Fewer than one in four eligible low-income renters receive housing assistance.[1] Tight multi-year caps on non-defense discretionary appropriations, the budget category that includes rental assistance programs, will make it difficult to expand those programs in the coming years. But a new “project-based” renters’ tax credit could help a substantial number of the lowest-income renters — including low-wage workers and poor seniors and people with disabilities — afford decent, stable housing. It could also help address an imbalance in current federal housing policy: counting tax benefits, federal housing assistance overwhelmingly goes to high-income homeowners, even though low-income renters have the most acute housing needs.

More than 11 million renter households, most with incomes below the poverty line, pay more than half their income for housing.[2] These families often must shift resources from basic needs like food or clothing to pay the rent, and are more likely than other families to experience eviction and even homelessness — problems that can adversely affect children’s development and adults’ ability to find and keep a job.

A project-based renters’ credit would help poor families afford a home by providing states with credits that they would allocate to rental housing owners and developers for use in particular developments. Families living in renters’ credit units would pay no more than 30 percent of their income for rent and utilities — the accepted federal standard of affordability — and the rental unit’s owner would receive a federal tax credit in return for reducing the rent to that level.

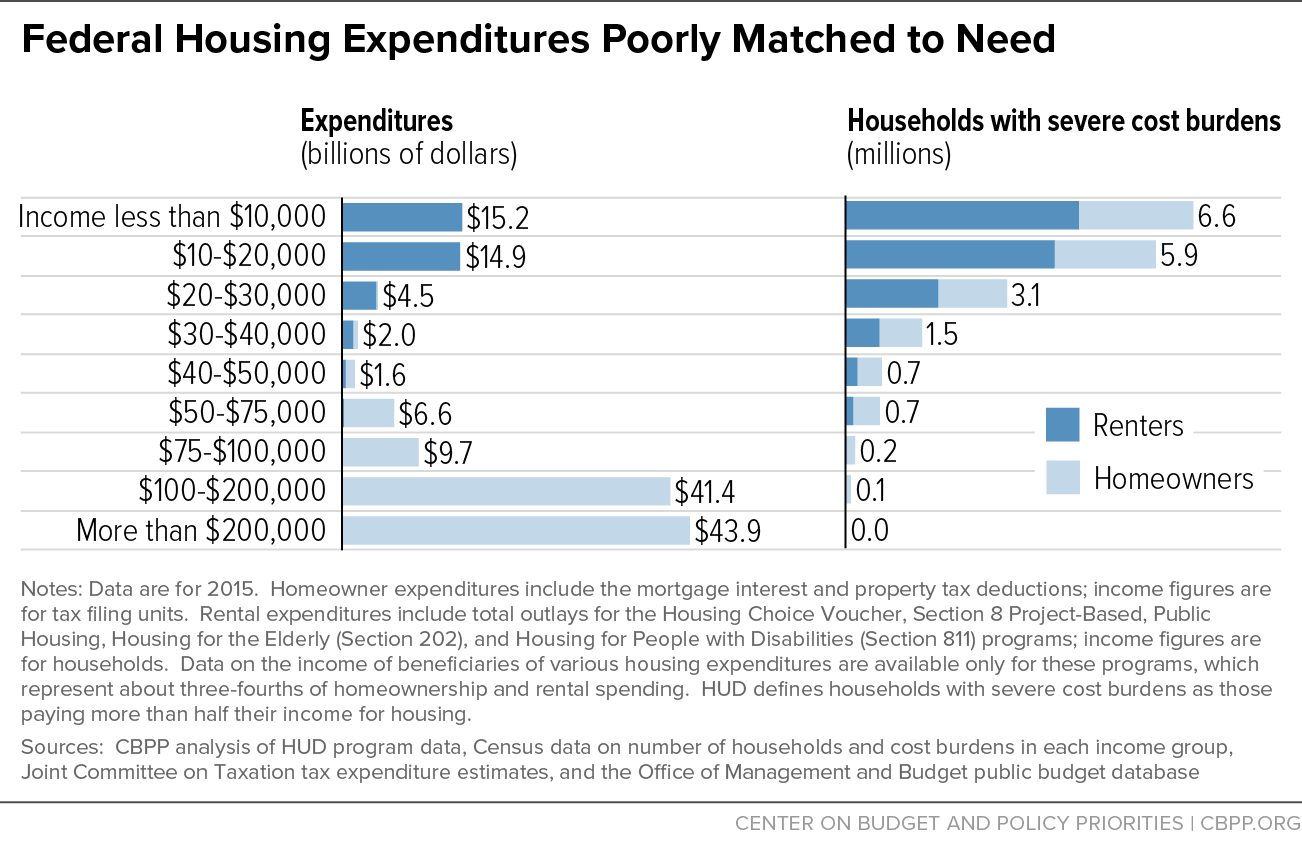

Creating a renters’ tax credit would improve the match between federal housing spending and need. The federal government spends close to $200 billion a year to help Americans buy or rent homes, but much of that spending benefits homeowners who could afford a home without help. About 60 percent of federal housing expenditures for which data are available go toward tax benefits for homeowners with incomes of $100,000 or more, and 30 percent go to those with incomes of $200,000 or more. Meanwhile, the large majority of households with severe housing cost burdens have low incomes, and most of them are renters rather than homeowners. (See Figure 1.)

