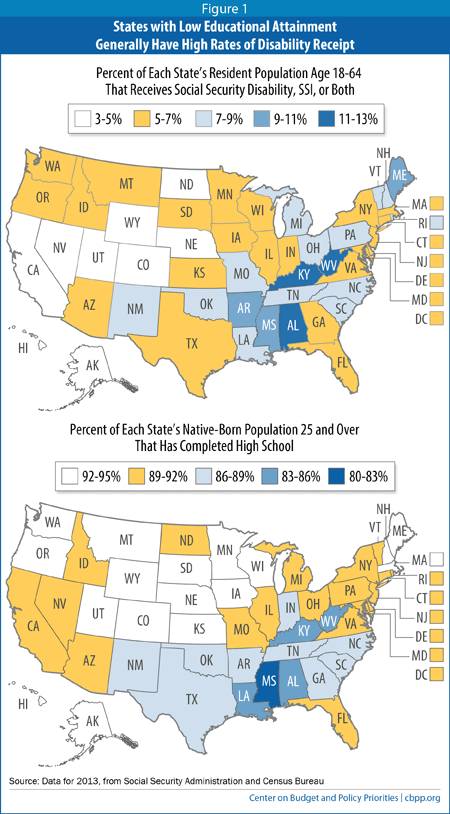

Geographic Pattern of Disability Receipt Largely Reflects Economic and Demographic Factors

Disability Benefits Especially Important in South and Appalachia

End Notes

[1] Bryann Da Silva provided invaluable research assistance.

[2] This analysis focuses on the rate of disability receipt by state — that is, the percentage of each state’s working-age population (age 18-64) that receives DI, SSI, or both. A map depicting the number of disability recipients would look different. Not surprisingly, they’re concentrated in the most populous states, led by California, Texas, New York, Florida, and Pennsylvania. All of those states except Pennsylvania have average or below-average rates of receipt.

Information about the number of disability recipients by state, county, zip code, and congressional district is available at “Geographic Statistics Fact Sheets,” Social Security Administration, http://www.ssa.gov/news/press/statefctshts.html.

[3] For further discussion of the statistical analysis that underpins this result, see the separate technical appendix at https://www.cbpp.org/cms/index.cfm?fa=view&id=5255.

[4] For more information about the geographic patterns of many health indicators, see the Data Hub maintained by the Robert Wood Johnson Foundation at http://www.rwjf.org/en/research-publications/research-features/rwjf-datahub.html.

[5] Melissa M. Favreault, Richard W. Johnson, and Karen E. Smith, “How Important Is Social Security Disability Insurance to U.S. Workers?,” Urban Institute, June 21, 2013, http://www.urban.org/UploadedPDF/412847-how-important-is-social-security.pdf; Michelle Stegman Bailey and Jeffrey Hemmeter, “Characteristics of Noninstitutionalized DI and SSI Program Participants: 2010 Update,” Social Security Bulletin, February 2014, http://www.ssa.gov/policy/docs/rsnotes/rsn2014-02.html.

[6] See Chart Book: Social Security Disability Insurance, Center on Budget and Policy Priorities (CBPP), August 4, 2014, https://www.cbpp.org/cms/index.cfm?fa=view&id=4169. SSI (unlike DI) does not require a work history and serves relatively more young beneficiaries with early-onset mental impairments and intellectual disabilities, but rates of SSI receipt, too, rise with age. See “Policy Basics: Introduction to Supplemental Security Income,” CBPP, February 27, 2014, https://www.cbpp.org/cms/index.cfm?fa=view&id=3370.

[7]Favreault et al., op. cit.

[8] Kathryn Pitkin Derose, José J. Escarce, and Nicole Lurie, “Immigrants And Health Care: Sources Of Vulnerability,” Health Affairs, vol. 26 no. 5, September 2007, http://content.healthaffairs.org/content/26/5/1258.full; The Health of Immigrants in New York City, New York City Department of Health and Mental Hygiene, June 2006, http://www.nyc.gov/html/doh/downloads/pdf/episrv/episrv-immigrant-report.pdf.

[9] Chart Book, CBPP, op. cit.; Stephen C. Goss et al., “Disabled Worker Allowance Rates: Variation Under Changing Economic Conditions,” Social Security Administration, Actuarial Note 153, August 2013, http://www.ssa.gov/OACT/NOTES/pdf_notes/note153.pdf; Kalman Rupp, “Factors Affecting Initial Disability Allowance Rates for the Disability Insurance and Supplemental Security Income Programs: The Role of the Demographic and Diagnostic Composition of Applicants and Local Labor Market Conditions,” Social Security Bulletin, vol. 72 no. 4, 2012, http://www.ssa.gov/policy/docs/ssb/v72n4/v72n4p11.html.

[10] Nicole Maestas, Kathleen J. Mullen, and Alexander Strand, “Disability Insurance and Healthcare Reform: Evidence from Massachusetts,” Michigan Retirement Research Center, Working Paper 2013-289, November 2013, http://www.mrrc.isr.umich.edu/publications/papers/pdf/wp289.pdf; Norma B. Coe et al., “What Explains State Variation in SSDI Application Rates?,” Center for Retirement Research at Boston College, Working Paper 2011-23, December 2011, http://crr.bc.edu/working-papers/what-explains-state-variation-in-ssdi-application-rates/.

[11] Stephan Lindner, “Why are disability benefit rates so different across small areas?,” Urban Institute Metro Trends blog, April 4, 2014, http://blog.metrotrends.org/2014/04/disability-benefit-rates-small-areas/.

[12] Kathy Ruffing, “Not So Hale and Hearty: Explaining Disability Rates in One Alabama County,” Off the Charts blog, April 15, 2013, http://www.offthechartsblog.org/not-so-hale-and-hearty-explaining-disability-rates-in-one-alabama-county/; Trudy Lieberman, “‘This American Life’ piece provides an unfortunate example of incomplete reporting,” Columbia Journalism Review, May 21, 2013, http://www.cjr.org/united_states_project/disability_social_security_and.php?page=all.

[13] Kathy Ruffing and Paul N. Van de Water, Congress Needs to Boost Disability Insurance Share of Payroll Tax by 2016, CBPP, July 31, 2014, https://www.cbpp.org/cms/index.cfm?fa=view&id=4168.