- Home

- Federal Budget

- Commentary: Signs Suggest Trump Budget W...

Commentary: Signs Suggest Trump Budget Will Feature Unprecedented Cuts Plus Large Tax Cuts Favoring Wealthy

Mounting signs suggest that the forthcoming Trump budget may contain cuts harsher than those in House GOP budgets of recent years, which themselves would have slashed programs and services across much of the budget.

The budget that the Republican majority on the House Budget Committee approved last spring, for example, contained a stunning $6 trillion in domestic cuts over ten years, shrinking spending outside Social Security, Medicare, and interest payments to just 7 percent of gross domestic product by 2026. That’s less than three-fifths its average level over the past 40 years and little more than half its average level under President Reagan. The budget would have slashed non-defense discretionary programs (which include everything outside defense and entitlement programs) by roughly $1 trillion over ten years below the already austere levels set by the 2011 Budget Control Act (BCA) and the automatic “sequestration” cuts. [Last spring’s Republican budget] would have caused tens of millions of people to lose basic support, yet those unprecedented cuts may not be enough for the Trump Administration. And it would have cut programs for people with low or modest incomes by roughly $3.7 trillion over the decade, cutting them 42 percent by 2026 and thereby causing tens of millions of people of limited means to lose basic support.[1]

Yet those unprecedented cuts may not be enough for the Trump Administration. The Hill reported recently that members of the Trump team were meeting with career staff at the Office of Management and Budget (OMB) to assemble a budget with $10 trillion or more in savings (including interest savings), of which about $8½ trillion would apparently be cuts to programs outside defense (the rest would be interest savings). Many of the cuts in the Trump team’s blueprint come from plans that the Heritage Foundation and the Republican Study Committee (RSC) issued last year, according to The Hill. The Heritage report called for more than $8½ trillion in non-defense cuts (slightly over $10 trillion in savings when the effects on interest payments are taken into account; see box), while the RSC report called for almost $7½ trillion in such cuts.

Moreover, the “Penny Plan” that President Trump proposed during his campaign would slash non-defense discretionary funding by 2026 to an amount 37 percent below the 2010 level, adjusted for inflation, and nearly 40 percent below its lowest level under Ronald Reagan, when measured as a share of the economy.[2] Rep. Mick Mulvaney, Trump’s nominee for OMB director, supports the Penny Plan.[3]

Cuts of these magnitudes would have devastating effects on tens of millions of less fortunate families and on an array of basic services that middle-income Americans, as well, rely on. State and local governments, too, would be sharply affected, since a large share of federal domestic programs operate as grants to states and localities, which deliver basic services such as education, highways and mass transit, child nutrition, rental subsidies, clean water, and health care through Medicaid.

These budget cuts would apparently come alongside deep tax cuts heavily favoring the most well-off. The House GOP’s “Better Way” tax plan issued last year, which the Trump team is reportedly moving toward, would lose $3.1 trillion in revenue over the coming decade, according to the Urban-Brookings Tax Policy Center (TPC).[4] In the first year, 76 percent of these tax cuts would go to the top 1 percent of Americans; by the tenth year, 99 percent of the tax cuts would. Trump proposed an even larger, regressive tax cut in his campaign.

As a result, the forthcoming Trump budget is likely to represent the largest Robin Hood-in-reverse proposal from any President in modern U.S. history, shifting substantial amounts of income from people of modest means to those who already possess enormous wealth.

Heritage Blueprint Severely Cuts Non-Defense Programs

The Heritage Foundation’s “Blueprint for Reform,”* which Trump staff are reportedly using as a basis for the Trump budget, would:

