Government economic security programs such as food assistance, housing subsidies, and working-family tax credits — which bolster income, help families afford basic needs, and keep millions of children above the poverty line — also have longer-term benefits, studies find: they help children to do better in school and increase their earning power in their adult years.

One in three U.S. children spend a year or more below the poverty line before their 18th birthday.[1] Children experiencing poverty tend to be worse off in a range of ways, including being more likely to enter school behind their peers, scoring lower on achievement tests, working less and earning less as adults, and having worse health outcomes.[2] This pattern is especially clear for the poorest and youngest children and those who remain in poverty a long time during childhood.[3] Further, these adverse outcomes happen “in part because they are poorer, not just because low income is correlated with other household and parental characteristics,” a recent systematic research review concludes.[4] That is, income itself matters.

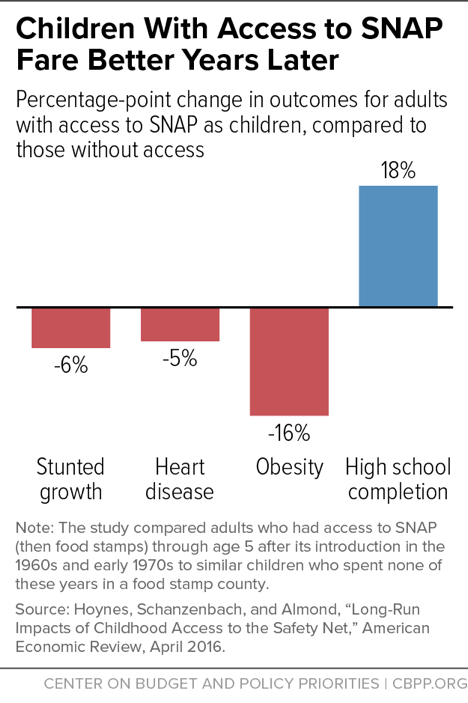

Economic security programs can blunt these negative effects of poverty and bring poor children closer to equal opportunity, numerous studies find. For example, a study of the long-term effects of the introduction of food stamps (now known as SNAP) in the 1960s and 1970s found that young children who had access to food stamps grew up to have higher high school graduation rates and lower rates of certain health problems such as heart disease and obesity, as compared to similar disadvantaged children who lacked access to food stamps because their county hadn’t yet implemented the program. In addition, women who had access to food stamps as young children had improved economic self-sufficiency in adulthood.

Other economic security programs have been found to improve health outcomes at birth, raise reading and math test scores in middle school, increase high school completion and college entry, lift lifetime income, and extend longevity. The findings come from studies of the Earned Income Tax Credit (EITC), anti-poverty and welfare-to-work pilot programs in the 1990s, an earlier public assistance program for mothers, and various negative income tax experiments in the late 1960s through early 1980s, among others. In addition, a recent well-known housing study found that housing vouchers that help poor families move to less poor neighborhoods before children turn 13 raise the earnings of these children by 31 percent when they reach adulthood.[5]

Researchers are still exploring the reasons why more adequate family income helps children over the long term. One way that the added income may help is, for example, by reducing severe poverty-related stress, a condition that scientists have linked to lasting consequences for children’s brain development and physical health. Another may be by helping families afford better learning environments from child care through college. Important gains for children have been found both in programs that boost income by raising parental employment and in programs that raise income without an increase in parental employment.

Overall, the weight of the evidence indicates that economic security programs not only open doors of opportunity for participating low-income children but also lift their future health, productivity, and ability to contribute to their communities and the economy in ways that benefit society as a whole.

Economic security programs help low-paid or out-of-work families afford the goods and services a child may need to thrive — whether it be nutritious food, a safe home and neighborhood, transportation to a doctor or library, eyeglasses to see the school blackboard, or lead-paint abatement to avoid lead poisoning.

Most families participating in these programs work for at least part of the year. Together with their earnings, the assistance they receive often lifts the family’s annual resources above the poverty line. (Under the federal government’s Supplemental Poverty Measure or SPM, which includes both cash income and non-cash assistance such as food assistance and tax credits, the poverty line equaled $25,583 in 2015 for a couple with two children that rents a home in an average-cost community.)[6] Specifically, in 2015:

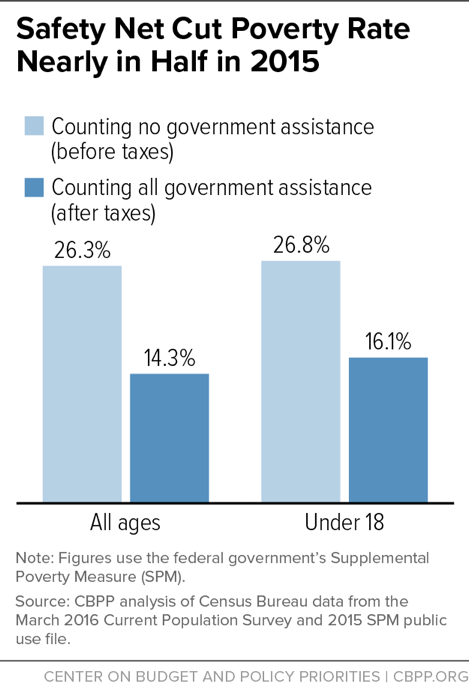

- Government assistance cut the poverty rate nearly in half, lifting 38 million people above the poverty line, including nearly 8 million children.

- This assistance lowered the child poverty rate from 26.8 percent (when families’ income from these programs is not counted) to 16.1 percent (when the assistance is counted). (See Figure 1.) [7]

These programs’ true poverty-reducing impact is likely even higher, because, surveyed households do not always recall and report all of their income from government assistance.[8]

Growing evidence shows that low income can have lasting adverse effects on children and that bolstering family income can help poor children catch up in a range of areas.

