Statement by Chad Stone, Chief Economist, on the November Employment Report

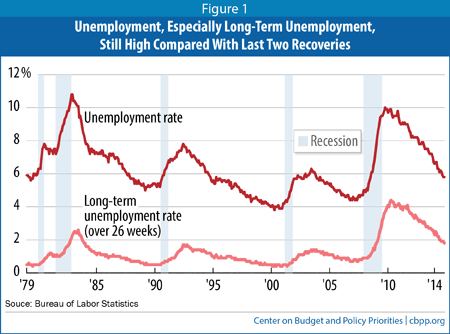

Today’s solid jobs report highlights a continuing labor market recovery, but one in which unemployment — especially long-term unemployment — remains high relative to recent recoveries (see chart). With inflation running below its 2 percent target, the Federal Reserve faces little if any danger of igniting unacceptable inflation by keeping interest rates low to encourage further job growth.

Unemployment has fallen substantially since peaking at 10 percent in October 2009. At 5.8 percent, however, it’s barely below the highest rate reached in connection with the 2001 recession. (Each of the last three recessions has been followed by a “jobless recovery phase” in which unemployment kept rising even as the economy started growing.) Unemployment also fell below 6 percent much sooner after the 1990-91 recession than during the current recovery, on its way down to 4 percent at the peak of the 1990s expansion.

Current estimates of an unemployment rate that’s consistent with the Fed’s “dual mandate” of maximum employment and stable prices cluster in the 5 to 5.5 percent range. That’s below the 6 percent that was estimated for the 1980s but above the 4 percent that was actually achieved in the 1990s.

While unemployment is edging closer to the 5 to 5.5 percent range, other labor market indicators suggest that considerable “slack” remains in the labor market (people not working but who want to be, or people who want to be working more hours than they are). Along with abnormally low labor force participation and elevated levels of people working part time for economic reasons rather than by choice, wage growth continues to be modest relative to productivity and profits, suggesting that labor markets are not yet tight enough to give workers much bargaining power.

Long-term unemployment (27 weeks or longer) remains particularly high. Some 31 percent of the unemployed are long-term, which is higher than at any time before the Great Recession. While the long-term unemployed face problems from the erosion of their job skills due to prolonged unemployment, as well as hiring discrimination based on their long-term jobless status, the evidence suggests that their desire to work and efforts to find jobs aren’t noticeably different from other jobseekers.

The cure for unemployment due to economic slack — including most long-term unemployment — is robust growth in demand for goods and services. The Fed has a crucial role to play by keeping interest rates low until the labor market returns to normal.

About the November Jobs Report

Employers reported strong payroll job growth in November. In the separate household survey, the unemployment rate stayed at 5.8 percent and the labor force, employment, and unemployment rates were little changed, following substantial improvements in October.

- Private and government payrolls combined rose by 321,000 jobs in November and the Bureau of Labor Statistics revised job growth in the previous two months upward by a total of 44,000 jobs. Private employers added 314,000 jobs in November, while overall government employment rose by 7,000. Federal government employment rose by 5,000, state government rose by 3,000 and local government fell by 1,000. So far this year, federal government employment has fallen by 17,000 while state government has risen by 16,000 and local government by 80,000.

- This is the 57th straight month of private-sector job creation, with payrolls growing by 10.9 million jobs (a pace of 192,000 jobs a month) since February 2010; total nonfarm employment (private plus government jobs) has grown by 10.4 million jobs over the same period, or 182,000 a month. Total government jobs fell by 535,000 over this period, dominated by a loss of 316,000 local government jobs. As noted, however, local government employment has grown by 80,000 so far this year

- The job losses incurred in the Great Recession have been erased. There are now 2.1 million more jobs on private payrolls and 1.7 million more jobs on total payrolls than at the start of the recession in December 2007. Because the working-age population has grown since then, however, the number of jobs remains well short of what is needed to restore full employment. Employers have expanded their payrolls at a 241,000-a-month pace this year, and such growth must continue to restore normal labor market conditions in a reasonable period of time.

- Average hourly earnings on nonfarm payrolls rose by 9 cents in November to $24.66. Over the last 12 months they have risen 2.1 percent. For production and non-supervisory workers, average hourly earnings rose 4 cents to $20.74, or 2.2 percent higher than a year earlier.

- The unemployment rate remained 5.8 percent in November, and 9.1 million people were unemployed. The unemployment rate was 4.9 percent for whites (0.5 percentage points higher than at the start of the recession), 11.1 percent for African Americans (2.1 percentage points higher than at the start of the recession), and 6.6 percent for Hispanics or Latinos (0.3 percentage points higher than at the start of the recession).

- The recession drove many people out of the labor force, and the ongoing lack of job opportunities has kept many potential jobseekers on the sidelines and not counted in the official unemployment rate. While the labor force and the number of people with jobs surged in October, there was little further gain in November. The labor force grew by just 119,000 and employment by just 4,000, while the number of unemployed rose by 115,000. These data come from a separate survey from the data on payroll employment and typically show much greater volatility month-to-month. In October and November together, the labor force increased by 268,000 a month, employment increased by 344,000 a month, and unemployment fell by 76,000 a month. Numbers like that going forward would be encouraging.

- The labor force participation rate (the share of the population aged 16 and over in the labor force) remained 62.8 percent in November. The sharp decline in labor force participation during the recovery appears over, but prior to recent years, the labor force participation rate hasn’t been this low since the 1970s. November’s rate remains among the lowest since 1978.

- The share of the population with a job, which plummeted in the recession from 62.7 percent in December 2007 to levels last seen in the mid-1980s and has remained below 60 percent since early 2009, remained 59.2 percent in November.

- The Labor Department’s most comprehensive alternative unemployment rate measure — which includes people who want to work but are discouraged from looking (those marginally attached to the labor force) and people working part time because they can’t find full-time jobs — edged down to 11.4 percent in November. That’s well down from its all-time high of 17.2 percent in April 2010 (in data that go back to 1994) but still 2.6 percentage points higher than at the start of the recession. By that measure, about 18 million people are unemployed or underemployed.

- Long-term unemployment remains a significant concern. About three in ten (30.7 percent) of the 9.1 million people who are unemployed — 2.8 million people — have been looking for work for 27 weeks or longer. These long-term unemployed represent 1.8 percent of the labor force. Before this recession, the previous highs for these statistics over the past six decades were 26.0 percent and 2.6 percent, respectively, in June 1983, early in the recovery from the 1981-82 recession. A year after peaking at 2.6 percent, however, the long-term unemployment rate had dropped to 1.4 percent, well below the current rate.

The Center on Budget and Policy Priorities is a nonprofit, nonpartisan research organization and policy institute that conducts research and analysis on a range of government policies and programs. It is supported primarily by foundation grants.