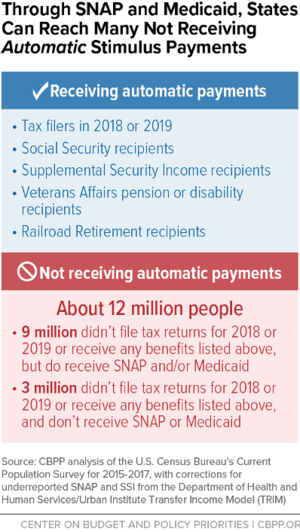

About 12 million Americans risk missing out on the stimulus payments provided through the recent CARES Act because they, unlike millions of people who are receiving the payments automatically from the IRS, must file a form by November 21 to receive it this year, or file a 2020 tax return next year to receive it in 2021. (This estimate, based on CBPP analysis of Census data, is approximate; please see Appendix II for our methodology.)[1] This group includes very low-income families with children, people who have been disconnected from work opportunities for a long period, and many low-income adults not raising children in their home.

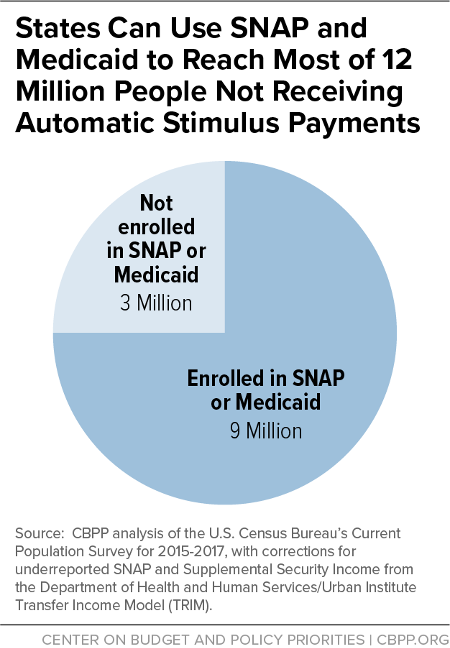

Governors and other state officials can play a central role in reaching these 12 million individuals, up to 9 million of whom — roughly 3 in 4 — participate in SNAP (formerly food stamps) or Medicaid, which states and counties administer.[2]

This group of non-filers eligible for payments are disproportionately people of color because they are likelier to have lower incomes due to historical racism and ongoing bias and discrimination. Twenty-seven percent of the 9 million people are Black — higher than their share of the U.S. population (12 percent) — while another 19 percent are Latino. Ensuring that low-income people of color receive the payments for which they qualify is especially important given emerging evidence that they are being hit hardest by both the economic and health effects of the pandemic.

The IRS, working with the Social Security Administration, Department of Veterans Affairs, and Railroad Retirement Board, has been automatically delivering the CARES Act stimulus payments (technically called Economic Impact Payments or EIPs) to tens of millions of people who regularly file federal income taxes or receive certain federally administered benefits, such as Social Security, Supplemental Security Income (SSI), Railroad Retirement, or Veterans Affairs pension or disability benefits. Eligible adults receive $1,200 plus $500 for each eligible child.

But the automatic payment method misses about 12 million people — adults and children — because they aren’t required to file federal income tax returns due to their low incomes and they do not participate in one of those specified, federally administered programs.[3] Together, these people are eligible to receive $12 billion in payments. (See Table 1 for state-by-state estimates.)

To receive the payments this year, these individuals must provide their information to the IRS no later than October 15 through a 2019 tax return or by November 21 when using the IRS “Non-Filer” tool, a simplified online form for people not required to file a tax return.[4] The tool requires a user to create an online account, enter certain personal information (including direct deposit information, if available), verify their email address, and submit the form. The IRS plans to issue all payments before the December 31, 2020 deadline in the CARES Act.