In a systematic review of high-quality income studies, researchers at the London School of Economics and Political Science noted that almost all of the studies found positive effects of higher family income on children’s educational, behavioral, and health outcomes.[9]

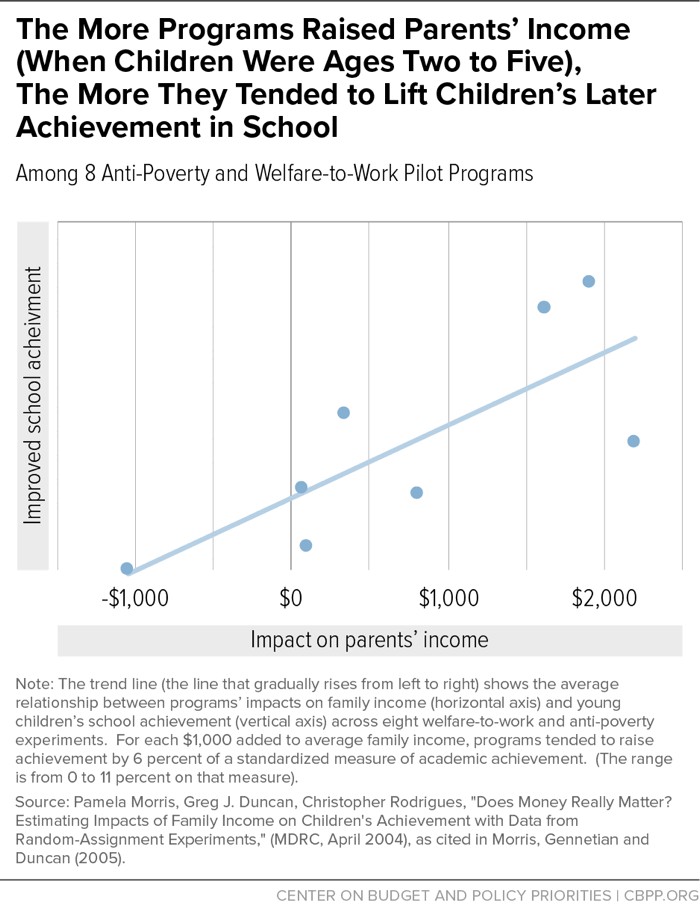

Particularly compelling evidence that income support can help poor children catch up in school comes from a series of cross-program comparisons of several welfare-to-work and anti-poverty pilot programs in the United States and Canada in the 1990s. When programs provided more generous income assistance, the comparisons consistently showed better academic performance among young children transitioning into school. And the more the programs increased participating families’ incomes, the more their children’s academic achievement rose, relative to peers assigned to a traditional, less generous welfare program. (See Figure 2.) The five most generous programs raised average income by $1,700 a year.[10] In a related earlier study of several of the same interventions, participation in the more-generous programs raised low-income children’s average test scores from the equivalent of the 25th percentile to the 30th percentile.[11]

Interventions that did not raise income because they focused solely on boosting employment and lowering welfare participation largely failed to improve children’s academic performance. Assessing the cross-program data, researchers concluded that “young children’s school achievement is improved by the income gains generated by these programs but is not affected by changes in parental employment and welfare receipt occurring at the same time.”[12]

A later study that examined 16 interventions produced similar findings, with income gains leading to higher school achievement but with little effect from higher parental employment.[13]

A more recent study traced what happened to American Indian youth after a Cherokee tribal government in North Carolina opened a casino and disbursed profits averaging $4,000 a year to each adult member of the tribe, cutting their families’ poverty rate roughly in half. [14], [15] A $4,000 boost in annual household income from these stipends, continued for four years, led to a rise of 1.1 years of education completed by age 21 among American Indian youth who were poor prior to the casino’s opening, and raised by nearly 40 percent their likelihood of graduating from high school, researchers estimated.[16] The additional income also increased the youths’ school attendance by almost four days per quarter and reduced the chances of committing a minor crime by 22 percent for 16- and 17-year-olds across all income groups, the researchers concluded.

Earlier income subsidy programs also showed positive results. A series of federally funded Negative Income Tax (NIT) experiments from 1968 to 1982 randomly assigned families to receive varying levels of guaranteed income in several urban and rural sites around the country. As summarized by researchers Neil Salkind and Ron Haskins:[17]

The quality of nutritional intake was higher in the experimental than in the control group…. Three of the experiments found higher school attendance levels…. Receiving the [guaranteed income] was associated with higher grades and achievement test scores, which act as powerful reinforcers for increased self-esteem…. In New Jersey, educational level was higher among experimental than control children.[18] (Italics in original.)

Nine out of the experiments’ ten significant educational impacts on children were positive, Salkind and Haskins’ summary showed.

Income’s impacts in the NIT experiments appeared to vary by age of child. One research team noted that, “the Negative Income Tax studies appear to suggest that income is more important for the school achievement of pre-adolescents and for the school attainment of adolescents.”[19] Specifically, two of three sites that evaluated school achievement found significant achievement gains for children in elementary school but not for adolescents.[20] At the same time, adolescents’ likelihood of completing high school and their average years of completed schooling increased in New Jersey, the only NIT site that appears to have examined school completion: high school completion increased by 20 to 90 percent, on average, the New Jersey evaluation reported. By ages 19 and 20, teens from families with a guaranteed income completed an average of one-third to one and a half more years of formal education, relative to teens in a randomly assigned control group.[21]

Two other NIT experiment sites that examined school attendance but not school completion (Seattle and Denver) found school attendance improved by 9 percentage points for teens ages 16 to 21; for 18-year-olds, attendance rose by an impressive 14 percentage points, from 28 percent to 42 percent.[22] (A recent follow-up study found no impact on the Seattle and Denver children’s later earnings, as discussed below.)

