The Small Public Housing Agency Opportunity Act (SPHAOA), introduced in similar form by Senators John Tester (D-MT) and Deb Fischer (R-NE) and Representative Steve Palazzo (R-MS),[1] is intended to reduce administrative burdens for small local agencies that operate the public housing and Housing Choice Voucher programs. Unfortunately, the bills’ deregulation provisions go so far to sweep aside federal rules and safeguards that they could have unintended and undesirable consequences — such as higher federal costs, fewer low-income families receiving federal housing assistance, and higher rents for many vulnerable households. They would also complicate program administration by establishing a separate set of rules for small agencies.

More promisingly, the bills seek to help local agencies work together to administer rental assistance more efficiently. This approach could streamline rental assistance administration without weakening standards or accountability and should be the focus of legislative efforts to address the administrative challenges that stem from the large number of small agencies.

Those challenges are considerable. Nearly 3,800 agencies administer Housing Choice Vouchers or public housing units; 2,800 of them administer 550 or fewer total units (thus meeting SPHAOA’s definition of a small agency), and more than 1,300 agencies administer fewer than 100 units. This fragmentation has significant adverse consequences. Small agencies have higher administrative costs than large ones, require costlier federal oversight, and have lower voucher program performance ratings.

SPHAOA seeks to address this challenge mainly through risky and unnecessary deregulation. But policymakers have already done much in recent years to streamline rental assistance, including enacting a broad set of reforms in the Housing Opportunity Through Modernization Act (HOTMA) in July 2016. These recent measures will substantially reduce administrative costs through careful changes that apply to all agencies regardless of size, and they balance streamlining against other goals such as ensuring effective assistance to low-income families and efficient use of federal funds.

The Department of Housing and Urban Development (HUD) is also evaluating alternative policies that go beyond recently enacted reforms. For example, HUD is conducting a rent reform demonstration testing whether alternative formulas for setting tenant rents can both ease administrative burdens and support work. In addition, in December 2015, Congress directed HUD to add 100 agencies — nearly all of them small or mid-sized — to its Moving to Work (MTW) demonstration. This expansion will provide broad flexibility to test alternative policies and, in a departure from prior practice under MTW, requires that those policies be carefully evaluated.

HUD should move promptly to implement HOTMA and ensure that MTW expansion generates findings that are rigorous and useful. Until the recent streamlining measures have been assessed and the ongoing and planned demonstration evaluations completed, there is no justification for Congress to consider sweeping additional deregulation like that proposed in SPHAOA.

Rather than weakening standards for small housing agencies, Congress and HUD should help and encourage them to work together with other agencies to achieve economies of scale and administer assistance more effectively. SPHAOA seeks to advance this goal by allowing agencies that administer rental assistance jointly through a consortium to combine their reports to HUD. Consortia — which can allow two or more agencies to combine many aspects of program operations while maintaining separate organizational identities and local boards of directors — are a potentially powerful tool for easing administrative and oversight burdens and improving program performance. But realizing their potential will require stronger action on this front than SPHAOA proposes.

Congress should take a series of steps to support consortia and other types of cooperation and consolidation across housing agencies:

- Direct HUD to permit consortia to have a single voucher contract with HUD rather than a separate one for each agency.

- Modify the voucher administrative fee formula to remove disincentives for forming consortia.

- Make clear that state laws may not block local agencies from forming consortia.

- Direct HUD to make greater use of its authority to consolidate poorly performing agencies.

- Direct HUD to develop and make available technology that could help agencies establish and operate consolidated waiting lists, thereby allowing families that need assistance to submit a single application.

- Fund a regional housing mobility demonstration in the final 2017 appropriations legislation.

- Expand the conversion of small agencies’ public housing to project-based vouchers under the Rental Assistance Demonstration, which would let the agencies continue managing the properties but greatly ease administrative burdens.

This paper reviews data on small housing agencies and assesses SPHAOA. It discusses the steps Congress has already taken to address SPHAOA’s goals of reducing administrative burdens and examines unintended problems SPHAOA’s deregulation provisions could foster. It also discusses other proposals to help agencies work together to administer rental assistance more efficiently.

Nearly 3,800 public housing agencies (PHAs) receive funding from HUD to operate public housing, administer vouchers, or both. PHAs range dramatically in size: some administer as few as four rental assistance units while the largest, the New York City Housing Authority, receives funding from HUD for nearly 274,000 units.

| TABLE 1 |

|---|

| Program administered |

Number of PHAs |

Number of occupied units |

|---|

| |

|

Vouchers |

Public housing |

|---|

| Vouchers only |

805 |

506,292 |

-- |

| Public housing only |

1,558 |

-- |

201,793 |

| Vouchers and public housing |

1,433 |

1,678,463 |

848,982 |

| |

|

2,184,755 |

1,050,775 |

| Total |

3,796 |

3,235,530 |

SPHAOA defines as “small” any PHA that administers 550 or fewer public housing units and/or authorized vouchers.[2] Nearly 2,800 PHAs — close to three-quarters of all agencies — come within this definition.[3] These small agencies assist close to 400,000 low-income households nationally, 12 percent of the total assisted through public housing and vouchers. More than 1,300 of these small agencies administer fewer than 100 units; more than 200 of them administer fewer than 20 units.