An aggressive outreach program is needed at the state and local levels to inform eligible individuals, who by definition have very low incomes, that they are eligible and to help them undertake the required steps. Such outreach efforts will benefit both individuals and communities. The payments are considerable, both for the recipients and by other standards of assistance; in some states, the amount of money at stake is as much as ten times the state’s total annual cash assistance to families with children. These funds would go to extremely low-income individuals and families at a time when need is rising due to the pandemic. And ensuring these people apply for and receive the payments for which they qualify will also benefit local and state economies, in which much of the money will be spent.

Governors and other state officials can play a vital role in reaching the 12 million eligible people. The health and human services agencies that administer SNAP and Medicaid are uniquely positioned to reach, using established communication channels, the subgroup of 9 million people who participate in those two programs. Governors and state agencies can also do much to reach the other 3 million eligible people, who generally do not receive state or federal benefits. Public education efforts and partnerships with key stakeholder groups, such as service providers for people experiencing homelessness, will be critical to connecting people to the $1,200 payments.

In addition, if federal policymakers issue additional stimulus payments to boost economic demand and reduce hardship, state efforts now to connect eligible low-income individuals with the tax system should pay dividends in helping these people access any future rounds of payments.

The CARES Act, signed into law on March 27, includes stimulus payments to support overall consumer demand amidst historic job losses and business closures and to help families deal with the fallout from the COVID-19 crisis. The payments are designed to be significant — $1,200 per adult ($2,400 for a married couple) and $500 per dependent child — and broad-based; unlike the payments provided during the Great Recession,[5] they are available to people with the lowest incomes. Moreover, there is no earnings test, so people with zero earnings are eligible for the full amounts. The payments begin phasing out at incomes of $150,000 for married couples, $112,500 for heads of households, and $75,000 for singles. Unfortunately, the law unreasonably excludes certain groups from the payments. Immigrant families (except for certain military families) are ineligible if any adult or spouse (if filing jointly) lacks a Social Security number. Also ineligible are 17-year-olds, college students whom their parents can claim as dependents, and adult dependents.

To deliver these payments to the nation’s roughly 300 million eligible people, policymakers chose the IRS, which has contact with a large share of the population. The payments, therefore, are designed as a tax credit. They are “fully refundable,” meaning that eligible households receive the full amount regardless of what — if anything — they pay in federal income tax. Importantly, because the country is in the middle of a crisis, the law instructs the Secretary of the Treasury (who oversees the IRS) to deliver the payments “as rapidly as possible.”

The IRS, working with other agencies, has been delivering the payments using a generally step-by-step approach, starting with payments to the people easiest to reach. First up were people who filed federal income tax returns in 2018 or 2019 and for whom the IRS had direct deposit information. Then, the IRS began working with the Social Security Administration and the Railroad Retirement Board to automatically deliver payments to retirees and persons with disabilities who receive Social Security or Railroad Retirement benefits but do not typically file tax returns. Next up for automatic payments were recipients of SSI or veterans’ pension or disability benefits who do not file tax returns.

For these groups, the process of delivering payments has gone relatively smoothly, especially considering the depleted state of the IRS after nearly a decade of funding cuts.[6] The challenge now is to ensure that the remaining 12 million people, who neither file federal income tax returns nor receive certain federal benefits, receive the payments for which they are eligible “as rapidly as possible,” as the law mandates. In addition to developing the “Non-Filer” tool described above for people who don’t typically file tax returns, the IRS has expanded its outreach efforts beyond its usual partners to reach non-filers with low incomes and those in the military, veteran, and homeless communities.[7] But many non-filers are not connected to traditional channels of information and are likely to miss out on payments without additional efforts.

Remaining 12 Million Eligible People Have Very Low Incomes

By definition, the estimated 12 million people not receiving payments automatically have very low incomes because they aren’t required to file federal income tax returns.[8] Only people with annual income above the following levels have a legal obligation to file a return for 2020: $12,400 for singles, $18,650 for heads of household (such as a single parent with children), and $24,800 for married couples.[9] (Many people with incomes below those thresholds do file federal income tax returns in order to claim the Earned Income Tax Credit [EITC] or Child Tax Credit. Low-income families with children have an incentive to file a return to claim these tax credits, as do adults not raising children in their homes, though to a lesser degree.[10])

The 12 million group is predominantly non-elderly. Many senior citizens are receiving automatic payments because they receive Social Security, Railroad Retirement, SSI, or veterans’ pensions or disability benefits. Up to 1 million seniors, though, may be eligible for payments but do not receive them automatically.

