troopers’ salaries, roads, arts centers, etc.) that help make a particular state a desirable place in which to live. Retaining its estate-tax revenue also could allow the state to avoid raising other taxes that apply to many more people The report, Assessing the Impact of State Estate Taxes, is available at the Center’s website. # # # # The Center on Budget and Policy Priorities is a nonprofit, nonpartisan research organization and policy institute that conducts research and analysis on a range of government policies and programs. It is supported primarily by foundation grants. |

The estate tax

applies only to estates above a certain dollar value, which ranges from

$675,000 to $1.5 million depending on the state. Nationally, only the

wealthiest 2 percent of estates (about 52,000 estates, according to the IRS)

are large enough to face the tax. According to the Federal Reserve Board’s

Survey of Consumer Finances, the median net worth of

The estate tax

applies only to estates above a certain dollar value, which ranges from

$675,000 to $1.5 million depending on the state. Nationally, only the

wealthiest 2 percent of estates (about 52,000 estates, according to the IRS)

are large enough to face the tax. According to the Federal Reserve Board’s

Survey of Consumer Finances, the median net worth of