The new credit would complement the existing Low-Income Housing Tax Credit (LIHTC), which is an effective subsidy for building and rehabilitating affordable housing but on its own rarely makes units affordable to poor families — who generally cannot afford rents adequate to cover the ongoing costs of operating housing (such as maintenance, insurance, and utilities). It would assist families who are not reached by rental assistance programs such as Housing Choice Vouchers, which are highly effective but assist only a fraction of eligible families because of inadequate funding.

The credit could help a sizable number of poor families to afford housing at a relatively modest overall cost. For example, a credit with an annual cost of $6 billion once fully phased in could enable about 720,000 poor families to live in a stable home at per-family cost of $8,300, close to the same as the cost of a housing voucher.[3] This would amount to less than 5 percent of current federal homeownership tax expenditures and just 14 percent of the cost of the mortgage interest and property tax deductions now provided to taxpayers with incomes above $200,000. The credit would be scaled up gradually, so its cost and the number of families assisted would be much lower during the early years of implementation.

In recent years, proposals for a renters’ tax credit have received growing attention from a diverse range of organizations. The Bipartisan Policy Center, University of California Terner Center for Housing Innovation (with support from the J. Ronald Terwilliger Foundation for Housing America’s Families), Center for American Progress, Enterprise Community Partners, Center for Global Policy Solutions, and Mortgage Bankers Association have each highlighted versions of a renters’ credit as a promising strategy to address poverty, homelessness, and high rent burdens.[4]

The Center on Budget and Policy Priorities released a proposal for a renters’ credit in 2013.[5] As explained in Appendix 2, this paper refines that proposal by improving the treatment of tenant-paid utilities, excluding the credit from taxable income, allowing more flexible credit transfers, and deepening income targeting. In addition, it outlines a credit that states would allocate only to owners or developers for use in particular housing developments (a “project-based” renters’ credit). While we continue to support proposals that would also give states the option to allocate credits to tenants directly or to lenders, a project-based renters’ credit would be the easiest approach to administer and might therefore be a good starting point for rebalancing federal housing tax policy.

A renters’ credit could have far-reaching benefits for the lowest-income renter households, and particularly children in those households. Research shows that housing vouchers — which like the proposed credit enable poor families to live in decent, stable housing while paying around 30 percent of their income — greatly reduce homelessness and housing instability.[6] In addition, housing vouchers provided to homeless families lower the chance that a child will be removed from its family and placed in foster care (which often occurs because parents cannot afford suitable housing), reduce the frequency with which children must move from one school to another, and lower rates of behavioral and sleep problems among children and psychological distress and domestic violence among the adults with whom children live.[7] Research has also found that children whose families receive rental assistance earn more and are less likely to be incarcerated as adults.[8]

In addition to extending rental assistance to more families, a state-administered renters’ credit would offer opportunities for coordination with other state-run programs. (This coordination is difficult to achieve through existing rental assistance programs, which are mainly locally administered.) For example, states could use the renters’ credit to reduce rents in LIHTC developments to levels affordable to poor households, help families participating in Temporary Assistance for Needy Families (TANF) for whom lack of stable housing is a barrier to work, provide supportive housing to families at risk of having their children placed in foster care, and enable Medicaid-eligible elderly people or people with disabilities to live in service-enriched developments rather than nursing homes or other institutions. In some cases, these initiatives could generate substantial savings in health care, child welfare, and other state-administered programs.[9]

States could also use the new credit to provide low-income families with access to housing in a wider range of communities. Rental assistance has particularly strong benefits when it enables families with children to live in low-poverty neighborhoods.[10] Children whose families use vouchers to move to such neighborhoods when they are young earn significantly more as adults and are far more likely to attend college and less likely to become single parents.[11] When rental assistance has allowed low-income children to attend well performing, economically integrated schools over the long term, their math and reading test scores are significantly better than comparable children who attended higher-poverty schools.[12] States could opt to prioritize allocation of credits for developments in neighborhoods with low poverty rates, low crime, and strong schools, and federal policy could provide incentives to encourage this.

Finally, the proposed renters’ credit would be well suited to ensure that the lowest-income households share in the benefits of investment in transportation and other infrastructure. Infrastructure improvements can drive up rents in affected neighborhoods, preventing low-income families from moving to those areas and in some cases displacing long-time residents. By allocating renters’ credits to developments in neighborhoods where infrastructure investments are planned, states could ensure that working-poor families and seniors and people with disabilities are not excluded from those investments’ benefits.

We discuss below the following seven key features of the proposed credit:

- Credit allocation;

- Income eligibility and targeting;

- Rent payments by families;

- Setting the credit amount;

- Income mixing and resident choice;

- Process for claiming credits; and

- Handling administrative costs.

Under the proposed credit, states would receive authority to allocate renters’ credits up to a cap set by a federal formula. This approach would be similar to that used for existing state-administered housing tax expenditures, including LIHTC and three programs that states can support through allocations of federal tax-exempt bond authority: private activity bonds for affordable rental housing; Mortgage Revenue Bonds, which subsidize mortgages for eligible households; and Mortgage Credit Certificates, which provide a tax credit for a percentage of a household’s mortgage interest. A capped renters’ credit would make it possible to provide a substantial per-household credit at a more moderate cost than providing an uncapped credit covering all eligible households.[13] The formula determining the amount of credits each state would be permitted to allocate could apportion credits on a per capita basis as the LIHTC formula does.

