To Help Stabilize the Individual Health Insurance Market, Take ACA Repeal Off the Table

End Notes

[1] See for example Mike DeBonis and John Wagner, “With Help From Pence, House Republicans Suddenly Rekindle Health Care Talks,” Washington Post, April 3, 2017, https://www.washingtonpost.com/powerpost/with-help-from-pence-house-republicans-suddenly-rekindle-health-care-talks/2017/04/03/88ec08e4-1888-11e7-855e-4824bbb5d748_story.html?utm_term=.3a6636a88d1f.

[2] Robert Pear and Jeremy W. Peters, “Repeal of Affordable Care Act Is Back on Agenda, Republicans Say,” New York Times, March 28, 2017, https://www.nytimes.com/2017/03/28/us/politics/health-care-obamacare-freedom-caucus.html.

[3] Centers for Medicare & Medicaid Services, “Key Dates for Calendar Year 2017,” revised February 2017, https://www.cms.gov/CCIIO/Resources/Regulations-and-Guidance/Downloads/Revised-Key-Dates-for-Calendar-Year-2017-2-17-17.pdf.

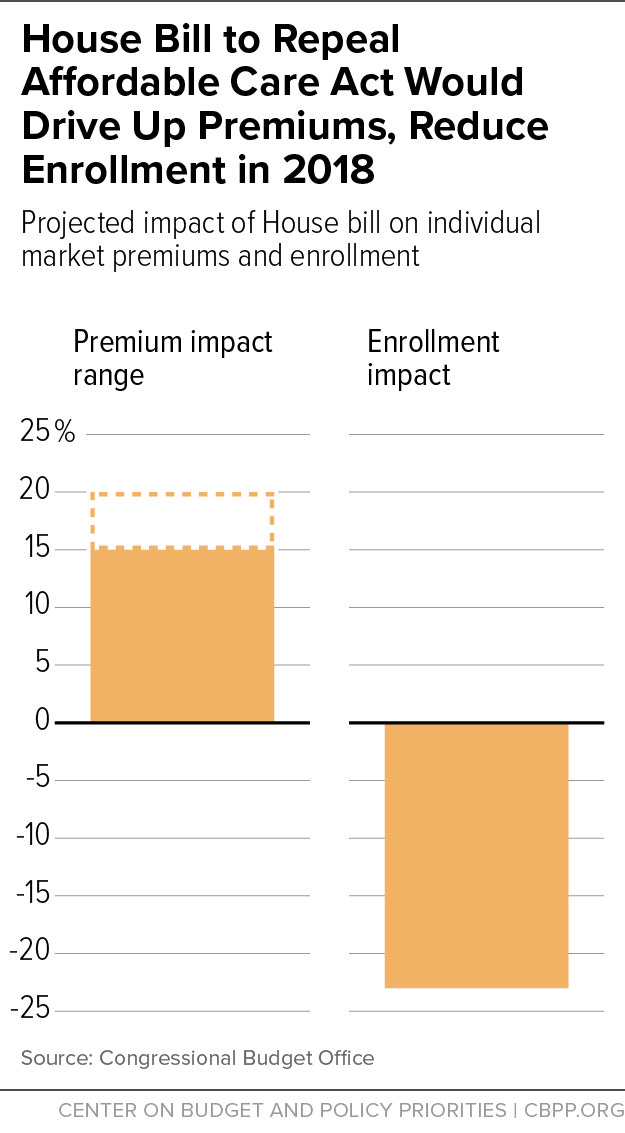

[4] The CBO estimate takes into account both repeal of the individual mandate and the AHCA’s other near-term changes, including its Patient and State Stability Fund Grants. Congressional Budget Office, “American Health Care Act,” March 13, 2017, https://www.cbo.gov/system/files/115th-congress-2017-2018/costestimate/americanhealthcareact.pdf. To convert the 15 to 20 percent increase into a dollar figure, we project current law average premiums for 2018 based on actual average premiums for 2017 (available from Centers for Medicare & Medicaid Services, “Health Insurance Marketplaces 2017 Open Enrollment Period Final Enrollment Report,” March 15, 2017, https://www.cms.gov/Newsroom/MediaReleaseDatabase/Fact-sheets/2017-Fact-Sheet-items/2017-03-15.html) and growth projections from the Centers for Medicare & Medicaid Services Office of the Actuary.

[5] Aviva Aron-Dine and Tara Straw, “House GOP Health Bill Still Cuts Tax Credits, Raises Costs by Thousands of Dollars for Millions of People,” Center on Budget and Policy Priorities, March 22, 2017, https://www.cbpp.org/research/health/house-gop-health-bill-still-cuts-tax-credits-raises-costs-by-thousands-of-dollars. These estimates are for the 39 states that use the HealthCare.gov eligibility and enrollment platform.

[6] Aron-Dine and Straw.

[7] Insurers who completely exit a state’s individual market are generally barred from participation for the next five years. But insurers can avoid that outcome by offering a token plan in which they enroll few or no customers.

[8] According to state Division of Insurance documents, individual market rate filings are due May 1 in Connecticut (http://ct.gov/cid/lib/cid/BulletinHC-90-17.pdf) and Oregon (http://dfr.oregon.gov/business/insurance-industry/health-ins-regulation/Documents/2018-filing-timelines.pdf), May 3 in Virginia (https://www.scc.virginia.gov/SCC-INTERNET/boi/co/acafilinginfo/files/deadline.pdf), May 17 in Nevada (http://doi.nv.gov/uploadedFiles/doinvgov/_public-documents/Insurers/Filing_Information/NV%20Rate%20Filing%20Timeline%20-%20Draft%20v%202.0.pdf ), May 22 in Pennsylvania (http://www.insurance.pa.gov/Companies/ProductAndRateRequire/Documents/2018%20ACA%20Compliant%20Health%20Insurance%20Rate%20Filing%20Guidance%20Final.pdf), and May 26 in Ohio (http://www.insurance.ohio.gov/Company/Documents/ACA%20Filing%20Resources/ODI_Training_2018PY_20170307.pdf).

[9] See for example Sarah Kliff, “Trump’s Executive Order on Obamacare, Explained by Two Health Policy Experts,” Vox, January 20, 2017, http://www.vox.com/2017/1/20/14343332/trump-obamacare-executive-order.

[10] Sarah Lueck, “Commentary: How the Trump Administration Might Sabotage ACA Insurance Markets,” Center on Budget and Policy Priorities, April 4, 2017, https://www.cbpp.org/health/commentary-how-the-trump-administration-might-sabotage-aca-insurance-markets.

[11] Ryan’s full statement was, “Yeah, I don’t know what else to say other than Obamacare’s the law of the land. It’s gonna remain the law of the land until it’s replaced. We did not have quite the votes to replace this law. And so, yeah, we’re gonna be living with Obamacare for the foreseeable future.” http://time.com/4713114/paul-ryan-ahca-health-care-failure-transcript/