- Home

- Fact Sheet: Corporate Tax Revenues At Hi...

Fact Sheet: Corporate Tax Revenues At Historic Lows Even Before Proposed Costly New Tax Breaks

A new Center report, The Decline of Corporate Income Tax Revenues, provides context for the debate over corporate tax-cut legislation now before Congress.

It shows that corporate tax revenues have fallen to historically low levels as a share of total federal revenues and of the economy. Despite the weakening of corporate tax revenues, and despite the fact that the Congressional Budget Office and other organizations*now project very large federal budget deficits over the coming decade and beyond, Congress appears poised to shower costly new tax breaks on corporations.

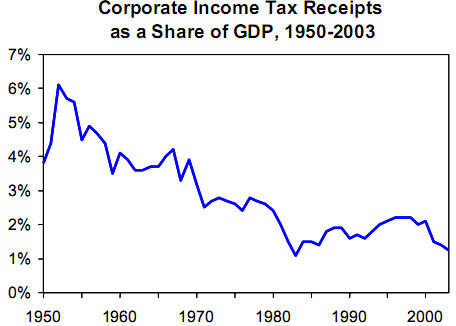

- Corporate tax revenues are at historically low levels and are projected to remain low for the coming decade. Preliminary CBO estimates show that in 2003, corporate income tax revenues were smaller, both as a share of the Gross Domestic Product and as a share of all federal tax receipts, than in any year since the 1930s except for 1983. Total corporate tax revenues fell by more than one-third between 2000 and 2003.

The recent economic slowdown has played a substantial role in the collapse of corporate tax revenues. But tax cuts enacted over the past few years have contributed significantly as well.

Moreover, CBO projects that corporate tax revenues will remain at historically low levels throughout the coming decade, even after the economy has fully recovered and even if the corporate tax cuts enacted in 2002 and 2003 expire as scheduled, which seems unlikely.

- Expanded use of tax shelters reduces corporate tax revenues further. Beyond a weak economy and new tax breaks, a third reason for the decline in corporate tax revenues is corporations’ increasingly aggressive use of tax avoidance strategies, including the sheltering of corporate profits overseas. While no precise estimate exists of the amount of income that corporations shelter from income tax, former IRS Commissioner Charles Rossotti identified abusive corporate tax shelters as “one of the most serious and current compliance problem areas.” Indeed, internal IRS studies on tax sheltering, recently disclosed by the General Accounting Office, indicate that “tens of billions of dollars of taxes are being improperly avoided.” A study by the Institute on Taxation and Economic Policy of 250 large corporations, which together pay about 30 percent of all corporate income taxes, found that one in six paid no corporate income tax whatsoever in at least one of the three years examined (1996-1998).

- The corporate tax rate has declined in recent decades. During the 1990s, non-financial corporations as a group paid an average of 25.3 percent of their profits in federal corporate income taxes, according to new Congressional Research Service estimates. By contrast, they paid more than 49 percent in the 1950s, 38 percent in the 1960s, and 33 percent in the 1970s. This decline reflects reductions in the statutory tax rate as well as corporations’ expanded use of deductions and other tax benefits.

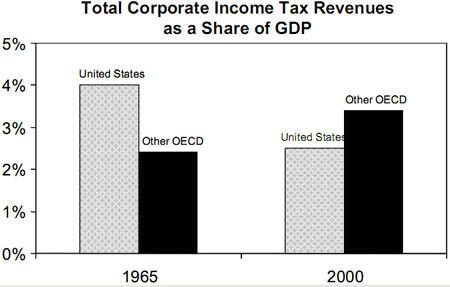

- U.S. corporations pay lower taxes than most foreign competitors. Some argue that the U.S. tax system imposes a greater burden on U.S. companies than foreign governments place on their companies. But data from the Organization for Economic Cooperation and Development for 2000 show that nearly three-quarters of the 29 OECD countries collect more in corporate revenues relative to the size of their economies than the United States.

Furthermore, as the graph at right shows, the corporate tax burden in other OECD countries has increased in recent decades, while in the United States it has declined.

- Proposed new corporate tax breaks would worsen the deficit substantially over time. Pressure to cut corporate taxes is likely to intensify this fall as Congress acts to comply with a recent World Trade Organization ruling that tax subsidies for U.S. exporters violate trade agreements. Repealing these export subsidies would raise about $50 billion in revenues over 10 years. Supporters of corporate tax cuts are using this as an opportunity to push for new corporate tax breaks that go far beyond those being repealed.

Indeed, both the measure introduced by House Ways and Means Chairman Thomas (H.R. 2896) and the measure adopted by the Senate Finance Committee on October 1 (S. 1637) include significantly more than $50 billion in new corporate tax cuts. Both bills use timing gimmicks to hide their true cost. The House bill includes a number of tax cuts that artificially expire before the end of the ten-year period; these tax cuts would very likely be extended, making the bill much more costly. The Senate bill contains several tax cuts that do not become fully effective until late in the decade; thus it is deficit-neutral over the first ten years but will cost billions of dollars annually once the tax cuts are in effect.

End Notes

* A joint analysis by the Center on Budget and Policy Priorities, the Concord Coalition, and the Committee for Economic Development projects deficits totaling $5 trillion through 2013; Goldman Sachs estimates deficits totaling $5.5 trillion over this period.