Statement: Chad Stone, Chief Economist, on the November Employment Report

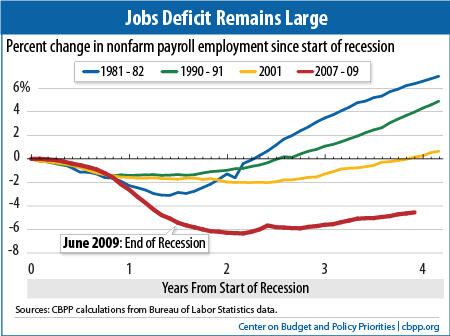

Today's employment report shows continued moderate growth in private payroll employment but a further decline in government jobs. Thus, the overall jobs deficit remains large (see chart) and jobs remain hard to find. The drop in the unemployment rate to 8.6 percent arises from people leaving the labor force, not from a fundamental improvement in job prospects.

Because the situation calls for aggressive federal action to boost the economy, Congress must renew the emergency unemployment insurance benefits and payroll tax cut that are set to expire at the end of this year.

Although the economy has grown for nine straight quarters and private employers have added jobs for 21 straight months, the pace of economic growth and job creation has been modest compared with the pace that's needed to restore full employment.

Policies like those proposed in the President's American Jobs Act would boost economic growth and employment significantly in 2012 and 2013, according to the Congressional Budget Office (CBO). Indeed, the policy scoring highest in terms of bang-for-the buck in CBO's ranking of a range of policies is unemployment insurance. Letting federal emergency unemployment benefits expire at the end of this year would not only be cruel to unemployed workers and their families, but would also weaken the recovery by reducing their capacity to buy goods and services in an economy that is already suffering from weak aggregate demand.

Congress is legitimately concerned with the long-term budget deficit, but policymakers should not let that concern eclipse efforts to address the immediate problem of a huge jobs deficit. Both Federal Reserve Chairman Ben Bernanke and CBO Director Douglas Elmendorf have testified that there is no contradiction between implementing policies to boost economic growth now and implementing policies to impose fiscal restraint that take effect several years from now, when the economy is stronger.

About the November Jobs Report

Job growth was modest in November, and the labor market remains in a deep slump.

- Private and government payrolls combined rose by 120,000 jobs in November. Private employers added 140,000 jobs. The decline of 20,000 government jobs reflected a loss of 4,000 federal jobs, 5,000 state government jobs, and 11,000 local government jobs.

- This is the 21st straight month of private-sector job creation, with payrolls growing by 2.9 million jobs (a pace of 140,000 jobs a month) since February 2010; total nonfarm employment (private plus government jobs) has grown by 2.5 million jobs over the same period, or 117,000 a month. Growth of 200,000 to 300,000 jobs or more a month is typical in strong economic recoveries, so the modest pace of just 114,000 jobs per month over the last six months is deeply disappointing.

- In November, despite 21 months of private-sector job growth, there were still 6.3 million fewer jobs on nonfarm payrolls than when the recession began in December 2007 and 5.9 million fewer jobs on private payrolls.

- The unemployment rate dropped to 8.6 percent in November, and the number of unemployed Americans was 13.3 million. The unemployment rate was 7.6 percent for whites (3.2 percentage points higher than at the start of the recession), 15.5 percent for African Americans (6.5 percentage points higher than at the start of the recession), and 11.4 percent for Hispanics or Latinos (5.1 percentage points higher than at the start of the recession).

- The recession and lack of job opportunities drove many people out of the labor force, and we have yet to see a sustained return to labor force participation (people aged 16 and over working or actively looking for work) that would mark a strong jobs recovery. Rather than being good news, the drop in the unemployment rate in November is symptomatic of this problem. The labor force shrank by 315,000 people in November, accounting for a substantial share of the decline in the number of unemployed. The labor force participation rate fell to 64.0 percent in November, a half point lower than it was a year ago when the unemployment rate was 9.8 percent, and remains at levels last seen in 1984.

- The share of the population with a job, which plummeted in the recession from 62.7 percent in December 2007 to levels last seen in the mid-1980s, was 58.5 percent in November and has not been above that level for the last year and a half.

- It remains very difficult to find a job. The Labor Department's most comprehensive alternative unemployment rate measure — which includes people who want to work but are discouraged from looking and people working part time because they can't find full-time jobs — was 15.6 percent in November, down only modestly from its all-time high of 17.4 percent in October 2009 in data that go back to 1994. By that measure, over 24 million people are unemployed or underemployed.

- As discussed above, long-term unemployment remains a significant concern. Over two-fifths (43.0 percent) of the 13.3 million people who are unemployed — 5.7 million people — have been looking for work for 27 weeks or longer. These long-term unemployed represent 3.7 percent of the labor force. Prior to this recession, the previous highs for these statistics over the past six decades were 26.0 percent and 2.6 percent, respectively, in June 1983.

The Center on Budget and Policy Priorities is a nonprofit, nonpartisan research organization and policy institute that conducts research and analysis on a range of government policies and programs. It is supported primarily by foundation grants.