Statement: Chad Stone, Chief Economist, on the March Employment Report

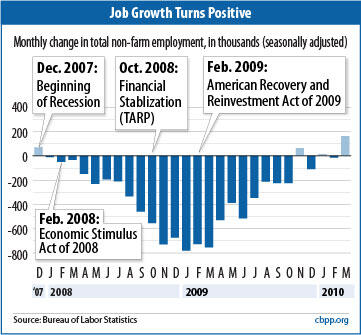

Today’s jobs report provides further evidence that the labor market has stabilized after experiencing its most severe jobs decline since the 1930s. Job losses slowed dramatically after President Obama and Congress enacted the American Recovery and Reinvestment Act in February 2009, and the growth in payroll employment in March 2010 is welcome news (see chart). Indeed, employers have added 117,000 jobs over the past five months, the report shows, which stands in marked contrast to the 3.7 million job loss over the same period a year earlier.

Before breaking out the champagne, however, we should understand that special factors, including temporary hiring for the 2010 census, were important contributors to the March gains. Moreover, we need much stronger job growth than we have yet seen over a sustained period to reduce the unemployment rate and erase the huge jobs deficit that remains the legacy of the longest and deepest recession since the Great Depression.

That is why it is so disappointing that Congress has allowed the Recovery Act measures providing extra weeks of unemployment insurance (UI) and subsidized COBRA health insurance coverage for unemployed workers to lapse and has failed to pass a meaningful jobs bill that would provide a needed boost to the nascent economic recovery. Extending the Recovery Act’s UI and COBRA provisions to the end of the year and providing additional fiscal assistance to cash-strapped states — two critical provisions in the pending congressional jobs bills — are widely recognized as highly effective ways to boost economic activity and create jobs. Congress should act quickly to pass legislation that includes those measures. They will help workers struggling to find a job and in danger of losing their UI benefits, and they will help the economy.

About the March Jobs Report

- Private and government payrolls rose by 162,000 jobs in March, with 48,000 of those jobs coming from temporary government hiring for the decennial census. Private-sector payrolls rose by 123,000 jobs. Some of the March job growth may also reflect a rebound from the temporary effects of severe winter weather in suppressing job growth in February. Despite the gains in March, net job losses since the recession began in December 2007 total 8.2 million. (Private-sector payrolls have shrunk by 8.3 million jobs over the period.)

- Revisions to the data show that the economy added rather than lost jobs in January and that February’s job losses were smaller than previously reported. Over the past five months, employers have added a net 117,000 jobs to their payrolls, compared with a loss of 3.7 million jobs over the same period a year earlier.

- For the third straight month, the unemployment rate remained at 9.7 percent, 4.7 percentage points higher than at the start of the recession.

- For the third straight month, more people entered the labor force than left it; the labor force participation rate (the percentage of people with a job or actively looking for a job) edged up to 64.9 percent in March. The combination of an increase in labor force participation and a steady unemployment rate resulted in a slight rise in the percentage of the population with a job, from 58.5 percent to 58.6 percent. Nevertheless, both the labor force participation rate and the percentage of the population with a job remain near lows that were last seen in 1986 and 1983, respectively.

- The Labor Department’s most comprehensive alternative unemployment rate measure — which includes people who want to work but are discouraged from looking and people working part time because they can’t find full-time jobs — edged up to 16.9 percent in March. While that figure is below the peak of 17.4 percent reached in October 2009, it is still quite high.

- Long-term unemployment remains a significant concern. Over two-fifths (44.1 percent) of the 15.0 million people who are unemployed have been looking for work for 27 weeks or longer. These long-term unemployed represent 4.3 percent of the labor force, a higher percentage than at any point in the past six decades (the next highest was 2.6 percent in June 1983).

The Center on Budget and Policy Priorities is a nonprofit, nonpartisan research organization and policy institute that conducts research and analysis on a range of government policies and programs. It is supported primarily by foundation grants.