The Senate is soon expected to consider a proposal to raise the minimum wage from $7.25 to $10.10 in three annual increments and then index it to inflation. The proposal — the Fair Minimum Wage Act of 2013 (FMWA), introduced by Senator Tom Harkin (D-IA) — also would raise the subminimum wage paid to those who also receive tips, which has been frozen at $2.13 for over two decades.[1] The FMWA would provide low-wage workers with a much-needed boost to their paychecks: today’s minimum wage is 22 percent below its late 1960s peak, after adjusting for inflation. It also would help offset some of the unfavorable trends facing low-wage workers, including stagnant or falling real wages, too little upward mobility, and a deep deficit of bargaining power that leaves them solidly on the “have-not” side of the inequality divide.

The common claim that raising the minimum wage reduces employment for low-wage workers is one of the most extensively studied issues in empirical economics. The weight of the evidence is that such impacts are small to none, and that minimum-wage increases of the magnitude that have been enacted in the past — and that would occur under the FMWA — are a clear net benefit to low-wage workers as a group as well as a policy tool that pushes back against rising inequality.

Some opponents of raising the minimum wage also claim that it would primarily benefit teenagers working for extra money. To the contrary, the vast majority of those who would benefit are adults, most are women, and their families depend on their paychecks; the average worker who would benefit from the FMWA brings home half of the family earnings.[2] This reflects the fact that the low-wage workforce has gotten older and more highly educated in recent decades: between 1979 and 2011, the share of low-wage workers (those earning less than $10 per hour in 2011 dollars) aged 25 to 64 grew from 48 percent to 60 percent, while the share with at least some college education grew from 25 percent to 43 percent.

In addition, though opponents often suggest that the existence of the Earned Income Tax Credit (EITC) obviates the need for a minimum-wage increase, both a strong EITC and an adequate minimum wage are needed to ensure that work “pays” for those in low-wage jobs. The two policies are complements, not alternatives.

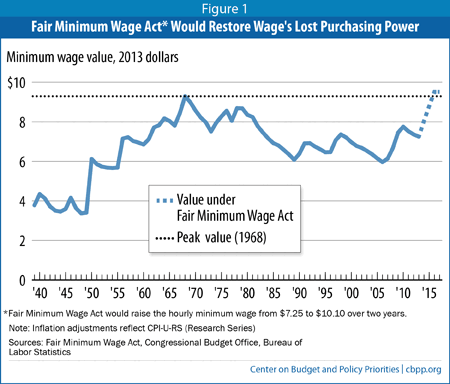

Introduced by the Fair Labor Standards Act of 1938, the nation’s first minimum wage was $0.25 per hour and covered relatively few workers. Congress has increased both the value and coverage of the minimum wage numerous times over the years (see Figure 1).

The minimum wage is not adjusted for inflation, a shortcoming that the FMWA would correct. Thus, except on rare occasions when prices decline, it loses buying power every year unless Congress raises it. Congress regularly raised the minimum wage from the 1940s through the 1970s but then ignored it in the 1980s; the minimum wage fell 30 percent in real terms between 1979 and 1989. Congress raised it in both the early and mid-1990s and then left it unchanged until 2007, when a series of increases began phasing in. The wage’s current level of $7.25 is still 22 percent below its peak value in the late 1960s, after adjusting for inflation.

If policymakers enacted the FMWA soon, the minimum wage would rise to $8.20 early in 2014, $9.15 in early 2015, and $10.10 by 2016. In 2016, its value (adjusting for inflation) would be slightly above its peak inflation-adjusted value in the late 1960s.[3] The FMWA would index the minimum wage to inflation after 2016 to maintain its purchasing power.

The FMWA also would raise the subminimum wage for workers who regularly receive tips, such as waitresses and airport workers who assist travelers with bags. The subminimum was introduced in the mid-1960s, when it stood at 50 percent of the minimum wage. The subminimum wage has been frozen at just $2.13 per hour for over two decades and is now about 30 percent of the minimum.[4] The FMWA would lift it to 70 percent of the minimum wage and keep it there.

Current law states that if tipped workers’ tips fail to bring their hourly pay up to the minimum wage, their employer must make up the difference. But “[t]his requirement is very difficult to enforce,” a study notes.[5] Even if it were well enforced, a low subminimum wage pulls down the total take-home pay of tipped workers, leaving more of them at or just barely above minimum-wage levels and allowing employers to shift a larger share of their workers’ compensation to irregular tips rather than a regular hourly wage.