| TABLE 2 |

|---|

| Program administered |

Number of PHAs |

Number of occupied units |

|---|

| |

|

Vouchers |

Public housing |

|---|

| Vouchers only |

591 |

96,018 |

-- |

| Public housing only |

1,540 |

-- |

138,599 |

| Vouchers and public housing |

647 |

83,649 |

79,957 |

| |

|

179,667 |

218,556 |

| Total |

2,778 |

398,223 |

While some policymakers may believe that small agencies mainly serve sparsely populated rural areas, nearly half (49 percent) of all units administered by small agencies are in metropolitan areas. For example, 68 small PHAs administer vouchers in the greater Boston metropolitan area, in addition to 25 larger agencies and two state-administered housing voucher programs.

| TABLE 3 |

|---|

| Programs administered |

Non-Metro PHAs |

Metro PHAs |

|---|

| |

PHAs |

Number of units |

PHAs |

Number of units |

|---|

| |

Vouchers |

Public housing |

|

Vouchers |

Public housing |

|---|

| Vouchers only |

215 |

35,303 |

-- |

376 |

60,715 |

-- |

| Public housing only |

1,032 |

-- |

86,049 |

508 |

-- |

52,550 |

| Vouchers and public housing |

346 |

39,012 |

44,092 |

301 |

44,637 |

35,865 |

| |

|

74,315 |

130,141 |

|

105,352 |

88,415 |

| Total |

1,593 |

204,456 |

1,185 |

193,767 |

The large number of small housing agencies makes federal rental assistance programs costlier to administer and less effective.[4] The federal staff time required to contract with a housing agency and conduct many oversight functions is roughly the same regardless of how many families the agency assists. As a result, federal oversight costs are much higher per family for small agencies. A 2008 HUD report estimated that between half and two-thirds of the effort HUD put into basic compliance monitoring went toward agencies administering only 10 percent of units.[5]

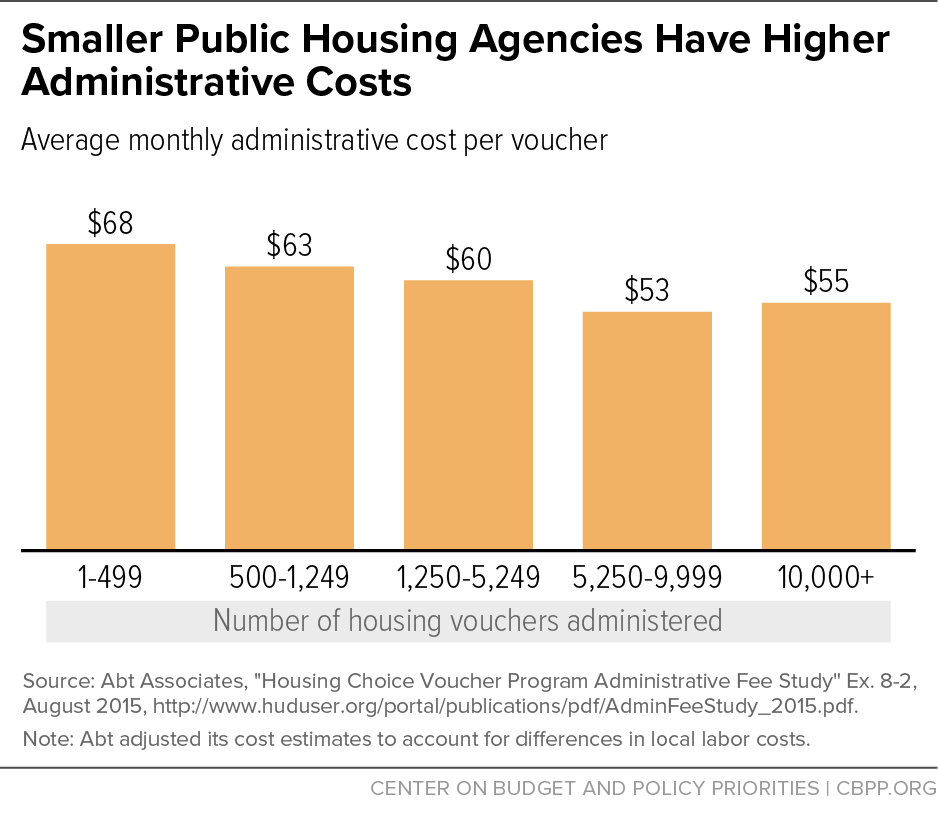

Small agencies’ own administrative costs are also higher than those at larger agencies, for essentially the same reason: many of their administrative tasks cost about the same regardless of the number of families assisted. A recent HUD study found that per-voucher administrative costs were 24 percent higher at agencies with fewer than 500 vouchers than at the largest agencies (see Figure 1). The federal administrative funding formula provides more funding per voucher to smaller agencies, so these higher costs are in large part passed on to the federal government.