A recent retrospective study of income assistance provided a century ago found positive effects that were life-long. Researchers conducted a study that tracked sons who had participated in the Mothers’ Pensions program (participating daughters’ names changed too frequently), which was the first broadly targeted monthly public income assistance program in the United States. The program operated from 1911 to 1935 and served low-income mothers whose husbands were missing or incapacitated. The study found that assisted children completed one-third more years of schooling, had nearly 14 percent higher incomes by early adulthood, were less likely to be underweight, and lived an average of one year longer, compared with peers whose mothers had applied for the income assistance but were turned away. (The rejected families were generally slightly less poor at the time of application but significantly poorer after the assistance was taken into account.)[23]

A robust set of studies have found that the EITC, which supplements earnings and offsets taxes for low-income working families, also boosts children’s school achievement, chances of attending college, and health outcomes. (See Figure 3.) Another working-family tax credit, the Child Tax Credit (CTC), is newer and less studied but shares key design features with the EITC (most notably, both credits increase in value as a low-income worker’s earnings increase, thereby rewarding work), and both credits have shown positive results for children.

Evidence for tax credits’ positive effects begins early in life. Several studies examined family income and child outcomes following federal and state EITC expansions enacted during the 1980s through the 2000s. Infants whose mothers were eligible for the largest federal tax credit increases or lived in a state that enacted a state EITC tended to experience the greatest improvements in birth weight — an early health indicator that is a strong predictor of children’s longer-term health outcomes, educational attainment, and later-life earnings.[24] Studies have also linked living in a state that recently enacted or enlarged a state EITC with significant reductions in mothers’ mental stress and smoking during pregnancy (which could contribute to the improvements in birth weight).[25]

Mounting evidence also links the EITC and CTC to higher test scores. Students living in households with additional income from the EITC had significantly larger combined math and reading test scores, according to a study of nearly two decades’ worth of data on mothers and children.[26] Another study, examining a series of federal and state EITC expansions, found that in years and states when lawmakers increased the EITC, children’s test scores rose — particularly in math — in both elementary and middle school.[27] Likewise, a study that matched tax records with school performance for 2.5 million students in grades 3 to 8 reported an association between income from the EITC and CTC and higher reading and math scores.[28]

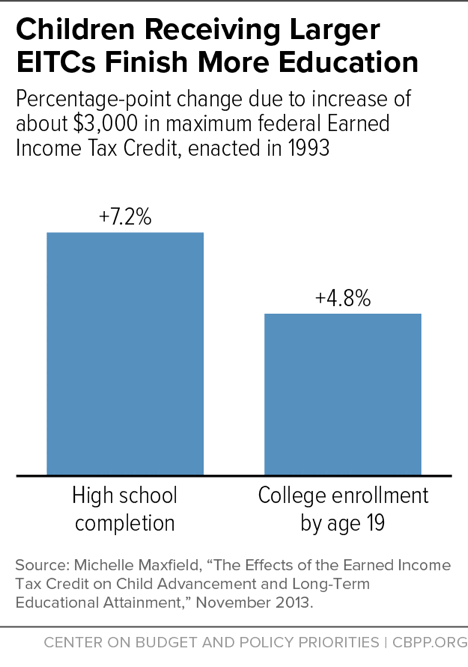

The EITC’s and CTC’s beneficial effects appear to follow children into adulthood. One preliminary study links the receipt of larger EITCs to higher rates of graduating from high school and attending college.[29] The size of these effects is noteworthy: the author estimated that a child in a family eligible for the largest EITC expansion in the early 1990s had a 7.2 percentage-point increase in high school completion. Those children also had a 4.8 percentage-point higher probability of completing one or more years of college by age 19 (see Figure 4) — an improvement comparable to that from major educational interventions such as reductions in classroom size. The findings show that the academic benefits of larger EITC benefits extend to children of all racial and ethnic groups, with some evidence that the benefits are larger for children of color, boys, and younger children (i.e., for preschoolers, relative to middle school students).

Moreover, skill gains associated with families’ EITC income add significantly to their children’s expected earnings later in life. Researchers have projected that each dollar of income through tax credits may increase the real value of the child’s future earnings by more than one dollar.[30]

Tax credits may improve a low-income child’s chances of attending college not only by improving his or her skills during middle childhood but also more directly, by making college more affordable. One study estimates that for a high-school student whose family makes around the amount needed to qualify for the maximum EITC — about $11,000 — as little as $1,000 in tax refunds received in the spring of senior year (in 2015 dollars) increases college entry rates the next year by more than 2 percent. Further, the authors report suggestive evidence that assisted students persist through a full four-year college education.[31] Given the high payoff associated with a college degree — with lifetime net earnings gains of about $200,000 to $550,000 for a public four-year degree after subtracting in-state tuition and fees, according to various studies — such effects on college entry suggest that the gains in productivity and earnings roughly equal or exceed the added EITC income.[32]

As economists Austin Nichols and Jesse Rothstein summarize in a recent review of the literature on the EITC: “Taking all of the estimates together, there is robust evidence of quite large effects of the EITC on children’s academic achievement and attainment, with potentially important consequences for later-life outcomes.”[33]

In addition, expansions of state and federal EITCs may even reduce child maltreatment, according to one study. Among single mothers in the study, for example, each $1,000 in higher income (in 2009 dollars) received because of EITC expansions between 2000 and 2009 was associated with a decline of approximately 8 to 10 percent in child protective services investigations. Declines were especially large in investigations of physical neglect or of failure to provide a child’s basic material needs — the category of maltreatment that has long been most closely correlated with low income. “The general pattern of our results is suggestive of a causal link” between higher income and reductions in child neglect and involvement by child protection agencies among the families benefiting most from the EITC, the researchers concluded.[34]

Food stamps (subsequently renamed the Supplemental Nutrition Assistance Program or SNAP) provide a food subsidy that is modest in size — about $1.40 per person per meal in 2015 — but plays a critical role in reducing hunger, food insecurity, and poverty.

