- Home

- Proposed Appropriations Caps Would Requi...

Proposed Appropriations Caps Would Require Deep Cuts in Domestic Discretionary Programs

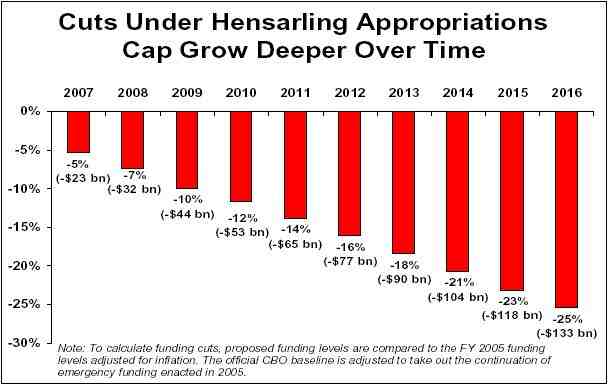

Rep. Jeb Hensarling (R-Tex.) and a number of co-sponsors have introduced budget legislation, H.R. 2290, to make an array of major changes in budget rules and procedures, including the establishment of austere caps on annual appropriations for non-defense discretionary programs (i.e., non-defense programs that are not entitlements). The caps would require deep cuts in domestic and international discretionary programs, totaling $738 billion over the ten-year period from 2007 through 2016.

- By 2016, overall funding for non-defense discretionary programs would be cut one quarter, or $133 billion in that year alone. (Cuts are measured here relative to the CBO baseline — that is, relative to the 2005 funding levels, adjusted for inflation.) Non-defense discretionary programs include education, scientific and medical research, health care for veterans, international assistance and State Department operations, transportation, environmental protection, national parks, housing, job training, law enforcement, homeland security, NASA, the Internal Revenue Service and numerous other program areas. Non-defense discretionary programs account for less than one-fifth of the federal budget.

- The legislation treats defense funding separately and essentially protects it from cuts. Moreover, the bill would allow additional money to be appropriated for defense programs if non-defense discretionary programs were cut even more severely (i.e., were reduced below the austere non-defense discretionary caps). The bill is one-sided here: it would allow non-defense programs to cut more deeply to funnel more money to defense but would forbid policymakers from easing the severity of the cuts in non-defense programs by achieving savings in the defense budget and using the saved money to provide some additional resources for the non-defense programs. (See the box below.)

- On each of the occasions in the past when caps on discretionary spending were enacted (i.e., in the 1990s), this was done as part of an overall deficit-reduction plan. By contrast, the Hensarling caps are not part of such an approach. In fact, despite their severity, they might well lead to no deficit reduction whatsoever. Unlike the 1990s, the caps would not be accompanied by “pay as you go” requirements. As a result, the savings from the cuts in discretionary programs that the caps would require could simply be used to free up budgetary room for even more tax cuts.

How the Caps Would Work, and Why They Would Result In Sharply Divergent Treatment of Defense and Non-defense Programs

The Hensarling legislation would establish annual caps both on total funding for discretionary programs as a whole and on total funding for non-defense discretionary programs.There would not be a separate cap on defense funding.

As a result, funding levels for defense could be increased without limit, as long as non-defense appropriations were cut deeply enough for total discretionary funding to fit within the overall discretionary cap. By contrast, no additional funding could be provided for non-defense programs by achieving savings on the defense side of the budget, because shifting funds from defense to non-defense programs would breach the non-defense discretionary caps.

In other words, non-defense programs could be cut even more deeply to benefit the defense budget, but defense funding could not be reduced to moderate the severity of the domestic program cuts. This also means that defense would be essentially guaranteed to receive funding at levels at least equal to the difference between the overall discretionary cap and the non-defense discretionary cap. The Hensarling bill sets the caps at levels that would assure that defense funding over the coming decade is approximately 10 percent greater than current defense funding adjusted for inflation, even if no domestic amounts are diverted to defense. (This calculation treats the cost of Afghanistan, and the international war on terror as outside the caps, and in fact the Hensarling bill establishes a mechanism whereby such funding can be, and is expected to be, treated outside the regular budget process.)

