Statement: Chad Stone, Chief Economist, on the July Employment Report

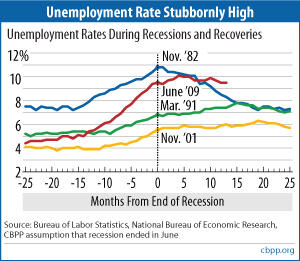

Today’s jobs report shows a labor market that is still not generating enough jobs to lower the unemployment rate. Unless job creation picks up dramatically, unemployment will likely remain elevated for some time to come, as it did in the previous two recessions, though at much higher rates this time (see chart).

Creating fewer than 100,000-more private sector jobs a month, the labor market is barely treading water. The economy would have to create over 300,000 jobs a month for two years just to restore employment to where it was at the start of the recession, and more than that to restore full employment with a growing population.

Congressional opponents of stimulus measures that could create more jobs have held sway for most of this year. Yesterday was an exception, however, as the Senate approved measures giving states $26 billion to preserve jobs and fill part of their gaping budget shortfalls. And last month, the Senate finally overcame opposition to continuing to provide additional weeks of unemployment insurance (UI) benefits to unemployed workers—though Congress only extended the benefits through November, failed to renew subsidized COBRA health insurance benefits, and eliminated the extra $25 a week of UI benefits provided in last year’s Recovery Act

The House should quickly approve the state fiscal relief measures that the Senate passed yesterday. They are temporary, well-targeted, and effective job-creating stimulus measures, and they are offset by deficit-cutting measures that will take effect in

About the July Jobs Report

The labor market remains in a deep slump with weak — but at least positive — underlying private sector job growth, many more people looking for work than there are new jobs being created, and a disturbingly high unemployment rate.

- Private and government payrolls combined fell by 131,000 jobs in July. Private payrolls rose by 71,000 jobs, while government payrolls fell by 202,000. Government reductions were dominated by the scheduled elimination of 143,000 temporary jobs associated with the decennial census, but state and local payrolls also shrank by 10,000 and 38,000 jobs, respectively (non-Census federal employment fell by 11,000 jobs). There are 7.7 million fewer jobs on nonfarm payrolls than there were when the recession began in December 2007 and 7.8 million fewer jobs on private payrolls.

- So far this year, private sector job creation has averaged 90,000 jobs per month.

- The unemployment rate remained at 9.5 percent in July, and the number of unemployed remained 14.6 million as 181,000 people left the labor force.

- The labor force participation rate (the percentage of people with a job or actively looking for a job) has now declined for three straight months and is back to where it was at the end of 2009—and 1.4 percentage points lower than it was at the start of the recession.

- The number of people with a job (which is estimated from a different survey from the one used to estimate payroll employment) fell in July. As a result, the percentage of the population with a job declined for the third straight month, to 58.4 percent. Both the labor force participation rate and the percentage of the population with a job remain near lows that were last seen in the 1980s.

- The Labor Department’s most comprehensive alternative unemployment rate measure — which includes people who want to work but are discouraged from looking and people working part time because they can’t find full-time jobs — remained at 16.5 percent in July. While that figure is below the peak of 17.4 percent reached in October 2009, it is still very high.

- Long-term unemployment remains a significant concern. Over two-fifths (44.9 percent) of the 14.6 million people who are unemployed — 6.6 million people — have been looking for work for 27 weeks or longer. These long-term unemployed represent 4.3 percent of the labor force. Prior to this recession, the previous highs for these statistics over the past six decades were 26.0 percent and 2.6 percent, respectively, in June 1983.

The Center on Budget and Policy Priorities is a nonprofit, nonpartisan research organization and policy institute that conducts research and analysis on a range of government policies and programs. It is supported primarily by foundation grants.

End Notes

End Note:

[1] See Chuck Marr and Gillian Brunet, “Extension of High-Income Tax Cuts Would Benefit Few Small Businesses; Jobs Tax Credit Would Be Better,” Center on Budget and Policy Priorities, August 3, 2010.