Each state would designate an agency to administer the renters’ credit, which would most likely be the same agency that administers LIHTC. States would award credits to particular developments through a competitive process according to criteria established in an annual plan, which could be the same plan used to set LIHTC allocation criteria.

Income Eligibility and Targeting

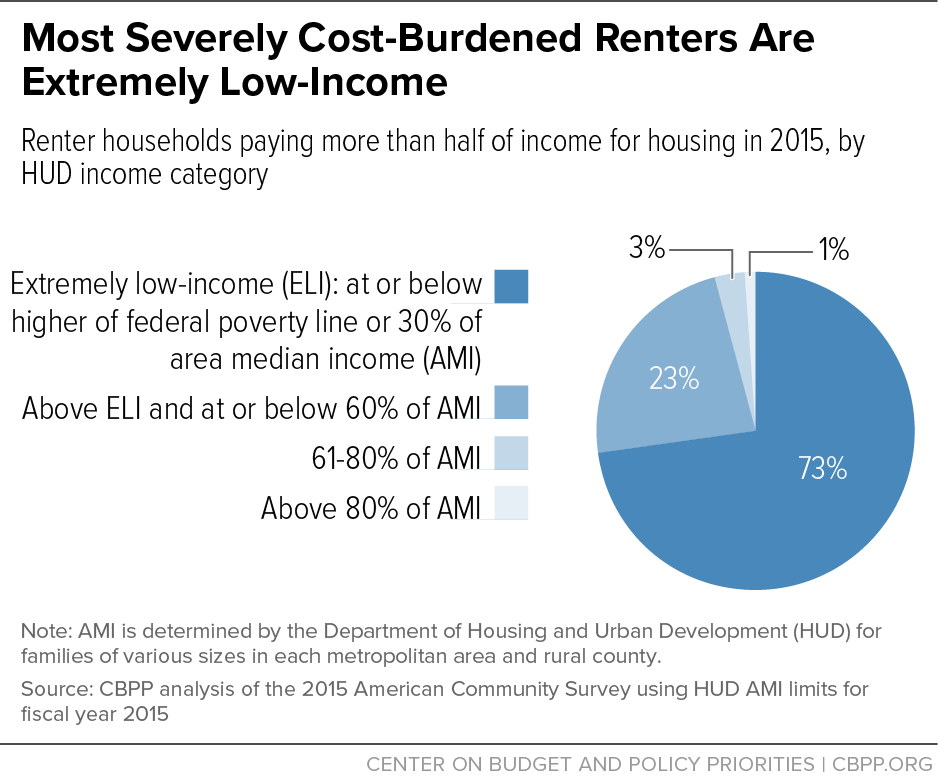

The renters’ credit would target families whose income when they move in is below the higher of 30 percent of the median income in the local area or the federal poverty line, referred to by the federal government as “extremely low-income” families. This income limit would vary from one area to another, but would average $15,100 nationally for an individual living alone and $25,000 for a family of four.[14]

This approach would ensure that credits are directed to families that are most likely to need help to afford housing. The large majority of renter households that pay more than half of their income for housing have extremely low incomes. (See Figure 2.) The lowest-income households are also more likely to experience other serious housing problems, including severely inadequate housing, overcrowding, homelessness, and eviction.

In allocating credits, states could prioritize developments that target particular populations, such as homeless families or veterans. Subject to the federal income limits and state targeting priorities, owners would select tenants from applicants on a waiting list for assistance.

Families in units assisted with the renters’ credit would pay 30 percent of their income for rent, the same share most participants in federal rental assistance programs pay today.[15] This formula is designed to ensure that the poorest families can afford modest housing while avoiding giving somewhat better-off families larger subsidies than they need. As under LIHTC and federal rental assistance programs, owners would be required to deduct an allowance for tenant-paid utilities from the rent.

The owner would determine the family’s income. This would be similar to the approach used in LIHTC developments and certain other types of developments with project-based subsidies, where owners certify tenant incomes, subject to various requirements to document the determination to oversight agencies or have documentation available if requested.

Owners would be required to determine the incomes of most families in renters’ credit units at least annually to ensure that the rent remains matched to the amount the family can afford. For families whose incomes are primarily from fixed sources (such as Social Security or Supplemental Security Income), owners could review income as infrequently as once every third year, with adjustment for inflation in the intervening years (as income from these sources typically rises annually with an inflation-based cost-of-living adjustment).[16]

Rents would be based on the family’s income in the prior year, to reduce the need for ongoing adjustment (which would be required if rents were based on current-year income). States could, but would not have to, require owners to adjust the family’s rent if its income changes during the year.

The amount of the credits an owner receives would be based on the gap between family rent payments and the full rent for the unit, capped based on modest rents in the local market and adjusted by a credit percentage established by the state.

To ensure that the credit would subsidize only modest rents, the rent counted toward determining the credit would be the lower of the rent that would be charged absent the renters’ credit or a market-based rent cap set based on the HUD fair market rent (FMR) for the zip code (if the unit is in a metropolitan area) or non-metropolitan county. These FMRs reflect estimates of the 40th percentile of market rent and utility costs for units with various numbers of bedrooms.[17]

In most cases there would be comparable units without renters’ credits in the same development (as discussed under income mixing below), so it would be clear what rent would have been charged absent the renters’ credit. In addition, if rents are capped based on FMRs, owners could not inflate rents above market levels except in limited circumstances, such as when units have fewer amenities than other units in the area or are poorly located within the zip code or county, and consequently have market rents below the FMR. (States would be required to conduct regular quality inspections, so units would have to be of at least standard quality to receive credits.) States should, however, have authority to establish other policies to ensure that rents used to set renters’ credit amounts are not inflated, and should also be permitted to adjust the FMR-based rent cap up or down by 25 percent to accommodate rapidly changing rental markets or other unusual local circumstances.