The outstanding payments amount to roughly $12 billion nationally, which — if delivered and spent — would not only reduce hardship but also give state and local economies a much-needed boost.

SNAP and Medicaid Agencies Can Reach About 9 Million Eligible People Not Receiving Automatic Payments

We estimate that approximately 9 million of the 12 million people who won’t automatically receive the payments receive state- or county-administered benefits such as SNAP or Medicaid, a fact that underscores the key role for state government in reaching this group. (See Figure 1.) They have low incomes and are among those who most need the payments to cover essential expenses. The payments for which they qualify, worth a combined $9 billion, represent a significant sum both individually and collectively. In Alabama and North Carolina, for example, their payments total an estimated $209 million and $324 million, respectively, or nine to ten times the amount of basic cash assistance those states provide annually through their Temporary Assistance for Needy Families (TANF) programs ($20 million and $37 million), our estimates suggest.[11]

While many SNAP and Medicaid recipients file federal income tax returns and hence will receive their payments automatically, state agencies are the primary organizations able to reach those who don’t file.[12] State agencies are uniquely placed to use existing contact information to alert eligible people about the payments and connect them with services to help them obtain their payment.[13]

As state agencies reach out to the 9 million people, the following groups would be useful targets for outreach efforts:

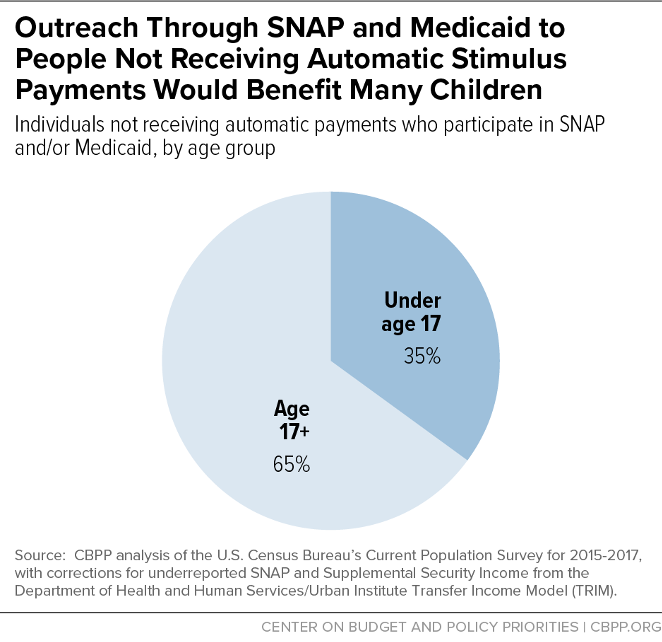

- Very low-income children. About 3.2 million of the 9 million people — that is, more than one-third — are under age 17, which exceeds their share of the U.S. population overall (22 percent).[14] (See Figure 2.) Roughly 1 in 5 of the households that include these children participate in TANF as well as SNAP and/or Medicaid.

- Adults not raising children in their home. More than 40 percent of the 9 million people are adults without children under age 17. Roughly one-quarter of these childless adults are themselves under age 25, and could include youth aging out of foster care, low-income students, and others struggling to get by on their own. Another third of these childless adults are between 50 and 65, and might include people with limited job skills or disabilities.

- People of color. Twenty-seven percent of the 9 million people are Black — higher than their share of the U.S. population (12 percent) — while another 19 percent are Latino. Forty-eight percent are non-Latino white, making them the largest single racial-ethnic group, but this share is lower than in the U.S. population (61 percent). Ensuring that low-income people of color receive the payments for which they qualify is especially important given emerging evidence that they are being hit hardest by both the economic and the health effects of the pandemic.[15]

- People with lower education levels. Some 19 percent of the 9 million people have no family member with a high school degree, almost three times the rate in the general population. People with less education are among those especially vulnerable during the current crisis: almost half of people with a high school degree or less have had someone in their household lose a job or hours due to the pandemic, and two-thirds report having insufficient savings to cover three months of bills and expenses in an emergency.[16]

- People lacking secure housing. Many individuals who do not have permanent housing have very low incomes and are likely to be among the non-filer population.

