Congressional Impasse Jeopardizes January Jobless Benefits for Nearly Two Million Workers

End Notes

[1] National Employment Law Project, "Holiday Message from House of Representatives to Long-Term Unemployed: 'Tis Better to Abandon You Than To Compromise," December 21, 2011, http://www.nelp.org/page/-/UI/2011/nelp-uilapse-brief-dec21.pdf?nocdn=1.

[2] Douglas Elmendorf, "Policies for Increasing Economic Growth and Employment in 2012 and 2013," testimony before the Senate Budget Committee, Congressional Budget Office, November 15, 2011, http://www.cbo.gov/ftpdocs/124xx/doc12437/11-15-Outlook_Stimulus_Testimony.pdf.

[3] For a more thorough discussion of the unemployment insurance system, please see Hannah Shaw and Chad Stone, "Introduction to Unemployment Insurance," Center on Budget and Policy Priorities, April 16, 2010, https://www.cbpp.org/sites/default/files/atoms/files/12-19-02ui.pdf.

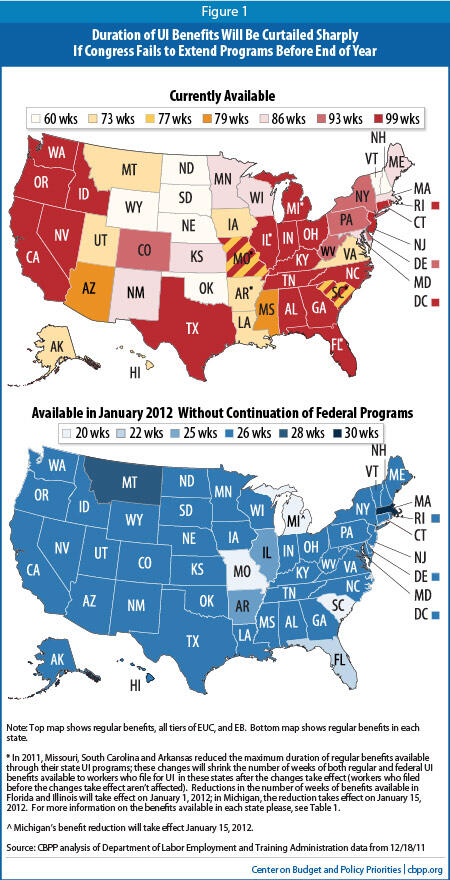

[4] Fewer weeks of federal benefits are available in states with reduced regular benefits.

[5] See "Policy Basics: How Many Weeks of Unemployment Compensation Are Available" (updated weekly) for further information on the maximum duration of UI by state: https://www.cbpp.org/sites/default/files/atoms/files/PolicyBasics_UI_Weeks.pdf

[6] Technically, it is scheduled to expire "the week ending on or before January 3, 2012." This means January 1, 2012 in New York state (because of how state law defines benefit weeks), but December 31, 2011 everywhere else.

[7] Many states have temporarily changed their EB laws to take advantage of the full federal funding by adopting an optional unemployment rate trigger that allows them to provide EB, but they have written their laws so that the optional trigger is no longer in effect once full federal funding ends.

[8] According to permanent law, EB is "on" in states that have adopted the optional unemployment rate triggers if the state unemployment rate rises above certain unemployment rate thresholds and if the state unemployment rate is at least 10 percent higher than it was at a comparable time in one or both of the past two years. This "lookback" provision did not anticipate a recession in which large numbers of states would experience as protracted a period of very high unemployment as in the current downturn. As a result, when full-federal funding for the program was re-authorized at the end of 2010, Congress accorded states the option of adopting a three-year "lookback," which many did. If the three-year lookback is not continued, EB will "trigger off" in every state.

[9] While most states offer up to 26 weeks of regular UI benefits, the maximum is 28 in Montana, 30 in Massachusetts, 25 in Arkansas, and 20 in Missouri and South Carolina. Three states will reduce the maximum number of weeks of regular UI benefits in January 2012: Michigan (to 20 on January 15th), Illinois (to 25 on January 1st), and Florida (to 22 on January 1st with further reductions down to as few as 12 weeks if the state's unemployment rate falls below 5 percent).

[10] Unpublished estimates from the National Employment Law Project (update of National Employment Law Project, "Hanging On By a Thread," October 11, 2011, http://www.nelp.org/page/-/UI/2011/NELP_UI_Extension_Report_2011.pdf?nocdn=1).

[11] Executive Office of the President, "Unemployment Insurance Extensions and Reforms in the American Jobs Act," December 2011, http://www.whitehouse.gov/sites/default/files/ui_report_final_121511.pdf.