Amendment 4 Would Cost Florida Jobs, Raise Taxes on Year-Round Residents, and Force Cuts in Public Services

Amendment 4 would cost the state jobs and lead to both tax increases for large numbers of Florida residents and cuts in local services such as police and fire protection, according to a new report from the Center on Budget and Policy Priorities. The measure, on the Florida ballot in November, also would put new and emerging businesses at a competitive disadvantage while producing little if any economic benefit.

“In order to give a tax break to out-of-state investors and part-time residents, Amendment 4 would raise taxes on Floridians who live in the state year-round and force cuts to public services that full-time residents rely upon,” said Phil Oliff, author of the report and policy analyst at the Center. “And by sending big tax breaks out of state, it would cost Florida jobs.”

Amendment 4 would lock a deeply flawed set of property tax changes into the state’s constitution. It would reduce the taxable value of certain types of property, mainly properties that are not primary residences, including property owned by large corporations and part-time residents. The measure would:

- Raise taxes on many established, year-round residents. Under Amendment 4, local governments would have to raise property tax rates in order to preserve funding for local services such as fire and police protection. This would increase property taxes on those who benefit least from the measure — established, full-time homeowners — to cut taxes for part-time residents and out-of-state corporations.Image

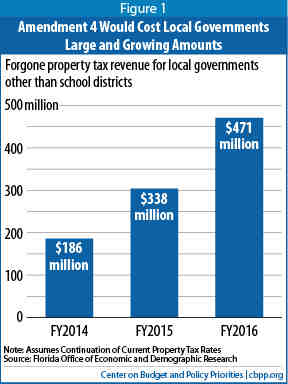

- Cause deep cuts in local services. To the extent that local governments don’t respond to Amendment 4 by raising property tax rates, they would have to make large — and growing — cuts to local services like police and fire protection. At current rates the local revenue loss from Amendment 4 would grow to $471 million by 2016 — the equivalent of 7,656 police officers at the state’s average annual police salary. Local government revenues are already down due to the recession. Local governments almost certainly would respond to Amendment 4 with a combination of tax rate increases and service cuts.

- Harm Florida’s economy. The tax cuts for non-residents and out-of-state corporations that would result from the measure would require offsetting tax increases or cuts in local services, or — the almost certain result — both. Both of these steps would take money out of Florida’s economy, hindering economic growth.

- Send millions of dollars in tax benefits out of state — costing Florida jobs. Much of the tax cuts from Amendment 4 would go to out-of-state shareholders in major corporations with Florida landholdings and owners of second homes who spend much of their time and money in other places. As a result, the net effect would be to cost Florida jobs, not create them.

- Hurt new and expanding businesses — important engines of job growth. Amendment 4 would ultimately place newer businesses at a competitive disadvantage by requiring them to pay more in property taxes than their more established competitors, even if the newer and more established businesses own identical properties. Tilting the playing field against newer businesses makes little economic sense.

“A small number of relatively new businesses create a disproportionate share of new jobs,” said Oliff. “Making those businesses pay more property taxes than their competitors will harm Florida’s future economic growth.”

Amendment 4 appears on the ballot alongside another measure that poses a serious threat to local services. Amendment 3 would place a severe limit on state revenue growth, and in so doing would very likely squeeze state aid to local governments. Because local governments get a substantial share of their funding from the state, such cuts could punch a large hole in local budgets, precipitating significant local service cuts and tax increases. Paired with the revenue loss from Amendment 4, the impact would be even more dramatic.

The full report, Florida’s Amendment 4 Would Cause Tax Rate Increases and Deep Local Service Cuts, Likely Harming the State’s Economy, is available at https://www.cbpp.org/cms/index.cfm?fa=view&id=3839.

The Center on Budget and Policy Priorities is a nonprofit, nonpartisan research organization and policy institute that conducts research and analysis on a range of government policies and programs. It is supported primarily by foundation grants.