Proposed Caps Would Require Painful Reductions

The caps that the Hensarling bill would impose on non-defense discretionary programs for each of the next five years would be set at levels equal to or below the levels for non-defense discretionary programs proposed in the Administration’s fiscal year 2006 budget. Under both the Administration’s budget and the Hensarling bill, funding for non-defense discretionary programs in 2007 would be capped at a level about 5 percent below the 2005 funding level, adjusted for inflation. The cuts would then grow deeper with each passing year. By 2010, the President’s budget would cut funding for non-defense discretionary programs by 10 percent, while the Hensarling bill would cut it by 12 percent.

The President’s budget and the Hensarling bill diverge for the years after 2010. The President’s budget covers only the next five years, while the Hensarling caps would run through 2016. Those caps would require steadily deepening cuts over this period. By 2016, overall funding for non-defense discretionary programs would be cut by 25.4 percent, or one-fourth. In dollar terms, the cut in 2016 alone would amount to $133 billion. Over the ten-year period from 2007 through 2016, the cuts in funding for non-defense discretionary programs would total $738 billion.

To get a sense of how severe such cuts would be, we examine what would happen if a 25.4 percent cut were applied to this year’s appropriations. A cut of this magnitude would have reduced funding in 2005 by $20 billion for education and training programs, by $7.3 billion for veterans’ medical care, and by $2.1 billion for pollution control and abatement. It would have decreased the budget of the National Institutes of Health by $7.3 billion and cut funding for NASA by $4.1 billion. Head Start and other children and families services programs would have been cut by $2.2 billion, and low-income housing programs by $7.4 billion. It also would have meant the loss of Pell grants for 1.4 million students, and terminated 2 million low-income women and young children at nutritional risk from the WIC program.

Hensarling Legislation Stands in Stark Contrast to Prior Deficit Reduction Packages

The Hensarling proposal differs markedly in scope and substance from the discretionary caps enacted in the past. The discretionary caps enacted in the early 1990s were part of carefully balanced deficit-reduction packages in which all parts of the budget were put on the table and there was broad, shared sacrifice. Those packages included increases in taxes, along with reductions in programs, with most of the tax increases being targeted on people who were the most well-off and could best afford to pay more.

As noted above, the caps of the 1990s also were accompanied by “pay-as-you-go” rules that required both entitlement expansions and tax cuts to be offset fully, thereby ensuring that the savings from the discretionary caps would be devoted solely to deficit reduction. In addition, the discretionary caps enacted in the early 1990s were the product of extensive negotiations with appropriators and were designed to represent achievable (and hence enforceable) policy goals. The Hensarling caps are different: they seek to impose budgetary limits in a one-sided manner that asks for sharply disproportionate sacrifice from the domestic discretionary component of the budget.

The Hensarling caps are part of a larger bill that Rep. Hensarling and his co-sponsors have introduced to make sweeping changes in budget rules. For example, the bill also includes an entitlement cap that would require cuts of more than $2 trillion over ten years in entitlement programs other than Social Security. Nowhere in the legislation, however, is there any limit or any form of budget discipline placed on tax cuts. Unlimited new tax cuts would be allowed. Indeed, the bill would change Senate rules so that permanent tax cuts would be easier to pass.[1] This underscores the risk that the deep budget cuts required by the appropriations caps could result in even larger future tax cuts, with little or no deficit reduction occurring.

Finally, the Hensarling proposal covers a much longer time frame than earlier discretionary caps. This calls further into question the enforceability of the proposed caps. The Budget Enforcement Act of 1990 established five-year discretionary caps, which then were extended in 1993. The caps were extended again in 1997, but the increased severity of those caps led to widespread noncompliance with them, and they were effectively disregarded. Given the unprecedented severity of the caps in the Hensarling proposal, which would require much deeper cuts than those that the ultimately unenforceable 1997 caps would have necessitated, the Hensarling caps could become increasingly difficult to enforce as time passed.

End Notes

[1] The Hensarling bill includes the repeal of the Senate rule that bars budget reconciliation bills from increasing deficits in years beyond the years that the reconciliation directive covers. This rule is a central reason why the 2001 reconciliation legislation had to include sunsets on its tax cuts, rather than making them permanent.