Press Release: Tax Returns: New Report Questions Effectiveness, Design of Bush Tax Cuts through 2004 and Beyond

A new study of three years of Administration tax cuts, issued by the Center on Budget and Policy Priorities, finds adverse fiscal, distributional, and long-term economic effects from the tax cuts. The study,

, represents perhaps the most comprehensive analysis yet issued of the effects of the tax cuts, synthesizing previous findings on both the 2001, 2002, and 2003 tax cuts and the tax policy proposals in the Administration’s fiscal year 2005 budget and featuring significant new data from the Urban Institute-Brookings Institution Tax Policy Center.Among the study’s highlights:

- The average tax cut for the top one percent of households will be nearly $35,000 this year, 54 times the average tax cut of $647 that the middle fifth of households will receive. This finding is based on a new analysis by the Tax Policy Center that examines the effects of all components of the tax cuts and is the first comprehensive Tax Policy Center analysis to be based on a revised and improved Tax Policy Center model that fully incorporates the corporate and estate tax reductions.

- The tax cuts will bestow more than $30 billion in 2004 on the 257,000 households with incomes exceeding $1 million, with these households securing average tax cuts of $123,600 each. The $30+ billion in tax cuts that these “millionaires” will receive in 2004 far exceeds the total amount of tax cuts that the nearly 29 million households who comprise the middle fifth of the U.S. population will get.

- The tax cuts were not well designed to stimulate a weak economy. Only eight to 14 percent of the 2003 tax-cut package, which was promoted as being necessary to boost economic recovery, consists of high “bang-for-the-buck” tax cuts that will be provided by the end of fiscal year 2004. (A high bang-for-the-buck proposal is one that increases economic “demand” in the short term by more than one dollar for each dollar of lost tax revenue.) The tax cuts consequently have produced significantly less economic stimulus than could have been provided for the same (or less) budgetary cost. The failure of policymakers to design and enact more effective stimulus measures has likely contributed to job creation being more meager during this recovery than in other recoveries since the end of World War II.

- From 2005 through 2014, the increased interest payments on the debt that will result from the tax cuts will amount to approximately $1.1 trillion, if the tax cuts are made permanent and the other tax-cut proposals in the Administration’s fiscal year 2005 budget are enacted. The interest payments would reach $218 billion in 2014.

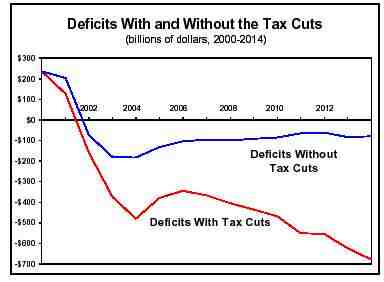

- Without the tax cuts, deficits would be modest over the next ten years and be below $100 billion in 2014. By contrast, with the Administration’s tax-cut policies, the deficit is likely to grow to approximately $677 billion by 2014.

| Distribution of Tax-Cut Benefits in 2004 | |||

| Income Class | Average tax cut | % increase in after-tax income | % share of tax cut |

| Middle 20 percent | $647 | 2.3% | 8.9% |

| Top one percent | $34,992 | 5.3% | 24.2% |

| Over $1 million | $123,592 | 6.4% | 15.3% |

| Source: Urban-Brookings Tax Policy Center | |||

“The tax cuts have contributed to federal revenues, measured as a share of the economy, dropping to their lowest level since the Truman Administration, and have conferred the greatest benefits on households at the highest income levels,” said Isaac Shapiro, senior fellow at the Center on Budget and Policy Priorities and co-author of the study. “The tax cuts also have produced less economic stimulus and job growth than could have been accomplished with the same or even lesser amounts of resources, because the tax cuts were poorly designed to respond to the economic slump.”

Shapiro added: “The problems that the tax cuts pose are likely to grow more severe if the tax cuts are made permanent, since the persistent, large deficits to which they would be a major contributing factor are likely to slow future economic growth, saddle future generations with sizable interest payments on a greatly enlarged national debt, and leave the nation ill-prepared for the retirement of baby boomers.”

Other significant findings from the study include the following.

Bulk of Middle-Class Tax Cuts Could Have Been Provided at One-Third the Cost

The tax cuts enacted over the past three years include three major “middle-class” provisions: the provisions establishing the 10 percent tax bracket, expanding the Child Tax Credit, and providing tax relief to married couples. These three tax cuts were enacted in 2001 and became fully effective in 2003, when their implementation was accelerated.

These three provisions provide substantial help to the broad middle class. These measures also provide significant tax benefits to high-income households. The middle fifth of households will receive an average tax cut of $547 in 2004 from these provisions. The top one percent of households will receive an average tax cut of $1,320 from these measures.