A recent study examined what happened as the federal government gradually introduced food stamps across the country, county by county, in the 1960s and early 1970s. It concluded that children from disadvantaged families that had access to food stamps in utero or early childhood had better health outcomes as adults than otherwise-similar children born in counties that had not yet implemented the program. Adults who’d grown up in counties with food stamps reported better health and had lower rates of “metabolic syndrome,” which is a combined measure of obesity, high blood pressure, heart disease, and diabetes. In addition, women with access to food stamps as young children reported improved “economic self-sufficiency,” based on a combined measure of employment, income, poverty status, high school graduation, and program participation. Early access to food stamps also increased disadvantaged children’s chances of graduating from high school by 18 percentage points. (See Figure 5.)[35]

A second study examined how changes in food stamp eligibility rules for legal immigrant adults in the 1990s and early 2000s may have affected their children’s health. The researcher estimated that for each additional year that immigrant parents were eligible for food stamps while their children were in the prenatal year through age 5, the children experienced a decline of 6 percent (or 1.6 percentage points) in the likelihood that their parents will report them as being in “poor,” “fair,” or “good” health (rather than “very good” or “excellent” health) between ages 6 and 16. For every $1,000 in food stamp benefits (in 2009 inflation-adjusted dollars), the likelihood of less-than-very-good health declined by 15 percent.[36] This study provides evidence that participating in food stamps as a young child can affect health later in life, as well as when the children are school age.

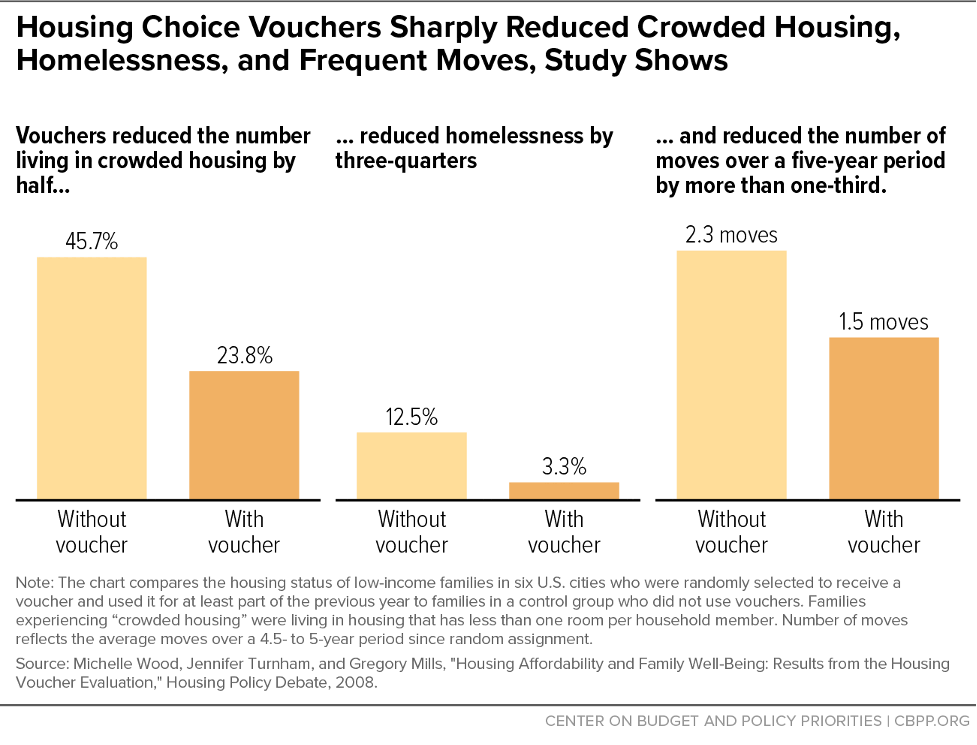

Rental subsidies such as vouchers and public housing help families afford decent, stable housing. By lowering families’ rent to 30 percent of their income and requiring that housing meet minimum quality standards, housing assistance also reduces housing-related problems that can impair children’s academic achievement, including overcrowding, homelessness, and frequent moves that result in disruptive school changes.[37] In addition, housing voucher programs that enable families to move out of poor neighborhoods can boost young children’s future earnings.

In a multi-site, rigorous evaluation, low-income families that received housing vouchers were 52 percent less likely to live in overcrowded housing, 74 percent less likely to become homeless, and moved about 35 percent less often than otherwise-similar low-income families that didn’t receive housing assistance. (See Figure 6.)[38]

Research links the housing-related problems that housing assistance addresses to a range of adverse outcomes with long-term consequences. Children in homeless families are more likely than other low-income children to drop out of school, repeat a grade, or perform poorly on tests.[39] Frequent moves, particularly those that cause children to change schools during kindergarten or high school, tend to worsen educational performance; this is true both for the children and for their classmates in schools in which large numbers of students move in or out during the year.[40] Moving frequently can also impose stress and cause students to have difficulty concentrating, may cause gaps in learning because schools cover material in a different order, and may weaken the bond with teachers or cause children to miss school days. [41] Overcrowding (which is generally not allowed in assisted housing) can deny children a quiet space to do homework and trigger stressful conflicts that interfere with academic performance.[42],[43]

One large-scale study in Chicago showed that housing vouchers had modest positive impacts on young boys’ achievement test scores, compared with peers on a waiting list who received no housing subsidy.[44] The test score improvement per dollar of benefit income was smaller than previous estimates had found for the EITC but comparable to the per-dollar impact of reducing classroom size in an earlier Tennessee experiment, the data suggest.[45] The findings also included signs of improvement for older girls’ math scores. The researchers emphasize that there was no general pattern of improvement across a broad list of child outcomes that included health and crime. Other research, however, shows that vouchers are more effective for children when they are designed to help families move to areas of higher opportunity — which the vouchers in the Chicago study were not.