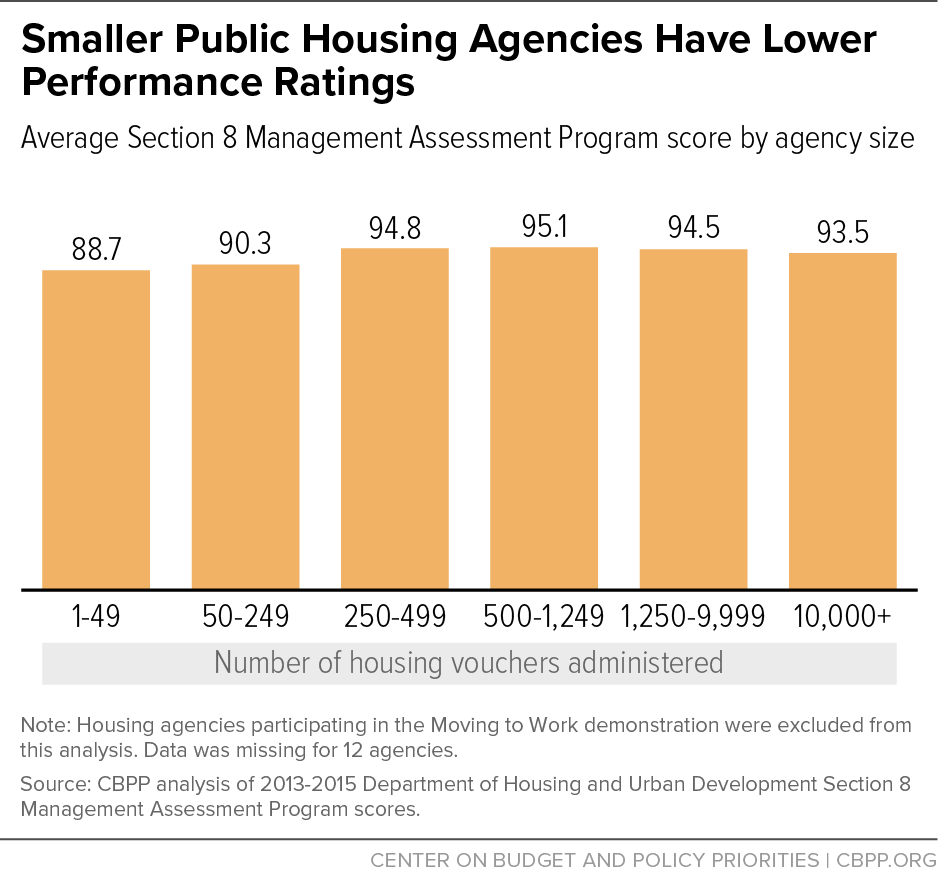

In addition, agencies with fewer than 250 authorized vouchers score significantly lower than larger agencies on the Section 8 Management Assessment Program (SEMAP), HUD’s voucher performance measurement system (see Figure 2). They are about four times more likely to be designated as “troubled” or “near troubled” under SEMAP and less likely to be designated as high performers.[6]

Agencies without sufficient scale to devote staff time to plan and implement new initiatives are less likely to take advantage of options that provide additional types of housing opportunities, such as supportive housing for people with disabilities. Similarly, smaller PHAs are less able to spare staff time to develop partnerships with community agencies that could improve families’ finances or help homeless individuals navigate the housing application process and find an appropriate unit if they receive a voucher. Small agencies invest less in technology so they are less able to track various components of program operations to increase efficiency and improve outcomes, a Government Accountability Office (GAO) study found.[7]

Fragmentation of voucher programs among numerous housing agencies can also make it more difficult for families to move to neighborhoods with low poverty rates, well performing schools, and low crime — which research shows can improve children’s long-term chances of success and mothers’ mental and physical health.[8] Agency staff may be unfamiliar with housing opportunities outside their jurisdiction and unlikely to encourage families to make such moves. And PHAs in destination communities may be reluctant to accept new families or help them find a willing landlord, seeing newcomers as potential competition with current residents for scarce rentals.

In addition, in metro areas where multiple agencies administer federal rental assistance, families seeking to maximize their opportunity to receive assistance must apply separately to agencies throughout the region, which can be time consuming and costly.

Policymakers have passed substantial reforms in recent years to reduce unnecessary administrative burdens and expand flexibility for all housing agencies, including changes affecting many of the issues that SPHAOA covers. SPHAOA would go further in a number of areas, but many SPHAOA provisions are so sweeping that they could lead to serious adverse consequences, such as substantial rent increases for vulnerable families. In addition, because SPHAOA would create two different sets of rules based on agency size, it would complicate federal oversight and could increase complexity for some low-income families and private owners renting to voucher holders. Enacting SPHAOA’s potentially harmful proposals for further deregulation would be unwise, particularly before the effects of the recent changes have been assessed.

