- Home

- Recent Report On TANF’s Responsiveness T...

Recent Report on TANF’s Responsiveness to the Recession Has Serious Flaws

A recent study on how the Temporary Assistance for Needy Families (TANF) program responded to increased need during the Great Recession, by Ron Haskins and Kimberly Howard of the Brookings Institution and Vicky Albert of the University of Nevada, asserts that “TANF was more responsive to the recession than critics have claimed.” It concludes that TANF responded in the majority of states as a good safety net program would.[1] These conclusions, however, are off the mark as they rest on seriously flawed analysis. When the flaws are addressed, the results lead to the opposite conclusion.

A premise of the study is that other researchers’ analyses of TANF’s responsiveness are faulty because they do not account for state differences in the timing and severity of the recent recession. Haskins, Howard, and Albert examine changes in state TANF caseloads using two different measures (or methodologies). One measure examines caseload changes in each state over the state’s period of rising unemployment; the other measure examines each state’s caseload change from its lowest point during the period of rising unemployment in the state to its highest point, through December 2011. The second measure is designed to yield the largest possible increase in a state’s TANF caseload. For both measures, the period of rising unemployment is determined by looking at unemployment in the state from December 2006 (one year before the start of the start of the national recession) through June 2011 (two years after the end of the national recession).

Using the first of these measures, the authors find the TANF caseload increased by 12 percent in the average state, which is almost identical to the estimate we earlier produced of a 13 percent increase nationally.[2] Not surprisingly, the second measure produces a larger estimate of responsiveness — an increase of 30 percent in the TANF caseload in the average state; the authors use that measure to draw their main conclusions.

The principal problem with the authors’ analysis is not with this measure itself, but in how they use and interpret its results. Using the second measure (the one that produces the larger caseload-gain figures), the authors classify states into four groups: generous (seven states), responsive (18 states), status quo (19 states), and unresponsive (seven states). The authors conclude that in the 19 “status quo” states — where the average TANF caseload increased by an average of 14 percent — the response was “acceptable” because the increase in the unemployment rate was “modest” as well. This is a striking interpretation and conclusion — because the unemployment rate in those states increased by an average of 98 percent, hardly a modest rise and certainly not one from which we would expect only a modest response for a basic safety-net program like TANF. In defining this as an acceptable response from TANF, the authors set an extremely low bar for what should be expected of TANF during hard economic times.

Moreover, the authors claim that TANF responded to a greater degree in the 2000 and 2007 recessions than the Aid to Families with Dependent Children program (AFDC), TANF’s predecessor, did in previous recessions. This claim falls apart under scrutiny, however, because it rests on inappropriate use of data. The authors arrive at this conclusion by averaging the percentage increase (or decrease) in the AFDC caseload during the 1980, 1981, and 1990 recessions and comparing that to the average percentage change in the TANF caseload during the 2000 and 2007 recessions. There are three major flaws in this part of the analysis.

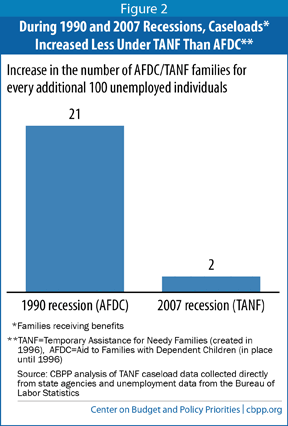

- First, comparing the percentage change in AFDC caseloads in earlier recessions to the percentage change in TANF caseloads during the most recent recessions, as the authors do, produces highly skewed results. The “percentage change” in caseloads is not the appropriate metric to use here. The AFDC caseload at the start of all three of the early recessions was much larger than the TANF caseload at the start of the 2000 and 2007 recessions, making a percentage-change comparison highly misleading, as Figure 2 demonstrates. From the beginning to the end of the 1990 recession, the number of unemployed individuals rose by 1.7 million, while the AFDC caseload increased by 350,000 families. From the beginning to the end of the 2007 recession, the number of unemployed individuals rose by 7 million, while the TANF caseload increased by just 124,000 families. Put another way, during the 1990 recession, the AFDC caseload increased by 21 families for every 100 additional unemployed individuals, while the comparable figure for the TANF caseload during the 2007 recession was an increase of only two families for every additional 100 unemployed individuals. (Note: measuring the increase in the TANF caseload at its peak in December 2010, three years after the official start of the recession, doesn’t change the basic finding that TANF largely failed to respond to the recession; it almost doubles the number of additional families that received TANF benefits, but only to four families for every 100 additional unemployed workers.)Image

Haskins, Howard and Albert’s paper ignores the difference in the size of the AFDC and TANF caseloads, as well as the ratio of the increase in the number of AFDC or TANF beneficiaries to the increase in the number of unemployed individuals. Instead, it provides only percentage-change figures, which mask the trends and seem to show comparable responsiveness in the recent recession. (As a clarifying example of the flaws with the authors’ approach, consider the response to increased need of two hypothetical programs, one of which has 100 participants while the other has 10,000. If participation were to rise from 100 to 125 participants in the first program and from 10,000 to 11,000 in the second, a percentage-change comparison would make you think that the first program was much more responsive — participation in it increased by 25 percent while rising 10 percent in the second program. But the first program would have added only 25 participants in response to increased need while the second added 1,000.)