Table 1 gives state-by-state estimates of the number of individuals among the 9 million non-filers who receive SNAP and/or Medicaid, and the resulting funds that would flow into state economies if payments reached all of them. (Appendix Table 1 shows state-by-state estimates of the number of individuals and the payment amounts among the 12 million non-filers. Appendix Table 2 shows more detailed state-by-state estimates of the subgroup of roughly 6.5 million SNAP recipients who were likely missed by automatic payments.)

| TABLE 1 |

|---|

| Estimated Adults and Children Missed by Automatic Payments Who Receive SNAP and/or Medicaid Benefits |

|---|

| |

Total individuals |

Potential total payments (in millions of dollars) |

|---|

| United States |

9,270,000 |

$9,000 |

| Alabama |

220,000 |

$209 |

| Alaska |

26,000 |

$24 |

| Arizona |

200,000 |

$198 |

| Arkansas |

110,000 |

$101 |

| California |

1,082,000 |

$1,035 |

| Colorado |

* |

* |

| Connecticut |

* |

* |

| Delaware |

27,000 |

$28 |

| District of Columbia |

35,000 |

$35 |

| Florida |

750,000 |

$742 |

| Georgia |

383,000 |

$365 |

| Hawaii |

33,000 |

$33 |

| Idaho |

* |

* |

| Illinois |

312,000 |

$309 |

| Indiana |

162,000 |

$146 |

| Iowa |

* |

* |

| Kansas |

* |

* |

| Kentucky |

171,000 |

$162 |

| Louisiana |

233,000 |

$ 221 |

| Maine |

* |

* |

| Maryland |

* |

* |

| Massachusetts |

159,000 |

$158 |

| Michigan |

308,000 |

$293 |

| Minnesota |

* |

* |

| Mississippi |

145,000 |

$133 |

| Missouri |

143,000 |

$140 |

| Montana |

19,000 |

$18 |

| Nebraska |

* |

* |

| Nevada |

87,000 |

$83 |

| New Hampshire |

* |

* |

| New Jersey |

186,000 |

$182 |

| New Mexico |

105,000 |

$101 |

| New York |

625,000 |

$616 |

| North Carolina |

340,000 |

$324 |

| North Dakota |

16,000 |

$15 |

| Ohio |

394,000 |

$358 |

| Oklahoma |

130,000 |

$126 |

| Oregon |

118,000 |

$113 |

| Pennsylvania |

363,000 |

$337 |

| Rhode Island |

30,000 |

$31 |

| South Carolina |

213,000 |

$194 |

| South Dakota |

27,000 |

$24 |

| Tennessee |

215,000 |

$ 213 |

| Texas |

685,000 |

$624 |

| Utah |

* |

* |

| Vermont |

14,000 |

$13 |

| Virginia |

191,000 |

$177 |

| Washington |

185,000 |

$179 |

| West Virginia |

100,000 |

$94 |

| Wisconsin |

* |

* |

| Wyoming |

* |

* |

While the 9 million people receiving SNAP and/or Medicaid will be the easiest for states to reach, 3 million other people eligible for payments may be outside the reach of SNAP and Medicaid state agencies. More than half of them are non-elderly adults not raising children at home.[17] Though some may receive other state- or locally administered benefits or be connected to community-based organizations, overall this group tends to be less connected to services and can include people experiencing job or earnings loss, housing insecurity, or homelessness.

The CARES Act payments are a key pillar of the federal fiscal stimulus measures designed both to help families cope with the loss of jobs and income in the pandemic and to offset the strong downward pressure on the overall economy. The payments for the 12 million people at risk of missing out on them would be particularly effective in boosting economic activity because these individuals have very low incomes and tend to live close to the edge, spending (rather than saving) any additional money they receive. High-income people, in contrast, tend not to live paycheck to paycheck and save at relatively high levels.

