|

STATEMENT BY CHAD STONE, CHIEF ECONOMIST,

ON THE OCTOBER EMPLOYMENT REPORT

The weakness in the economy showed up with a vengeance in today’s employment report. As unemployment continues to rise, the percentage of Americans with a job is at its lowest level since 1993 and more than one in five of the unemployed has been looking for work for at least 27 weeks.

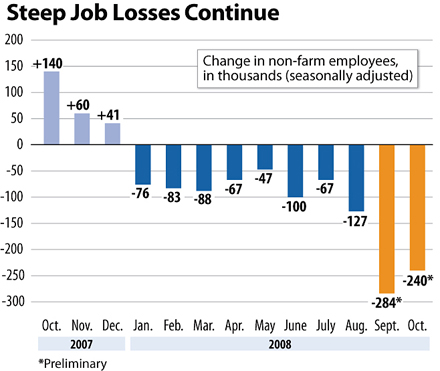

- Private and government payrolls combined have now shrunk for 10 straight months, and net job losses so far this year total 1.2 million. (Private sector payrolls alone have shrunk for 11 straight months, with a cumulative loss of 1.3 million jobs.)

- The net private and government job losses of 240,000 jobs in October and 284,000 jobs in September are each larger in any month since November 2001, the trough of the last recession.

- The official unemployment rate jumped from 6.1 percent to 6.5 percent in October, and other indicators show even greater labor market weakness.

- The percentage of the population with a job (61.8 percent) is at its lowest level since 1993.

- The Labor Department’s most comprehensive alternative unemployment rate measure — which includes people who want to work but are discouraged from looking and people working part time because they can’t find full-time jobs — stood at 11.8 percent in October, up 3.0 percentage points so far this year and the highest level since January 1994.

- Well over one in every five (22.3 percent) of the 10.1 million unemployed has not been able to find a job despite looking for 27 weeks or more.

Things will not likely get better for job-seekers in coming months. The economy shrank in the third quarter (July-August-September), and economists are forecasting an even larger contraction in the fourth quarter. In the most recent round of bad news, the Institute for Supply Management index of the strength of manufacturing activity has fallen to a level below that in the depths of the previous two recessions, auto sales have plunged, and initial claims for unemployment insurance are approaching 500,000, their highest levels since late 2003.

In such a weak labor market, unemployed workers are much more likely to exhaust their unemployment insurance (UI) benefits before they can find a job. At the end of June, policymakers enacted an additional 13 weeks of UI benefits for workers exhausting their regular benefits, but those extra weeks of benefits have run out for people who started receiving them in July. The House of Representatives in September overwhelmingly passed and sent to the Senate legislation that would add additional weeks to this temporary extended benefits program (as well as passing a broader stimulus package that included these extended UI benefits).

The Senate has the opportunity to help unemployed job-seekers and put a down payment on the economic stimulus package that will ultimately be needed to counteract the ongoing weakening of the economy by quickly passing this legislation when it comes back later this month.

# # #

The Center on Budget and Policy Priorities is a nonprofit, nonpartisan research organization and policy institute that conducts research and analysis on a range of government policies and programs. It is supported primarily by foundation grants. |