- Home

- Harsh Labor Market Conditions Justify Ex...

Harsh Labor Market Conditions Justify Extending Unemployment Benefits in Hard-Hit States

House-Passed Bill Would Apply to States with at Least 8.5 Percent Unemployment

On September 22, the House passed H.R. 3548, the Unemployment Compensation Extension Act of 2009, by an overwhelming bipartisan majority of 331 to 83. This legislation, which if enacted would provide additional weeks of unemployment insurance benefits in states with the highest unemployment rates, is an appropriate response to the continuing harsh conditions in the labor market.

- By the end of September, more than 400,000 workers will have exhausted both their regular, state-funded unemployment benefits and their federal extended benefits without being able to find a job, according to estimates from the National Employment Law Project (NELP). [1] By the end of December, an estimated 1.3 million workers will have exhausted all of these benefits.

- The House bill would provide 13 additional weeks of unemployment benefits in states where the unemployment rate is 8.5 percent or higher. The bill is well targeted on the workers who are likely to continue to have the hardest time finding a new job: more than 80 percent of the projected 1.3 million “exhaustees” live in a state with an unemployment rate at or above 8.5 percent.

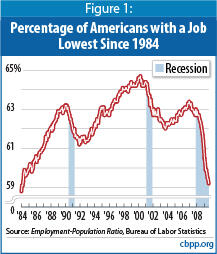

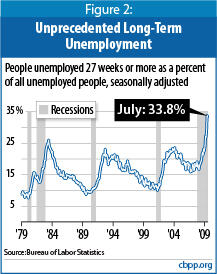

- While the recession may soon be ending, the lesson from the last two recessions is that unemployment does not begin to decline until many months after the economy begins growing again. (Unemployment peaked 19 months after the end of the 2001 recession, for example.) Recent data on the job market remain grim: in August the percentage of the population with a job fell to its lowest level since 1984, while long-term unemployment (the share of jobless workers who have been unemployed for more than 26 weeks) was only slightly below July’s record of 33.8 percent, the highest ever recorded in data going back to 1948.

- The House bill would not add to the deficit. The legislation would cover the cost by extending the federal surcharge on the Federal Unemployment Tax Act tax collected from employers, a tax that Congress established in 1976 and has regularly extended.

- In addition to helping the workers themselves, the bill would help the economy by cushioning the income losses of jobless workers, enabling them to maintain a higher level of spending than they could without UI benefits, thereby supporting a higher level of overall economic activity.

Bill Targeted on States with Worst Job Markets

The American Reinvestment and Recovery Act (ARRA) provides additional weeks of unemployment insurance (UI) benefits to workers who are unable to find a job before their regular, state-funded benefits run out (typically after 26 weeks). ARRA provides the greatest number of extra weeks in states with the highest unemployment rates, and where, therefore, it is likely to be hardest to find a new job. Under ARRA, all states qualify for a minimum of 20 weeks of Emergency Unemployment Compensation (EUC) for workers who have exhausted their regular benefits, but states where the unemployment rate is 6 percent or higher qualify for 33 weeks of EUC.

In some states, workers who exhaust their EUC qualify for additional weeks of benefits under the permanently authorized Extended Benefits (EB) Program, which the federal government and the states jointly fund. Thirty-six states and the District of Columbia have adopted an optional “trigger” for their EB programs under which workers qualify for 13 weeks of EB if the state’s unemployment rate is 6.5 percent or more, and for 20 weeks of EB if it is 8 percent or more.[2]

The House bill would provide an additional tier of 13 weeks of EUC for states with an unemployment rate of 8.5 percent or higher. It is deficit-neutral; the legislation would cover the cost by extending for another year the federal surcharge on the Federal Unemployment Tax Act (FUTA) tax collected from employers. The FUTA surcharge was enacted in 1976 and has been renewed regularly ever since.

Labor Market Expected to Remain Harsh Even as Economy Begins Recovering

Evidence is mounting that the recession that began in December 2007 is coming to an end (or might recently have ended ), but that is cold comfort to those struggling to find a job in a labor market that is likely to remain harsh until well after the recovery is underway. [3] As Federal Reserve Chairman Ben Bernanke said recently, “even though from a technical perspective the recession is very likely over at this point, it’s still going to feel like a very weak economy for some time as many people will still find that their job security and their employment status is not what they wish it was.”[4]

Improvements in the labor market typically lag behind a turnaround in economic growth as the economy begins to emerge from recession. In the 1990-91 recession, the unemployment rate did not peak until 15 months after the recession ended. In the 2001 recession, unemployment peaked 19 months after the end of the recession, and job losses did not bottom out for another two months after that.