Payments to very low-income people are among the most effective ways to stimulate the economy during a recession, a Congressional Budget Office (CBO) analysis issued during the Great Recession found.[18] CBO estimated that a tax cut for high-income people would yield 20 to 60 cents of economic activity (measured by gross domestic product) for every dollar of cost, because relatively few of those recipients would spend the money. By contrast, a tax cut for low- and moderate-income people would generate 60 cents to $1.50 of economic activity per dollar of tax cut. CBO also estimated that an added dollar of SNAP or unemployment insurance would generate 80 cents to $2.10 in economic activity; these types of stimulus are so effective because both groups tend to be highly cash-constrained. The 12 million eligible people discussed in this report are arguably even more cash-constrained, so delivering payments to this group would be extremely effective stimulus.

Governors and State SNAP, Medicaid Agencies Have Key Role

Governors and state agencies that administer SNAP and Medicaid can play a central role in raising awareness about the payments and connecting non-filers with assistance in getting them. Governors can direct agencies to use available resources to identify individuals eligible for the payments and provide support to help this vulnerable group apply. They also can use their leadership positions to educate the public and organize statewide outreach efforts; governors have led many past outreach efforts, such as campaigns to promote federal tax refunds, children’s health care coverage, and immunization campaigns. Governors can drive such efforts through their chief-executive authority, their convening power, and by leveraging their ability to drive significant earned and unearned media interest (that is, through traditional press stories and paid advertising). In states that administer SNAP and/or Medicaid at the county level, county leaders can play a similar role.

State agencies administering SNAP and Medicaid also can help identify people eligible for the payments and educate them about their eligibility and how to claim the funds. Though many of these agencies face overwhelming workloads now, incorporating this outreach into their regular activities would yield a high impact at relatively low cost. These agencies have daily contact with program participants by phone, in person, or in writing.

Many states have online portals where SNAP or Medicaid recipients can manage their benefits or report changes; 17 states have already posted to their websites basic information about the payments and how to apply (see Appendix III), and other states could as well.[19] For example, states can link to the IRS website and its online form for non-filers to complete in order to receive their payment. States also can provide educational and outreach materials to other government and nonprofit service providers. Some states provide application kiosks and staff to assist applicants in their office lobbies. While most state health and human services offices are currently closed, as they reopen they could provide access to the IRS Non-Filer form, as well.

Moreover, state agencies have contact information for program participants and have many opportunities for direct communication with those potentially eligible. They are in direct written contact through text, email, and regular mail regarding the participants’ SNAP or Medicaid benefits and could insert information about how to apply for the payments with those routine communications. (For example, in an email to 93,000 individuals in households participating in SNAP and TANF about the availability of free tax preparation services through VITA, Connecticut Governor Ned Lamont and the Department of Social Services included information about the EIP.) Agencies are also routinely in contact with some participants over the phone, particularly through their call centers. Some of the eligible group will have in-depth interactions with these agencies; for example, a large majority of families participating in state cash assistance programs will likely be in touch with their caseworker over the summer months to renew their benefits or address other issues. This type of interaction represents an excellent opportunity for the state to explain a family’s potential eligibility for the payment and help them apply.

Millions of other individuals contact states via phone or the internet every day. While waiting on hold at a call center or conducting business online, they could receive information about the payments and how non-filers can apply. Local human services offices generally inform their eligibility workers and call center staff about other community resources available to families, such as local food banks and other community-based resources, and states could include information about the payments in their materials for eligibility workers so they can provide accurate information.

To contact some non-filers who might not be connected to SNAP or Medicaid, such as very low-income adults without children and people who lack secure housing (including those who are homeless), state agencies can also ask their contracted service providers and other community partners to reach out. The combined efforts of state and community organizations can vastly increase the number of eligible people who actually receive their payments.

Governors and state agencies can also help potentially eligible non-filers connect with third-party organizations that can help them apply accurately and free of charge. Unscrupulous entities and individuals may try to scam individuals out of their payment; states can use their communication networks to help push against these fraudulent efforts and direct eligible individuals to trusted helpers and to correct information.