HUD is just beginning to implement the Housing Opportunity Through Modernization Act (HOTMA), which became law on July 29, 2016 and streamlines many aspects of rental assistance administration. Other measures passed in 2014 and 2015 sharply reduced the frequency with which agencies must conduct voucher housing quality inspections and tenant income reviews — two of the most time-consuming tasks involved in administering rental assistance.[9] Once fully implemented, these changes should considerably reduce administrative costs for all housing agencies, small and large. Importantly, these recent laws ease unnecessary administrative burdens while keeping in place the core characteristics that have made rental assistance effective.

Congress and HUD have also begun to test alternative rental assistance policies beyond those in the recent laws. Most significantly, legislation enacted in December 2015 requires HUD to add 100 agencies to the Moving to Work (MTW) demonstration, which today gives 39 agencies broad flexibility to implement alternative policies. MTW, which mainly includes large agencies, has produced few concrete research findings because the changes MTW agencies have implemented have not been rigorously evaluated. It also has had some serious adverse consequences, such as allowing agencies to assist many fewer families than they could with available funding.

Under the expansion, HUD must admit at least 50 agencies with 1,000 or fewer units, direct each cohort of new MTW agencies to test a specific alternative policy, and ensure that these policies are rigorously evaluated. It will be important that HUD implement the expansion in a manner that produces meaningful results (for example, by preventing agencies from making multiple major policy changes at once so that it is impossible to assess the effect of any one) and limits reductions in assistance and other adverse side effects. The expansion should produce careful research regarding a range of alternative policies, and is another reason to avoid hasty, sweeping measures to deregulate small agencies.

Many of the changes in recently enacted legislation simplify the process of determining tenant rent payments, an area that is the subject of SPHAOA provisions that pose serious risks for low-income families. SPHAOA would require HUD to carry out a rent reform “demonstration” allowing as many as 555 agencies (20 percent of all small agencies) to make sweeping changes to rent rules. Despite the demonstration label, SPHAOA does not require a rigorous evaluation. Indeed, it would be virtually impossible for HUD to meaningfully evaluate the changes that hundreds of small agencies would make. Yet those changes could have significant impacts.

- Of greatest concern, agencies in the demonstration could charge families a minimum rent of any amount even it exceeds 30 percent of the family’s income; today minimum rents are capped at $50 per month.[10] This proposal would effectively permit small PHAs to impose flat rents with no link to income, eviscerating the fundamental policy of HUD’s rental assistance programs that the rental charge should reflect a household’s ability to pay.

- Agencies could replace the current rent limit of 30 percent of a family’s income with a “tiered-rent” system that would raise rents on the poorest tenants while cutting them for many higher-income families and could raise federal costs.

- Agencies could base rents on a family’s gross income, thereby eliminating deductions for families with dependents, elderly and disabled households, and households with unreimbursed medical or child-care expenses. These deductions are designed to reflect the more limited resources these household have available to pay for housing.

- Agencies could determine families’ incomes and make adjustments to the rent they owe only once every five years rather than annually (or every three years for families on fixed incomes), as current law requires. A family could request a review before the five years have elapsed if its income changes by an amount exceeding an agency-established threshold. There would be no cap, however, on the threshold that an agency could establish, so it could sharply curtail families’ access to interim rent changes by setting the threshold at a very high level. This would reduce agencies’ administrative costs but could expose families whose income drops substantially to serious hardship and even displacement from their homes. Moreover, since tenant incomes tend to rise over time, on average, limiting income reviews to every five years would likely cut rent revenues and increase federal costs.

In addition to their direct effects on families, these changes would allow participating small agencies to establish a complex patchwork of widely varying local rent rules that could be confusing for families and private owners and difficult for HUD to oversee.

Unlike the SPHAOA rent demonstration, recently enacted rent simplification provisions would reduce administrative burdens for all agencies, small and large, while protecting tenants from sharp rent increases. Also unlike the SPHAOA provisions, the enacted reforms were carefully crafted to avoid increasing federal costs; Congressional Budget Office estimates showed that modest cost increases from some provisions would be more than offset by reductions from others.

For example, a change enacted in December 2015 allows agencies and owners to conduct income reviews every three years (rather than annually) for households receiving most or all of their income from fixed sources such as Social Security or Supplemental Security Income, which are unlikely to experience much income variation. This will reduce burdens for agencies while posing far less risk of hardship for families and added federal costs than the SPHAOA provision allowing agencies to review incomes as infrequently as every five years for all families, including those with volatile incomes.

In addition, HOTMA streamlined requirements for “interim” reviews when a tenant’s income changes between regular annual (and now sometimes triennial) income reviews, without the serious risks that would result from SPHAOA’s proposal to allow agencies to essentially eliminate interim reviews. Previously, PHAs were required to recalculate rents if a family’s income dropped by any amount, and allowed to do so whenever a family’s income rose. HOTMA modified this to require reviews only when a family’s income drops by more than 10 percent and to allow reviews for increases above 10 percent, though rent increases stemming from earnings increases would always be delayed until the next annual review. These policies, which emerged from years of discussion among Congress, HUD, and stakeholders, carefully balance the goals of streamlining administration, containing costs, encouraging work, and protecting vulnerable tenants.