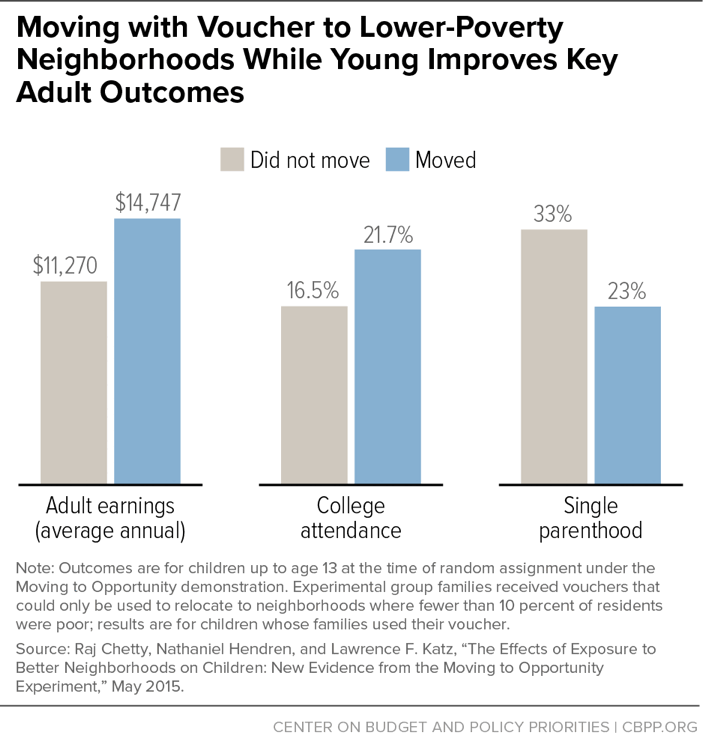

Studies have found lasting positive results from recent innovations in housing assistance that help low-income families use housing vouchers to move to lower-poverty areas with higher opportunity and less crime.[46]

Children whose families moved to low-poverty neighborhoods were more likely to attend college and earn more as adults, relative to children who remained in high-poverty neighborhoods, according to an important recent study by Raj Chetty and colleagues.[47] Researchers found that children under age 13 living in families that used a housing voucher to move to a lower-poverty neighborhood from a public housing development were 32 percent more likely to attend college and earned 31 percent (nearly $3,500) more per year as young adults than their counterparts in families that did not receive a voucher. The boost in total lifetime earnings was estimated to be $302,000, on average. The children were also likelier to live in better neighborhoods as adults, and the girls were 30 percent less likely to be single parents as adults. (See Figure 7.) The researchers concluded that for families that moved, vouchers “may reduce the intergenerational persistence of poverty and ultimately generate positive returns for taxpayers.”[48] In contrast, the researchers suggested that moving at older ages (above 13) may offer children fewer years of childhood exposure to their new environment so that, on balance, the disruption of moving may do more harm than good.

Likewise, a Maryland study found that low-income children are more likely to succeed in school when housing assistance is used to help them grow up with residential stability in high-opportunity areas with low-poverty schools. Low-income families accepted into public housing were assigned a housing site and an affiliated neighborhood school. After five to seven years, students assigned to a low-poverty elementary school “significantly outperformed,” in both math and reading, their peers in public housing who attended higher-poverty schools.[49] In addition, educational performance improved with time in the low-poverty schools, suggesting that residential stability may play an important role in children’s success. By the end of elementary school, students in families that had used housing assistance to move to a high-opportunity area had cut their initial, sizeable achievement gap with non-poor students in their district by half for math and one-third for reading.

Moreover, while some opponents of using vouchers to help poor families move to low-income areas argue that this would increase crime in the destination neighborhoods, a careful study of neighborhood crime rates in ten large cities found no evidence of this occurring.[50]

Researchers are still exploring why a secure financial base matters for children’s development and lifelong opportunities. Because children’s individual needs vary, the reasons likely vary for different children and at different stages of childhood. Examples of key influences include income’s effects on children’s early nutrition, exposure to stress, and learning environments.[51]

One way assistance programs may help children is by improving nutrition in their earliest years, starting before birth. Researchers note that even mild voluntary daytime fasting in the first trimester of pregnancy is associated with lower child test scores by age 7 as well as lower adult earnings and a 20 percent increase in the likelihood of disability, especially mental disability.[52],[53] Similar effects may have been at play when the Food Stamp Program was introduced to different areas of the country in the 1960s and 1970s; data showing reduced underweight births indicate that “newborn health improved promptly” after the program arrived.[54] Poor nutrition in early childhood has been linked with a lifelong shift in the body’s metabolism and a cluster of chronic metabolism-related illnesses, including diabetes, high blood pressure, and heart disease — a connection that researchers say may explain the lasting effect of food stamp access in childhood in reducing these illnesses in adulthood.[55]

Reducing severe stress is a second major way that income can affect children, partly through its effects on parents and parenting. “Increasingly sophisticated studies suggest that income support can reduce mothers’ stress,” according to a research review by Greg Duncan and his colleagues.[56] This can contribute to more effective parenting. For example, a $4,000 infusion of income from stipends funded from the opening of a casino was associated with improvements in the quality of parent-child relationships (including improved parental supervision, more positive interactions with mothers, and fewer arguments between parents and children), which in turn appear to have contributed to improvements in children’s emotional and behavioral health by age 16.[57]

In some studies, financial stress and distraction appear to have an immediate effect on adults’ mental functioning.[58] In two studies of adults — one experiment in a New Jersey mall and another study involving essentially randomized payment schedules among farmers in India — researchers at Harvard and Princeton found evidence that increases in financial stress temporarily lowered measured IQs by 9 to 14 points, similar to the effect of staying awake for 24 hours.[59] The short-term effects of family financial distress on students’ concentration and learning have not been well studied, though low-income students’ short-term reactions to neighborhood violence have been linked to lower test scores.[60]

Stress can also matter in the long run. Duncan and his colleagues note, “low-income children have significantly higher levels of stress hormones than their wealthier counterparts” — whether because of stressed parents, dangerous neighborhoods and schools, or other factors — and “disparities in stress exposure and related stress hormones may explain to some extent why poor children have lower levels of cognitive ability and achievement as well as poorer health later in life.”[61] For example, they note, high childhood stress has been linked to “a host of inflammatory diseases later in life,” such as arthritis. Severe stress is also thought to have lasting negative effects on a young child’s developing brain. (See box.)

