- Home

- Federal Rental Assistance

Policy Basics: Federal Rental Assistance

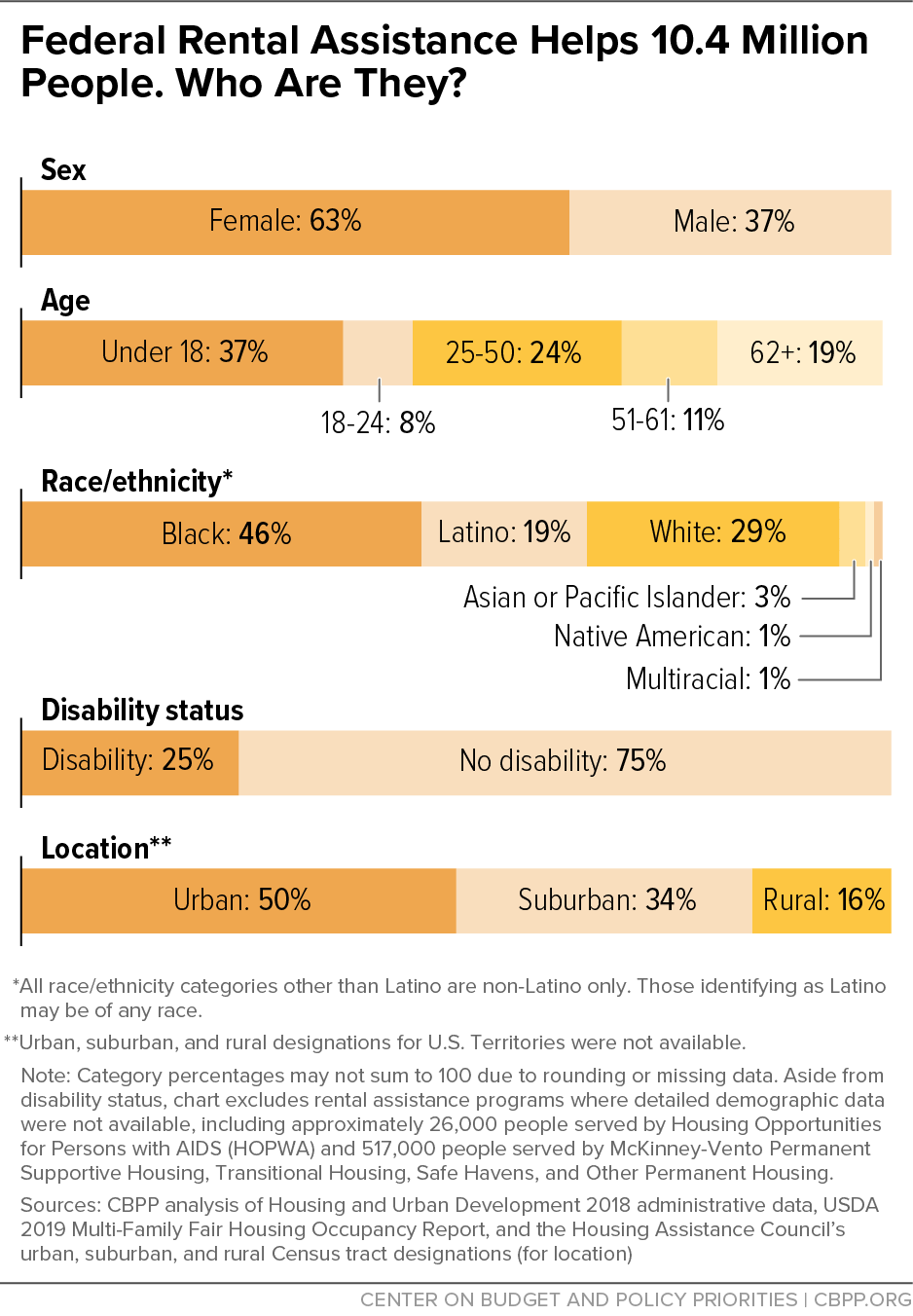

Federal rental assistance enables more than 10 million people in 5.2 million low-income households to afford modest homes.

What Is Federal Rental Assistance?

Three major programs — Housing Choice Vouchers, Section 8 Project-Based Rental Assistance, and Public Housing — assist about 84 percent of the households receiving federal rental assistance.

Other programs serve specific populations, including the Section 202 and Section 811 supportive housing programs for older adults and people with disabilities, respectively; Housing Opportunities for People with AIDS/HIV (HOPWA), and McKinney-Vento permanent housing programs for people experiencing homelessness.

Tribal governments can provide rental assistance for American Indians and Alaska Natives living on tribal lands through the Indian Housing Block Grant, the main source of federal housing assistance for tribal nations. Tribal nations do not generally receive funding for other federal rental assistance programs.