HOTMA also will sharply reduce the administrative burdens resulting from the requirement that housing agencies and owners deduct medical expenses from the income of elderly people and people with disabilities. And it will do so without permitting agencies to eliminate this and other income deductions entirely, as SPHAOA would. HOTMA raised the threshold for the medical deduction from 3 percent of annual income to 10 percent. This would substantially reduce the number of people eligible for the deduction while still providing relief for tenants with extremely high medical or disability-related expenses.

It is worthwhile to test alternative rent policies that go beyond the changes in HOTMA, particularly to determine whether there are cost-effective policies that would encourage increased work effort. But the “demonstration” in SPHAOA is not needed to do this. In the 2010 appropriations act, Congress directed HUD to initiate a rent reform demonstration. This demonstration is testing alternative rent policies at four agencies, is subject to rigorous evaluation, and is expected to produce results by 2019. HUD is also strongly considering experimenting with alternative rent policies as part of the MTW expansion, which could test policies similar to those outlined in SPHAOA but subject to rigorous evaluation. Congress should not permit hundreds of agencies to make fundamental changes in rent policy — as the SPHAOA demonstration would do — without first learning the impact of such changes on families and program costs, which the pending demonstrations should make possible.

Vouchers may be used only in houses or apartments that meet federal quality standards. SPHAOA would allow small agencies to conduct inspections to verify that this requirement is met as infrequently as once every three years. In 2014, Congress enacted legislation reducing the frequency of required inspections from every year to every two years for all agencies. That legislation and HOTMA also enacted other policies to reduce inspection-related administrative burdens for agencies and owners, such as allowing PHAs to rely on recent inspections performed for other federal housing programs.

These changes had wide support, reflecting a consensus that they would substantially reduce administrative burdens while ensuring that vouchers are used in decent-quality units. Reducing the frequency of inspections to every three years could upset this balance and pose risks for assisted families. It also makes little sense when agencies have just implemented the reduction to every two years and the effects of that reduction are not yet apparent. Also, there is no sound reason for holding small agencies that administer voucher programs to a lower standard than larger agencies, as SPHAOA would do.

SPHAOA would also remove compliance with housing quality requirements as a factor in assessing small agencies’ performance in managing their voucher programs. Currently, about one-fourth of the points available under HUD’s assessment policy are based on PHAs’ compliance with requirements to assure that units rented by voucher holders meet minimum quality standards. SPHAOA would thus eliminate agency incentives to maintain quality, and could thereby expose more families living in voucher-assisted properties to poor housing quality (and allow units to deteriorate and worsen neighborhood blight).

SPHAOA would also prohibit HUD from inspecting any public housing properties owned by a small agency more frequently than every three years, unless HUD has previously determined that the agency’s performance is severely deficient and placed the agency in “troubled” status. Today HUD rules generally require inspections of public housing properties at one- to three-year intervals, depending on the agency’s prior performance; this is similar to the rules for privately owned subsidized properties, many of which are owned by small entities.[11] The SPHAOA proposal risks allowing the 20 percent of public housing units that small agencies own to deteriorate in quality.

Housing agencies can contract with owners to use a portion of their vouchers at a particular housing development. Through such “project-basing,” agencies can, for example, partner with social service agencies to provide supportive housing to people with disabilities or to support the development of mixed-income housing in neighborhoods with strong educational or employment opportunities. HOTMA allows agencies to project-base up to 20 percent of their authorized vouchers and up to 30 percent if the agency uses the added 10 percent in areas where vouchers are difficult to use or to house particular types of households with special needs (such as the homeless). This is a significant — but targeted — increase above the pre-HOTMA limit, which allowed agencies to project-base up to 20 percent of their voucher funds.[12]

In contrast, SPHAOA would allow small agencies to project-base up to 50 percent of their vouchers, and with no requirement that they serve special-needs populations or expand affordable rentals in areas where vouchers are difficult to use. This policy would undermine the choice-based nature of the voucher program: for half of an agency’s vouchers, families would have to live in a unit chosen by the agency rather than a unit of their choice for at least a year, or longer if a tenant-based voucher did not become available. Moreover, there is no apparent rationale for applying a different policy to small agencies.

Most other provisions of SPHAOA would give small agencies additional flexibility in their use of funds, diminish their accountability to HUD, and reduce HUD’s oversight. While these provisions may provide administrative relief to small agencies, they could also have unintended adverse consequences for vulnerable families, communities, and the federal treasury.

Combining Voucher and Public Housing Funds Would Likely Mean Assisting Fewer Families

SPHAOA would allow small agencies to combine their voucher and public housing funding and use the funds for any purpose that either program permits.[13] This “fungibility” authority would allow agencies to shift voucher renewal funds to support administrative costs or to operate or repair their public housing rather than to provide voucher assistance to needy families.[14] Any or all of the more than 1,200 small PHAs administering voucher programs could reduce the number of families receiving vouchers under this sweeping provision.[15]

Under the current voucher funding formula, agencies that spend less because they provide fewer families with vouchers receive a proportional reduction in their funding the following year. Proponents of the fungibility option may not have realized its potential negative impact on agencies’ future funding. Enactment of SPHAOA almost certainly would lead to strong pressure on appropriators to alter the formula and allow agencies electing the fungibility option to shift voucher funds without losing some future funding.

