- Home

- Testimony Of Jared Bernstein, Senior Fel...

Testimony of Jared Bernstein, Senior Fellow, Before the House Education and Workforce Committee

Chairman Kline and ranking member Miller, I thank you for inviting me to testify today on issues directly in the wheelhouse of this committee: education, skills, and jobs.

My testimony begins by looking at the current jobs situation with an emphasis on educational investments. I then discuss ways in which recent budget cuts are threatening the educational support critical to a productive workforce. Finally, I specify a range of policy ideas that I urge the committee to consider in the interest of boosting future job growth.

Education Investments and the Current Job Market

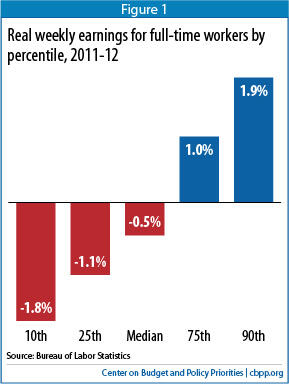

From the perspective of working families, the current economy is highly imbalanced. The stock market just hit new highs last week, boosted in part by historically high corporate profitability. Yet, middle- and low-wage workers continue to fall behind. As shown in my first chart, in 2012, the real weekly earnings of full-time workers were down about 2% for those at the bottom of the pay scale, flat for those in the middle, and up 2% for those at the top.

The “staircase” pattern of growth shown in the figure is characteristic of the income inequality that has been increasingly prevalent in our economy for decades now. Inequality has served as a kind of a wedge in the U.S. economy, such that the benefits of growth no longer accrue to working families the way they used to. This divergence of compensation and productivity is well-documented and is a central reason why even in macroeconomic good times — in the absence of the output gaps that remain large today — middle-class families have faced challenging economic times since well before the bursting of the housing bubble and the Great Recession that then ensued.

In this regard, a significant message from my testimony is that members of this committee need to be aware of the forthcoming budgetary constraints on programs that help support education, both at the federal and sub-federal levels, and particularly as regards educational access and affordability for the least advantaged among us.

But especially at times like the present, it would be a mistake to think that higher educational attainment alone would help ameliorate the economic squeeze so many families face. The supply of labor, even of so-called “skilled” labor, is not what’s holding back job growth right now. Inadequate labor demand — not enough jobs to meet the supply of workers — has been by far the more pressing factor in recent years.

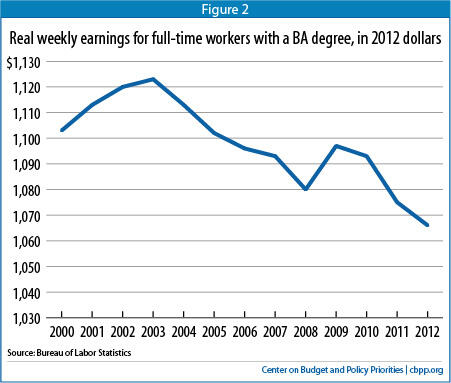

Our slack-demand job market has hurt even college-educated workers. I suspect the trend shown in my second figure, using the same data source as the first figure (BLS weekly earnings) will surprise some members on the committee. It shows that even the wages of workers with a bachelor’s degree have been losing ground in real terms, and not just over the recession, but over the prior expansion as well.

Trends like these should serve to remind policymakers and economists that we need to worry about both sides of the supply/demand equation. Yes, we need to ensure that policies are in place to help future workers achieve their academic potential. This role for policy is especially important when persistently high levels of income inequality block educational opportunity for children from economically disadvantaged backgrounds. But, in periods like the present characterized by persistent labor-market slack, we also need to be concerned that there will be jobs for them after their course of schooling is successfully completed.

Budget Cuts at the National and State Levels

Clearly, the education of its citizens is time-honored role of government — a “public good” that is essential to building a strong, competitive economy. It is widely accepted by economists of all political stripes that absent a public role, the nation’s citizenry would be under-educated, damaging both individual and national potential.

However, an objective observer of today’s politics would, I fear, be hard-pressed to see these concerns reflected in our political agenda or our policies. It is extremely hard to see how careening from crisis-to-crisis — from fiscal cliff to debt ceiling to sequester — supports the private sector need for both a well-educated labor force on the supply side and a stable climate of demand for the goods and services they produce.