States would set credits as a percentage — generally no higher than 110 percent — of the rent discount the owner provides. Flexibility to set credit rates above 100 percent would allow states to balance the goals of fostering widespread acceptance of the credit and limiting costs to maximize the number of families they can assist. Setting credit rates above 100 percent would increase the cost per family assisted above the amount of the rent subsidy alone (though it would not increase the total federal cost of the renters’ credit, which would be limited by the caps on the amount of credits each state could issue), but this would sometimes be appropriate since it would encourage owners to accept the credit and compensate them for administrative costs they bear as a result.[18] All rental assistance programs generate some administrative or other costs above the amount of the direct rent subsidy. In the voucher program, for example, Congress provides added funding to cover administrative costs equal to about 8 percent of subsidy funding.

States should be allowed to set the credit percentage as high as 120 percent for developments that assist families with children and are located in low-poverty, high-opportunity neighborhoods, or in neighborhoods where poverty rates are dropping, rents are rising, and current residents are at risk of displacement. The added credits may be needed to provide affordable housing in such neighborhoods, which may present added challenges due to higher land costs and other factors.

States would be permitted to allocate credits to particular developments for up to 15 years to ensure stable, affordable housing for residents. When credits are allocated for multi-year periods, it would be important that developers and investors know in advance the amount of credits they will receive, so that they can plan the financing and construction of the development and be confident that the amount of credits will not exceed the tax liability of the taxpayer who is planning to claim them. States would therefore be permitted to provide a fixed long-term credit allocation based on projected market rents and conservatively low estimates of tenant incomes.

These fixed credit allocations would remain the same even if family incomes turn out to be higher (or lower) than expected, which would generate more (or less) rent revenue than planned. Owners, however, would be required to report actual rent revenues to the state and follow certain procedures that would avoid windfalls from excess revenues or revenue shortfalls that would make it difficult for the development to cover operating costs or mortgage payments.

When incomes and rent revenues are higher than expected, the owner would pay the excess into a state-administered renters’ credit reserve. When incomes and rent revenues are lower than expected, owners could draw money from the reserve or, if the amounts in the reserve are insufficient, apply to the state for additional credits or other subsidies. If neither of the steps is adequate to make up a shortfall, the owner could generate added rent revenues by temporarily renting one or more renters’ credit units to a higher-income family at the full market rent.[19]

Income Mixing and Resident Choice

States should be required to ensure that renters’ credit developments comply with two limitations that experience with other forms of project-based rental assistance suggests will make the credit more efficient and effective. First, states should be prohibited from placing credits in more than 40 percent of the units in a building. Exceptions should be permitted only in certain circumstances, including buildings with 25 or fewer units and developments in which more than 40 percent of units were previously subsidized through other federal project-based subsidies.

Limiting the share of units in a property would avoid placing high concentrations of poor families in an area, which research suggests can adversely affect outcomes for residents. In addition, it would impose a degree of market discipline that would not exist if all units in a development had renters’ credits. Owners would need to rent units to a substantial number of non-renters’ credit households for rents at or close to market levels, which would place pressure on managers to maintain developments in good condition and provide adequate security and other services.

Second, residents who have lived in renters’ credit units for one year should be given preference for admission to units in other renters’ credit developments and provided information (compiled by the state) on those developments’ characteristics and location. This would allow residents to move closer to a job site, a needed caregiver, or a desired school without losing the assistance the renters’ credit provides. (A family from the waiting list for assistance would then fill the unit the resident vacated, so there would be no reduction in the number of units that become available to unassisted families.) Without this resident choice option, a family could feel pressure to forgo employment or other opportunities in order to keep its rental subsidy and the housing stability it provides. Resident choice could also provide building managers with an added incentive to keep units in good condition to encourage tenants to stay, since excessive resident turnover would add to the development’s operating costs.[20]

Owners of developments that are awarded a renters’ credit allocation and comply with all credit requirements would be able to claim the credit against their federal tax liability in each year of the credit period. As with LIHTC, a developer that is awarded a credit but is unable itself to claim the credit (because it is a tax-exempt non-profit or a for-profit with limited tax liability) could enter into a partnership with a corporation or other entity that would invest in the property and in exchange receive a stake in the development’s ownership and the right to claim the credit. In developments that receive LIHTC and also renters’ credits to make some LIHTC units affordable to extremely low-income families, the same investor would likely claim both credits.

Alternatively, the developer or owner could transfer the renters’ credit to an outside investor in exchange for the resources needed to reduce rents to the level the renters’ credit requires, without also selling that entity a stake in the ownership of the property.[21] This approach would make sense for short-term renters’ credit allocations and other situations where the owner or investor would prefer not to transfer ownership of the property.