The MTW demonstration, which gives agencies broad flexibility to shift funds between programs, illustrates the risks of fungibility. In 2015, MTW agencies transferred more than $650 million out of their voucher programs to other purposes (such as public housing redevelopment, services to low-income families, or agency administrative budgets) or left the funds unspent. More than 60,000 low-income families were left without housing assistance as a result.[16]

The fungibility provision is of particular concern given SPHAOA’s proposals to weaken performance standards. The bills would require HUD to consider an agency’s management “acceptable” if it uses 90 percent of its voucher funds for vouchers and 90 percent of its public housing units are occupied. In combination, these provisions could permit PHAs to shift up to 10 percent of voucher renewal funds to cover administrative costs or to shift the funds from vouchers to public housing. They also would weaken incentives for PHAs to maintain high occupancy rates in public housing.[17]

SPHAOA would eliminate or drastically modify most of the measures HUD uses to assess small PHAs’ performance in managing their public housing and voucher programs. It also would exempt small PHAs from all planning and reporting requirements that do not apply to private owners administering HUD subsidies. The impacts of these changes could be far-reaching.

Voucher Payment Errors and Federal Costs May Increase

SPHAOA would prohibit HUD from assessing the performance of small PHAs in administering their voucher programs on any factor other than the number of families served.[18] HUD could no longer evaluate small PHAs based on whether they have paid the correct amount of voucher subsidy for participating families.[19] As a result, SPHAOA would eliminate a powerful tool for ensuring that federal funds are spent properly. HUD assesses this aspect of PHA performance using tenant data that agencies already regularly report, so evaluating payment accuracy does not add to small agencies’ administrative burdens.[20]

Assisted Families and the Public Would Have Less Input into PHA Decisions

When Congress responded in 2008 to small PHAs’ request to relieve them of the administrative burdens of submitting annual plans to HUD (see footnote 3), it was careful to preserve PHAs’ obligation to hold a public hearing each year at which residents and the public could comment on changes to agency goals or policies. Congress established this principle of participatory and transparent public policymaking in the Quality Housing and Work Responsibility Act of 1998 to balance the increased discretion that the Act gave PHAs over key policy choices.

SPHAOA would eliminate the remaining obligations of small PHAs to have a Resident Advisory Board, to afford residents and the public a once-a-year opportunity to provide input into agencies’ policy decisions, and to certify their compliance with fair housing requirements.[21] This change is ill advised. These requirements are needed to ensure meaningful participation but impose only modest burdens on agencies.

SPHAOA would eliminate HUD’s authority to consolidate the voucher or public housing programs of a small agency that has exhibited chronic poor management with the programs of a nearby well-managed agency. It also would eliminate the requirement that HUD transfer administration of programs when agencies fail to remedy substantial noncompliance.[22] As explained below, HUD’s authority to consolidate poor performers is a potentially important tool to improve the efficiency of rental assistance; limiting this authority would be a step backwards.

The sheer number of PHAs undermines the effectiveness of the programs they administer and increases costs. To get the most value out of the federal funds spent on rental assistance, it is vital to take a 21st century look at their administrative geography and determine what would be most efficient and effective at promoting program goals. In considering efficiency, it is important to remember that all funding for the public housing and voucher programs is federal. States and localities do not contribute matching funds or share in administrative costs.

Rather than creating special rules for small PHAs that risk harming families and wasting funds, Congress should directly tackle the administrative complexity that results from having so many small PHAs. The most straightforward way to do this would be to establish regional entities that administer vouchers throughout a housing market area, or statewide housing voucher programs. There is no sound policy justification for maintaining separate voucher programs for towns, cities, or counties within a metropolitan area.

Mandatory consolidation of agencies into regional or statewide entities, however, would face significant political hurdles, since retaining their independent identity is a paramount concern for many PHAs. Short of a widespread, required consolidation, Congress could take major steps to help housing agencies work together to reduce administrative costs and improve outcomes.

SPHAOA seeks to advance this goal by encouraging agencies to enter consortia to administer rental assistance. In 1998, Congress for the first time permitted two or more PHAs to form a consortium to administer their public housing or voucher programs in order to reduce administrative burdens for PHAs and HUD. Agencies could be more willing to join a consortium agreement than to fully consolidate, since a consortium can enable them to achieve economies of scale in many aspects of program operations while maintaining their own local identities and boards of directors. Few agencies have formed consortia, however, in part because each agency in the consortia must separately report to HUD and manage certain other administrative tasks — limiting the streamlining that consortia provide.[23]

SPHAOA would require HUD to modify its electronic systems to allow agencies in a consortium agreement to function as a single entity for reporting purposes. This is a step in the right direction, but stronger action would be needed to ensure that consortia sharply reduce administrative burdens.

