BEYOND THE NUMBERS

UPDATE, SEPTEMBER 30: We’ve revised some of the figures in this post. Click here for the updated numbers.

As I’ve said before, from the standpoint of economic efficiency there’s a clear-cut case for letting the Bush tax cuts for people over $250,000 expire on schedule in December. Sunsetting the high-income tax cuts makes just as much sense from the standpoint of equity. Recent data from the Congressional Budget Office (CBO) show a stunning shift in income away from the middle class and towards the highest-income people in the country over the last three decades:

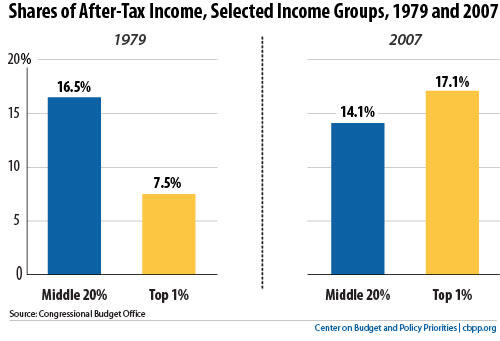

- In 1979, the middle fifth of Americans took home 16.5 percent of the nation’s total after-tax income. By 2007, after several decades of stagnant incomes in the middle and surging incomes at the top, the middle fifth’s share had dropped to 14.1 percent. Over the same period, the top 1 percent’s share more than doubled, from 7.5 percent of total after-tax income to 17.1 percent (see graph below). So by 2007, the top 1 percent had a bigger slice of the national income pie than the middle 20 percent.

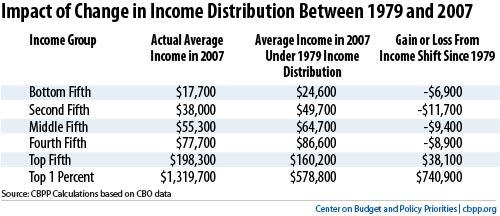

- If the distribution of after-tax incomes had remained unchanged between 1979 and 2007, the after-tax income of the average family in the middle would have been $9,000 (16 percent) higher in 2007 than it actually was. Instead of an income of $55,300, this typical family would have had $64,700 (see table below).

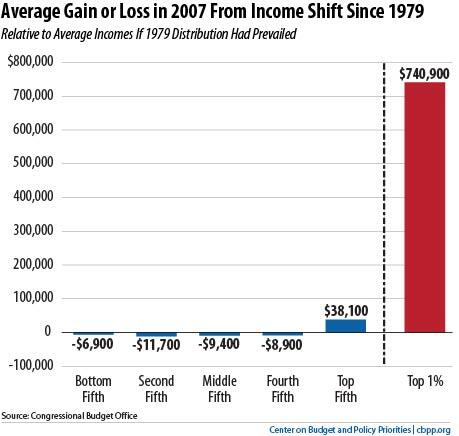

Here’s how that income shift looks in graph form:

Tax policy is one of the best tools we have to help offset the troubling trend of growing inequality. Unfortunately, the Bush tax cuts have had the opposite effect, providing much larger benefits — both in dollar terms and as a percentage of income — to people at the very top than to middle- and lower-income people. People making more than $1 million get an average of about $124,000 each year in tax cuts, according to the Urban-Brookings Tax Policy Center. The main reason, of course, is the large tax cuts targeted specifically at high-income households.

So this fall, when policymakers decide whether to extend the high-end tax cuts, they should keep in mind just how unequal incomes in the United States have become. As former Federal Reserve Vice Chairman Alan Blinder wrote recently in the Washington Post, is the rationale for extending these tax cuts “that America needs more income inequality? Seems to me we have enough.” To me, too.