Press Release: Several States Considering Closing Major Corporate Tax Loopholes

Governors in six states have recommended that their state adopt a key reform to outlaw a variety of abusive income-tax-avoidance strategies practiced by corporations such as Wal-Mart, a new Center on Budget and Policy Priorities report explains.

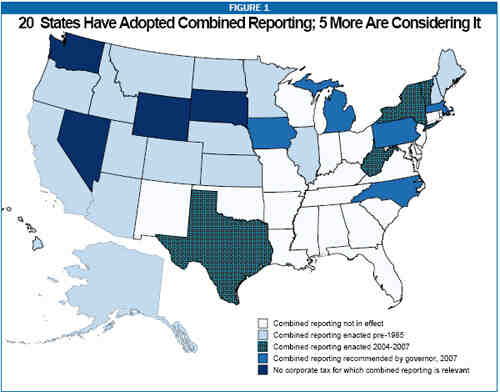

Eighteen states had already adopted the reform, known as “combined reporting,” as of the start of 2007. In recent weeks, the governors of Iowa, Massachusetts, Michigan, New York, North Carolina, and Pennsylvania all proposed the reform as part of their new budgets. New York’s legislature approved the proposal on April 1. On March 10 West Virginia’s legislature enacted a combined reporting bill that was not initiated by the governor, but which he is expected to sign.

“Six governors decided this year, independently of one another, that it’s time to make their corporate tax systems fairer and stronger by adopting this reform,” said Michael Mazerov, a senior fellow at the Center and the report’s author. “Tax experts have long urged states to take this step, and this year a growing number of states are listening.”

Reform Prevents Corporations from Hiding Profits in “Tax Haven” Subsidiaries

To avoid state corporate income taxes, a number of large, multistate corporations have devised strategies to move profits out of the states in which they are earned and into states in which they will be taxed at lower rates — or not at all. They do this by creating subsidiaries largely or solely as tax shelters in “tax haven” states like Delaware and then artificially shifting funds to them in the form of royalties or rent.

For example, Wal-Mart has transferred ownership of all of its stores to a Wal-Mart subsidiary. In most states, this enables Wal-Mart to deduct the “rent” it pays the subsidiary (i.e., the rent it pays itself) from the income that is subject to state corporate taxes. The subsidiary receiving the rent isn’t taxed because it qualifies as a tax-exempt “Real Estate Investment Trust” under federal and state law.

Strategies like these cost states billions of dollars in revenue, forcing individuals and small businesses — which lack the resources to exploit the loophole — to pay higher taxes than would otherwise be necessary. They also give multistate corporations an unfair tax advantage over in-state corporations and smaller businesses.

Combined reporting creates a level playing field for all businesses by treating a parent corporation and most of its subsidiaries as a single corporation for income tax purposes; the state taxes a share of the entities’ combined nationwide income. (The precise share depends in part on how much of the corporation’s total activity takes place in that state.)

Growing State Interest in Combined Reporting

Sixteen states have mandated and successfully used combined reporting for decades, as the map above shows. Until recently, however, that group had not expanded at all — not even after the U.S. Supreme Court ruled in 1983 that combined reporting was both fair and constitutional.

That changed in 2004-05, when Vermont became the first state in more than 20 years to adopt combined reporting and Texas included combined reporting in a new business tax it enacted. West Virginia and New York have adopted the reform in just the past few weeks. And Governor Michael Easley of North Carolina, Governor Chet Culver of Iowa, Governor Jennifer Granholm of Michigan, Governor Deval Patrick of Massachusetts, and Governor Edward Rendell of Pennsylvania have all recommended combined reporting as part of their current tax and budget packages.

“Combined reporting can bring in revenue to help a state finance essential public services like education and health care,” said Mazerov. “Closing major corporate tax loopholes through combined reporting will make a state’s tax system fairer to state residents and businesses, as well as stronger over the long term.”

The Center on Budget and Policy Priorities is a nonprofit, nonpartisan research organization and policy institute that conducts research and analysis on a range of government policies and programs. It is supported primarily by foundation grants.