The bulk of the cost of administering the renters’ credit would be incurred at the state level, for activities such as allocating credits and conducting inspections and other oversight activities. It is highly unlikely that Congress would provide funds to cover state administrative costs. As a result, states would be responsible for paying those costs themselves. This would follow the approach used in LIHTC and other existing state-administered tax expenditures.

States would be permitted to charge property owners or investors participating in the renters’ credit fees to cover administrative costs. As noted above, states could set the amount of the credit modestly above the rent reduction. If this added credit is sufficient to cover a fee paid to the state (plus any administrative costs incurred directly by an owner), the fee would not deter owners or investors from accepting the credit.

In addition, states could use general revenues to pay for administrative costs or could direct state housing agencies to use available revenues for this purpose (such as surplus fees from the mortgage revenue bond or LIHTC programs). Finally, states could use funds provided under the federal HOME and Community Development Block Grant programs for renters’ credit administrative costs.

States that choose not to provide administrative funds could opt out of the credit, and the federal government could then reallocate the state’s credits to other states that are willing to provide the administrative funds. But states would have a strong incentive to provide the funds needed to implement the renters’ credit through one of the approaches described above. The credit would benefit real estate owners and low-income tenants in the state; might reduce costs in child welfare, Medicaid, and other state-run systems; and, more broadly, would bring funds into the state’s economy that would exceed administrative costs by a large margin.

Policymakers should consider instituting a renters’ credit to help rebalance federal housing policy and address a portion of the unmet need for housing assistance among low-income households. A renters’ credit costing $6 billion a year could help about 720,000 extremely low-income households afford housing. States could use the credit to address a series of pressing needs, including ending or sharply reducing homelessness among veterans and other groups, enabling low-income elderly people or people with disabilities to live independently in their communities rather than in nursing homes, and providing stable homes near high-performing schools for poor families with children. Establishing a new renters’ credit would complement existing low-income housing programs and make the nation’s housing spending more equitable and effective.

| TABLE 1 |

|---|

| State |

Credit Amount in Millions (2017$) |

Households Assisted |

Severely Cost-Burdened Households Eligible for Credit (2011-2015) |

|---|

| Alabama |

$88.3

|

13,600

|

131,400

|

| Alaska |

$17.5

|

1,700

|

13,300

|

| Arizona |

$124.0

|

16,100

|

168,800

|

| Arkansas |

$54.1

|

9,300

|

75,600

|

| California |

$711.0

|

66,900

|

1,180,800

|

| Colorado |

$99.1

|

11,100

|

130,800

|

| Connecticut |

$65.2

|

6,100

|

100,500

|

| Delaware |

$17.5

|

1,700

|

18,800

|

| District of Columbia |

$17.5

|

1,600

|

34,200

|

| Florida |

$368.2

|

42,900

|

502,300

|

| Georgia |

$185.5

|

23,000

|

287,600

|

| Hawaii |

$26.0

|

2,100

|

31,300

|

| Idaho |

$30.1

|

4,700

|

33,100

|

| Illinois |

$233.6

|

26,700

|

350,400

|

| Indiana |

$120.2

|

16,600

|

167,500

|

| Iowa |

$56.7

|

7,500

|

69,100

|

| Kansas |

$52.9

|

8,200

|

64,200

|

| Kentucky |

$80.4

|

13,300

|

117,700

|

| Louisiana |

$84.8

|

11,600

|

134,400

|

| Maine |

$24.1

|

3,600

|

32,000

|

| Maryland |

$109.1

|

9,400

|

135,900

|

| Massachusetts |

$123.4

|

11,000

|

194,300

|

| Michigan |

$180.2

|

23,600

|

265,200

|

| Minnesota |

$99.7

|

12,100

|

113,400

|

| Mississippi |

$54.4

|

9,900

|

79,500

|

| Missouri |

$110.5

|

15,300

|

157,500

|

| Montana |

$18.8

|

3,200

|

22,200

|

| Nebraska |

$34.4

|

5,500

|

41,800

|

| Nevada |

$52.5

|

6,600

|

77,300

|

| New Hampshire |

$24.2

|

2,900

|

25,400

|

| New Jersey |

$162.7

|

13,800

|

241,300

|

| New Mexico |

$37.9

|

5,800

|

51,400

|

| New York |

$359.6

|

31,700

|

733,900

|

| North Carolina |

$182.4

|

26,600

|

259,600

|

| North Dakota |

$17.5

|

2,600

|

17,500

|

| Ohio |

$210.9

|

30,900

|

337,000

|

| Oklahoma |

$71.0

|

10,700

|

90,700

|

| Oregon |

$73.2

|

9,600

|

118,100

|

| Pennsylvania |

$232.5

|

27,200

|

319,000

|

| Rhode Island |

$19.2

|

2,100

|

33,200

|

| South Carolina |

$88.9

|

13,700

|

115,300

|

| South Dakota |

$17.5

|

2,700

|

15,300

|

| Tennessee |

$119.9

|

17,400

|

169,400

|

| Texas |

$498.9

|

65,900

|

634,800

|

| Utah |

$54.4

|

7,200

|

48,800

|

| Vermont |

$17.5

|

2,300

|

10,900

|

| Virginia |

$152.3

|

14,300

|

182,300

|

| Washington |

$130.2

|

14,500

|

175,700

|

| West Virginia |

$33.5

|

5,000

|

44,500

|

| Wisconsin |

$104.8

|

14,100

|

145,400

|

| Wyoming |

$17.5

|

2,300

|

10,500

|

The renters’ credit described in this analysis has the same basic design as a version we proposed in 2013. Both would establish a capped, state-administered credit that would be claimed mainly by rental housing owners and would enable residents to rent housing for approximately 30 percent of their income. Many program details are also identical in the two versions, but there are several significant changes. The new version proposes a credit allocated only to owners and developers as a relatively simple, easily administrable starting point for federal policy change, although we continue to support the options in the earlier version allowing direct allocation to low-income families and lenders. In addition, we have refined the proposal in several other areas: tenant-paid utilities, exclusion of the credit from taxable income, credit transfers, and income targeting.[22]

