Tax Cuts a Major Factor in Return of Deficits

| PDF of fact sheet HTM of full report PDF of full report |

| If you cannot access the files through the links, right-click on the underlined text, click "Save Link As," download to your directory, and open the document in Adobe Acrobat Reader. |

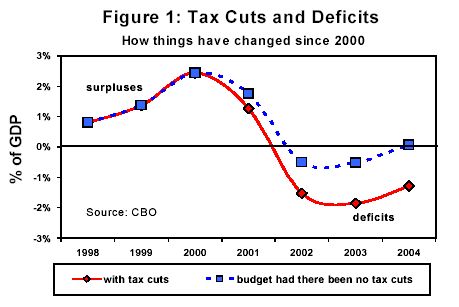

- A third of the deterioration in the budget is due to the tax cuts. Since 2000, the budget has deteriorated by an amount equal to 4.0 percent of GDP. One-third of this deterioration has been caused by tax cuts enacted in the last two years, making the tax cuts one of the principal factors behind the budget deterioration.

The CBO data do not reflect the possible economic stimulus effects of recent tax or spending measures. The President’s Council of Economic Advisers argues that the tax cuts have stimulated economic growth and has estimated how much worse the economy would have been without them. Yet even using the CEA estimates, the net cost of the tax cuts would still turn out to have caused almost 30 percent of the budget deterioration since 2000. Moreover, other studies suggest the CEA estimates likely overstate the tax cuts’ effect on the economy.

- Without the tax cuts, surpluses would return in 2004. The recession, along with defense, homeland security, and other spending increases already enacted, would have driven the budget into deficit in 2002 and 2003 even without the tax cuts. But the budget would be back in surplus in 2004 and stay there for the rest of the decade were it not for the tax cuts. In contrast, the Administration itself says the budget will remain in deficit every year for the next 75 years under its budget, which would make the 2001 tax cut permanent, add further tax cuts, and increase spending in areas like a prescription drug benefit.

- More than half of 2003 and 2004 budgetary costs are due to tax cuts. Over the last two years, Congress has enacted legislation costing an annual average of $260 billion in 2003 and 2004. Some 58 percent of this cost is due to tax cuts, more than all other legislation — including increases for the military and homeland security, last year’s farm bill, and other legislation — combined. (Using the favorable CEA assumptions to factor in the supposed economic benefits of the tax cuts reduces that 58 percent figure only slightly, to 54 percent.)