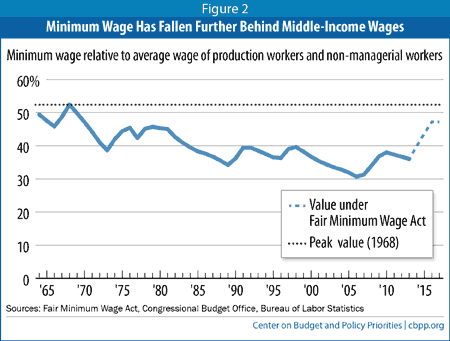

The minimum wage has declined in recent decades not only in real terms but also compared to the median wage. Figure 2 plots the trajectory of the minimum wage relative to the average hourly wage of blue-collar production workers and non-managerial workers, a wage series that tracks median wages fairly closely (but provides a longer time series). It shows that the minimum wage has fallen behind the hourly pay of these middle-wage workers over time, from roughly 50 percent of this average wage back in the 1960s to as low as 30 percent in 2006. The FMWA would partially restore the minimum wage’s relative value.

The decline in the minimum wage’s relative value has contributed to the increased dispersion in wages over the past few decades — particularly among low-wage women, whose pay tends to be more closely tied to the minimum wage than low-wage men’s pay. For example, research shows that between 1979 and 2009, two-thirds of the increase in the gap between middle- and low-wage women reflects the erosion in the value of the minimum wage.

[6] For men, the erosion of the minimum wage explains 11 percent of the growth in the middle-to-low-wage gap.

Recent data suggest that income and wages continue to grow more unequal, and since 2000 and more recently in the aftermath of the Great Recession, much of the economy’s growth has accrued to the top of the income scale.[7] As inequality has increased, the distance between minimum-wage workers and high-income earners has grown even more. The FMWA, by providing low-wage workers with both a real and a relative wage increase, would partially counteract that trend.

Though opponents of raising the minimum wage claim that it hurts the workers it is designed to help by pricing them out of the labor market, the weight of careful evidence says otherwise with respect to wage increases of the size being proposed.

House Speaker John Boehner has argued against raising the minimum wage, stating: “If you raise the price of something, guess what? You get less of it.”[8] That is, if the cost of low-wage labor rises, employers will lay off workers and hire fewer workers going forward. However, there are numerous ways to accommodate wage increases without layoffs, such as more efficient production, higher prices, and lower profits. In addition, even if employers do “buy less” low-wage labor by reducing a worker’s hours, the worker’s weekly earnings could still go up because of the increase in the hourly wage.[9]

In a review of over 60 studies that look for statistical linkages between minimum-wage increases and job losses, economist John Schmitt reports that the most accurately measured results cluster around zero: some studies find that raising the minimum wage has a small negative effect on employment, a smaller number find that it has a small positive effect, and most find no significant effect.[10] “The weight of the evidence points to little or no employment response to modest increases in the minimum wage,” Schmitt concludes.

It is important to stress that some high quality research finds job losses and reduced hours for affected workers. In other words, there are some cases where employers do “buy less” labor when its price goes up. But even in these studies, the impacts are small enough so that the net result for the vast majority of low-wage workers is a net gain in earnings. That is, there would be relatively few job losses compared to the number of workers who would remain at work with higher wages, and some workers whose hours were reduced would still see increases in their weekly earnings. As economist Arin Dube recently stated, “[t]he academic disagreements are over no job losses or small job losses for highly impacted groups.”[11]

Influential research that took advantage of the variation in minimum wages across states (19 states plus the District of Columbia have their own minimums that exceed the current federal level) supports this conclusion. Noted economist David Card looked at teenage wage and employment outcomes[12] after the minimum-wage increases in the early 1990s and concluded that “[c]omparisons of grouped and individual state data confirm that the rise in the minimum wage raised average teenage wages. . . . On the other hand, there is no evidence that the rise in the minimum wage significantly lowered teenage employment rates. . . .”[13]

Later work by Card and Alan Krueger compared fast food restaurants in New Jersey and Pennsylvania after a minimum-wage increase in New Jersey but not Pennsylvania and found no significant job-loss effects.[14] In a series of papers with various co-authors, Dube extends this approach to neighboring counties across the country:

Comparing across these neighboring counties, we showed that there was no evidence of job losses for high impact sectors such as restaurants and retail. This was true even considering four or more years after the minimum wage hike. In follow up work, we used the same cross-border methodology to study the effect on teens — a high impact demographic group. . . . Again, we found no discernible impact on employment. In yet another paper, we used a different dataset and less fine-grained regional controls and again replicated our findings that minimum wages did not reduce teen employment during the 1990s and 2000s.[15]

As is often the case in economic research, there is no definitive “right answer” to the question of how minimum-wage increases affect the employment of low-wage workers. But an extremely large and rigorous body of research should lead policymakers to heavily discount claims that employers will make large job cuts in response to a minimum-wage increase. Even the evaluations that find small losses of jobs or hours show that raising the minimum wage has its intended effect: boosting the pay of the vast majority of workers without significantly hurting their employment prospects.

