- Home

- Federal Budget

- House Funding Bill Imposes Further Cuts ...

House Funding Bill Imposes Further Cuts to Transportation Infrastructure

New cuts in Department of Transportation funding in the 2016 appropriations bill before the House would bring the total cut since 2010 to 30 percent, adjusted for inflation. The bill illustrates the serious problems caused by the 2011 Budget Control Act’s (BCA) tight funding caps subsequently lowered by sequestration — and thus highlights the need for sequestration relief.

The Transportation Department portion of the bill, which funds aviation, passenger rail, and some mass transit (along with various smaller activities), cuts funding for these programs by $0.7 billion below the 2015 level, with most of the reductions occurring in infrastructure investments to improve the safety and efficiency of transportation systems and promote economic growth. (Other parts of the Transportation Department, including almost all highway and most mass transit programs, are funded outside the appropriations process.) The bill also funds the Department of Housing and Urban Development (see box).

The Transportation Department programs funded through annual appropriations would be at their lowest in 14 years. These cuts to transportation programs are not a one-year phenomenon. Rather, 2016 will be the sixth year of austerity in domestic appropriations, and the cumulative effects on transportation infrastructure are dramatic. The Transportation Department programs funded through annual appropriations would be at their lowest in 14 years, adjusted for inflation.

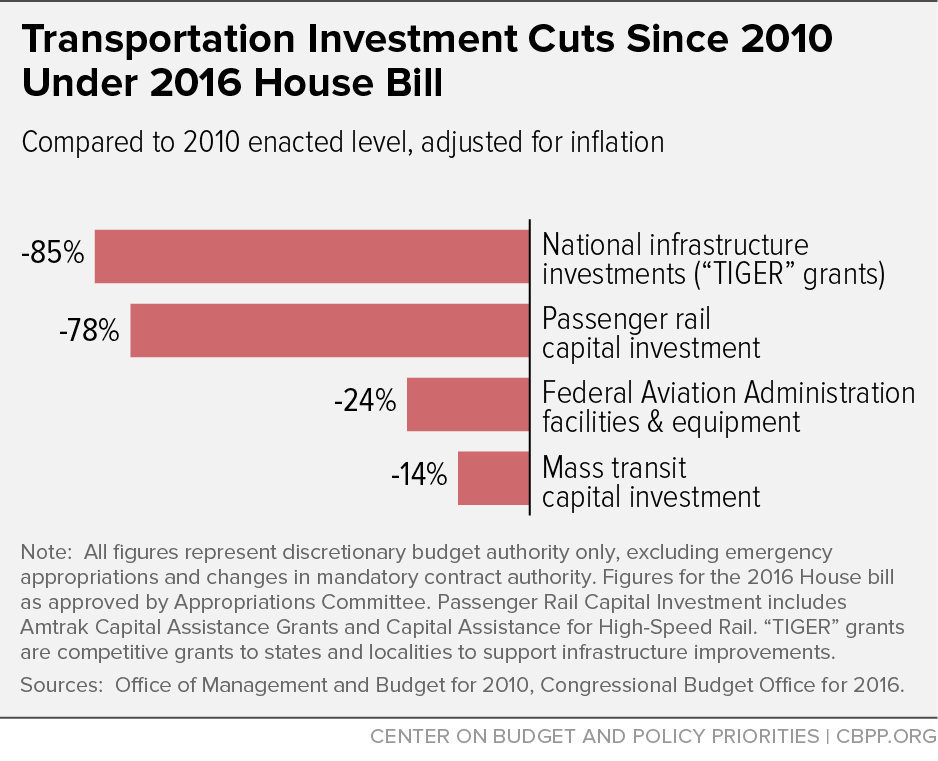

Like the bill’s new cuts, the cumulative cuts since 2010 fall most heavily on capital investment programs in areas such as “TIGER” grants to states and localities to support infrastructure improvements, Amtrak and other rail programs, air traffic control systems, and mass transit (see Figure 1). This focus on cutting investment programs seems inevitable, given policymakers’ understandable decisions to target scarce funding under the tight budget caps to preserving basic operating and safety functions.

For example, the Federal Aviation Administration (FAA) operations account, which covers air traffic control and aviation safety activities, has received increases since 2010, though not enough to keep up with inflation. But because of the size of the FAA operations account (roughly half of Transportation Department appropriations), the remaining programs have been severely squeezed in order to stay within the austere BCA caps — shrinking by 47 percent since 2010 under the House bill, adjusted for inflation. The bulk of these programs support infrastructure investment or research and development. In fact, the bill funds almost every Department of Transportation account related to infrastructure investment or research and development below the 2010 level even before adjusting for inflation.

