| |

February 11, 2005

WHAT IS — AND ISN'T — IN THE PRESIDENT'S BUDGET

The 2006 budget the White House released this week is a statement of the

Administration's priorities. The Administration is responding to continuing

high deficits not by reassessing any of the tax cuts that have contributed

substantially to the deficits, but solely through reductions in a wide array of

domestic programs. Indeed, the budget proposes new tax cuts, as well as making

existing tax cuts permanent.

As a result, the proposed

budget would not reduce the deficit at all from what it would be absent

the policy changes proposed by the Administration. The domestic program cuts

are more than outweighed by the proposed tax cuts and the defense and homeland

security spending increases in the budget. Tables in the Administration’s

budget show deficits would be $29 billion higher over the next five years

with the Administration’s budget proposals than without them. Beyond this

period, as the price of the tax cut proposals swells, the budget would greatly

increase the deficit.

See:

Quick Overview:

Assessing President Bush's New Budget Proposal

Quick Overview:

Assessing President Bush's New Budget Proposal

What the President's Budget Shows About the Administration's Priorities

What the President's Budget Shows About the Administration's Priorities

What Is in the Budget

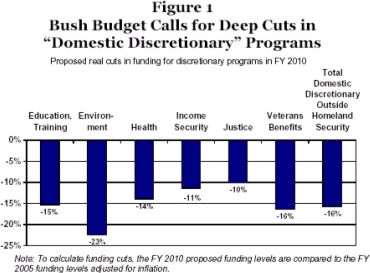

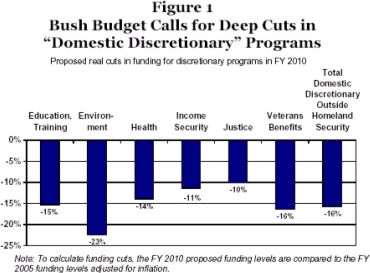

- Substantial domestic program reductions overall. The

budget includes $214 billion over five years in cuts in domestic discretionary

programs (non-entitlement programs other than those in the Defense Department,

international affairs, or homeland security), with the cuts growing much larger

with each passing year and reaching $66 billion — or 16 percent — by 2010.

(Cuts are compared to the 2005 level, adjusted for inflation.) The budget would

lock in its cuts in discretionary programs through the enactment of caps on the

total amount that can be appropriated each year for these years.

See:

- Substantial

reductions to a wide range of program areas. The budget fails to provide

proposed funding levels for individual appropriated programs for years after

2006, the first time since 1989 that an Administration’s budget has lacked this

type of information. By examining unpublished backup budget documents provided

by OMB to the Budget Committees of Congress, however, one can see the cuts the

budget contains in 2007-2010 in various program areas. (As noted, the cuts in

these years are quite important, since the proposed discretionary spending caps

would lock in deep cuts in discretionary programs.) As Figure 1 shows, by 2010,

the cuts would reach 23%, or $8 billion, in environmental programs and national

parks, 14 percent (or $8 billion) in health research and services, and 16

percent (or $6 billion) in veterans’ services (including veterans’ health care),

to name a few.

- Low-income working families with children would be affected by

a number of the proposed cuts.

- approximately 300,000 people, primarily in low-income working

families, would lose food stamp benefits under the Administration’s proposed cut

in the food stamp program;

- 300,000 children would lose child care assistance in 2009 under

the Administration’s proposed five-year freeze in child care funding; and

- In addition, the proposed reduction of $45 billion over ten years

in federal funding for state Medicaid programs would likely lead to a number of

states to take actions that would increase the ranks of the uninsured and the

underinsured; low-income working families would likely be among those most

heavily affected.

- More tax cuts, along with a gimmick to help get them through

Congress. Lack of revenues is the main reason behind the rise in

deficits: revenues are now lower, as a share of the economy, than in any year

in the 1960s, the 1970s, the 1980s, or the 1990s. The Administration’s

budget would make its tax cuts permanent and add a number of new tax cuts on

top. In all, these tax cuts would cost $1.4 trillion over ten years

($1.6 trillion when the added interest payments on the debt are taken into

account).

What Isn’t in

the Budget

The budget conceals the fiscal effects of

Administration proposals that would increase the deficit, as well as the

consequences of various cuts in domestic programs it proposes.

Items omitted from the budget include:

- All costs of military operations in Iraq and Afghanistan and

the global war on terrorism, after the $80 billion the Administration has

requested for 2005 is exhausted. CBO estimates these additional costs could

total around $350 billion over the next ten years (excluding interest payments

on the debt), assuming an eventual phasedown of U.S. activities in Iraq and

Afghanistan.

- Any of the cost of the President’s proposal to divert Social

Security payroll taxes to establish private accounts. That plan would add

about $1.4 trillion to the debt over its first ten years (2009-2018) and about

$3.5 trillion more to the debt in the following ten years (2019-2028). The

White House has cited $750 billion in costs for an earlier ten-year period

(2006-2015), but that number is misleadingly low: the plan wouldn’t even begin

phasing in until 2009 and wouldn’t become fully effective until 2011.

- The cost of continuing relief from the alternative minimum tax

(AMT) after 2006. The President’s budget proposes extending the current

temporary AMT fix only for one year, through 2006. According to CBO, extending

AMT relief through 2015 could cost nearly $700 billion over ten years (excluding

interest).

Also absent from the budget are ways

to reduce the deficit that would produce a more even-handed approach to deficit

reduction. As one example, the budget could have offered to cancel or defer two

tax cuts enacted in 2001 that have not even begun to take effect yet. Some 97

percent of the tax cuts that these two provisions will provide will go to

households with incomes over $200,000. Eliminating these provisions would

reduce the deficit by close to $200 billion from 2010 to 2019.

See:

|

|