ADMINISTRATION’S TAX CUTTING AGENDA WOULD COST $2.7 TRILLION

THROUGH 2013

by Joel Friedman, Richard Kogan and Denis KadochnikovADMINISTRATION’S TAX CUTTING AGENDA WOULD COST $2.7 TRILLION THROUGH 2013

| PDF of

full report HTM of fact sheet PDF of fact sheet |

| If you cannot access the files through the links, right-click on the underlined text, click "Save Link As," download to your directory, and open the document in Adobe Acrobat Reader. |

But this $1.6 trillion figure underestimates the

dimensions of the Administration’s tax-reduction agenda and its impact on

the federal budget. First, the increase in interest payments on the debt

that would result from these tax cuts is not included in the $1.6 trillion

figure. This cost must be taken into account.

|

Total Cost — Including the 2001

As noted, the cost of the tax cuts in the President’s budget and extension of the AMT relief that the budget contains would cost $2.7 trillion through 2013. These costs come on top of the original cost of the 2001 tax cut, which lasts through 2010. In total, the costs from 2001 through 2013 of the tax cuts enacted to date and the additional tax-cut agenda reflected in the new budget amount to $4.6 trillion, including interest payments. In 2013, the combined revenue losses would constitute a larger share of the economy than did the Reagan tax cuts of the early 1980s. |

Even this $1.95 trillion figure understates the

magnitude of the Administration’s tax reduction agenda. This figure omits

the cost of preventing the Alternative Minimum

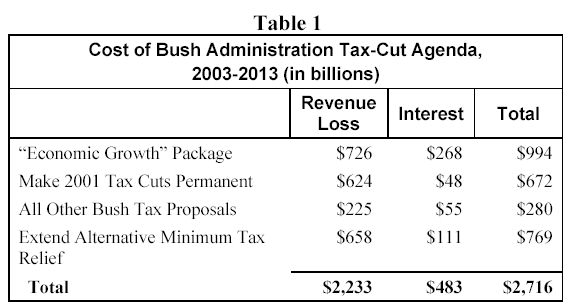

But these AMT costs clearly are coming. Taking the relief that the Administration proposes through 2005 and extending it through the rest of the decade adds approximately $770 billion in cost through 2013, including the interest payments on the debt. This brings the overall cost of the Administration’s tax cut path to $2.7 trillion over ten years. (See Table 1.)

Moreover, the costs in decades after 2013 would be even larger, despite the fact that those are the decades in which the baby-boom generation will be retiring in large numbers and deficits already are projected to reach unmanageable levels. For example, the cost of estate tax repeal would be much higher in subsequent decades than through 2013 because estate tax repeal does not take effect until 2010. In addition, the dramatic changes that the budget proposes in the taxation of savings and retirement accounts are designed so they have no net cost over the first ten years but ultimately result in enormous revenue losses. The ultimate cost of the savings provisions would be far larger than the cost of the dividend proposal and possibly larger than the cost of estate tax repeal.

The ultimate cost of the emerging tax-cut agenda thus can only be described as massive. The remainder of this analysis examines in more detail the budgetary effects of the principal elements of the Administration’s tax-reduction plans.

The “Economic Growth” Package

The President announced his new

“economic growth” package on

|

The Popular Misimpression About Why the Tax Cuts Expire in 2010 It often is mistakenly said that the framers of the 2001 tax-cut legislation had to make the 2001 tax cuts expire in 2010 in order to comply with Senate rules. In fact, compliance with Senate rules would have required the tax cuts to expire in 2011, not 2010. The framers of the legislation chose to have the tax cuts expire in 2010 because the earlier expiration made the multi-year price tag of each provision smaller. That enabled them to shoe-horn more tax-cutting provisions into the legislation. |

The other major component of the package is a proposal to accelerate four tax cuts enacted in 2001. The four provisions include: reductions in the top four income-tax rates; an increase in the amount of taxable income that is subject to the 10 percent tax rate; an increase in the child tax credit to $1,000; and increases for married couples in both the standard deduction and the amount of taxable income subject to the 15 percent tax rate. Under current law, these provisions become fully effective at various points between 2006 and 2010. The Administration proposes to make them all fully effective in 2003.

Making the 2001 Tax Cuts Permanent

The large package of tax cuts that was enacted in 2001 is scheduled to expire at the end of 2010. According to the JCT, making the tax cuts that expire in 2010 permanent would cost $624 billion through 2013. More than one-quarter of these costs would come from the repeal of the estate tax.

Additional Tax Proposals in the President’s Budget

The Administration’s budget also includes other tax-cut proposals. The measures with the largest costs over the next ten years include a refundable tax credit for the purchase of health insurance in the individual health insurance market, the permanent extension of the research and experimentation tax credit, and a new deduction for the purchase of long-term care insurance. Similar or identical proposals were included in the Administration’s first two budgets.

In addition, the Administration is

proposing dramatic changes in the tax treatment of savings and retirement

accounts. Under these proposals, most of the interest, dividend, and

capital gains income in the nation eventually would be sheltered from

taxation. The JCT shows these sweeping proposals as having net costs of

only $5 billion over the next ten years, largely because these tax cuts are

structured in such a way as to “backload” their costs heavily into

subsequent decades. While there would be almost no net revenue loss in the

initial years, the losses would then mount with each passing year and

eventually become extremely large.[3]

A recent analysis by the co-directors of the

The JCT estimates that, taken together, the dozens of proposed tax cuts that are outside the growth package (and are not part of the proposal to make the 2001 tax cut permanent) would cost $225 billion through 2013.

