Statement by Chad Stone, Chief Economist, on the July Employment Report

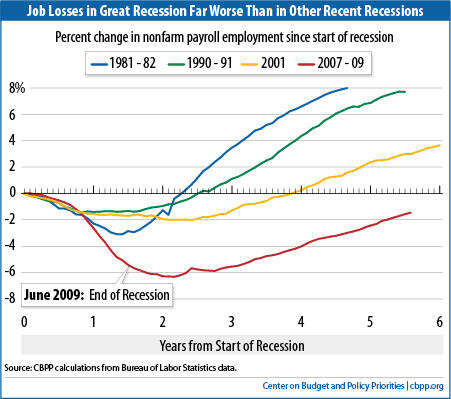

Today’s disappointing jobs report reflects a familiar pattern. Though private employers added jobs for the 41st straight month, nonfarm payroll employment remains lower than at the December 2007 start of the recession (see chart) — and well below what’s required for full employment. The unemployment rate fell to 7.4 percent, but as Federal Reserve Chairman Ben Bernanke stated recently, the current unemployment rate “overstates the health of our labor markets.” In particular, the share of the population with a job remains stuck near levels at the depth of the recession.

Yes, the economy has been growing, but not fast enough to generate a robust jobs recovery that not only puts job seekers back to work more quickly but also convinces more people who would like a job to look for one. One reason why the unemployment rate overstates the health of the labor market, which Bernanke emphasized, is that the labor force participation rate (the percentage of people working or actively looking for work) fell in the Great Recession and continued to fall into this year. That has offset the drop in the unemployment rate and kept the percentage of the population with a job depressed.

It need not be this way. Policymakers could remove one major barrier to stronger economic growth and job creation by replacing the sequestration budget cuts with a balanced package of tax and spending changes that achieve a similar amount of deficit reduction but are phased in more slowly (and hence back-loaded) so as not to weaken the recovery. Better, they could enact a package that provides up-front stimulus as well as substantial phased-in deficit reduction.

About the July Jobs Report

Job growth in July was moderate, and the drop in the unemployment rate was not matched by an increase in labor force growth. A robust jobs recovery remains elusive.

- Private and government payrolls combined rose by 162,000 jobs in July and job growth in May and June was revised down by a total of 26,000 jobs. Private employers added just 161,000 jobs in July, while government employment rose by 1,000. Federal government employment fell by 2,000, state government employment fell by 3,000, and local government increased by 6,000.

- This is the 41st straight month of private-sector job creation, with payrolls growing by 7.3 million jobs (a pace of 179,000 jobs a month) since February 2010; total nonfarm employment (private plus government jobs) has grown by 6.7 million jobs over the same period, or 164,000 a month. Total government jobs fell by 618,000 over this period, dominated by a loss of 369,000 local government jobs.

- Despite 41 months of private-sector job growth, there were still 2.0 million fewer jobs on nonfarm payrolls and 1.5 million fewer jobs on private payrolls in July than when the recession began in December 2007. July’s job growth would be considered acceptable in an economy that had already largely recovered from the recession, but it is well below the sustained job growth of 200,000 to 300,000 a month that would mark a robust jobs recovery. Job growth in 2013 has averaged 192,000 a month but has not topped 200,000 since February.

- The unemployment rate was 7.4 percent in July, and 11.5 million people were unemployed. In July, the unemployment rate was 6.6 percent for whites (2.2 percentage points higher than at the start of the recession), 12.6 percent for African Americans (3.6 percentage points higher than at the start of the recession), and 9.4 percent for Hispanics or Latinos (3.1 percentage points higher than at the start of the recession).

- The recession drove many people out of the labor force, and lack of job opportunities in the ongoing jobs slump has kept many potential jobseekers on the sidelines. In July, the number of unemployed fell by 263,000 but the number of employed increased by only 227,000. The labor force shrank slightly and the labor force participation rate (the share of people aged 16 and over who are working or actively looking for work) edged down to 63.4 percent in July, 0.2 percentage points lower than it was at the start of the year.

- The share of the population with a job, which plummeted in the recession from 62.7 percent in December 2007 to levels last seen in the mid-1980s and has remained below 60 percent since early 2009, was unchanged at 58.7 percent in July.

- The Labor Department’s most comprehensive alternative unemployment rate measure — which includes people who want to work but are discouraged from looking (those marginally attached to the labor force) and people working part time because they can’t find full-time jobs — was 14.0 percent in July. That’s down from its all-time high of 17.1 percent in late 2009 and early 2010 (in data that go back to 1994) but still 5.2 percentage points higher than at the start of the recession. By that measure, roughly 22 million people are unemployed or underemployed.

- Long-term unemployment remains a significant concern. Nearly two-fifths (37.0 percent) of the 11.5 million people who are unemployed — 4.2 million people — have been looking for work for 27 weeks or longer. These long-term unemployed represent 2.7 percent of the labor force. Before this recession, the previous highs for these statistics over the past six decades were 26.0 percent and 2.6 percent, respectively, in June 1983.

The Center on Budget and Policy Priorities is a nonprofit, nonpartisan research organization and policy institute that conducts research and analysis on a range of government policies and programs. It is supported primarily by foundation grants.