Policy Basics: Project-Based Vouchers

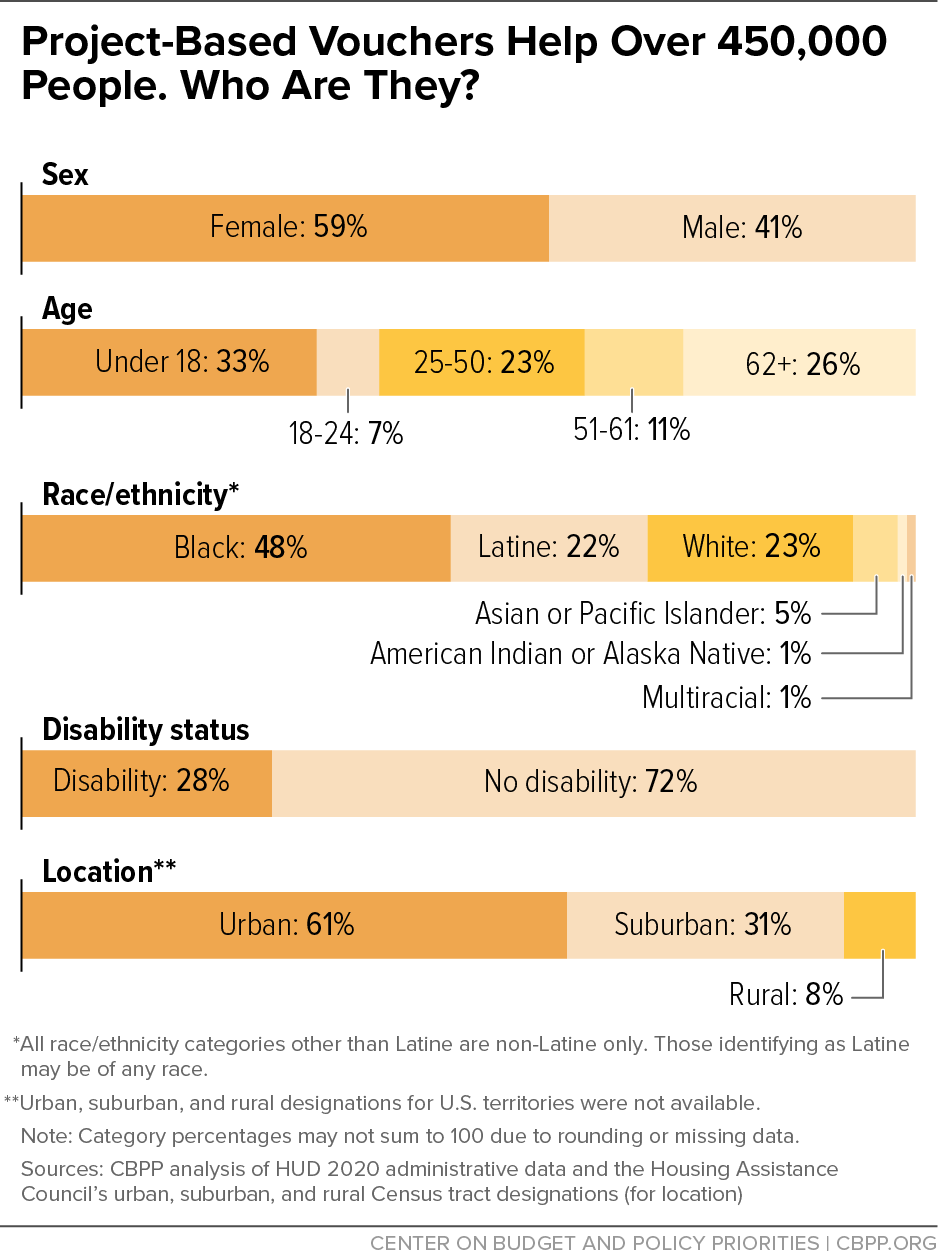

Project-based vouchers, part of the Housing Choice Voucher program, provide place-based subsidies to help more than 450,000 people in over 260,000 households afford modest housing in the private market.

What Are Project-Based Vouchers?

Most Housing Choice Vouchers are “tenant-based,” meaning people can use them to rent any private apartment that meets program guidelines. Project-based vouchers (PBV), in contrast, are attached to a specific unit whose landlord contracts with the state or local public housing agency to rent the unit to families and individuals with low incomes. After a household has lived in a home subsidized with a PBV for a year, the family can opt to move to a different location, such as a home closer to a job opportunity or school better suited to a child’s needs, with the next tenant-based voucher that becomes available. Another individual or family from the waiting list can then move in and benefit from the PBV rent subsidy.