In particular, an exclusive focus on deficit reduction appears to have wholly crowded out policies devoted to educational opportunity or job creation. Worse, spending cuts are threatening to reduce the government’s commitment to supporting education and training while austerity economics is hurting the fragile recovery.

As this committee well knows, spending cuts agreed to so far have been almost exclusively from the discretionary side of the budget. Within the non-defense discretionary (NDD) budget, some key education programs are at already at risk. For example, my Center on Budget and Policy Priorities colleague Richard Kogan points out that if the Pell Grant appropriation grows only with inflation from its 2012 funding level, “the program will face a funding shortfall of about $50 billion over the next decade. In other words, an additional $50 billion will be needed to maintain Pell Grant award levels without cutting students from the program.”

Kogan’s analysis is based on the lower NDD spending caps already legislated, largely through the Budget Control Act. Thus, any further cuts to this part of the budget will exacerbate this shortfall.

About one-third of NDD spending provides grants to states and localities to support services including education, to which is allocated about 25% of those grants, or around $40 billion this year. According to

:These funds mostly end up with elementary and high schools, primarily to help them educate children from low-income families and children with learning disorders and other types of disabilities. The funds also go to agencies that provide preschool education to low- income children through the Head Start program, and to school districts to help them train better teachers and reduce class sizes.

These same authors report the results of a 2012 survey of education administrators of K-12 public schools, wherein majorities say that “sequestration cuts would mean ‘reducing professional development (69.4 percent), reducing academic programs (58.1 percent), eliminating personnel (56.6 percent) and increasing class size (54.9 percent).’”

Invariably, today’s budget discussions take place at a level high above the programmatic implications of the cuts being considered. But many of the programs that will be targeted by NDD cuts already enacted are well known to this committee, such as high poverty schools that get assistance through Title 1, special education through the Individuals with Disabilities Education Act, Head Start, and teacher quality improvement grants.

Finally, while NDD spending has taken a hit with significant implications for K-12, the recession and slow recovery has had at least two other negative consequences for the provision of educational quality and opportunity: a) job losses for teachers and other educational workers, and b) higher costs of attendance at public universities.

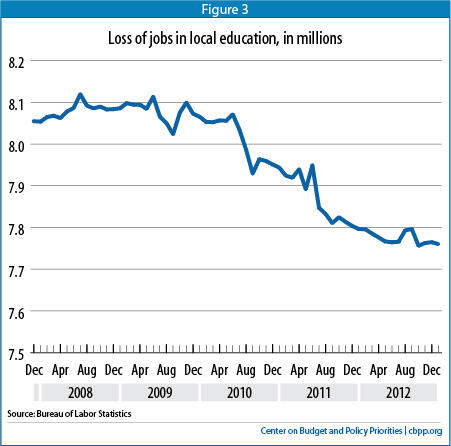

State budget constraints have led to significant service cuts at the state and local level, and public education has of course been a central target. Recovery Act funds helped to temporarily offset some of these localized budget pressures, but Figure 3 shows the extent to which the budget cuts forced layoffs in local education since its peak in early 2008. Since then, jobs in that sector are down about 360,000. Meanwhile, both enrollments and costs are rising, so spending per pupil is down in most states.

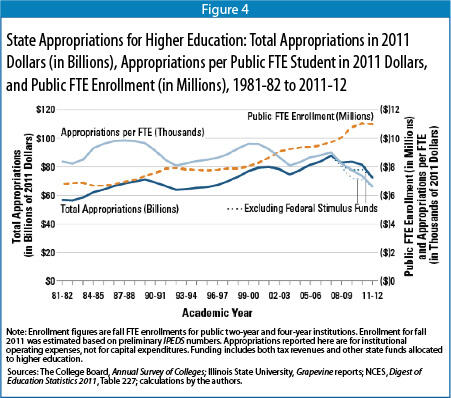

Another consequence of state budget cuts has been diminished support of their public university systems. Figure 4 plots state appropriations for higher education, both in total and per full-time equivalent student, against enrollments. The number of students going to public colleges rose significantly in the downturn, in part because returning to school can be a smart option during a period when the labor market is particularly unwelcoming. But as can be seen, the gap between enrollment and appropriations was wider in recent years than in any time covered by these data (from the College Board).

