- Home

- Poverty And Inequality

- Commentary: Under Current Poverty Progra...

Commentary: Under Current Poverty Programs, It Pays to Work, Despite House Republicans’ Contentions

Adults in poverty are significantly better off if they take a job, work more hours, or receive a wage hike.In the overwhelming majority of cases, adults in poverty are significantly better off if they take a job, work more hours, or receive a wage hike, we found in our recent comprehensive analysis of the data and research related to work and the safety net.[1] Further, various changes in the safety net over the past two decades (including health reform, or the Affordable Care Act) have substantially increased incentives to work for people in poverty.

Nevertheless, leading up to the release of their forthcoming plan to address poverty, House Republicans continue to claim that the low-income assistance system strongly discourages work. They have said that people receiving assistance from these programs often receive more, or nearly as much, from not working — and receiving government aid — as from working. Or they’ve argued that low-paid workers have little incentive to work more hours or seek higher wages because losses in government aid will cancel out the earnings gains. They may repeat such claims in the coming days. But our research has found that these assertions don’t withstand scrutiny.

Gains From Work Are Almost Always Substantial

Our review of an important Congressional Budget Office (CBO) study,[2] as well as other data and research, found:

-

Working is nearly always substantially better from a financial standpoint than not working. A critical question is whether the safety net is designed so it is worthwhile for someone who isn’t working to take a job. The answer is clear: the financial incentive to take a job is unmistakable.

This is demonstrated first by examining the taxes that apply to all poor single-parent families that work, along with the benefits that go to all such families that qualify for them. After taking into account state and federal taxes, including federal tax credits like the Earned Income Tax Credit (EITC) and Child Tax Credit, plus SNAP (food stamp assistance), a single mother with two children taking a half-time job at the federal minimum wage gains over $10,000 in net annual income compared to not working. Her family’s income more than doubles.[3] If she takes a full-time job at the federal minimum wage, her family is nearly $20,000 better off than if she doesn’t work. Since the EITC and Child Tax Credit rise more for these families as earnings increase than their SNAP benefits decline, their assistance from government policies rises as they work more. The safety net as a whole increases their incentive to work.

This is also demonstrated by examining scenarios in which families receive Temporary Assistance for Needy Families (TANF) benefits or housing assistance, which are not available to most poor families that meet those programs’ eligibility criteria. Even in the relatively infrequent examples where poor families receive both TANF and housing assistance, which generally phase down as earnings rise, the families’ incomes typically are substantially higher if they work than if they do not.

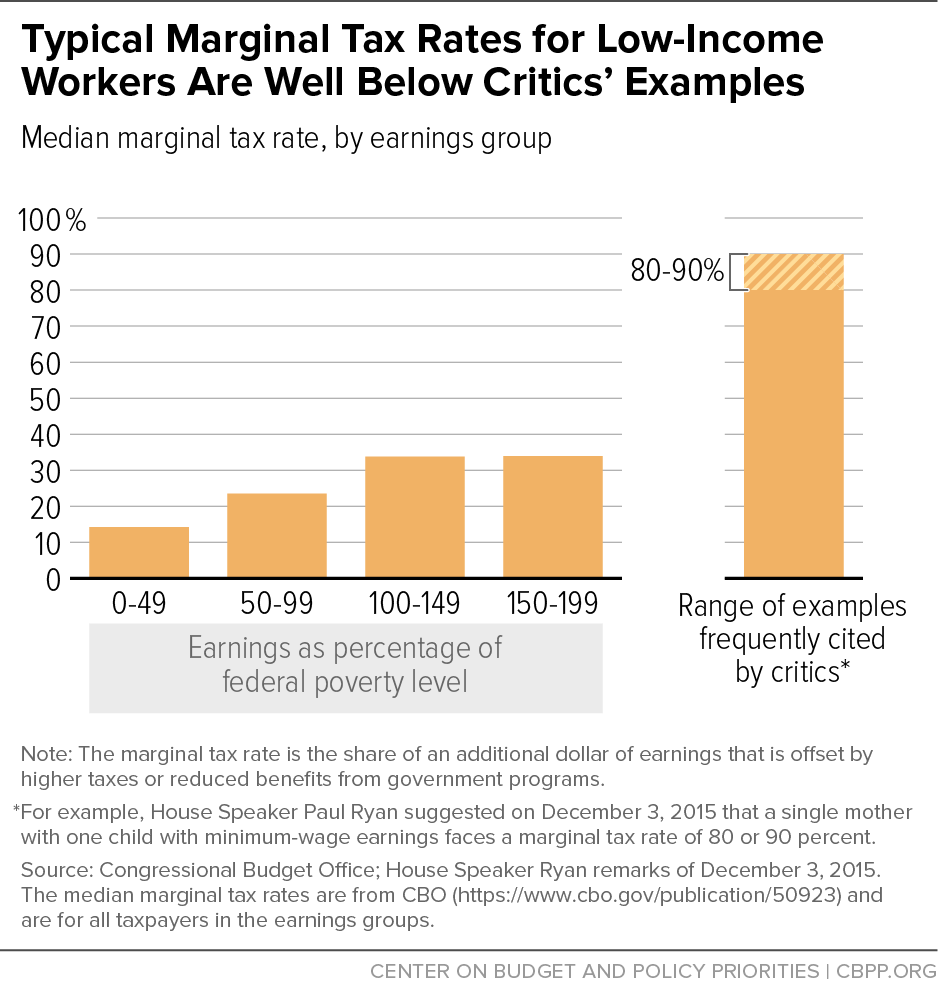

- Workers in poverty typically have a greater incentive to work more hours or at higher wages than other workers do. A recent Congressional Budget Office (CBO) analysis found workers with earnings below the poverty line face “marginal tax rates” — i.e., the reduction in benefits or increase in taxes for each additional dollar earned — that are typically well below those that other workers face. The median or typical worker with earnings below half of the poverty line has a marginal tax rate of 14 percent, according to CBO’s analysis, meaning that he or she loses 14 cents in higher taxes and/or lower benefits for each additional dollar earned. Workers with earnings between 50 and 100 percent of the poverty line typically face marginal tax rates of 24 percent. In contrast, the groups of earners with somewhat higher incomes that CBO examined typically have marginal tax rates of about 33 or 34 percent. (See Figure 1.)