Families in units with PBVs contribute 30 percent of their income for rent and utilities or a minimum rent of up to $50 per month; the voucher pays the difference between the tenant contribution and the unit’s total rent and utility costs.

PBVs, administered by state and local housing agencies, are distinct from Section 8 Project-Based Rental Assistance (PBRA), a program through which property owners have contracted directly with the Department of Housing and Urban Development (HUD) to rent units to families with low incomes. Congress has generally ended HUD’s authority to sign new PBRA contracts, so PBVs are the largest, most available tool to create new project-based rental assistance. Unlike PBV residents, PBRA tenants generally do not have the right to move with a tenant-based voucher and consequently cannot move to a new location without giving up their rental assistance.

Who Is Eligible for Project-Based Vouchers?

Federal rules ensure that Housing Choice Vouchers — whether tenant- or project-based — are targeted to the families who need them most. Seventy-five percent of new households admitted each year to an agency’s Housing Choice Voucher program must be “extremely low income,” with incomes not exceeding 30 percent of the local median or the poverty line, whichever is higher. Other new households may have incomes up to 80 percent of the local median.

Housing agencies may set admissions preferences based on housing need or other criteria. Families with an individual whose immigration status makes them ineligible for a voucher can receive prorated assistance based on the number of family members who are eligible.

Only 1 in 4 families eligible for federal rental assistance actually receive it due to funding limitations, so most housing agencies maintain waitlists of families eligible for vouchers.

Agencies can maintain separate waitlists for PBVs and tenant-based vouchers or a single waitlist for all vouchers.

How Are Project-Based Vouchers Funded?

PBVs are funded as part of a housing agency’s annual housing voucher funding from HUD. Agencies can use up to 20 percent of their Housing Choice Vouchers for PBVs. They also can use an additional 10 percent of their Housing Choice Vouchers for PBVs that: (a) assist veterans or people experiencing homelessness, (b) are located in properties that provide supportive housing to older adults or people with disabilities, or (c) are located in areas where the poverty rate is 20 percent or less. Units converted from other federal assistance to PBVs, such as public housing conversions through the Rental Assistance Demonstration, do not count toward this cap.

Agencies enter into a contract with a property owner for up to 20 years initially, with the option to renew. PBVs can generally be attached to no more than 25 percent of the units in a given property or 25 units, whichever is greater, unless the property is located in a low-poverty area or residents are eligible for supportive housing. These restrictions aim to allow people with varying levels of income to live together in a community.

What Are the Benefits of Project-Based Vouchers?

Over 60 percent of all medium and large public housing agencies, which administer 92 percent of authorized vouchers, use PBVs. Project-basing some vouchers can help communities:

- Improve access to supportive services for tenants with vouchers. Some tenants, such as older adults, people with disabilities, or people who have experienced prolonged homelessness or housing instability, might need additional services (such as intensive case management, housing navigation, or physical and behavioral health services) to maintain stable housing and improve their health. Attaching PBVs to multiple units in the same property can allow service providers to work more efficiently with residents and increase access to services. PBVs are particularly well suited to create supportive housing since properties that make services available to residents are exempt from the restriction on the number of PBV-subsidized homes in a property. In addition, agencies can set waitlist preferences to prioritize people who are eligible for the services offered.

Help families secure units where it may be hard to use vouchers. Living in lower-poverty neighborhoods can benefit both adults and their children, but families with vouchers may be unfamiliar with such neighborhoods or have difficulty finding willing landlords, or their voucher may not pay the going rent in these neighborhoods. In neighborhoods with low vacancy rates, stiff competition for available units exacerbates these problems. PBVs lower many of those barriers by creating dedicated units for families with low incomes. PBVs may also be more attractive to landlords than tenant-based vouchers because they provide more stable income and may provide higher payments.

In addition, housing agencies can attach PBVs to a greater share of units in properties in lower-poverty areas. In census tracts where the poverty rate is 20 percent or less, agencies can attach PBVs to 25 units or 40 percent of the units in the project, whichever is larger. PBVs can also lock in lower rents in neighborhoods with fast-rising housing costs because the contract can limit rent increases to reflect changes in the landlord’s cost to operate the building rather than changes in market rents.

- Create more affordable and mixed-income housing. Agencies can attach PBVs to newly constructed or rehabilitated units as well as existing units. By guaranteeing a future source of stable income for a development, PBVs can be integral to the financing package that makes constructing or rehabilitating affordable housing possible. Since properties generally can use PBVs in only a minority of the units, these projects are more likely than older forms of assisted housing to serve tenants with a mix of incomes while preserving low-income families’ ability to choose to move to a location that better suits them without losing rental assistance.

The Center on Budget and Policy Priorities is a nonprofit, nonpartisan research organization and policy institute that conducts research and analysis on a range of government policies and programs. It is supported primarily by foundation grants.