MAKING TAX CUTS PERMANENT

WOULD POSE LONG-TERM ECONOMIC DANGERS

by John Springer

|

PDF of

fact sheet HTM of analysis PDF of analysis |

|

| If you cannot access the files through the links, right-click on the underlined text, click "Save Link As," download to your directory, and open the document in Adobe Acrobat Reader. |

A new Center report, The President’s Proposal to Make Tax Cuts Permanent, examines the proposal in the President’s State of the Union address to make permanent a range of tax cuts that are scheduled to expire by the end of 2010. (Last year’s budget included a similar proposal, but the subsequent enactment of a new round of tax cuts has increased the cost of making the tax cuts permanent.) The Administration’s proposal would have the following effects:

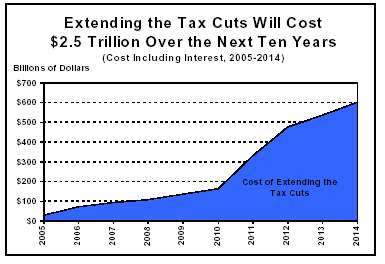

- Add substantially to the deficit. Making the tax cuts permanent would cost approximately $2.5 trillion over the first decade (2005-2014), including the higher interest payments that would have to be made on the national debt. Moreover, making the tax cuts permanent would cost more than twice that amount in the second decade (2015-2024). This is because the lion’s share of the tax cuts are not set to expire until after 2010, so more than three-quarters of the first decade’s cost reflects only four years of extending these tax cuts.

- Likely weaken long-term growth. A number of analyses by respected institutions and leading economists — including studies by the Congressional Budget Office, the Joint Committee on Taxation, and economists at Brookings — indicate that over the long term, the tax cuts are more likely to have a negative than a positive effect on the economy. This is because any positive effects on economic growth from reduced marginal tax rates are likely to be cancelled out — and may well be outweighed — by the negative effects from the greatly enlarged deficits. These studies do not support Administration claims that the tax cuts will significantly increase long-term economic and job growth.

- Likely create more uncertainty in financial markets, not less. The President and other members of the Administration have argued that making the tax cuts permanent will create “certainty” about the tax code, thereby sustaining the economic recovery. A more likely outcome is that making the tax cuts permanent will create greater uncertainty in financial markets, because of the large and unsustainable increases in deficits such a policy would cause.

Policies rooted in fiscal discipline are more likely to be sustainable over the long run than unaffordable tax cuts that enlarge high deficits. Thus, these policies are more likely to lead to the type of certainty about the fiscal environment that encourages desired levels of investment and economic growth. This conclusion is supported by two prominent recent reports: a new analysis by former Treasury Secretary Robert Rubin, Brookings Institution economist Peter Orszag, and Wall Street economist Allen Sinai on the dangers of sustained large budget deficits, and a report the International Monetary Fund released in January 2004 on the U.S. fiscal situation. Both reports emphasize the uncertainty in financial markets that a continuation of current fiscal policies — of which the tax cuts are a large part — risks exacerbating.

-

Overwhelmingly favor very-high-income households.

Estimates based on data from the Urban Institute-Brookings Institution Tax

Policy Center show that if the tax cuts (including repeal of the estate tax)

are made permanent:

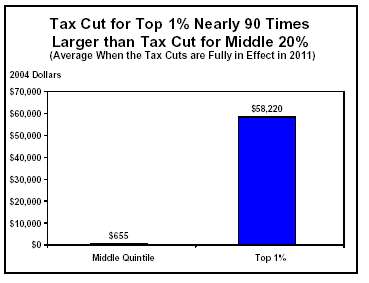

- the top one percent of households would gain an average of $58,220 a year (in 2004 dollars) when the tax cuts are fully in effect;

- families in the middle of the income spectrum would receive an average of $655 a year;

- the top one percent of households would receive an average tax cut that, in dollar terms, is nearly 90 times larger than the average tax cut for households in the middle of the income spectrum.

Moreover, the cost to middle- and low-income households of making the tax cuts permanent is likely to outweigh the modest tax cuts that many of these households would receive. This cost includes the higher amounts these households may pay for various services if increasingly large budget cuts are instituted to help pay for the tax cuts, as well as the impact of higher interest rates and other possible adverse economic effects of the enlarged deficits.

The Administration often emphasizes the benefits of its tax cuts for middle-class families with children. These families, however, typically benefit from only three of the tax-cut provisions: the increase in the child tax credit to $1,000, the creation of the 10 percent tax bracket, and tax relief for married couples. These three provisions could be made permanent for one-fifth of the cost of making all of the tax cuts permanent.