- Home

- State Budget And Tax

- Fact Sheet: Tax Cuts Don’t Boost Small B...

Fact Sheet: Tax Cuts Don’t Boost Small Business Employment

Updated

Cutting state personal income taxes doesn’t promote small business growth and job creation. More likely, it will impede entrepreneurship by taking resources away from education and other public investments key to a strong economy.

- State tax levels have a negligible impact on small business job growth. A study commissioned by the U.S. Small Business Administration, for example, found “no evidence of an economically significant effect of state tax [policy] portfolios on entrepreneurial activity.”

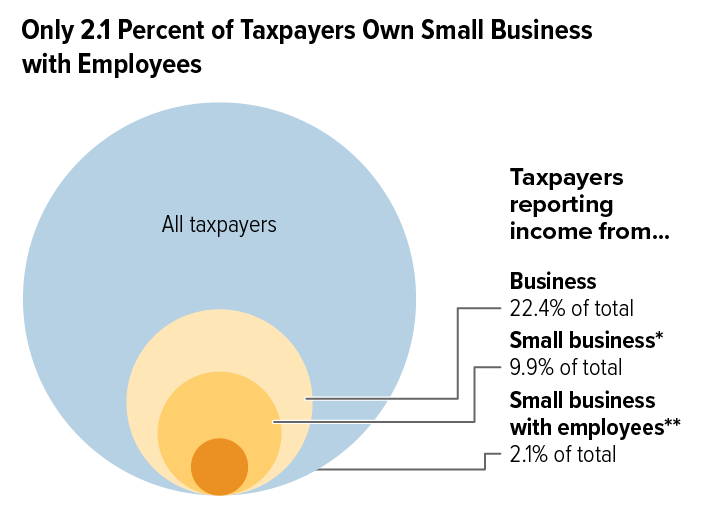

- The vast majority of taxpayers are in no position to create a job, with or without a tax cut. Only 2.1 percent of personal income taxpayers own a small business with any employees other than the owners (see graph).

- Most small businesses don’t earn enough for tax cuts to make a crucial difference. With more than 8 in 10 small businesses making less than $50,000 in annual taxable income, even eliminating the tax wouldn’t come close to paying one full-time worker’s salary.

- The country’s most successful entrepreneurs rarely cite taxes as a key factor in their location decisions. In a survey of the founders of many of the country’s fastest-growing firms, only 5 percent cited low tax rates as a factor in deciding where to launch their company. The quality of the local workforce and the general quality of life in the area are much more important factors to these entrepreneurs.

- Product demand, not tax cuts, is what drives small businesses to hire. Savvy business owners won’t expand unless they have (or expect) more customers, no matter what their taxes are. As the nonpartisan Congressional Budget Office found, “Increasing the after-tax income of businesses typically does not create much incentive for them to hire more workers in order to produce more, because production depends principally on their ability to sell their products.”

- Tax cuts take resources away from public investments that help small businesses succeed. Because states must balance their budgets, tax cuts reduce support for schools, transportation, safe communities, and other building blocks of a strong economy that help small businesses grow.

*The Treasury Department defines a small business as one with between $10,000 and $10,000,000 in receipts and at least $5,000 in business-related expenses.

**The Treasury Department considers a small business to have an employee if it incurs at least $10,000 in wage or salary expenses.

Source: Knittel et al., Methodology to Identify Small Businesses and Their Owners, Treasury Department in 2011, updated Tables 2014-7 and 2014-8.

Topics:

Stay up to date

Receive the latest news and reports from the Center