Congress should direct HUD to allow all agencies in a consortium to have a single voucher funding contract with HUD, and to implement this policy by notice. (HUD proposed a rule making this change in July 2014 but appears unlikely to finalize it before the end of this Administration.[24])

Enabling agencies in a consortium to function as a single entity for funding, reporting, and oversight purposes would substantially reduce PHAs’ and HUD’s administrative burdens. Agencies would also benefit from greater economies of scale. GAO has noted, for example, that greater efficiencies are possible when small agencies join together to hire inspectors or when a voucher program is large enough to generate sufficient administrative fees to support a fraud detection unit.[25] Economies of scale also could free up staff time to take advantage of program options such as using project-based vouchers to help develop or preserve mixed-income housing and supportive housing. Creating a consortium with a single jurisdiction would also eliminate the administrative work required when a voucher holder moves from one community to another.

In August 2015, HUD completed a multi-year study of the cost of administering a high-performing Housing Choice Voucher program.[26] The study recommends paying additional fees for agencies that assist fewer than 750 families (continuing in modified form the current policy of paying higher per-voucher fees to small agencies) and HUD has proposed a regulation that would incorporate this recommendation into a revised formula. This recommendation reflects the study’s findings concerning the additional costs of small agency administration, but it does not appear to be sound policy. The added fees it would provide would cost approximately $40 million more per year and would encourage small agencies to operate independently rather than forming consortia.[27]

If HUD does not revise its proposed formula to pay the same (or more similar) fees to smaller housing agencies as large ones — with a potential exception for smaller agencies that are isolated enough that they do not have a real opportunity to form consortia or consolidate — Congress should direct it to do so. In addition, Congress should direct HUD to use part of the savings from scaling back added fees for small agencies to help PHAs meet the transition costs of forming a consortium or consolidating.

Federal law broadly permits PHAs to form consortia unless state laws stand in the way. In most states, the laws governing the powers and jurisdictions of PHAs appear to permit consortia. But these laws are often unclear, inconsistent, or confusing and have sometimes been interpreted restrictively by state attorneys general or others.

To avoid any confusion, Congress should explicitly bar state laws from blocking formation of consortia. Congress could do so by revising the consortia section of the U.S. Housing Act[28] to include a broad preemption provision for both Housing Choice Vouchers and public housing, modeled on (but expanding) Congress’ existing preemption of state law for purposes of administering tenant-based Section 8.[29] By broadening the statute’s preemption language to apply to all U.S. Housing Act programs PHAs administer, Congress could better enable PHAs to form consortia by eliminating concerns regarding a state’s interpretation of its joint powers statute or other enabling laws.

HUD has authority under existing statutes and regulations to take over administration of programs that are in substantial default or are “troubled” under HUD’s performance assessment rules and fail to improve satisfactorily within two years. HUD may also consolidate the poorly performing agency with a willing, well-managed PHA or appoint another PHA or private management entity to manage the agency’s programs.[30] HUD, however, has made little use of this authority. Congress should direct HUD to use available remedies for poor performance to foster the formation of larger, more effective and more efficient local programs, where appropriate.

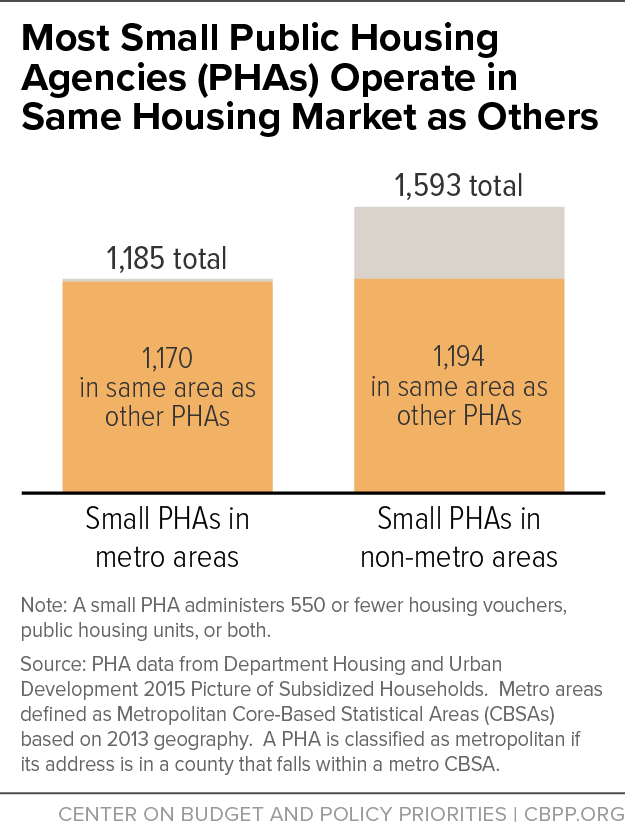

A related, beneficial change would be to encourage agencies within the same housing market area to consolidate their waiting lists, which would reduce administrative costs and allow families needing housing assistance to submit a single application. As noted in Figure 3, almost all small PHAs that operate in metropolitan areas share those areas with other agencies. Even rural counties often have two or more agencies; about 1,000 small agencies are located in a non-metro county with at least one other PHA. In such areas, needy families seeking affordable housing must apply in multiple locations to increase their chances of receiving assistance.