Recent monthly employment reports show little evidence that the emerging economic recovery is reviving the job market. To be sure, the labor market is no longer in free fall, as it was at the beginning of the year. But even as economic activity is picking up, employers remain reluctant to hire, and people who want to work remain discouraged about their prospects of finding a job.

- Although the pace of job losses has slowed considerably in recent months, private and government payrolls combined have shrunk for 20 straight months, and net job losses since the start of the recession in December 2007 total 6.9 million. (Private sector payrolls have shrunk by 7.0 million jobs over the same period.)

- Nonfarm payrolls fell by 216,000 jobs in August. Taking out losses of government jobs, private payrolls fell by 198,000 jobs. Each of these declines is the smallest since August 2008, but gains of this magnitude will be necessary to reverse the rise in the unemployment rate.

- The unemployment rate, which was 4.9 percent at the start of the recession, rose from 9.4 percent in July to 9.7 percent in August, its highest rate since June 1983. Many forecasters expect the rate will rise above 10 percent in coming months.

- The Labor Department’s most comprehensive alternative unemployment rate measure — which includes people who want to work but are discouraged from looking and people working part time because they can’t find full-time jobs — jumped to 16.8 percent in August. That is 8.1 percentage points higher than when the recession began; it also is the highest on record in data that go back to 1994.

Two statistics in particular highlight the plight of job seekers in the current labor market.

- Employment has plummeted. With little growth in the labor force and a jump in unemployment in August, the percentage of the population with a job fell to its lowest level since March 1984 (see Figure 1).

- Long-term unemployment is near a record level. In August, one-third (33.3 percent) of the unemployed had been looking for work for 27 weeks or more — just below the 33.8 percent recorded in July, which was the highest ever recorded in data going back to 1948 (see Figure 2).

Workers Exhausting Their Benefits, Creating Hardship and Weakening Economic Stimulus

The extra weeks of benefits and other UI provisions in ARRA have helped millions of unemployed workers weather the recession better than they otherwise would have. The additional UI benefits are also one reason why ARRA has significantly lessened the decline in economic activity in this recession and will significantly boost the recovery over the next year or so.[5] Nevertheless, the recession has been long and deep. As a result, people are beginning to exhaust their benefits.

In August 2009, just over half (52 percent) of those receiving UI exhausted their regular benefits and became reliant on the first tier of EUC benefits available in all states. That is the highest exhaustion rate for regular benefits in the program’s history, according to NELP. The UI provisions of ARRA are scheduled to expire at the end of this year, but with the labor market still so weak and exhaustions of regular UI benefits at such a high rate, there will continue to be a strong need for emergency benefits in 2010.

But policymakers face an even more immediate problem than renewing ARRA’s UI provisions: the plight of people who are exhausting their regular and extended UI benefits. By the end of this month more than 400,000 people will have exhausted their federal extended benefits (EUC and EB), according to NELP; 1.3 million will have exhausted them through the end of the year. That is the problem the bill that just passed the House addresses.

The House bill is well targeted. All of the recipients of extra weeks live in states with unemployment at or above 8.5 percent, and are therefore likely to have the hardest time finding a new job. This group constitutes more than 80 percent of the 1.3 million workers projected to exhaust all their benefits by the end of the year. (See Table 1). In addition, there are exhaustees in states where the unemployment rate has not yet reached 8.5 percent but might well do so in coming months as unemployment rates keep rising and in states that are close to the 8.0 percent unemployment rate that would trigger additional EB benefits. Finally, it is worth noting that about a tenth of the estimated exhaustees live in states that have not adopted the optional EB unemployment rate trigger but where the unemployment rate is high enough that they would qualify for additional weeks if it were adopted.[6]

| TABLE 1: | ||

| Number of Exhaustees | As Percent of Total | |

| In states eligible for proposed new tier of benefits | 1,081,964 | 81.3% |

| In states close to eligible for proposed new tier (Unemployment rate of 8.0 to 8.4 percent) | 20,972 | 1.6% |

| In states close to eligible for 20 weeks of EB (Unemployment rate of 7.5 to 8.0 percent) | 74,188 | 5.6% |

| In states eligible for more weeks of EB if state adopts optional EB trigger (Unemployment rate of 6.5 percent or higher but no optional trigger) | 139,476 | 10.5% |