Community-Based Organizations and Local Officials Also Vital

Community-based organizations and local officials can also play a vital role in helping connect non-filers to economic impact payments. Both serve as essential outreach channels for the EITC and other public awareness campaigns. Community organizations such as community action agencies, faith-based organizations, and religious institutions are connected to many of the 3 million non-filers who don’t participate in SNAP or Medicaid, so they are key avenues for outreach. In addition, organizations providing critical services such as food banks and health care likely interact with harder-to-reach populations that state agencies and other outreach channels may miss. Some community-based organizations have staff who can help people complete the IRS Non-Filer form, which is especially valuable for people without internet access.

Local officials have established platforms they can use to share information about the payments and how to get them. Mayors and city, county, and town officials are attuned to the needs of their communities and are already working to address challenges that non-filers may face, including homelessness, language barriers, and lack of internet access. Local officials have connections with various entities that can disseminate information, such as school districts and utility companies. In addition to publicizing information about the payments, local officials can help inform people of local sources for help from community organizations.

To receive a payment this year, individuals not receiving a federally administrated benefit must provide their information to the IRS no later than October 15 if filing a tax return or by November 21 if using the simplified IRS online form for people who aren’t required to file a tax return, known as the “Non-Filer” tool.[20] The tool requires a user to create an online account, enter personal information (including direct deposit information, if available), verify their email address, and submit the form. Some individuals who do not typically file a return may find this process hard to complete without assistance even during normal times, and especially during a pandemic.

While the simplified form requires much less information than filing a full tax return, individuals must have internet access, an email address, a direct deposit account or an address to which the payment can be delivered, and facility with the online form and account. For individuals with little or no income, disabilities, or limited contact with public agencies, any of these elements may be challenging.

Normally, agencies could direct people to free taxpayer assistance services such as Volunteer Income Tax Assistance (VITA) sites for help. With most VITA sites closed due to COVID-19, some are offering online services to low-income taxpayers during the pandemic to help filers and non-filers navigate their IRS requirements. Since the IRS is not currently processing paper tax returns, all non-filers will have to submit their information electronically in order to receive their payment in a timely manner. Many non-filers will need help from agencies or these online tax assistance services to submit complete and accurate tax forms and avoid delays with their payment.

The most expedient way to receive a payment is through direct deposit to a bank account, a financial payment app (such as Venmo, PayPal, or Cash App), or a prepaid debit card. When individuals include their direct deposit information on their simplified form, the IRS typically delivers the payment within one to two weeks if no errors arise with the routing information. For individuals for whom the IRS does not receive direct deposit information the IRS will mail a paper check or, in some cases, a prepaid debit card.[21]

Many non-filers may need assistance establishing a bank account or an alternative account that can receive direct deposits. An estimated 14 percent of people with incomes below $40,000 are “unbanked” (meaning they lack a checking, savings, or money market account), and the share is likely even higher among non-filers who do not regularly receive federal benefit payments.[22] Bank accounts through certain institutions can be opened online. Several financial apps also address this gap and provide avenues for people to receive direct deposits to their account within the app.

Appendix Table 1 displays state-by-state estimates of the 12 million people eligible for payments based on nationally representative survey data. See Appendix II for more detail.

