- Home

- Medicare Is Not “Bankrupt”

Medicare Is Not “Bankrupt”

Claims by some policymakers that the Medicare program is nearing “bankruptcy” are highly misleading.[1] Although Medicare faces financing challenges, the program is not on the verge of bankruptcy or ceasing to operate. Such claims demonstrate misunderstanding (or misrepresentation) of Medicare’s finances.

Hospital Insurance

Medicare’s Hospital Insurance (HI) program — Part A of Medicare — covers inpatient hospital services and post-acute care in nursing homes and rehabilitation facilities. It obtains about 90 percent of its financing from payroll taxes. Employees and their employers each pay 1.45 percent of total wages, and self-employed people pay an equivalent 2.9 percent of their self-employment income. Taxpayers with incomes over $200,000 for singles and $250,000 for couples pay an additional 0.9 percent of wages and self-employment income above those thresholds. The rest of HI’s income derives primarily from a portion of the income taxes collected on Social Security benefits. HI’s trust fund also collects interest on its balances.

The 2022 report of Medicare’s trustees finds that the HI trust fund will remain solvent — that is, able to pay 100 percent of the costs of the hospital insurance coverage that Medicare provides — through 2028. Even in 2028, when the report projects the HI trust fund reserves will be depleted, incoming payroll taxes and other revenue will still be sufficient to pay 90 percent of Medicare hospital insurance costs.[2] The share of costs covered by dedicated revenues will decline slowly to 80 percent in 2046 and then rise gradually to 93 percent by 2096. This shortfall will need to be closed through raising revenues, slowing the growth in costs, or most likely both. But the Medicare Hospital Insurance program will not run out of all financial resources and cease to operate after 2028, as the “bankruptcy” term may suggest.

Supplementary Medical Insurance

The 2028 date does not apply to Medicare coverage for physician and outpatient costs or to the Medicare prescription drug benefit. These parts of Medicare are financed through the program’s Supplementary Medical Insurance (SMI) trust fund, which consists of two separate accounts — one for Medicare Part B, which pays for physician and other outpatient health services, and one for Part D, which pays for outpatient prescription drugs.

The base premium for Part B is set each year to cover about one-quarter of costs; federal funding supported by general revenues pays roughly three-quarters of costs. Upper-income beneficiaries pay higher income-related premiums; low-income beneficiaries are not required to pay premiums.

General revenues also finance about three-quarters of Part D; premiums pay for about 15 percent. As with Part B, higher-income beneficiaries pay more. Payments from states cover part of the cost of beneficiaries who are dually eligible for both Medicare and Medicaid and account for about 11 percent of Part D income.

The trustees’ report does not project that Medicare Parts B and D will become insolvent at any point. The SMI trust fund always has sufficient financing to cover Part B and Part D costs, because the beneficiary premiums and general revenue contributions are specifically set at levels to ensure this is the case. Thus, SMI cannot go “bankrupt.”

Recent Changes in Medicare’s Financial Outlook

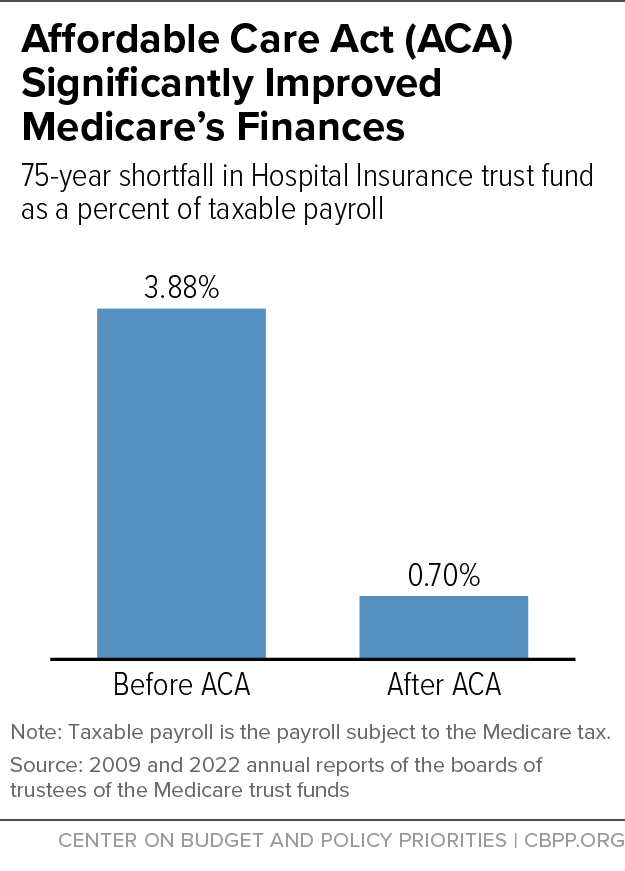

The outlook for the HI trust fund has slightly improved from the 2021 report. The projected reserve depletion date is two years later (in 2028), and the 75-year shortfall has decreased from 0.77 percent to 0.70 percent of taxable payroll. The projected depletion date is uncertain, however, and could easily vary by several years, one way or the other.

Since 1970, changes in law, the economy, the cost of health care, and other factors have brought the projected year of Medicare HI insolvency as close as two years away or pushed it as far as 28 years into the future.[3] Trustees’ reports have been projecting impending insolvency for five decades, but Medicare has always paid all of the benefits owed because Presidents and Congresses have taken steps to keep spending and resources in balance in the near term. Unlike Social Security, which has had no major changes in law since 1983, the rapid evolution of the health care system has required frequent adjustments to Medicare — a pattern that is certain to continue.

