- Home

- What Is A Health Savings Account?

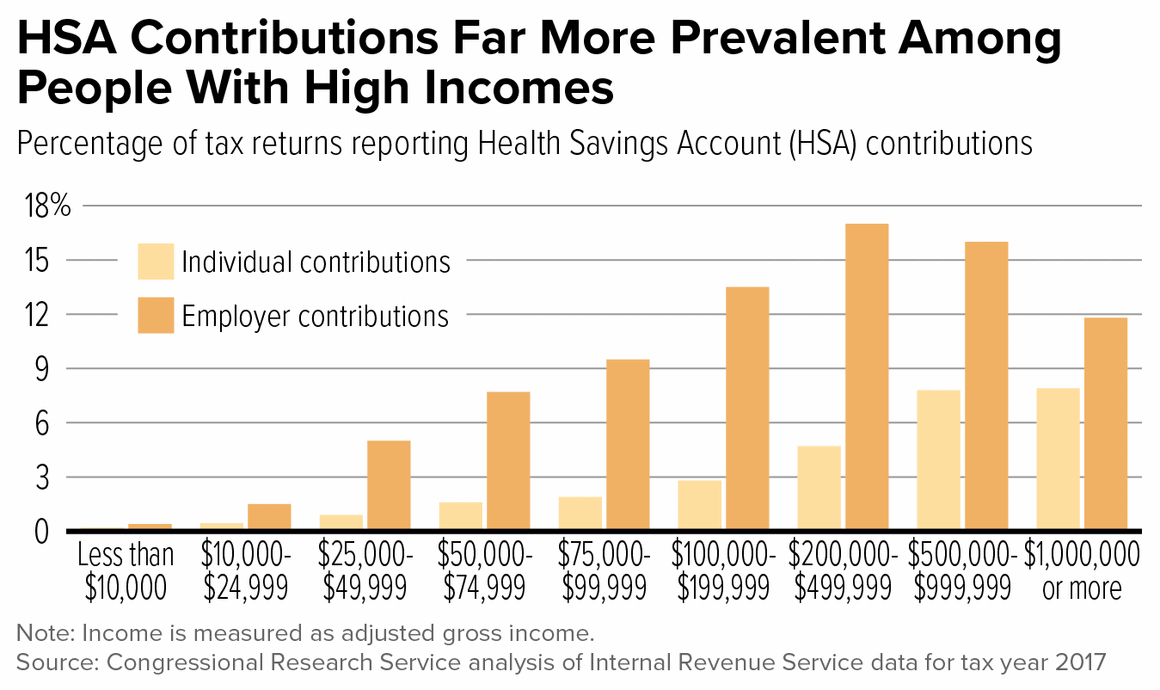

Some policymakers are proposing to expand Health Savings Accounts (HSAs) as a way to make health care more affordable. But HSAs do little or nothing to help uninsured people afford coverage, while offering people with high incomes lucrative tax-sheltering opportunities.

Under current law, people in a high-deductible health plan — meaning a deductible that is at least $3,000 for a family and that applies to virtually all services except preventive care — may establish an HSA to save for out-of-pocket health expenses.

| Single | Family | |

|---|---|---|

| Minimum deductible | $1,500 | $3,000 |

| Maximum out-of-pocket | $7,500 | $15,000 |

For 2023

Uninsured people receive little benefit. After paying premiums and paying upfront for needed medical care prior to meeting the deductible, many people with low incomes won’t have money left to put into an HSA. Even if they can contribute, their tax benefit is minimal: the large majority of uninsured people are in the 12 percent tax bracket or lower, so at most they would save 12 cents in taxes for each dollar put into an HSA.

High-income people get the biggest benefit. They are less likely to need a tax break to pay for insurance or health care, yet they receive the largest tax break for each dollar put into an HSA because they are in the highest tax bracket. Someone in the 37 percent bracket, for example, saves 37 cents in taxes for each dollar put into an HSA, can earn investment gains, and can withdraw the money tax-free.

Comparing Health Plans

(Based on actual plans currently available in Arizona)

Age: 34

Marital status: Single

Annual income: $25,000 (12 percent tax bracket; 171 percent of the poverty level)

Pre-existing condition: Diabetes, requiring regular office visits, insulin, and other medical supplies. Without insurance, managing his diabetes would cost $5,600 a year.

| 2023 Marketplace Plan | High-Deductible Plan With HSA |

|---|---|

|

|

| Bottom line: higher out-of-pocket costs | |

|

|

| Bottom line: little benefit for people with modest incomes | |

|

|

| Bottom line: challenges for people with significant health costs | |