Our new proposal would establish a “project-based” credit that states would allocate to owners or developers for use in particular rental housing developments. By contrast, our 2013 proposal would have allowed states to make any of three types of credit allocations: project-based credits, “tenant-based” credits allocated directly to low-income families for use in a modest unit of their choice in the private market, and “lender-based” credits allocated to lenders who would then enter agreements to use the credits in properties whose mortgages they hold.

These three allocation options would meet different needs. Project-based credits could be particularly effective for providing access to high-opportunity neighborhoods where it would otherwise be difficult for poor households to rent units, assisting groups such as the elderly or large families that have greater difficulty renting homes with tenant-based subsidies, funding supportive housing for the formerly homeless or people with disabilities, and supporting affordable housing development (since lenders could consider the revenues from the credits when assessing the owner’s ability to repay loans that fund rehabilitation or construction).

Tenant-based credits, however, would provide families with broader choice about where they live, which could, for example, allow an unemployed worker to move near a job opportunity or parents to relocate near a school they would like their child to attend. And lender-based credits could potentially reach smaller properties whose owners would be reluctant to seek a project-based allocation or rent to a family with a tenant-based credit.

Despite these advantages of the various credit types, however, legislation would not need to establish all three at once. Project-based credits would be the simplest to implement and oversee, since states would allocate them directly to the same entity that would be responsible for complying with key credit requirements like rent limits and quality standards. Project-based credits would also be more similar than the other credit types to the existing Low-Income Housing Tax Credit (LIHTC), and consequently more familiar to state administrators and other stakeholders. It is likely that even if a renters’ credit allowed all three types of allocations, states would initially opt to project-base most of their credits. Moreover, federal policymakers may prefer to enact the simpler project-based credit and allow it operate for a period of time before considering whether to add the tenant-based and lender-based options.

It is important to note, however, that if policymakers enact the solely project-based credit described in this analysis, there would remain a pressing need for rental assistance allocated in other ways — and particularly for tenant-based subsidies. Policymakers could opt to meet this need in later years by allowing states to allocate tenant-based and lender-based credits. They could also choose to provide more tenant-based subsidies by expanding the Housing Choice Voucher program, the major source of tenant-based rental assistance today, as a number of analysts have proposed. For example, the Bipartisan Policy Center’s Housing Commission recommended extending vouchers to all extremely low-income families that need help to afford housing.[23]

Our new proposal would require states to count tenant-paid utilities toward rental costs when calculating renters’ credit amounts. Rental subsidies will be more effective if they cover utilities, since payment of utilities is essential to a household’s ability to maintain decent living conditions and avoid eviction. Moreover, if tenant-paid utilities were not counted, this would unfairly disadvantage families that pay their own utilities relative to those whose utilities are included in their rent. For these reasons, the existing federal rental assistance programs include tenant-paid utilities in covered rental costs. To avoid encouraging higher utility use, subsidy calculations for these programs use allowances based on typical utility costs (with different allowance for tenants who are responsible for paying different combinations of utilities, live in the service areas of different utility companies, and live in different types of buildings) rather than a tenant’s actual utility expenses.

Our 2013 proposal would have allowed states to decide whether to cover tenant-paid utilities through the renters’ credit. This was intended to give states an option to reduce the credit’s administrative costs, particularly under a tenant-based credit where it would be more challenging for states to determine and verify which utility allowance they should apply for families living in units they find themselves in the private market. Our proposal would have allowed states to weigh the benefits of covering tenant-paid utilities against those costs.

It would be fairly simple, however, to include utilities in a project-based renters’ credit. In most project-based developments, all tenants would be served by the same utility companies and responsible for the same mix of utility costs, so there would be no need to make these determinations for individual households. Moreover, LIHTC uses utility allowances to determine rents, so project-based renters’ credit units that are also assisted though LIHTC (or other programs that operate similarly) would already have utility allowances associated with them. As a result, under our new proposal for a solely project-based credit, the benefits of covering utilities appear to clearly outweigh any adverse consequences from added complexity.

The proposal in this analysis would establish a renters’ credit that would not count toward the taxable income of the entity that claims it, while in 2013 we proposed a credit that would count toward taxable income. Our new non-taxable credit proposal is consistent with the approach taken for nearly all federal tax credits and would likely be more effective in encouraging participation in the credit by owners and investors, many of which use other non-taxable credits such as LIHTC, the rehabilitation credit, and the historic preservation credit.