| APPENDIX TABLE 1 |

|---|

| Estimated Adults and Children Missed by Automatic Payments |

|---|

| |

Total individuals |

Potential total payments (in millions of dollars) |

|---|

| United States |

12,399,000 |

$12,000 |

| Alabama |

267,000 |

$264 |

| Alaska |

32,000 |

$31 |

| Arizona |

267,000 |

$274 |

| Arkansas |

143,000 |

$137 |

| California |

1,484,000 |

$1,499 |

| Colorado |

152,000 |

$160 |

| Connecticut |

108,000 |

$109 |

| Delaware |

34,000 |

$37 |

| District of Columbia |

46,000 |

$47 |

| Florida |

991,000 |

$1,017 |

| Georgia |

505,000 |

$506 |

| Hawaii |

50,000 |

$53 |

| Idaho |

42,000 |

$44 |

| Illinois |

392,000 |

$401 |

| Indiana |

214,000 |

$206 |

| Iowa |

64,000 |

$65 |

| Kansas |

100,000 |

$103 |

| Kentucky |

209,000 |

$206 |

| Louisiana |

303,000 |

$302 |

| Maine |

* |

* |

| Maryland |

147,000 |

$157 |

| Massachusetts |

223,000 |

$232 |

| Michigan |

369,000 |

$361 |

| Minnesota |

122,000 |

$127 |

| Mississippi |

185,000 |

$180 |

| Missouri |

197,000 |

$202 |

| Montana |

25,000 |

$25 |

| Nebraska |

* |

* |

| Nevada |

112,000 |

$112 |

| New Hampshire |

* |

* |

| New Jersey |

276,000 |

$287 |

| New Mexico |

124,000 |

$124 |

| New York |

814,000 |

$834 |

| North Carolina |

471,000 |

$474 |

| North Dakota |

24,000 |

$24 |

| Ohio |

489,000 |

$466 |

| Oklahoma |

165,000 |

$166 |

| Oregon |

158,000 |

$159 |

| Pennsylvania |

449,000 |

$438 |

| Rhode Island |

37,000 |

$39 |

| South Carolina |

273,000 |

$262 |

| South Dakota |

34,000 |

$32 |

| Tennessee |

280,000 |

$288 |

| Texas |

1,024,000 |

$1,010 |

| Utah |

57,000 |

$58 |

| Vermont |

17,000 |

$16 |

| Virginia |

321,000 |

$326 |

| Washington |

228,000 |

$228 |

| West Virginia |

115,000 |

$112 |

| Wisconsin |

140,000 |

$142 |

| Wyoming |

16,000 |

$16 |

Appendix Table 2 displays state-by-state estimates of the subgroup of the 9 million people eligible for payments who receive SNAP (whether or not they receive Medicaid) based on administrative data.

