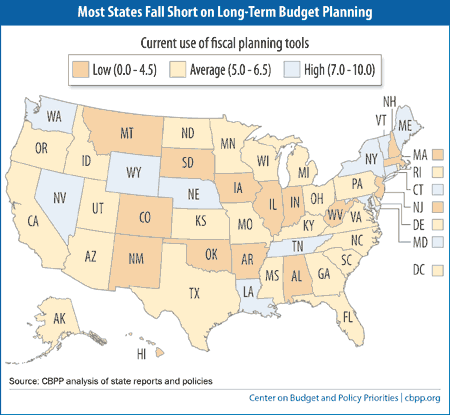

Most States Fall Short on Long-Term Budget Planning

Almost every state should adopt a much more rigorous approach to their long-term budget planning, according to a new report from the Center on Budget and Policy Priorities. The report ranks the states on the degree to which they use ten proven tools to help states chart their fiscal course accurately and make mid-course corrections when needed.

The report’s findings cut across regional and partisan divides: Connecticut, Maryland, and Tennessee incorporate most of the ten tools into their budget process, for example, while New Jersey, Oklahoma, and South Dakota incorporate the fewest (see map).

The recent fiscal crisis challenged states’ capacity to fund public services such as education and health care, the report explains. State budgets have yet to fully recover from the worst recession in seven decades. States also must deal with longer-term issues such as the aging of the population and rising health care costs.

“State-funded services like education and infrastructure are essential to the nation’s economy, and a state’s budget decisions today will affect us all for many years to come,” explained Nicholas Johnson, Vice President for State Fiscal Policy and a report co-author. “So each year’s decisions should be informed by the best available information about the state’s changing needs and circumstances, such as how much tax revenue the state will generate and how much it will cost to provide those services.”

“Laying out a clear roadmap of the budget’s implications can help build a stronger state economy in both the short and long run,” he added.

The ten tools in the report fall into three broad categories:

- A map for the future: the budget and accompanying documents should include a detailed roadmap of the budget’s immediate and future impacts on the state’s fiscal health.

- Professional and credible estimates: standards and sufficient oversight are needed to guarantee that these analyses of the budget’s impacts are professional, credible, and prepared without political influence.

- Ways to stay on course: mechanisms should be in place to trigger any needed changes during the budget year, before too much damage is done.

“Every state does these things to some extent, but no state does them nearly as well as it could,” McNichol noted.

The report, “Budgeting for the Future: Fiscal Planning Tools Can Show the Way,” is available at https://www.cbpp.org/cms/index.cfm?fa=view&id=4085.

The Center on Budget and Policy Priorities is a nonprofit, nonpartisan research organization and policy institute that conducts research and analysis on a range of government policies and programs. It is supported primarily by foundation grants.