Some critics also argue that the minimum wage is poorly targeted, meaning that many people who benefit from a minimum-wage increase do not live in low-income households. This argument is typically made in conjunction with claims that there are large downsides to raising the minimum wage and that those “costs” are not worth absorbing because the beneficiaries do not really need the extra earnings. Economic Policy Institute figures on the workers whom the FMWA would affect contradict this simplistic picture:[16]

- About 17 million workers would receive a wage boost; 8 million children live in families with an affected worker.

- The majority of beneficiaries are women (58 percent).

- Most are adults (84 percent are over age 20; 47 percent are over 30).

- Most are non-Hispanic whites (57 percent), but African Americans and Hispanics are over-represented among those affected by the proposed increase: these groups make up 11 percent and 16 percent of the total workforce, respectively, but represent 16 percent and 21 percent of workers who would see their wages rise under the FMWA.

- Just under half (47 percent) of affected workers work full-time (35+ hours per week); another 36 percent work 20-34 hours per week.

- Some 54 percent of the benefits of the increase would flow to the bottom third of the workforce, with family income below $40,000. Some 25 percent of the benefits would flow to the bottom 10 percent of the workforce, with family income below $20,000.[17]

- The average affected worker brings home half of the family earnings.

In addition, the low-wage workforce has gotten older and better educated over time. One study found that the share of low-wage workers (those earning less than $10 an hour in 2011 dollars) who are aged 16-24 fell from 47 percent in 1979 to 36 percent in 2011, while the share aged 25-64 rose from 48 percent to 60 percent.[18] The share of low-wage workers who were high-school dropouts fell from 40 percent to 20 percent during this period, while the share with at least some college rose from 25 percent to 43 percent.

Clearly, the beneficiaries of a minimum-wage increase are older and better educated than the beneficiaries of an increase several decades ago. The claim that the minimum wage is largely a teenagers’ issue is not supported by these demographic trends.

Some critics also argue that raising the minimum wage isn’t necessary because of the Earned Income Tax Credit, a pro-work wage subsidy for low-income workers. But citing the existence of the EITC as a reason not toraise the minimum wage ignores the goal of the FMWA: to lift the earnings and incomes of low-wage workers and their families above current levels. In reality, it takes both a strong EITC and an adequate minimum wage to ensure that work “pays” for those in low-wage jobs. The two policies are complements, not alternatives.

For example, because the EITC is a proven work incentive, it expands the number of people seeking jobs in the low-wage sector, which can put some downward pressure on the wages that employers offer potential workers.[19] A higher minimum wage helps offset that effect.

In addition, the EITC provides a wage supplement in the form of a tax refund that comes once a year. The minimum wage is reflected in every paycheck, helping families meet bills as they arise.

Also, if policymakers tried to place too much of the burden of “making work pay” for low-income workers on the EITC rather than a combination of the EITC and an adequate minimum wage, the cost to the government would be well beyond what policymakers likely would accept.[20]

In strengthening the minimum wage through the FMWA, policymakers might want to strengthen the EITC as well. In particular, adults not raising minor children receive little from the EITC. The average EITC benefit such workers receive is only about $270 per year, and the credit phases out completely at earnings of about $14,600, so childless adults who work full-time year-round at the current minimum wage receive virtually no EITC at all. Expanding the EITC for childless workers would help the two policies work together more effectively to lift the incomes of low earners while also providing stronger incentives for more childless adults to enter the labor force.

The much analyzed history of minimum-wage increases shows that they have achieved their goal of boosting the earnings of low-wage workers, most of whom really need the extra resources, with virtually no budgetary costs and few unintended consequences. The FMWA, by phasing in over three years and then indexing the minimum wage and raising the subminimum wage, would mean that millions of workers would have more adequate earnings to use to support their families. It would also re-inject some much needed fairness back into a labor market where it has become increasingly challenging for low-wage workers to get ahead.