The President’s budget proposes a sharply different path for transportation infrastructure. It calls for shifting the funding source for several of the surface transportation programs from annual appropriations to multi-year authorizing law in order to provide more stable and predictable funding for necessary investments. This is part of the President’s comprehensive “Grow America” surface transportation legislation, which also addresses shortfalls in highway and other transportation programs and provides substantial increases above current levels.

As long as the investment programs discussed in this paper remain funded through annual appropriations, however, the President’s proposal to eliminate the $37 billion sequestration cut to overall non-defense appropriations (by replacing it with alternate deficit reduction measures) will be crucial to avoiding further cuts to transportation infrastructure funding and to begin restoring some of the ground lost over the past several years.

House Bill Also Cuts Investments in Housing and Community Development

The appropriations caps and sequestration required by the Budget Control Act have also caused a sharp drop in investments at the other cabinet agency funded by the House bill, the Department of Housing and Urban Development (HUD). Total funding for HUD’s housing assistance and community development programs has declined by $6.1 billion or nearly 12 percent between 2010 and 2015, adjusted for inflation.

One place these cuts have been felt is in HUD’s largest rental assistance program, the Housing Choice Voucher program: 85,000 fewer families were using housing vouchers in December 2014 than two years earlier, due largely to sequestration.*

To its credit, the House Transportation-HUD appropriations bill for 2016 includes a modest funding increase for housing vouchers, yet the resources are unlikely to be sufficient to renew all vouchers in use this year, according to HUD, let alone reverse previous cuts.

The House bill also cuts several key HUD programs that preserve and expand the supply of low-income housing and community facilities — programs that have fared even worse than the voucher program in the tightly constrained budget environment. Under the bill:

- HOME Investment Partnership funding would be frozen at the 2015 level, the lowest level since the program began in 1992. But the bill achieves this freeze level only by relying on a transfer of $133 million from the National Housing Trust Fund to the HOME program that results in a net funding reduction for the development and rehabilitation of affordable rental housing for low-income families.

- Capital assistance to repair and rehabilitate public housing would be cut to a level that is 39 percent below the 2010 level, adjusted for inflation. Funding would cover only about half of the repair needs that are likely to accrue this year, and would make no dent in the roughly $26 billion backlog.

- The formula grant portion of the Community Development Block Grant would be one-third below the 2010 level, adjusted for inflation. These grants help states and localities meet needs for housing, economic development, and public facilities and services primarily benefitting low- and moderate-income people.

- Assisted housing for low-income elderly and disabled people would be less than half of the 2010 level, adjusted for inflation. As a result of prior cuts, these programs no longer support development of additional assisted housing, focusing instead on preserving existing housing.

- The Choice Neighborhoods program, which revitalizes distressed communities through the redevelopment of public and other assisted housing, would be one-tenth of the 2010 level for programs addressing this need.

* Douglas Rice, “House Bill Would Halt Progress on Housing Vouchers, Homelessness,” Center on Budget and Policy Priorities, May 4, 2015, https://www.cbpp.org/blog/house-bill-would-halt-progress-on-housing-vouchers-homelessness.

Cuts Affect Investments in Air Traffic Control, Rail, Mass Transit

The Appendix Table shows funding levels in the House bill as approved by committee for the major appropriated programs in the Transportation Department. Key transportation investment programs facing cuts under the House bill include:

FAA facilities and equipment. This account funds maintenance and upgrades of the FAA’s existing air traffic control and navigation infrastructure, along with construction of the “NextGen” system, which will use satellite-based technologies to improve the safety, capacity, and efficiency of traffic control. The House bill provides $2.5 billion for FAA facilities and equipment in 2016 — the lowest level in 16 years, even before adjusting for inflation, and 24 percent below the 2010 level after adjusting for inflation. The bill cuts FAA facilities and equipment by $100 million in 2016; the President’s budget, in contrast, raises it by $255 million.

According to the Administration, the House bill’s funding level would require the FAA to defer maintenance on current air traffic control systems and slow adoption of next-generation technology, potentially leading to worsening air traffic delays and higher replacement costs.

National infrastructure investments (“TIGER Grants”). The TIGER (Transportation Infrastructure Generating Economic Recovery) program makes competitive grants to states, localities, and other sponsors for highway, mass transit, rail, and port projects of regional or national significance. Competition for these grants has been intense throughout the program’s seven-year history; 72 projects were selected out of 797 applications in 2014, for example.

