Statement: Chad Stone, Chief Economist, on the April Employment Report

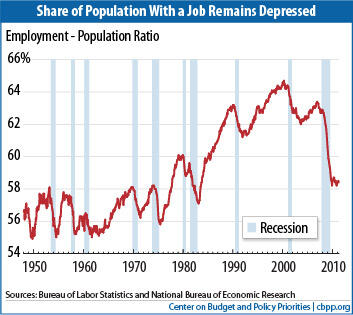

Today’s employment report provides mixed signals on the jobs market. The survey of employers shows they added jobs at a solid pace in April. Yet the jobs deficit from the recession remains very large and, even more discouraging, the survey of households shows that unemployment is still high, with too many people remaining on the sidelines rather than returning to the labor force believing they can find work. As a result, the percentage of the population with a job remains depressed (see chart).

We already have enough barriers to quickly erasing the jobs deficit and reducing unemployment; we don’t need the economic uncertainty that’s created when lawmakers threaten to delay a necessary increase in the debt limit in order to extract further immediate budget cuts, and we certainly don’t need the drag on the economic recovery that those budget cuts would produce. To be sure, the problem of long-term deficits is a serious one that policymakers should address as soon as possible. But, rather than making immediate spending cuts that would threaten the recovery, they should enact comprehensive legislation this year that addresses the deficit in a balanced way — but that begins to take effect once the economy is stronger.

We need faster economic growth than we have seen so far to create jobs not only for those who are now unemployed but also for those who would like to work but have stopped looking because jobs are scarce, those looking for their first job, and those returning to the labor force after taking time out for school or family responsibilities. A recovery that strong will remain elusive as long as businesses have substantial excess productive capacity and their sales are growing only modestly. Yet the Federal Reserve is showing no inclination to step up its efforts to stimulate the economy, even though it has just revised down its already relatively modest projections of economic growth for this year.

Meanwhile, all too many policymakers want to take fiscal policy in the opposite direction from what is needed to give the economic recovery a boost. Brinksmanship over the debt limit is bad enough because it creates unnecessary uncertainty. The policies demanded by those who don’t want to raise the debt limit would be even worse because the immediate cuts in government spending they seek would drain purchasing power from an economy that needs all the demand it can get right now. In contrast, following sound principles for long-term deficit reduction can reduce the budget deficit without making the jobs deficit worse.[1]

About the April Jobs Report

Job growth was solid in April, but other indicators show that the labor market remains in a deep slump.

- Private and government payrolls rose by 244,000 jobs in April. Private employers on net added 268,000 jobs, while local government employment fell by 14,000, state government employment fell by 8,000, and federal government employment fell by 2,000.

- This is the 14th straight month of private-sector job creation, with payrolls growing by 2.1 million jobs (a pace of 149,000 jobs a month) since February 2010; total nonfarm employment (private plus government jobs) has grown by 1.8 million jobs over the same period, or 127,000 a month. Growth of 200,000 to 300,000 jobs a month or more is typical in strong economic recoveries; in the past three months, total nonfarm job growth has averaged 233,000 a month — still near the bottom of that range.

- In April, despite 14 months of private-sector job growth, there were still 7.0 million fewer jobs on nonfarm payrolls than when the recession began in December 2007, and 6.7 million fewer jobs on private payrolls.

- The unemployment rate moved up from 8.8 percent to 9.0 percent in April, and the number of unemployed rose to 13.7 million. The unemployment rate was 8.0 percent for whites (3.6 percentage points higher than at the start of the recession), 16.1 percent for African Americans (7.1 percentage points higher than at the start of the recession), and 11.8 percent for Hispanics or Latinos (5.5 percentage points higher than at the start of the recession).

- The recession and lack of job opportunities drove many people out of the labor force, and we have yet to see the return to labor force participation (working or actively looking for work) that marks a strong jobs recovery. The labor force participation rate (the share of the population aged 16 and over working or looking for work) remained depressed at 64.2 percent for the fourth straight month, the lowest it has been since 1984. The size of the labor force hardly changed at all in April, but the household survey showed that the number of unemployed rose by 205,000 as the number of those with a job fell by almost the same amount (190,000).

- As shown in the chart above, the share of the population with a job, which plummeted in the recession to levels last seen in the mid-1980s, edged down to 58.4 percent in April. Prior to the current slump, the last time it was lower was August 1983.

- It remains very difficult to find a job. The Labor Department’s most comprehensive alternative unemployment rate measure — which includes people who want to work but are discouraged from looking and people working part time because they can’t find full-time jobs — edged up to 15.9 percent in April, not much below its all-time high of 17.4 percent in October 2009 in data that go back to 1994. By that measure, almost 25 million people are unemployed or underemployed.

- Long-term unemployment remains a significant concern. Over two-fifths (43.4 percent) of the 13.7 million people who are unemployed — 5.8 million people — have been looking for work for 27 weeks or longer. These long-term unemployed represent 3.8 percent of the labor force. Prior to this recession, the previous highs for these statistics over the past six decades were 26.0 percent and 2.6 percent, respectively, in June 1983.

The Center on Budget and Policy Priorities is a nonprofit, nonpartisan research organization and policy institute that conducts research and analysis on a range of government policies and programs. It is supported primarily by foundation grants.

End Notes

End Note:

[1] See Robert Greenstein, “A Framework for Deficit Reduction: Principles and Cautions,” Center on Budget and Policy Priorities, March 24, 2011.