| APPENDIX TABLE 2 |

|---|

| |

Households |

Individuals |

Potential value of payments |

|---|

| |

Total |

Total |

Under 17 years |

In millions of dollars |

|---|

| United States |

3,270,000 |

6,534,000 |

3,024,000 |

$5,700 |

| Alabama |

45,500 |

99,600 |

47,700 |

$86 |

| Alaska |

7,900 |

17,700 |

7,700 |

$16 |

| Arizona |

68,500 |

133,000 |

56,300 |

$120 |

| Arkansas |

20,800 |

46,800 |

23,500 |

$40 |

| California |

543,600 |

1,095,100 |

548,900 |

$930 |

| Colorado |

35,200 |

78,700 |

42,200 |

$65 |

| Connecticut |

39,100 |

65,400 |

22,800 |

$63 |

| Delaware |

11,300 |

22,800 |

11,100 |

$20 |

| District of Columbia |

13,200 |

23,500 |

9,300 |

$22 |

| Florida |

245,800 |

437,400 |

184,000 |

$396 |

| Georgia |

151,800 |

330,400 |

158,500 |

$286 |

| Hawaii |

12,100 |

22,800 |

9,500 |

$21 |

| Idaho |

7,300 |

18,800 |

10,800 |

$15 |

| Illinois |

172,000 |

315,900 |

129,200 |

$289 |

| Indiana |

34,600 |

79,200 |

39,900 |

$67 |

| Iowa |

26,300 |

55,600 |

27,900 |

$47 |

| Kansas |

9,100 |

21,600 |

11,800 |

$18 |

| Kentucky |

49,700 |

95,900 |

36,400 |

$90 |

| Louisiana |

48,300 |

113,300 |

60,400 |

$94 |

| Maine |

6,900 |

14,900 |

6,900 |

$13 |

| Maryland |

67,300 |

121,800 |

50,000 |

$111 |

| Massachusetts |

56,100 |

108,200 |

48,200 |

$96 |

| Michigan |

93,500 |

159,100 |

53,100 |

$154 |

| Minnesota |

26,100 |

49,500 |

27,100 |

$40 |

| Mississippi |

41,600 |

88,800 |

40,800 |

$78 |

| Missouri |

38,400 |

86,300 |

45,700 |

$72 |

| Montana |

5,100 |

11,600 |

5,400 |

$10 |

| Nebraska |

9,600 |

20,900 |

11,000 |

$17 |

| Nevada |

38,300 |

69,700 |

28,400 |

$64 |

| New Hampshire |

4,400 |

9,900 |

4,900 |

$8 |

| New Jersey |

66,800 |

139,800 |

76,800 |

$114 |

| New Mexico |

27,000 |

56,800 |

25,200 |

$51 |

| New York |

188,600 |

351,200 |

152,500 |

$315 |

| North Carolina |

120,900 |

241,400 |

110,200 |

$213 |

| North Dakota |

3,400 |

8,400 |

4,400 |

$7 |

| Ohio |

92,900 |

179,800 |

78,100 |

$161 |

| Oklahoma |

31,100 |

74,000 |

38,200 |

$62 |

| Oregon |

50,600 |

92,700 |

34,400 |

$87 |

| Pennsylvania |

105,500 |

211,700 |

95,200 |

$187 |

| Rhode Island |

11,200 |

19,900 |

7,700 |

$18 |

| South Carolina |

58,500 |

134,200 |

68,900 |

$113 |

| South Dakota |

5,500 |

13,900 |

7,600 |

$11 |

| Tennessee |

80,700 |

161,400 |

70,100 |

$145 |

| Texas |

290,500 |

610,000 |

300,700 |

$521 |

| Utah |

13,900 |

33,200 |

18,600 |

$27 |

| Vermont |

2,500 |

5,100 |

2,300 |

$4 |

| Virginia |

53,000 |

126,000 |

65,700 |

$105 |

| Washington |

68,900 |

118,800 |

47,100 |

$110 |

| West Virginia |

25,100 |

50,800 |

20,600 |

$47 |

| Wisconsin |

34,800 |

67,800 |

28,500 |

$61 |

| Wyoming |

1,800 |

4,700 |

2,500 |

$4 |

Table 1 in this paper and Appendix Table 1 both rely on nationally representative survey data to estimate the number of individuals eligible for Economic Impact Payments while excluding those likely to receive those payments automatically because they filed federal income taxes[23] or participate in federal benefit programs (Social Security, Railroad Retirement, SSI, or veterans’ pensions or disability benefits). The estimates are approximate and are affected by underreporting of income and benefits, recent changes in program participation, and other data limitations.

Data reflect the population, economy, and program participation patterns of 2015 through 2017 and are from CBPP’s analysis of the Census Bureau’s Current Population Survey (CPS) Annual Social and Economic Supplement, adjusted to correct for underreporting of SNAP and SSI participation in the CPS using baseline data from the Transfer Income Model Version 3 (TRIM 3). TRIM 3 is developed and maintained by the Urban Institute with primary funding from the Department of Health and Human Services Office of the Assistant Secretary for Planning and Evaluation (HHS/ASPE). To improve the reliability of the state estimates, we average together three years of data (2015 through 2017), the most recent available from TRIM. We exclude immigrant families likely to be ineligible due to lacking a Social Security number.

Our SNAP results in Appendix Table 2 are from CBPP’s analysis of USDA SNAP household characteristics data for fiscal years 2016-2018. Because of data limitations (SNAP records do not include annual income or tax filing status), we limit the sample to those making less than the tax filing threshold on a monthly basis and exclude those who might qualify for the EITC or Child Tax Credit based on earnings, monthly income, age, and family composition; we also exclude family members of certain SNAP-ineligible immigrants who didn’t report a Social Security number. To err on the conservative side, the figures exclude families that receive SNAP for less than 12 months because such families are especially likely to have worked and earned more in the months before entering the program, and thus to have filed taxes for the year. The figures also (conservatively) exclude families where any family member received Social Security, SSI, or veterans’ pensions or disability benefits.

Federal Agency Information

National Organization Information:

State health and human service agency information (examples):