The House bill provides $100 million for TIGER grants in 2016, down from $500 million in 2015 and $600 million in 2010 — an inflation-adjusted cut of 85 percent since 2010.

Mass transit capital investment grants. The principal mass transit investment program funded through annual appropriations, this program provides competitive grants for construction or expansion of subway, light rail, commuter rail, and bus projects. The House bill’s funding level of $1.9 billion is $199 million below the 2015 level, for an inflation-adjusted cut of 14 percent since 2010.

Maintaining current service levels for the growing number of mass transit riders will require $7 billion a year in new investments, according to the Transportation Department.

Amtrak. The House bill provides $1.1 billion for Amtrak in 2016, $251 million below the 2015 level and 35 percent below the 2010 level, adjusted for inflation.

Appropriations for Amtrak primarily help meet capital and debt service costs, such as maintaining infrastructure, replacing aging equipment, and implementing safety upgrades such as Positive Train Control to prevent accidents. Amtrak’s maintenance backlog exceeds $9 billion for its Northeast Corridor infrastructure alone.

Other investments in passenger rail service. Beyond Amtrak, the House bill provides no funding for investments and safety improvements in passenger rail service. Congress provided $2.5 billion in 2010 to develop high-speed passenger rail service but nothing since then.

Conclusion

Policymakers have an alternative to continuing the harmful cuts in transportation infrastructure of recent years. They can provide sequestration relief to non-defense (and defense) programs — by replacing sequestration with alternative deficit reduction, as under the bipartisan 2013 deal negotiated by then-House Budget Committee Chair Paul Ryan and then-Senate Budget Committee Chair Patty Murray — and dedicate some of the freed-up funds to maintaining and improving the nation’s transportation networks.

| APPENDIX TABLE | |||||||

|---|---|---|---|---|---|---|---|

| Department of Transportation Appropriations ($ in billions) |

|||||||

| 2010 enacted | 2015 enacted | 2016 | Percent change adjusted for inflation | ||||

| current dollars | constant 2016 dollars | current dollars | constant 2016 dollars | House Bill | 2010 to 2016 | 2015 to 2016 | |

| Department of Transportation, Total | 21.8 | 24.4 | 17.9 | 18.3 | 17.2 | -30% | -6% |

| Nat'l Infrastructure Investments ("TIGER") | 0.6 | 0.7 | 0.5 | 0.5 | 0.1 | -85% | -80% |

| Federal Aviation Administration | 12.5 | 14.0 | 12.5 | 12.7 | 12.5 | -10% | -2% |

| Operations | 9.4 | 10.5 | 9.7 | 9.9 | 9.8 | -6% | -1% |

| Facilities & Equipment | 2.9 | 3.3 | 2.6 | 2.7 | 2.5 | -24% | -6% |

| Federal Highway Administration | 0.9 | 1.0 | 0.0 | 0.0 | 0.0 | -100% | n/a |

| Federal Railroad Administration | 4.4 | 4.9 | 1.6 | 1.7 | 1.4 | -72% | -18% |

| Amtrak Capital Assistance Grants | 1.0 | 1.1 | 1.1 | 1.2 | 0.9 | -24% | -27% |

| Amtrak Operating Grants | 0.6 | 0.6 | 0.3 | 0.3 | 0.3 | -54% | 13% |

| Capital Assistance for High-Speed Rail | 2.5 | 2.8 | 0.0 | 0.0 | 0.0 | -100% | n/a |

| Federal Transit Administration | 2.4 | 2.7 | 2.3 | 2.3 | 2.2 | -19% | -8% |

| Capital Investment Grants* | 2.0 | 2.2 | 2.1 | 2.2 | 1.9 | -14% | -11% |

| Other** | 1.0 | 1.1 | 1.0 | 1.0 | 1.1 | -7% | 2% |

* Excluding rescissions of unobligated balances.

** Office of the Secretary (excluding the TIGER program), National Highway Traffic Safety Administration, Saint Lawrence Seaway Development Corporation, Pipeline and Hazardous Materials Safety Administration, Office of Inspector General, Maritime Administration, and Surface Transportation Board

Note: All figures given represent discretionary budget authority only, excluding emergency appropriations and excluding increases or reductions in mandatory contract authority. Figures for the 2016 House bill represent the measure as approved by committee.

Sources: Office of Management and Budget for 2010, Congressional Budget Office for 2015 and 2016 House bill.

More from the Authors