Further, maternal stress may act together with undernutrition and other poverty-related challenges to damage a young child’s immune system in ways that can later lead to early-onset arthritis and other chronic ailments and disabilities. These health problems can result in lost work hours and lower adult productivity. According to a study in the Proceedings of the National Academy of Sciences:

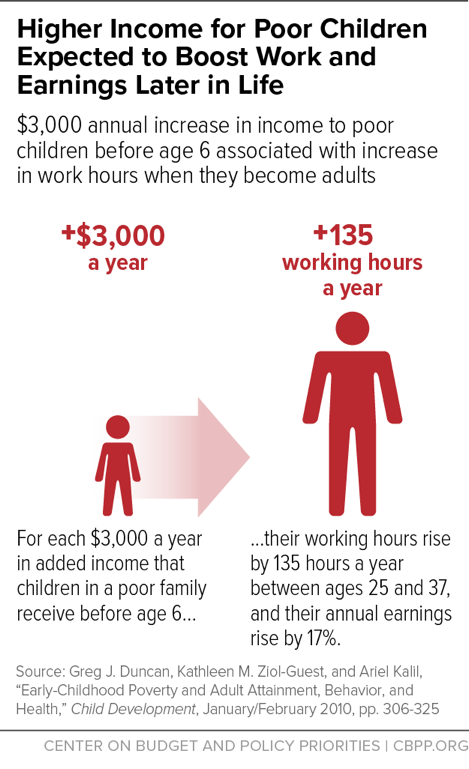

Results show that low income, particularly in very early childhood (between the prenatal and second year of life), is associated with increases in early-adult hypertension, arthritis, and limitations on activities of daily living. Moreover, these relationships and particularly arthritis partially account for the associations between early childhood poverty and adult productivity as measured by adult work hours and earnings. The results suggest that the associations between early childhood poverty and these adult disease states may be immune-related.[62]

Chronic illness may thus partly explain the intergenerational link observed in earlier studies between parental income levels and a child’s later work outcomes. For example, one study that followed low-income children from early childhood into their adult years found that each additional $3,000 in annual income in early childhood (in 2005 dollars) is associated with an added 135 hours of work per year as a young adult and an additional 17 percent in annual earnings.[63] (See Figure 8.)

Income can also help families afford more effective learning environments, from child care through college. An evaluation of welfare-to-work and anti-poverty interventions of the 1990s found that programs that increased family income but didn’t actively encourage or require use of child care centers also increased the use of center-based child care and improved children’s academic performance in the early years of elementary school.[64] Those researchers concluded that the use of center-based care among young children partially explained the positive effects of income on children’s academic achievement. This finding builds on earlier research suggesting that access to center-based child care for low-income young children has benefits for their cognitive development.[65]

Income has also had a growing effect on college attendance in recent decades. Researchers found a “dramatic increase” in the strength of the positive relationship between family income and college attendance among youth in their late teens in the early 2000s compared to those in the early 1980s, even when controlling for cognitive skills.[66] As previously noted, income from the EITC has been linked with modest increases in college enrollment rates by making college more affordable for high school seniors.

Together, income security’s effects in very early childhood and its later effects, such as on access to education, appear to add up. In a previously mentioned study, children who received Mothers Pensions roughly a century ago lived an average of about a year longer than otherwise-similar children who were turned down. Researchers calculated that approximately 75 percent of this lifespan effect could plausibly be explained by the program’s combined positive influence in three separate areas — reducing underweight births by half, increasing education by 0.34 years of schooling, and raising adult income by 14 percent — each of which prior research had linked with longevity.[67]

Some have suggested that increases in parental employment — not income — are the real reason children seem to fare better in economic security programs. The evidence suggests otherwise.

Educational gains have been found both from income-support programs that raise parental employment and those that do not. One cross-program comparison of 16 local welfare-to-work and anti-poverty policies in the early 1990s noted:

All of these policies increased parental employment, while only some increased family income. These analyses indicated improved academic achievement for preschool and elementary school children by programs that boosted both income and parental employment, but not by programs that only increased employment. These experimental findings suggest that income plays a causal role in boosting younger children’s achievement.[68]

Moreover, as the same researchers noted, earlier income-boosting programs that did not raise employment (such as the NIT experiments) also lifted children’s educational outcomes. Taken together, this suggests that income gains tend to help children succeed in school, while lifting parental employment is neither necessary nor sufficient to do so.

At the same time, as previously noted, welfare-to-work interventions that did not raise income because they focused solely on boosting employment and lowering welfare participation largely failed to improve children’s academic performance. Researchers concluded that young children’s school achievement is improved by the programs’ positive income effects but not by their effect on raising parental employment.[69]

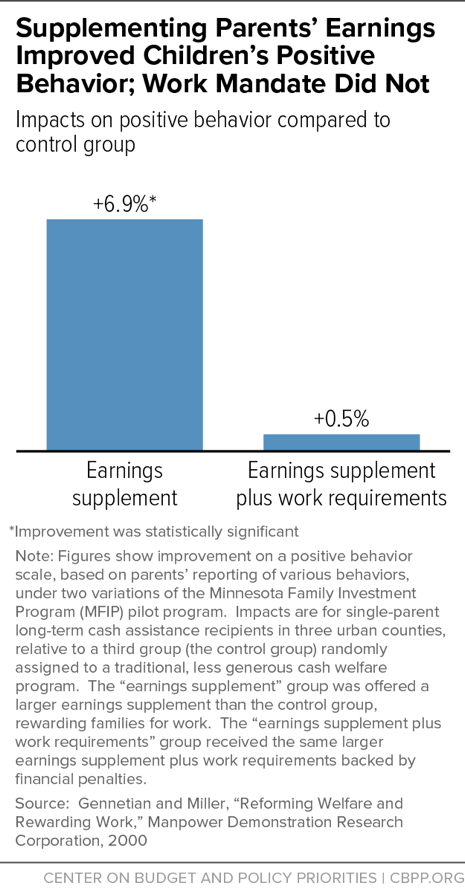

One of the pilot programs, the Minnesota Family Investment Program (MFIP), looked at whether adding an employment mandate to income assistance helps children. The study divided families at random into three groups. The control group received the then-conventional program of minimal Aid to Families with Dependent Children (AFDC) income support equaling at most about half of the poverty line for a mother with two children ($853 a month in 2016 dollars). (Cash assistance benefit levels have since eroded further in Minnesota and most other states.) A second “Incentives Only” group added a somewhat more generous earnings supplement as a reward for families that worked. A third group received those positive work incentives plus work requirements backed by financial penalties.