But the distribution of tax benefits under the other tax-cut provisions enacted in the past three years is far less evenly distributed. The new Tax Policy Center data show that the top one percent of households will receive an average tax cut in 2004 of $33,700 from the other tax-cut provisions. By contrast, the middle fifth of households will receive an average tax cut of just $100 from these other provisions.

The study also finds that these three middle-class provisions would account for only about one-third of the cost of the tax cuts when the Administration’s tax cuts were fully in effect. The bulk of the tax-cut benefits that the middle class will receive thus could have been provided for about one-third of the long-term cost that the Treasury will bear if the Administration’s full tax-cut agenda is enacted, with nearly all of the recent tax cuts being made permanent and some new tax cuts being added on top.

Long-Term Costs and Distributional Effects

If the Administration’s tax-cut agenda is approved (and relief from the swelling Alternative Minimum Tax is continued, as most observers expect it will be), future costs will be extremely large.

- Over the 10-year period from 2005 through 2014, the tax cuts will increase federal deficits by nearly $4 trillion. This includes the cost of the increased interest payments that will have to be paid on the national debt.

- Over the next 75 years, the cost of the tax cuts would be more than three times the size of the Social Security shortfall, and larger than the shortfalls in the Social Security and Medicare Hospital Insurance trust funds combined.

As uneven as the distribution of the tax cuts is in 2004, the distribution will become still more uneven over time. The tax cuts of greatest benefit to the middle class already are fully in effect. Some of the tax cuts of most benefit to high-income households, however — such as the elimination of the estate tax — are only partly in effect now or have not yet begun to take effect.

The Very Well-Off: Big Winners on Two Fronts

In addition to the large tax cuts they are now receiving, high-income households secured huge gains in income in the 1980s and 1990s. The Congressional Budget Office publishes the most comprehensive data available on changes in incomes and taxes for different income groups. Just-released CBO data cover years from 1979 until 2001. These data show:

- The average after-tax income of the top one percent of the population more than doubled over this period, rising from $294,300 in 1979 to $703,100 in 2001, an increase of 139 percent. (These figures are adjusted for inflation.)

- By contrast, the average after-tax income of households that make up the middle fifth of the U.S. population rose $6,300, or 17 percent, during this period. The average after-tax income of the poorest fifth of households rose $1,100, or eight percent.

Jobs and Economic Growth

Job growth during this recovery might have lagged well behind that of previous recoveries even if recent economic policies had been better designed. Nonetheless, the unusually poor job growth of the past couple of years suggests the Administration’s tax cuts have fallen well short of accomplishing one of their stated goals.

- Employment remains substantially below its level at the start of the downturn, a development unparalleled this far into a post-World War II recovery. Substantial job growth typically occurs by this point.

- The Economic Policy Institute has compared actual job growth since the summer of 2003 to the level of job growth the Administration predicted would occur with passage of the 2003 tax cut. The Administration predicted that with passage of that measure, 5.5 million jobs would be created in the 18 months from June 2003 through December 2004. Employment figures through March 2004, however, indicate that in the first half of this 18-month period, only 689,000 jobs were created. This amounts to just 13 percent of the Administration’s jobs projection.

Overall economic growth also has been below par. Whether measured from the start of the recession or the end of the recession, the economy has grown more slowly in the past few years than it grew, on average, at comparable stages of other post-World War II recoveries.

The Administration’s Story

The Administration has highlighted the tax-cut benefits the middle class has received and also has promoted its tax cuts as being highly beneficial to groups such as small business owners. The Center’s study finds much of the information the Administration has put forward on these matters has been selective or misleading. As one example, President Bush has often cited the “average” tax cut that American families are receiving. The large majority of families, however, are getting considerably less than this “average” amount. The tax cut that the typical household will receive in 2004 is less than half the amount that the President has described as being the “average” tax cut this year. The Administration’s average tax-cut figures are skewed upward by the inclusion of the very large tax cuts going to a relatively small number of very affluent taxpayers.

Administration officials also have touted the benefits to small business owners of the reductions in the top income tax rate. But Treasury Department data show that the top-rate reduction benefits only two percent of small business owners.

The Center’s study concludes that the majority of Americans are likely to end up worse off over time as a result of the tax cuts, because action ultimately will need to be taken to rein in burgeoning deficits and pay for the tax cuts. “Because the tax cuts are so tilted toward the highest-income households,” said Joel Friedman, a senior fellow at the Center and co-author of the report, “the burden of financing these lopsided tax cuts eventually is likely to be borne disproportionately by households that have gained only modestly from the tax cuts. This will be the case unless offsetting spending cuts or tax increases are enacted that reduce benefits or raise taxes primarily on high-income households, an unlikely scenario. Over the long term, most Americans may well end up as net losers from the tax cuts.”

Click here to view the full report,

.The Center on Budget and Policy Priorities is a nonprofit, nonpartisan research organization and policy institute that conducts research and analysis on a range of government policies and programs. It is supported primarily by foundation grants.