Statement by Chad Stone, Chief Economist, on the January Employment Report

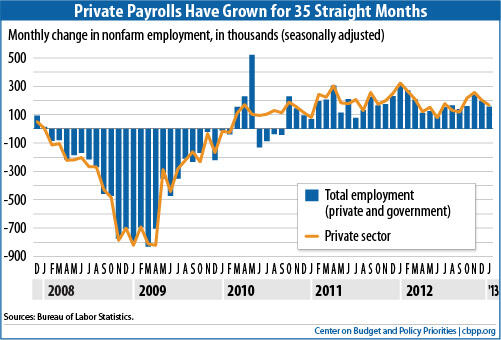

Employers continued to add jobs in January (see chart), but the economy must grow faster to bring unemployment down more quickly. Instead, the recovery apparently has hit a soft patch, and both growth and job creation could slow further if policymakers let the automatic across-the-board budget cuts (known as “sequestration”) take effect on March 1 or replace them with other immediate budget cuts that further weaken demand for goods and services.

Economic growth has been modest throughout the recovery, which began in mid-2009. Consequently, the growth to date has not fully erased the huge jobs deficit that the Great Recession created and unemployment remains unacceptably high. With enough demand, the economy could be producing a trillion dollars more output and several million more people could be working.

Earlier this week, the Commerce Department reported that growth in demand for goods and services (measured by final sales) slowed to a modest 1.1 percent annual rate. (Gross domestic product, or GDP, was essentially flat since the growth in final sales was financed out of inventories rather than the production of new goods and services, and, notably, a sharp decline in defense spending took 1.3 percentage points from demand.) The slowdown may have arisen from “weather-related disruptions and other transitory factors,” as the Federal Reserve said in this week’s monetary policy announcement. But the Fed’s decision to continue purchasing government securities in hopes of pushing down long-term interest rates and its expectation that it will keep short-term rates as close to zero as practicable for a considerable time suggest that it expects high unemployment to persist for some time.

The economy’s ability to resume stronger growth this year will suffer from the expiration of the payroll tax cut, and could suffer even more from spending cuts due to sequestration or other congressional action — all of which would further hinder demand. Indeed, part of the sharp decline in defense spending in the fourth quarter may have come from an anticipation of such cuts.

Policymakers missed an opportunity in the recent “fiscal cliff” negotiations to resolve the sequestration issue by adopting policies that achieved equivalent budget savings that were more balanced between taxes and spending and that did not take effect until the economy was stronger. They missed an opportunity to boost the recovery and brighten jobless workers’ job prospects when they failed to extend the payroll tax cut. And they missed an opportunity to achieve more deficit reduction that didn’t threaten the recovery when they did not end President Bush’s tax cuts for more very well-to-do Americans.

They have to do a better job of resolving sequestration this time if they want to enhance prospects of a stronger economic recovery, more job creation, and balanced deficit reduction.

About the January Jobs Report

Job growth moderated in January and the unemployment rate remained just below 8 percent, as it has for the past five months. (Payroll employment data have been revised back to January 2008 to reflect the annual benchmark adjustment for March 2012 and updated seasonal adjustment factors; unemployment and other household survey data for January 2013 reflect updated population estimates and are not directly comparable to earlier data, which have not been revised to incorporate those estimates.)

- Private and government payrolls combined rose by 157,000 jobs in January. Private employers added 166,000 jobs, while government employment fell by 9,000. Federal employment fell by 5,000 and local government employment fell by 6,000, while state government employment rose by 2,000.

- This is the 35th straight month of private-sector job creation, with payrolls growing by 6.1 million jobs (a pace of 175,000 jobs a month) since February 2010; total nonfarm employment (private plus government jobs) has grown by 5.5 million jobs over the same period, or 157,000 a month. Total government jobs fell by 606,000 over this period, dominated by a loss of 423,000 local government jobs. (These data reflect substantial upward revisions to November and December and incorporation of the new benchmark data for March 2012.)

- Despite 35 months of private-sector job growth, there were still 3.2 million fewer jobs on nonfarm payrolls and 2.7 million fewer jobs on private payrolls in January than when the recession began in December 2007. Despite job growth averaging 200,000 jobs a month over the past three months, the addition of just 157,000 jobs in January is well short of the 200,000 to 300,000 jobs a month that would mark a robust jobs recovery.

- The unemployment rate was 7.9 percent in January, and 12.3 million people were unemployed. In January, the unemployment rate was 7.0 percent for whites (2.6 percentage points higher than at the start of the recession), 13.8 percent for African Americans (4.8 percentage points higher than at the start of the recession), and 9.7 percent for Hispanics or Latinos (3.4 percentage points higher than at the start of the recession).

- Because they reflect the new population estimates, these unemployment data are not directly comparable to those from earlier years. Supplemental data in the January report show, however, that adjusting the December numbers would have had no effect on the unemployment rate and only a small effect on the number of unemployed. The official unemployment rate was been between 7.8 and 7.9 percent over the last four months of 2012 and the number of unemployed was been between 12.0 and 12.2 million.

- The recession and lack of job opportunities drove many people out of the labor force. The labor force participation rate (the share of people aged 16 and over who are working or actively looking for work) was 63.6 percent in January, about the same as its 63.7 percent average for 2012. Prior to this latest period, it had not been so low since the early 1980s.

- Using the unofficial adjusted numbers for December, the labor force rose by 7,000 in January, the number of people with a job fell by 110,000, and the number of unemployed rose by 117,000.

- The share of the population with a job, which plummeted in the recession from 62.7 percent in December 2007 to levels last seen in the mid-1980s and has remained below 60 percent since early 2009, was 58.6 percent in January, the same as its average in 2012. (Comparisons of these ratios are little affected by the new population estimates.)

- The Labor Department’s most comprehensive alternative unemployment rate measure — which includes people who want to work but are discouraged from looking (those marginally attached to the labor force) and people working part time because they can’t find full-time jobs — was 14.4 percent in January. That’s down from its all-time high of 17.1 percent in late 2009 (in data that go back to 1994) but still 5.6 percentage points higher than at the start of the recession. By that measure, roughly 23 million people are unemployed or underemployed.

- Long-term unemployment remains a significant concern. Almost two-fifths (38.1 percent) of the 12.2 million people who are unemployed — 4.7 million people — have been looking for work for 27 weeks or longer. These long-term unemployed represent 3.0 percent of the labor force. Before this recession, the previous highs for these statistics over the past six decades were 26.0 percent and 2.6 percent, respectively, in June 1983.

The Center on Budget and Policy Priorities is a nonprofit, nonpartisan research organization and policy institute that conducts research and analysis on a range of government policies and programs. It is supported primarily by foundation grants.