- Workers just above the poverty line typically also gain substantially from working additional hours or obtaining higher wages. Workers with earnings between 100 and 150 percent of the poverty line typically face marginal tax rates of 34 percent, according to CBO, or less than half of the 80 or 90 percent rates that some critics of low-income assistance programs incorrectly portray as the norm.

- Critics’ examples assume that workers receive an unusual combination of benefits that few low-income workers actually get. The examples cited of extremely high marginal tax rates are generally worst-case scenarios that apply only to a small fraction of families with children — namely, families that: a) have income in certain fairly narrow ranges, typically just above the poverty line; and b) receive an unusual combination of government benefits, all or most of which phase down in the same income range. We estimate that only about 3 percent of single mothers with two children and earnings below 150 percent of the poverty line (below about $29,000) receive the EITC, SNAP, and either TANF or housing aid (or both) and are in the earnings range where these benefits all phase down simultaneously — and consequently face marginal tax rates above 80 percent. The proportion is even smaller for other family configurations.

The ACA Significantly Boosted Work Incentives

The 2010 Affordable Care Act (ACA) significantly reduced work disincentives for many working-poor parents. Before health reform, Medicaid eligibility for working parents in the typical (or median) state ended at just 61 percent of the poverty line, creating a substantial work disincentive “cliff.” Health reform changed this markedly, especially in the 31 states and the District of Columbia that have adopted its Medicaid expansion. In those states, working parents remain eligible for Medicaid until their income reaches 138 percent of the poverty line, and those whose earnings rise above that level qualify for subsidies to purchase health coverage in the new insurance marketplaces if they lack access to affordable employer-based coverage.

In this vein, the House Republicans’ poverty plan needs to be considered in conjunction with their health plan, expected to be issued later this month, which likely will propose to repeal health reform’s coverage provisions, including the Medicaid expansion. That would reverse the progress on promoting work incentives that the ACA has advanced.

Safety Net Has Little Effect on Low-Income Workers’ Work Effort

A comprehensive review of the research on the effects of different aspects of the safety net on work found that the behavioral response is small enough, in aggregate, that it has little or no impact on the degree to which the safety net lifts people out of poverty.[4] A number of factors, beyond the fact that most poor workers face low marginal tax rates, may account for the small behavioral response. Many low-wage workers have limited flexibility to adjust their work schedules without threatening their job status. And many workers likely conclude that working more hours or accepting a promotion will benefit their careers over the long term. In addition, many families don’t fully understand how benefits (particularly tax credits) adjust as earnings rise and don’t make the technical marginal-rate calculations that certain economic theories assume, research also shows.

Policymakers Should Recognize the Tradeoffs Involved in Adjusting Marginal Tax Rates

Policymakers should not ignore those circumstances in which marginal tax rates can be quite high. But it’s important they also recognize that such circumstances are concentrated among a small fraction of families with earnings just above the poverty line that receive benefits from a number of programs that phase down simultaneously — and, just as importantly, that reducing such marginal rates involves very difficult tradeoffs.

There are really only two options to lowering marginal tax rates. One is to phase out benefits more slowly as earnings rise; this reduces marginal tax rates for those currently in the phase-out range. But it also extends benefits farther up the income scale and increases costs considerably, a tradeoff that many policymakers may not want to make. The second option is to shrink (or even eliminate) benefits for people in poverty so they have less of a benefit to phase out and thus lose less as benefits are phased down. This reduces marginal tax rates, but it pushes poor families into — or deeper into — poverty and increases hardship, and thus may cause significant harm to children in these families. In effect, the second option would “help” the poor by making them worse off.

We will soon find out whether the new House Republican poverty plan addresses this conundrum. The solution that some who use marginal-tax-rate arguments to attack safety net programs have advanced in the past — block grants with extensive state flexibility — does nothing to resolve these inevitable tradeoffs. Block grants would merely pass the buck in making these tradeoffs from federal to state decision-makers.

End Notes

[1] Isaac Shapiro, Robert Greenstein, Danilo Trisi, and Bryann DaSilva, “It Pays to Work: Work Incentives and the Safety Net,” Center on Budget and Policy Priorities, March 3, 2016, https://www.cbpp.org/sites/default/files/atoms/files/3-3-16tax.pdf.

[2] Congressional Budget Office, “Effective Marginal Tax Rates for Low- and Moderate-Income Workers in 2016,” November 2015, https://www.cbo.gov/sites/default/files/114th-congress-2015-2016/reports/50923-MarginalTaxRates.pdf.

[3] This calculation excludes the value of health benefits, which, in most states, would not be affected in these scenarios, because the mother and her children would remain eligible for Medicaid. The calculation also doesn’t include extra costs from working, such as child care expenses, or subsidies to help cover those expenses.

[4] Yonatan Ben-Shalom, Robert Moffitt, and John Karl Scholz, “An Assessment of the Effectiveness of Anti-Poverty Programs in the United States,” Institute for Research on Poverty, Discussion Paper no. 1392.11, revised June 2011.

More from the Authors