The Incentives Only policy raised average incomes by 11 percent among long-term public assistance recipients, relative to the control group. (The majority of the recipients remained below the poverty line, though, even after counting their food stamps and EITC.) The Incentives Only program also significantly raised children’s school performance and engagement. Adding work requirements on top of those earnings supplements, however, did not further help children’s school performance, and it decreased some measures of children’s positive behavior even though the mandates did result in more parents working. (See Figure 9.) (Adding the mandates increased earnings but decreased welfare income, resulting in no significant change in net income relative to the Incentives Only group.)[70]

The Minnesota findings “suggest that increases in income may benefit children’s academic functioning and that increases in employment alone are generally neutral but may have negative effects on selective aspects of children’s positive behavior,” evaluators concluded.[71]

Some people also suggest that better child care services, not income, may explain the better outcomes of young children in some financial assistance pilot programs. There is little doubt that good child care can help children succeed and that one way income support can help children succeed is by enabling their parents to purchase better child care. However, financial assistance has been found to promote children’s well-being whether or not it enhanced child care. In the Minnesota pilot project, for example, earnings incentives by themselves did not significantly increase the use of center-based child care but did significantly improve children’s well-being.[72] Adding work mandates boosted the Minnesota parents’ use of center-based child care but did not boost children’s educational outcomes further, and it reduced children’s positive behavior.

Further, the Mothers Pensions of the early 1900s showed positive long-term effects on children even though it is unlikely that the program greatly increased children’s participation in child care centers because it predated the widespread adoption of center-based child care.

Welfare time limits and other stringent welfare rules — which, in the absence of adequate child care or other services, often function more as a cut in assistance than as a path to stable employment — have been found to have harmful effects in other studies as well. One Delaware study found that the child protective services agency was more likely to become involved with families that had been randomly assigned to a program of lower welfare benefits, time limits, strict work requirements backed by financial penalties, and other limitations, relative to families receiving a modestly more generous traditional welfare program in the 1990s.[73] The study was unable to determine whether these negative impacts on children were due to lower income, increased parental stress, or other factors associated with the stricter rules. The findings are consistent, however, with the previously mentioned study finding that child maltreatment and child protective services involvement fell after state and federal EITC expansions boosted family incomes.

The bulk of evidence supports the conclusion that economic security programs play a strong role in helping low-income children, although there are exceptions. In science, including the social and behavioral sciences, individual studies are rarely conclusive by themselves; what matters is where the bulk of evidence lies. On balance, the evidence is strongly on the side of the importance of income assistance for low-income children.

In a systematic review of high-quality studies of income’s effects on children (mostly U.S. studies), researchers at the London School of Economics and Political Science noted that almost all the studies found positive effects of higher family income for children’s educational, behavioral, and health outcomes, with particularly strong findings for cognitive development and schooling. Of the 34 studies identified, only five found no evidence of an income effect on any of the outcomes examined, and methodological problems contributed to this result in at least four of those five, the researchers said. “The studies indicated that money makes a difference to children’s outcomes,” the researchers concluded.[74]

Not every study finds positive results. For example, even though NIT experiments in the 1960s through 1980s significantly improved children’s education outcomes, one preliminary follow-up study from two sites surprisingly found no earnings gains (or losses) for participating children in subsequent decades.[75] That follow-up study builds on the previously mentioned Seattle and Denver Income Maintenance Experiments (SIME/DIME), which were designed to test the effects of stronger income support by randomly assigning families to receive varying policies of income support. The follow-up study tracked down children whose families participated in SIME/DIME and observed no impact of participation on their earnings in adulthood. This lack of earnings effects is difficult to reconcile with previously reported positive impacts of NIT experiments on children’s education, together with education’s well-established positive effects on earnings. Although the design of the initial SIME/DIME experiment was methodologically strong, the follow-up study has a number of weaknesses that might explain its lack of significant positive findings in this area:

- The SIME/DIME intervention did not test protection against deep poverty (family incomes below half the poverty line), and most of the intervention’s added income was directed at families that already were well above the poverty line, for whom it would be expected to have fewer long-term impacts on children. SIME/DIME served a wide income range that ended above the national median income, or over three times the federal poverty line. The experiment’s control group received a relatively strong income guarantee under AFDC: about 100 percent of the federal poverty line for a qualifying mother with two children with no other income in Washington State, and three-fourths of the poverty line in Colorado.[76] As a result, the experiment’s added income support, relative to the control group, was generally targeted to families well above the poverty line. These targeting issues may explain the difference in findings with Aizer et al., (2014), which found that the early 1900s public assistance programs — which were targeted to some of the nation’s poorest mothers, and at a time when little or no other government support was available — had positive long-term effects on their sons’ health, education, income, and years of life.

- Another issue is that the SIME/DIME follow-up left out 18-year-olds, the group of adolescents the original study identified as gaining by far the most from SIME/DIME in terms of school enrollment; their enrollment rate rose 14 percentage points, according to a 1984 study by Steven Venti. (No doubt part of that impact is due to greater college enrollment; Manoli and Turner (2016) found evidence that income from the EITC raises college entry rates for high school seniors.) It would be surprising for college gains of that size not to raise later earnings, and leaving out 18-year-olds may be an important omission.

- Finally, the authors of the follow-up study tracked down only 59 percent of the children that they tried to locate. This raises questions about possible differences between the children they found and those they didn’t.