Regardless of whether agencies form consortia, it would help families in need if they could submit a single application for assistance from all housing agencies operating in a metropolitan area or rural county. Consolidated waiting lists also would reduce administrative costs for small agencies, whose staff now must maintain waiting lists with many duplicative applicants. In Massachusetts, an organization representing local housing agencies oversees such a list for a majority of the state’s voucher PHAs, saving participating agencies significant staff time. Recognizing the importance of a single application point for families seeking assistance, the Utah legislature recently required a single waiting list for all voucher agencies in each county.[31]

Federal policy should also seek to overcome the access barrier that the presence of multiple small agencies creates for eligible families. Allowing families to submit a single application ought to be one goal of small agency reform since it would benefit needy families while reducing agency costs. Congress should direct HUD to facilitate this improvement by developing software and related procedural guidance that interested agencies can use to consolidate waiting lists.

The 2017 HUD appropriations bill passed by the Senate Appropriations Committee would provide $14 million for a new Housing Choice Voucher Mobility Demonstration. This demonstration, proposed by HUD, would help public housing agencies in selected regions collaborate on initiatives to help low-income families use vouchers to move to higher-opportunity neighborhoods. Demonstration funds could be used to support staff time to plan for regional collaboration and align policies and administrative systems across public housing agencies, as well as to cover costs of other activities to expand families’ housing choices. The one-time funding also would support research to learn what strategies are most cost-effective. The mobility demonstration is a modest investment that could improve outcomes for children by enabling more families to use their vouchers in high-opportunity neighborhoods. It deserves congressional support.

Expand Conversion of Public Housing to Project-Based Vouchers

Under the Rental Assistance Demonstration (RAD), enacted in 2012 and later expanded, agencies can convert as many as 185,000 public housing units to either project-based vouchers (PBVs) or project-based Section 8 contracts. With either type of conversion, the PHAs usually would still own and manage the former public housing properties. These two different types of project-based Section 8 assistance would have substantially different impacts, however, on the administrative responsibilities of the agencies and HUD.

If PHAs chose to convert their properties to project-based Section 8 contracts, they would continue to have a direct legal relationship with HUD, and their responsibilities regarding tenant rent determinations, maintaining waiting lists, and submitting data to HUD would remain essentially the same as under the public housing program. These conversions also would not reduce HUD’s workload significantly, as each property would have its own Section 8 contract after conversion. HUD (or its contractors) would continue to monitor the physical condition of the properties and verify the accuracy of requests for subsidy payments. (HUD’s work would shift, however, from the office responsible for public housing to the one that oversees contracts with private owners of multifamily rental properties.)

Conversion to PBV, by contrast, could sharply reduce administrative burdens for the 2,187 small agencies — 79 percent of all small agencies — that administer public housing, as well as HUD. Converting to PBV assistance could relieve the 1,540 agencies that only administer public housing of most federal requirements. An agency cannot administer PBVs unless it has a tenant-based voucher program, so HUD would contract with another (typically larger) agency to administer the PBVs that subsidize the units of the converting agency, which would no longer have a direct financial or legal relationship with HUD, thereby reducing HUD’s workload considerably. Responsibility for complying with HUD rules for setting tenant rent contributions and submitting tenant and financial data to HUD would shift to the agency administering the PBV contract. The converting PHA could maintain its own waiting list or could have the administering agency take over that responsibility and determine applicants’ eligibility.

Conversion to PBV assistance also would benefit the 647 small PHAs that administer both public housing and vouchers. Conversion would eliminate the need for the agency to operate two different programs with different rules and accounting requirements. HUD would have one set of legal agreements with the agency, rather than two (managed by separate staff), and reporting requirements would be streamlined. If the converting PHA administered the PBVs itself, it would have to arrange for a third party to inspect the units (because PHAs are not permitted to carry out inspections themselves for buildings they own), but it would receive added funds to cover this cost.

Congress should increase the number of small housing agencies that convert public housing to PBVs under RAD. Most immediately, it should enact a provision in the 2017 Senate appropriations bill raising the number of units that can be converted from 185,000 to 250,000. Congress should also fund supplemental subsidies to make RAD conversion financially feasible for more small agencies. In addition, Congress should direct HUD to give small agencies seeking to convert public housing to PBVs a preference for available slots, educate them about the potential for reduced administrative burden, help public housing-only agencies identify other agencies that could administer the PBVs, and provide other technical assistance.

Deregulation based solely on agency size, without regard to performance, is not sound policy, particularly when coupled with the diminished accountability for small agencies that many SPHAOA provisions would produce. In HOTMA and other recent measures, Congress has extended streamlining to all agencies and designed changes thoughtfully to avoid adverse side effects. Congress should not consider additional sweeping deregulation before those changes have been assessed.

Policymakers should instead build on the other approach SPHAOA takes to the challenge posed by the large number of small agencies: helping agencies work together to operate the housing programs more efficiently and effectively. Congress could take a series of measures to support cooperation and consolidation across agencies. These changes could ease burdens on small agencies and HUD staff and substantially improve the effectiveness of federal rental assistance.