The Affordable Care Act (ACA), along with other factors, has significantly improved Medicare’s financial outlook, boosting revenues and making the program more efficient. The HI trust fund is now projected to remain solvent 11 years longer than before the ACA was enacted in 2010. And the HI program’s projected 75-year shortfall of 0.70 percent of taxable payroll is much less than the 3.88 percent of payroll that the trustees estimated before health reform. (See Figure 1.) This means that Congress could close the projected funding gap by raising the Medicare payroll tax — now 1.45 percent each for employers and employees — to about 1.8 percent, or by enacting an equivalent mix of spending reductions and tax increases.

Medicare’s Financing Challenges

Despite improvements made by the ACA, Medicare continues to face long-term budgetary challenges due to the aging of the population and increasing costs throughout the health care system. Total Medicare spending is projected to grow from 4.0 percent of gross domestic product (GDP) this year to 6.0 percent in 2040.

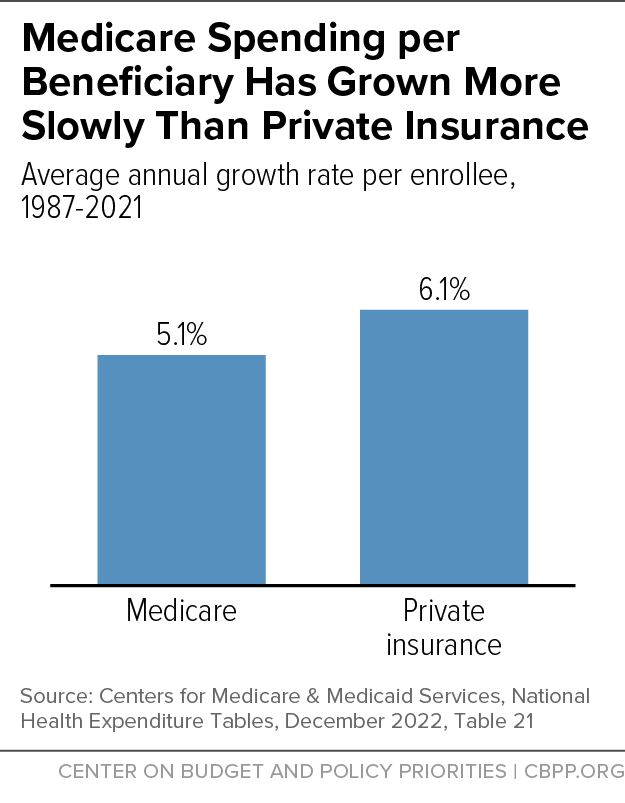

Medicare has been the leader in reforming the health care payment system to improve efficiency and has outperformed private health insurance in holding down the growth of health costs. Since 1987, Medicare spending per enrollee has grown by 5.1 percent a year, on average, compared with 6.1 percent for private health insurance.[4] (See Figure 2.)

Some additional program savings can be achieved over the next several years, while preserving Medicare’s guarantee of health coverage and without raising the eligibility age or otherwise shifting costs to beneficiaries. Possible measures include ending Medicare’s overpayments to pharmaceutical companies for drugs prescribed to low-income beneficiaries, increasing funding for actions to prevent and detect fraudulent and wasteful Medicare spending, further reducing overpayments to private Medicare Advantage plans, and ensuring efficient payments to other health care providers. There also is a wide range of options for raising Medicare payroll taxes or other revenues.[5]

A key long-term fiscal policy goal is to stabilize the federal debt relative to the size of the economy. But it is neither necessary nor desirable to accomplish this by radically restructuring Medicare — such as through “premium support” proposals that would convert it into a voucher program — or by shifting more health care costs to Medicare beneficiaries in other ways. Policymakers and the public should not be driven to adopt such proposals based on misleading claims that Medicare is on the verge of “bankruptcy” or is “unsustainable.”

End Notes

[1] For example, see Speaker of the House Kevin McCarthy quoted in Tony Romm, “House GOP eyes Social Security, Medicare amid spending battle,” Washington Post, January 24, 2023, https://www.washingtonpost.com/us-policy/2023/01/24/gop-social-security-medicare-debt-limit/.

[2] Boards of Trustees of the Federal Hospital Insurance and Federal Supplementary Medical Insurance Trust Funds, 2022 Annual Report, June 2, 2022, p. 27, https://www.cms.gov/files/document/2022-medicare-trustees-report.pdf.

[3] Patricia A. Davis, “Medicare: Insolvency Projections,” Congressional Research Service, updated October 25, 2021, https://www.fas.org/sgp/crs/misc/RS20946.pdf.

[4]Centers for Medicare & Medicaid Services, National Health Expenditure Tables, December 2022, Table 21, https://www.cms.gov/Research-Statistics-Data-and-Systems/Statistics-Trends-and-Reports/NationalHealthExpendData/NationalHealthAccountsHistorical.html.

[5] Paul N. Van de Water, “Strengthening Medicare Financing,” Center on Budget and Policy Priorities, December 14, 2020, https://www.cbpp.org/research/health/strengthening-medicare-financing; Gordon R. Mermin et al., “Options for Increasing Medicare Revenues,” Tax Policy Center, February 1, 2023, https://www.taxpolicycenter.org/publications/options-increasing-medicare-revenues/full.