In short, by aiming mostly at families above the poverty line, the initial SIME/DIME intervention might have been targeted in a way that did not strongly improve children’s long-term outcomes, even if it raised some school outcomes in the short term. Alternatively, the SIME/DIME follow-up study may not have measured the intervention’s true long-run impact on children’s earnings because it omitted an important age group (18-year-olds) or did not track down a representative selection of participants.

A study now being planned should help clarify income’s effects. The first U.S. study specifically designed to rigorously test the impact of income support payments on young children, it will compare supported children with a randomly assigned control group and carefully track both groups’ outcomes. (See box.)

Another area needing further study is the stage of childhood at which income matters most. Income effects for children’s education achievement and adult earnings are found most consistently for children under age 6. At the same time, there is also substantial evidence of income effects in older childhood, especially for other types of outcomes.

Gordon Berlin, the president of MDRC, a national leader in evaluating welfare-to-work programs and other anti-poverty initiatives, has explained that, “We have reliable evidence involving thousands of families in multiple studies demonstrating that ‘making work pay’ [by supplementing low earnings] causes improvements in young children’s school performance.”[77] Similarly, researchers Greg Duncan and Katherine Magnuson have observed, “Early childhood is a particularly sensitive period in which economic deprivation may compromise children’s life achievement and employment opportunities.”[78]

Income, however, may play somewhat different roles at different stages of childhood. For example, Duncan and Magnuson emphasize the importance of early childhood income but also note evidence that, when it comes to completed schooling, family income seems to matter “even more” during adolescence than in early childhood, and for improving later health and reducing non-marital births, its positive effect appears to be “largely attributable to income during adolescence, rather than earlier in childhood.”[79] A range of other studies have found significant test score effects for income support received in middle childhood,[80] effects on high school or college attendance around age 18, and college entry effects for high school seniors.[81] Thus, Duncan and his colleagues have noted, “investments later in life … may also be well advised.”[82]

On balance, despite some signs that income may matter more in some stages of childhood than others, evidence for such age differences remains mixed. Further research would provide more insight.

Economic security policies help form a critical foundation for the well-being of children by ensuring that low-income families can put food on the table, pay the rent, and afford other basics. Studies of the long-term effect of government assistance show “remarkably consistent evidence” of improved long-term outcomes for participating children, as a recent Brookings Institution report concludes.[83] Assistance programs such as the EITC, SNAP, and housing assistance not only help low-income families get by today but also help children thrive in the long run by improving their health status, educational success, and future work outcomes.

Researchers at Harvard’s Center on the Developing Child and elsewhere note that when children live in severely stressful situations — such as dangerous neighborhoods or times when their families have severe difficulty putting food on the table — and when their parents cannot shield them emotionally, the children may experience “toxic stress.” This stress can alter the physical growth and functioning of a child’s brain in ways that impede his or her ability to thrive in school and develop the social and emotional skills to function well in adulthood.a

Research has linked income losses around the time of pregnancy, for example, with a rise in stress that can affect both mother and baby. Temporary spells of low income in pregnancy appear to come with an increase in the mother’s stress hormone cortisol. High cortisol in pregnancy, in turn, was associated with “a year less schooling, a verbal IQ score that is five points lower and a 48 percent increase in the number of chronic [health] conditions” for the exposed children, compared to their own siblings born when the family had lower stress (and, usually, higher income).b

Another study documented that a young adult’s working memory (measured at age 17) “deteriorated in direct relation to the number of years the children lived in poverty (from birth through age 13).” The study found that “such deterioration occurred only among poverty-stricken children with chronically elevated physiological stress (as measured between ages 9 and 13).” That is, the mechanism by which early childhood poverty affected memory appears to be related to the stress that “usually accompanies poverty.”c

Stress and other circumstances of poverty may influence brain structure. Children in poverty had gray matter volumes 8 to 10 percent below normal in several areas of the brain associated with school readiness skills, one research team found. “To avoid long-term costs of impaired academic functioning, households below 150% of the federal poverty level should be targeted for additional resources aimed at remediating early childhood environments,” they concluded.d

Income support appears to help. For example, mothers targeted by the 1993 expansion of the EITC showed signs of reduced stress such as less inflammation and lower diastolic blood pressure.e

Scientists are preparing a more direct test of income support’s effects on young children, including its ability to reduce toxic stress and its effect on brain growth. The study will provide a $333 monthly ($4,000 a year) payment to parents of newborns for the child’s first 40 months of life. The study will track parental and child stress levels and children’s brain development (using brain scans), health, behavior problems, and learning.f

a National Scientific Council on the Developing Child, “Excessive Stress Disrupts the Architecture of the Developing Brain: Working Paper 3,” 2005/2014, updated edition, http://developingchild.harvard.edu/resources/wp3/.

b Anna Aizer, Laura Stroud, and Stephen Buka, “Maternal Stress and Child Outcomes: Evidence from Siblings,” National Bureau of Economic Research Working Paper 18422, 2012, www.nber.org/papers/w18422.pdf.

c Gary W. Evans, Jeanne Brooks-Gunn, and Pamela K. Klebanov, “Stressing Out the Poor: Chronic Physiological Stress and the Income-Achievement Gap,” Pathways, Winter 2011, http://www.stanford.edu/group/scspi/_media/pdf/pathways/winter_2011/PathwaysWinter11.pdf.

d Nicole L. Hair et al., “Association of Child Poverty, Brain Development, and Academic Achievement,” JAMA Pediatrics Vol. 169 No. 9 (September 2015), pp. 822-9, http://jamanetwork.com/journals/jamapediatrics/fullarticle/2381542.

e William N. Evans and Craig L. Garthwaite, “Giving Mom a Break: The Impact of Higher EITC Payments on Maternal Health,” American Economic Journal, Vol. 6 No. 2 (2014), pp. 258-290.

f Greg Duncan, “When a Basic Income Matters Most,” Economic Security Project, Medium, December 19, 2016, https://medium.com/economicsecproj/when-a-basic-income-matters-most-d90d093458a3#.43b144mt4.