- The second flaw is that in comparing across recessions, the analysis fails to account for differences in the magnitude of the increase in unemployment. One would expect a greater rise in AFDC or TANF caseloads with a greater increase in unemployment. The authors calculate that the AFDC caseload rose by 8.8 percent nationally in 1990 while the TANF caseload rose by a roughly similar percentage — 6.8 percent — in 2007. Yet their own data show that the unemployment rate increased by 30.3 percent in 1990, compared with 90 percent in 2007. Even using the authors’ flawed percentage-increase metric, TANF underperformed in the recent recession relative to how AFDC responded in the 1990 recession, rather than responding in a comparable manner.

- Third, averaging the percentage change across recessions is problematic because of other factors associated with AFDC or TANF that affected caseload levels during particular economic downturns. For example, the major budget cuts in AFDC that the Reagan Administration secured in 1981 coincided with the 1981 recession; these cuts make AFDC’s responsiveness during that recession look artificially low when one simply examines changes in caseload levels in these years.[3]

We have monitored the rise and fall of TANF caseloads since the start of the recession. While we agree that it’s important to look at how each state responded to the recession, as well as to national trends, we have a far less sanguine assessment of the program’s responsiveness to the recent recession than Haskins, Howard, and Albert do. In contrast to their claim that TANF responded reasonably to the large increase in need in the recent recession, we find that it fell well short of how we would expect such a basic safety net program to respond during tough economic times. We conclude that:

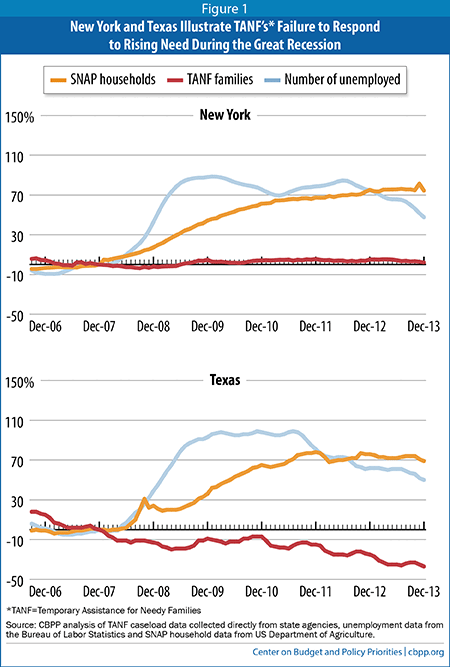

- Nationally, TANF responded only modestly to substantial increases in need during the Great Recession;

- Responsiveness among the states was very uneven, with some states’ caseloads rising more adequately in response to increased need while caseloads in other states rose little or not at all — and in some cases, actually declined; and

- TANF is emerging from the downturn an even weaker safety net than it was prior to the recession’s start. Owing largely to policy changes enacted in some states during the Great Recession, the national TANF caseload was 7 percent lower in December 2013 than it was in December 2006 (one year before the start of the recession) even though unemployment remained elevated.

In spite of its shortcomings, TANF is often held up as a model for altering other safety net programs. The Haskins, Howard, and Albert study is likely to be cited as evidence that TANF performs fine in recessions, so other programs (such as SNAP) can be changed to a similar block-grant structure. But that would be a highly inappropriate conclusion based on flawed use of data.

The three authors note that the safety net as a whole performed well during the Great Recession and prevented millions of people from falling into poverty, a point with which we concur. But TANF’s role in that safety net was only a very small one, and it would have been even smaller if President Obama and Congress had not provided additional TANF funds to states through the 2009 Recovery Act, which no one should count on future Congresses to replicate in a future recession. If the rest of the safety net had performed as poorly as TANF did, the level of hardship that the Great Recession caused would have been (and would continue to be) far greater than it was.

TANF Responded Unevenly to Increase in Need During Downturn (with state-by-state fact sheets)

End Notes

[1] Ron Haskins, Vicky Albert and Kimberly Howard, “The Responsiveness of the Temporary Assistance for Needy Families Program During the Great Recession,” The Brookings Institution, August 12, 2014, http://www.brookings.edu/research/papers/2014/08/responsiveness-tanf-great-recessions-haskins.

[2] LaDonna Pavetti, Danilo Trisi, and Liz Schott, “TANF Responded Unevenly to Increase in Need During Downturn,” Center on Budget and Policy Priorities, January 25, 2011, https://www.cbpp.org/cms/index.cfm?fa=view&id=3379.

[3] According to the authors’ calculations, the AFDC caseload decreased by 8.2 percent during this recession.

More from the Authors