As state contributions to higher education decline, tuitions typically must pick up the difference, and of course, over the recessionary period, this means rising prices (and greater demand) for higher ed while most households’ incomes were falling. In fact, between the 2007-08 school year and now, tuitions and fees for private four-year colleges rose about 13% compared to a 27% rise for public higher education. Of course, there are still large differences in the tuition levels between private and public institutions of higher education, with private tuition and fees about $30,000 per year in 2012-13 and public at about $9,000. But the large differential in the growth of tuition and fees between the two sectors means this gap is shrinking.

Fighting the Jobs Deficit

As stressed above, when it comes to economic policy, despite the fact that so many families continue to struggle, Congress’s sole focus appears to be deficit reduction. While it is essential to stabilize the growth of the debt in the medium term, a few factors should be considered. First, based on about $2.3 trillion in spending cuts and tax increases enacted since 2011, we are $1.2 trillion in further policy changes (that would save another $200 billion in interest payments) away from stabilizing the debt as a share of GDP by 2022.[1] So Congress and the administration have already made important progress in this regard.

Second, the most pressing near-term economic problem is not the budget deficit, it’s the jobs deficit. This is clear in relevant indicators of both: we have high unemployment and low interest rates. Were the budget deficit a near-term problem, in the sense of crowding out private borrowing, we’d see this in debt markets through higher rates of interest, but instead we see the opposite, with Treasury yields at historic lows. Yet the unemployment rate has been stuck around 8% for the past year.

In fact, as I travel around the nation discussing these matters with audiences from all walks of life, I constantly hear one refrain: “Why isn’t Washington doing anything about jobs and paychecks?”

So in closing out my testimony, I’d like to provide the committee with a brief and very lightly annotated list of ideas that I’d urge you to consider.

—Infrastructure investment: Our national stock of public goods is in significant disrepair, with significant costs to productivity and growth. With high unemployment and low borrowing costs, this is an excellent time to make such investments. One specific idea to consider here is the FAST! (Fix America’s Schools Today) bill introduced in the last Congress to repair the nation’s public schools, with an emphasis on energy-efficient retrofits.

—Manufacturing policies: Both offense (forward looking investments in areas like clean energy where private investment will be undersupplied) and defense (fighting back against non-tariff barriers like currency manipulation that disadvantage our exports).

—Helping Unions: Creating a more level playing field for unions to organize.

—Minimum wage: Ranking member Miller has proposed a useful increase in the wage floor that would help lift the earnings of our lowest wage workers by 85 cents a year for three years, bring the federal minimum from $7.25 to $9.80 and then indexing it to inflation. Such an increase in the minimum wage would lift year-round earnings from around $15,000 to around $20,000, and potentially lift the earnings of 30 million low-wage workers, with little or no negative impact on the employment of affected workers.

—More rigorous application of labor standards, including overtime rules, correct worker classification, and prosecuting wage theft.

—Strong work supports both in terms of wage subsidies for low-income workers like the Earned Income or Child Tax credits, and assistance with the costs of employment, including child care and transportation.

—Guaranteed health insurance coverage: While lower-income jobs obviously tighten family budget constraints, if that family has affordable and reliable health insurance coverage, they are far more likely to be able to make ends meet and achieve a level of security that all working families deserve.

—Better oversight of financial markets: While this may seem tangential to jobs for the middle class, it is in fact highly relevant. Today’s high unemployment rate, even years into a GDP recovery, is widely viewed as one consequence of the housing bubble, itself inflated by severely under-regulated financial markets. And while the Dodd-Frank financial reform bill has much to recommend it, Congress must accelerate its lagging implementation.

Not only would action on some subset of these policy ideas help to provide desperately needed opportunities to working families, but they would provide an excellent answer to the question of “what’s Washington doing to help?”

Finally, an amply funded government sector is essential to accomplish the above agenda, both in terms of educational access and jobs for the middle class. This will require future budget deals involving revenue increases and spending cuts, not solely in the interest of debt stabilization, but to support economic security and opportunity, financial market oversight, and work.

Thank you.

End Notes

[1] This figure may be modified up or down as a result of the forthcoming CBO forecast, to be released at 1:00 p.m. today. See http://www.cbo.gov/content/43858.

More from the Authors