Making the credit taxable would have some advantages, but these would be most significant under a tenant-based credit. One complication of a non-taxable credit is that it could potentially provide an extra tax benefit to some owners who claim it. Those owners would receive the credit itself, and in addition their tax liability would sometimes fall because they would replace some taxable rental income with a non-taxable credit. To avoid providing an excessive subsidy, states could offset this added benefit by setting the renters’ credit rate below 100 percent of the rent reduction, so that the total tax benefit comes out close to the rent loss. For example, if a state anticipates that an owner claiming the renters’ credit would have a 35 percent marginal tax rate, it could set the credit at 65 percent of the rent reduction and the total tax benefit would come out to 100 percent of the rent reduction.

This would be difficult with non-taxable tenant-based credits, however, since those credits could be used in almost any rental unit and the owners of the units could range from a low-income household in one of the lowest tax brackets to a corporation or high-income individual in one of the highest brackets. As a result, under a non-taxable tenant-based credit the state would risk either setting the percentage too high to offset the benefit from lower taxable rental income (creating excess subsidy) or too low (which would deter some owners from participating). Making the renters’ credit taxable would have avoided this uncertainty, since a taxable credit equal to 100 percent of the rent reduction would have essentially the same value as the rent payment regardless of what tax bracket the owner is in.

But the benefit of making the credit taxable would be much lower under the solely project-based credit in our new proposal, since the state would know the identity of the owner at the time it allocates the credit and should be able to avoid setting credit rates that are substantially above or below the appropriate level. The advantages of establishing a non-taxable project-based credit that would function similarly to other non-taxable housing-related credits therefore would likely exceed any gain from making the credit taxable.

Some rental housing owners would have difficulty using a renters’ credit themselves because they are tax exempt or do not have tax liability that is large or consistent enough to fully benefit from the credit. Under LIHTC, developers typically do not claim credits, but instead enter a partnership with a corporation or other entity that invests in the property and in exchange receives a stake in the development’s ownership (though generally not control over its management) and the right to claim the credit. Such partnerships could also be used for the renters’ credit, and when the renters’ credit and LIHTC are used together in a development the same investor would usually claim both credits.

In some projects, however, the owner may prefer not to transfer ownership to an investor or the transaction costs of establishing a partnership may be too high to justify doing so. This will often be the case, for example, where the renters’ credit would be used to make rents affordable to poor families in existing projects that do not require significant rehabilitation and where there is otherwise no need to change the development’s financing or ownership.

Our 2013 proposal would have allowed owners who could not claim credits themselves to transfer the credits to the lender who holds the mortgage on their property. The owner would have reduced tenants’ rents to 30 percent of their income, and the lender would have provided compensation to the owner (in the form of reduced interest or principal or a partial rebate of mortgage payments) in exchange for the right to claim the credit.[24]

Allowing such transfers to lenders would likely increase the number of owners who could use the credits, but it would also have limitations. Owners who do not have mortgages or whose existing mortgage lenders do not wish to accept credits could only use this option by taking out new loans, which might not otherwise make financial sense. And it is not clear what share of the lenders that currently provide rental housing mortgages would be willing to provide compensation to owners in exchange for tax credits.

Our new proposal would make it easier to use renters’ credits in properties whose owners cannot claim the credits themselves, by allowing credits to be transferred to any entity in the business of providing debt or equity financing to residential rental properties. In exchange, the entity that receives the credits would provide compensation to cover the cost to the owner of reducing tenants’ rents. These transfers would be analogous to transfers permitted under certain other federal tax credits to encourage a broader range of entities to invest in the activity the credit is intended to promote. For example, the railway maintenance tax credit — which is designed to encourage investment in maintenance of regional railroads — permits railway owners to transfer the credit to any outside entity that uses or provides services to any regional railroad, in exchange for funds to support railway maintenance.

Our 2013 proposal would have required states to target 75 percent of their renters’ credits on extremely low-income families — that is, those with incomes up to the higher of the federal poverty line or 30 percent of the local median income. States would have been permitted to provide the remaining credits to families with incomes up to the higher of 60 percent of median income or 150 percent of the poverty line.

Our new proposal modifies this policy to target all renters’ credits on extremely low-income families. This change would do more to make housing affordable to families in the income bracket that — as explained in the analysis — has by far the greatest need for housing assistance. Even with all renters’ credits targeted on extremely low-income families, the credit would only reach a fraction of the families in this income bracket who struggle to afford housing (unless the credit were expanded far beyond the scale discussed in the analysis).

Appendix 3: Methodology and Sources

This Appendix describes the sources and methods used for the estimates in the analysis and Appendix 1 of the costs and number of families assisted under the proposed renters’ credit.

Credit Amounts and Families Assisted

Our estimates of the number of families assisted by the renters’ credit assume a credit that once fully phased in would cost $6 billion in 2017 dollars. We estimate that such a credit would cost about $8,300 per household and help approximately 720,000 families afford housing (also after full phase-in). The credit’s total cost and impact would build to this level over an extended period. Because units would generally remain affordable for 15 years, the number of units would continue to grow significantly until states had allocated credits for 15 years. After that, costs and the number of families assisted would grow more slowly because new credit allocations would mostly be used to replace units reaching the end of their affordability period.

The estimate that a $6 billion credit would assist 720,000 families aggregates estimates of the number of families that would be assisted in each state, the District of Columbia, and five territories (Puerto Rico, Guam, American Samoa, the Virgin Islands, and the Northern Mariana Islands). We allocated the $6 billion credit amounts among those jurisdictions in proportion to their Low-Income Housing Tax Credit (LIHTC) allocations, since the proposed renters’ credit would use a formula similar to LIHTC’s. We then calculated the number of families assisted in each state by dividing the credit amount by an average per-household credit cost estimated using the 2011-2015 American Community Survey Public Use Microdata Sample (PUMS) and other sources according to the method described below.