The Alternative Minimum Tax

The Administration includes measures in this year’s budget to protect taxpayers from the swelling Alternative Minimum Tax — but only through 2005. The New York Times recently quoted Pamela Olson, Assistant Secretary of the Treasury for Tax Policy, as stating that the Administration plans to propose a long-term solution to the AMT, but not until President Bush’s second term. The article reported, “The target date [for a longer-term AMT proposal] is 2005, she said. ‘We are working on it,’ Ms. Olson said.” [5] But although addressing the AMT problem is clearly part of the Administration’s plans, the costs of doing so beyond 2005 are not included in its budget.

Source of the AMT Problem

The Alternative Minimum Tax is a parallel tax system originally designed to ensure that tax filers with high incomes could not avoid paying taxes altogether by aggressively using available deductions, exemptions, and tax shelters. Such taxpayers calculate their tax liability according to both the regular income tax and the AMT and pay whichever amount is higher.

Unlike the regular income tax code, however, the key components of the AMT are not indexed for inflation. As a result, as incomes rise over time to reflect the effects of inflation, more taxpayers become subject to the AMT. This problem was exacerbated by the tax cuts enacted in 2001, which reduced tax liabilities under the regular income tax code, particularly for those with high incomes, without making corresponding adjustments in the AMT.

About two million taxpayers are currently subject to the AMT. The Treasury Department estimates that the number of taxpayers subject to the AMT will soar to 39 million by 2012, assuming that the 2001 tax cuts are made permanent. The AMT would hit one of every three taxpayers in the nation by that year, with many middle-class families finding themselves subject to it and its complexities. By that time, the AMT would be “taking back” a goodly share of the 2001 tax cut from many of these families. It is inconceivable the President or the Congressional leadership of either party will allow the AMT to mushroom in this manner.

High Cost of AMT Relief

Preventing the individual Alternative Minimum

In reality, of course, AMT relief will be continued beyond 2005. The Bush Administration clearly intends to propose that such relief be maintained.[6] The cost of extending AMT relief beyond 2005 thus is essentially an "off-book liability" that must be considered part of the long-term cost of the Administration's proposal to make the tax cut permanent and to enact new tax cuts.[7] It is necessary to include the cost of addressing the AMT problem when assessing the long-term cost implications of the Administration’s tax-cut proposals.

The

Conclusion

The Administration’s “economic growth” package represents but a portion of the Administration’s tax-cutting plans. The Administration also is proposing to make permanent the tax cuts enacted in 2001 and to enact a wide variety of other new tax-cut measures. Furthermore, to ensure that these tax cuts do not dramatically increase the number of tax filers subject to the Alternative Minimum Tax, the Administration has indicated it will propose further AMT relief after 2005, when the temporary relief in its current budget would expire.

Taken together, these tax proposals (including the extension of AMT relief) would reduce revenues by more than $2.2 trillion through 2013. This loss of revenues would lead to a higher debt and an increase in interest payments totaling more than $480 billion through 2013. When these two costs are combined, the overall impact of the Administration’s tax-cut plans on the budget reaches $2.7 trillion through 2013 (and much more in subsequent decades). Finally, when these costs are added to the costs of the tax cuts that were enacted in 2001, the total cost of tax reductions from 2001 through 2013 mounts to $4.6 trillion.

End Notes:

[1]

In this analysis, all estimates of the direct cost of tax proposals

are from the Joint Committee on

[2] The Treasury estimates a cost of $695 billion through 2013 for the “growth” package, of which $388 billion is for the dividend proposal. The Joint Committee on Taxation estimates a cost of $396 billion for the dividend provision, and (as noted) a cost of $726 billion for the entire “growth” package.

[3]

Robert Greenstein and

[4]

Leonard E. Burman, William G. Gale, and

[5]

[6] The Administration’s temporary AMT relief builds on a similar provision in the 2001 tax-cut package that provided AMT relief through 2004. The cost of providing permanent AMT relief would have driven the cost of the 2001 tax-cut package well above what the fiscal year 2002 Congressional budget resolution allowed unless other elements of that package were scaled back. The framers of the tax cut consequently resorted to the gimmick of letting the AMT relief sunset at the end of 2004, knowing that Congress would have no choice but to extend AMT relief before the provision expired.

[7] The Administration has provided no indication that it would countenance scaling back parts of the enacted tax-cut package or raising other taxes to pay for the cost of the inevitable AMT relief or redirecting the AMT in a cost-neutral manner that would free large numbers of middle-class taxpayers from the AMT but expand its applicability to those at the highest income levels, whom the AMT leaves largely untouched.

[8]

Leonard Burman, William Gale, Jeffery Rohaly, and Benjamin Harris, “The

Individual AMT: Problems and Potential Solutions,”

[9]

This AMT option would index the AMT exemption, tax-bracket thresholds,

and exemption phase-out threshold for inflation beginning in 2002.

These indexed levels would become effective starting in 2006, after the

temporary relief proposed by the Administration has expired. This

option is used here to illustrate the likely cost of the

Administration’s agenda because indexing the AMT parameters at 2002

levels produces an exemption amount in 2005 very similar to the

Administration’s proposal for that year (2005 is the final year of AMT

relief under the Administration’s new plan). The cost of AMT relief

shown in this analysis is greater than the cost shown by the