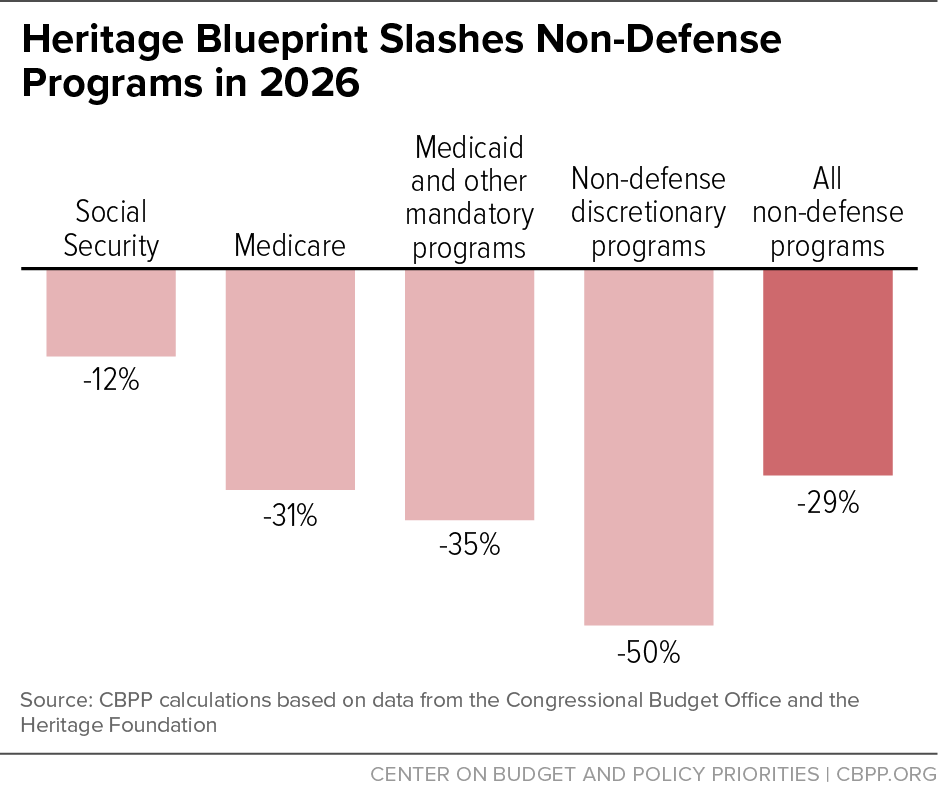

- Cut Medicaid and other mandatory (entitlement) programs outside Social Security and Medicare by $3.8 trillion over the decade, relative to the Congressional Budget Office baseline, and by 35 percent in 2026. The cuts would largely come in programs serving the most vulnerable Americans. The plan would repeal the Affordable Care Act and provide only a limited replacement, dramatically curtail Medicaid for seniors and non-disabled adults, eliminate Supplemental Security Income (SSI) cash benefits for poor children with disabilities, and cut the SNAP (food stamp) program, among others. Millions of people would lose health insurance, and poor families with a disabled child would experience more hardship.

- Cut Medicare by $1.7 trillion over the decade and by almost one-third in 2026. The plan would raise the Medicare eligibility age, increase premiums, and replace Medicare’s guaranteed benefit with premium support (a flat payment or voucher), among other changes.

- Cut non-defense discretionary programs by $2.5 trillion over the decade, slashing this spending by one-third next year and in half in 2026. The plan would eliminate large chunks of departments (sometimes by shifting their responsibilities to the states but without accompanying funding) and undermine federal responsibilities in areas ranging from rural development and transportation infrastructure to energy research, environmental protection, pre-school education, and low-income housing. These cuts would come on top of the cuts imposed by the BCA, which already are pushing these programs to their lowest level on record as a percent of the economy, with data back to 1962.

The plan would also cut Social Security by $633 billion over the decade. Indeed, more than one-quarter of the plan’s savings would come from Social Security and Medicare. Of course, President Trump has said that he would protect Social Security and Medicare. But doing so and still achieving roughly $10 trillion in total savings would require even more draconian cuts across the rest of the budget.

* “Blueprint for Reform: A Comprehensive Policy Agenda for a New Administration in 2017,” Heritage Foundation, July 14, 2016, http://www.heritage.org/research/reports/2016/07/blueprint-for-reform. The Heritage blueprint was constructed from the Congressional Budget Office baseline of March 2016; for consistency, our calculations of the resulting cuts are relative to that baseline.

House GOP Budget Gets 62 Percent of Budget Cuts From Low- and Moderate-Income Programs

End Notes

[1] Richard Kogan and Isaac Shapiro, “House GOP Budget Gets 62 Percent of Budget Cuts From Low- and Moderate-Income Programs,” CBPP, March 28, 2016, https://www.cbpp.org/research/federal-budget/house-gop-budget-gets-62-percent-of-budget-cuts-from-low-and-moderate-income.

[2] Richard Kogan and David Reich, “Trump “Penny Plan” Would Mean Large Cut in Non-Defense Spending,” CBPP, September 15, 2016, https://www.cbpp.org/research/federal-budget/trump-penny-plan-would-mean-large-cut-in-non-defense-spending.

[3] Ylan Q. Mui, “Budget nominee Mulvaney defends support for cuts to Social Security, Medicare,” Washington Post Wonkblog, January 24, 2017, https://www.washingtonpost.com/news/wonk/wp/2017/01/24/budget-nominee-mulvaney-to-face-questions-about-trumps-plan-for-tax-cuts-and-spending/?utm_term=.093b111a718a.

[4] Chuck Marr and Chye-Ching Huang, “House GOP ‘A Better Way’ Tax Cuts Would Overwhelmingly Benefit Top 1 Percent While Sharply Expanding Deficits,” CBPP, September 16, 2016, https://www.cbpp.org/research/federal-tax/house-gop-a-better-way-tax-cuts-would-overwhelmingly-benefit-top-1-percent.