We did not have adequate data to estimate per-household credits for the territories, which are not covered by the American Community Survey (ACS). For purposes of estimating the total number of families assisted nationally, we assumed that the average credit cost in the territories would be the same as the average in the 50 states and the District of Columbia.

Renter households were included in the credit cost estimates if the household had an income below HUD’s extremely low-income threshold (defined as earning less than 30 percent of the area median income or the federal poverty line) and paid 50 percent or more of its monthly income for housing (defined as rent plus utilities). Under the proposal in the analysis, all households with incomes below the extremely low-income threshold would potentially be eligible for the renters’ credit; limiting the cost estimates to households with housing cost burdens above 50 percent assumes that states would target assistance on families with the greatest need. Households with negative income and households that did not pay rent were excluded for purposes of the cost estimates.

If states provided some renters’ credits to families with rent and utility cost burdens below 50 percent, this would cause per-household costs to be somewhat lower than we estimate. However, this effect would likely be at least partly offset if states provided some renters’ credits to families that are homeless or doubled up with other families, since those groups (which we cannot identify through the ACS) would likely have per-household costs somewhat above our estimates.

The ACS PUMS data uses Public Use Microdata Areas (PUMAs) as the primary geographic unit. PUMAs partition each state into non-overlapping areas containing about 100,000 residents. HUD publishes extremely low-income thresholds by metropolitan area and county. Because PUMAs do not necessarily match up with those units of geography, we estimated an income threshold for each PUMA by averaging the income thresholds for all the counties in the PUMA, weighted by the number of renters earning $25,000 or less in each county. Households with incomes below the PUMA threshold were considered extremely low-income.

We then used existing variables in the ACS dataset to determine whether a household paid half or more of its income for housing. We used the monthly gross rent variable to estimate each household’s monthly housing costs. This variable includes monthly rent plus the estimated average monthly cost of utilities (electricity, gas, and water and sewer) and fuels (oil, coal, kerosene, wood, etc.) if these are the responsibility of the renter. We used the annual household income variable, adjusted for inflation and divided by 12, to determine each household’s monthly income. This variable includes the following income sources: wages, salary, commissions, bonuses, and tips from all jobs; self-employment income (net income after business expenses) from non-farm or farm businesses, including proprietorships and partnerships; interest, dividends, net rental income, royalty income, or income from real estates and trusts; Social Security or Railroad Retirement; Supplemental Security Income; any public assistance or welfare payments from the state or local welfare office; retirement, survivor, or disability pensions; and any other regularly received income (e.g., veterans’ payments, unemployment compensation, child support, or alimony).

Renters who already receive federal rental assistance would not be eligible for the credit. However, the ACS data do not include information on receipt of rental assistance. We are able to exclude the vast majority of these households by limiting our eligibility estimates to renters paying half or more of their income for housing, since only a small share of households that receive rental assistance pay more than half their income for housing. It is unlikely that inclusion of these households in our calculations had a significant effect on our estimate of per household costs.

Subsidies under the proposed credit would be capped in metro areas based on HUD-determined 2015 Small Area Fair Market Rents (SAFMRs), which are set at the zip code level. PUMAs do not correspond to zip code boundaries, so we needed to make approximate matches between PUMS households and zip codes. Using the Census Bureau’s Census tract-to-PUMA and Census tract-to-zip code geographic relationship files, we developed a PUMA-to-zip code crosswalk, which we weighted by the share of renters earning less than $25,000 in each zip code in each PUMA. We used this crosswalk to generate geographical relationships between PUMAs and zip codes, allowing us to assign ACS household records to zip codes and, subsequently, to the zip code-based SAFMRs.[25]

When a household lives outside a metropolitan area and therefore does not have an SAFMR, renters’ credit subsidy caps would be set based on county-level HUD Fair Market Rents (FMRs). Because the ACS PUMS file assigns households to PUMAs rather than counties, we estimated an FMR for each non-metropolitan PUMA by averaging the 2015 FMRs for all the counties in the PUMA, weighted by the number of renters earning $25,000 or less in each county.

Because many renters’ credit households are likely to live in LIHTC-subsidized buildings and those households will often be subject to different rent limits than other renters’ credit recipients, we use two formulas for estimating household credit amounts. We assumed half of credit recipients would live in a LIHTC unit and half would not, and randomly assigned eligible households to the two categories. For the half of households living in LIHTC units, we assume the amount of rent counted toward the credit equals either (1) 125 percent of the SAFMR or FMR or (2) 30 percent of the 60 percent of 2015 median income limit, whichever is lower. For the other half, we assume a rent equal to the value of the SAFMR or FMR. (Under our proposal, states could opt to set renters’ credit rent limits anywhere from 75 percent to 125 percent of the SAFMR or FMR and to allow the credits to cover rents above the LIHTC limit — which is usually 30 percent of 60 percent of median income — in LIHTC developments, so state decisions could cause costs to be higher or lower than we estimate.)

Since renters’ credit households would pay 30 percent of their monthly income for housing, for both groups we subtracted that amount from the rent determined above to estimate the credit cost. We then adjusted this cost estimate for inflation to 2017 dollars.