In addition, the Department of Agriculture (USDA) provides rental assistance for two-thirds of the units in properties it helps fund. For detailed, state-by-state data on most rental assistance programs see the National and State Housing Fact Sheets & Data.

The Department of Housing and Urban Development (HUD) oversees all federal rental assistance except the USDA Section 521 Rural Rental Assistance program.

Other federal programs provide grants, tax credits, or reduced-interest loans to build or rehabilitate rental housing. But, without rental assistance, such programs generally do not make units affordable to families with the lowest incomes.

How Does Federal Rental Assistance Help Recipients?

Federal rental assistance helps families afford uncrowded housing and avoid homelessness or other kinds of housing instability. By limiting housing costs, it also leaves families with more resources for other expenses such as food, medicine, child care, and transportation. Some programs connected to federal rental assistance, such as the Family Self-Sufficiency Program, also provide families with opportunities to build savings and achieve other financial goals.

Rental assistance programs like Section 811, Section 202, and HOPWA are specifically designed to provide affordable, accessible housing, and intensive coordinated services for specific populations through a supportive housing strategy. Housing Choice Vouchers can also be used for supportive housing when combined with services to address physical and mental health and substance use conditions, and to help with other issues such as finding employment or applying for benefits.

Federal rental assistance can also help expand housing choice and increase access to low-poverty, high-resource neighborhoods for families with low incomes. This is particularly helpful for people of color, who disproportionately live in high-poverty areas due to a long history of discriminatory government policies, including those that have limited where people of color could live while simultaneously starving those neighborhoods of resources. When rental assistance enables families to live in low-poverty neighborhoods, children are significantly more likely to attend college and have higher earnings as adults, and their parents can enjoy major health improvements such as lower rates of diabetes, extreme obesity, and depression.

Who Is Helped by Federal Rental Assistance?

Federal rental assistance makes housing affordable for over 10 million people, including nearly 4 million children. Rental assistance is also important for providing accessible, affordable homes for over 2 million people with disabilities and almost 2 million older adults.

In 2016, the latest year with available data, 89 percent of households in the HUD-assisted programs were older adults, had disabilities, worked, had recently worked, or likely were subject to policies under other programs that take away benefits for not meeting work requirements.

Who Is Eligible for Federal Rental Assistance?

A household must have a “low income” (below 80 percent of the local median) in order to begin receiving federal rental assistance. Some programs limit initial eligibility to households with incomes at or below 50 percent of the local median.

The main rental assistance programs also require that a share of new households admitted have “extremely low” incomes, meaning they may not exceed the higher of 30 percent of the local median or the federal poverty line. Three-fourths of assisted households have extremely low incomes.

Some programs are targeted to certain groups, such as older adults, people with disabilities, veterans, or families who previously experienced homeless.

Due to funding limitations, 3 in 4 eligible low-income renter households do not receive federal rental assistance, and 7.8 million renter households in 2019 did not receive rental assistance even though they paid more than half their income for housing, lived in substandard housing, or both (defined by HUD as “worst case” housing needs). There are long waits for housing assistance in most of the country.

How Much Do Assisted Families Pay for Housing?

Most households pay 30 percent of their income (after certain deductions are taken out) for rent and utilities. The major programs usually require a minimum rent of $25-$50 per month, even if this amount exceeds 30 percent of the family’s income.

What Role Does the Private Market Play?

Most federal rental assistance is used in privately owned properties. In some rental assistance programs (most notably the Housing Choice Voucher program), families use vouchers to rent any private apartment that meets program guidelines. In the other programs, rental assistance is “attached” to particular properties.

Over 3,400 state and local housing agencies administer the Housing Choice Voucher and Public Housing programs. These agencies and private owners of properties assisted under the other programs manage the waiting lists, select the tenants who will receive rental assistance, and determine families’ monthly rent contributions in accordance with federal rules.

Where Do Families With Federal Rental Assistance Live?

Housing Choice Vouchers and properties with federal rental assistance are located in most communities throughout the U.S. and the territories. (See the National and State Housing Fact Sheets & Data for particular states.)

While most rental assistance is in urban and suburban areas, 17 percent of assisted homes, for 1.5 million people, are in rural areas.

How Is Federal Rental Assistance Funded?

Congress funds rental assistance through annual appropriations. To maintain existing levels of housing assistance each year, Congress must provide sufficient funding for each program based on the number of households receiving assistance and adjustments for inflation. Insufficient resources to cover program costs can result in a reduction of rental assistance, which already fails to meet the need.

Because rental assistance programs are funded on a yearly basis, the programs do not expand automatically when people need more help, such as during a recession.

The Center on Budget and Policy Priorities is a nonprofit, nonpartisan research organization and policy institute that conducts research and analysis on a range of government policies and programs. It is supported primarily by foundation grants.