| Source: Department of Labor for Unemployment Rates and EB Trigger Status; National Employment Law Project for estimated exhaustions of federal extended benefits. | ||

| TABLE 2: | |||

| State | Avg. Unemployment Rate | Estimated Exhaustions | States without |

| Alabama | 10.2 | 37,794 | |

| Alaska | 8.3 | 3,700 | |

| Arizona | 9.0 | 22,632 | |

| Arkansas | 7.2 | 8,273 | x |

| California | 11.9 | 154,328 | |

| Colorado | 7.6 | 13,853 | |

| Connecticut | 7.9 | 11,739 | |

| Delaware | 8.2 | 3,518 | |

| District of Columbia | 10.9 | 3,703 | |

| Florida | 10.7 | 114,508 | |

| Georgia | 10.2 | 58,887 | |

| Hawaii | 7.2 | 5,456 | x |

| Idaho | 8.7 | 9,395 | |

| Illinois | 10.2 | 50,028 | |

| Indiana | 10.4 | 50,343 | |

| Iowa | 6.5 | 30,914 | x |

| Kansas | 7.2 | 3,819 | |

| Kentucky | 11.0 | 14,025 | |

| Louisiana | 7.3 | 8,773 | x |

| Maine | 8.6 | 4,838 | |

| Maryland | 7.2 | 25,681 | x |

| Massachusetts | 8.8 | 39,530 | |

| Michigan | 15.1 | 62,753 | |

| Minnesota | 8.2 | 13,754 | |

| Mississippi | 9.4 | 19,109 | x |

| Missouri | 9.4 | 20,556 | |

| Montana | 6.6 | 5,688 | x |

| Nebraska | 5.0 | 13,849 | x |

| Nevada | 12.5 | 14,135 | |

| New Hampshire | 6.8 | 1,478 | |

| New Jersey | 9.4 | 41,576 | |

| New Mexico | 7.1 | 1,577 | |

| New York | 8.8 | 89,662 | |

| North Carolina | 10.9 | 32,171 | |

| North Dakota | 4.2 | 4,195 | x |

| Ohio | 11.0 | 64,545 | |

| Oklahoma | 6.6 | 5,943 | x |

| Oregon | 12.0 | 11,235 | |

| Pennsylvania | 8.5 | 60,910 | |

| Puerto Rico | 15.0 | 6,437 | x |

| Rhode Island | 12.6 | 4,483 | |

| South Carolina | 11.8 | 21,852 | x |

| South Dakota | 4.9 | 1,543 | x |

| Tennessee | 10.8 | 32,788 | |

| Texas | 7.8 | 48,596 | |

| Utah | 5.9 | 18,226 | x |

| Vermont | 7.0 | 1,860 | |

| Virgin Islands | 1,350 | x | |

| Virginia | 6.8 | 12,877 | |

| Washington | 9.1 | 10,455 | |

| West Virginia | 9.0 | 3,756 | |

| Wisconsin | 8.9 | 24,180 | |

| Wyoming | 6.3 | 3,900 | x |

| UNITED STATES | 1,331,176 | ||

End Notes

[1] National Employment Law Project, “Talking Points: Immediate Action Needed to Extend Unemployment Benefits,” August 20, 2009.

[2] Because the EB program’s default triggers are relatively high, in past recessions the program has not activated in many states even with elevated unemployment. ARRA temporarily provided full federal funding for EB, which made it more attractive for states to choose an optional trigger that is more likely to activate the program.

[3] The widely recognized arbiter of when recessions begin and end is the Business-Cycle Dating Committee of the National Bureau of Economic Research, a non-governmental organization. The official announcement often comes many months after the official beginning or end of the recession. In an extreme example, the announcement that the last recession ended in November 2001 was not made until July 2003.

[4] “A Year in Turmoil: Fed Chairman Ben Bernanke Reflects on the Stabilization of the Financial System Since the Events of Last September,” uncorrected transcript, The Brookings Institution, September 15, 2009, p. 36, at http://www.brookings.edu/~/media/Files/events/2009/0915_financial_crisis/20090915_bernanke.pdf.

[5] On the effectiveness of ARRA, see James R. Horney et al., “Correcting Five Myths About the Stimulus Bill,” Center on Budget and Policy Priorities, July 10, 2009.

[6] South Carolina qualifies for 13 weeks of EB under a different trigger but would qualify for 20 weeks under the optional trigger most states have adopted.