- Home

- Senate And House GOP Leaders' Tax Propos...

Senate and House GOP Leaders' Tax Proposals Would Provide Windfall for Heirs of Largest Estates

But Would Let Child Tax Credit and Earned Income Tax Credit Improvements for 13 Million Working Families Expire

Senate and House Republican leaders are proposing to provide extremely large tax breaks averaging over $1 million per estate to the heirs of the biggest 0.3 percent of estates — that is, to the heirs of the richest three of every 1,000 people who die. The Senate and House leadership proposals each would do so by extending the lucrative estate-tax rules they extracted when Congress and the President enacted compromise tax-cut legislation at the end of 2010.

Specifically, the new Senate and House Republican proposals each would:[2]

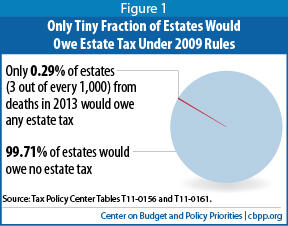

- Cost $119 billion more in forgone revenues over the next ten years than the Obama Administration proposal to reinstate the already generous 2009 estate-tax rules. Analysis by the Urban Institute-Brookings Tax Policy Center shows that all of the $119 billion would flow to the heirs of the estates of the wealthiest three of every 1,000 people who die, since those are the only estates that would owe any estate tax under the 2009 rules. (See Figure 1).

- Give taxable estates an average of more than $1.1 million each in tax reductions, compared to the tax that would be owed under a reinstatement of the 2009 estate-tax rules. The bigger the estate, the more lavish the tax break would be. Estates worth more than $20 million would receive an average tax reduction of $4.2 million in 2013.

For instance, a married couple with three children and earnings at the estimated poverty line for 2013 ($27,713) will receive $1,934 less in combined CTC and EITC benefits that year if policymakers do not extend the improvements in those tax credits. Meanwhile, many students will receive less federal financial assistance to attend college at a time when college costs continue to rise. (See box on page 3.)[5]

The Republican proposals comes at a time when the nation faces unsustainable long-term budget deficits and gaping income inequality. This proposal would make both problems worse.

To put the nation on a sustainable fiscal course, policymakers will face wrenching choices in the months and years ahead. Options being discussed include deep budget cuts that could squeeze funding heavily for areas from education and basic research to protecting the environment and the food and water supply and even national defense, as well as cuts that could reduce access to health care for low-income children and families and people who are elderly or have disabilities. Every dollar of additional tax cuts for the wealthiest estates will make these choices still more painful.

The 2009 estate tax rules already are very generous. The Tax Policy Center estimates that if policymakers reinstated the 2009 rules:

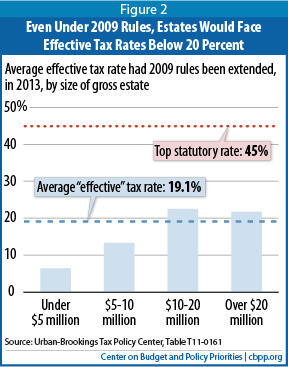

- The estates of 99.7 percent of Americans who die would owe no estate tax at all in 2013. (See Figure 1.) Only the estates of the wealthiest 0.29 percent of Americans who die — about 7,450 people nationwide in 2013 — would owe any tax. Moreover, under the 2009 rules, the small number of estates that were taxable would face an average effective tax rate of 19.1 percent, far below the statutory estate-tax rate of 45 percent. In other words, 81 percent of the value of these estates would remain after the tax, on average. An estate tax that exempts the estates of 997 of every 1,000 people who die and leaves in place an average of 81 percent of the very wealthiest estates is hardly a confiscatory or oppressive tax.

- Moreover, only 60 small farm and business estates in the entire country would owe any estate tax in 2013, under a reinstatement of the 2009 rules, and these estates would face an average effective tax rate of just 11.6 percent.

Proposal Prioritizes Wealthiest People over Low- and Moderate-Income Working Families

The Senate Republican proposal would extend the 2010 legislation’s estate-tax parameters, which benefit only a small group of very large estates. The proposal would also extend all of President Bush’s income-tax cuts, which provide an average tax cut of about $129,000 per year to people with incomes over $1 million according to the Tax Policy Center.a

Yet the Senate Republican proposal fails to extend tax-credit improvements included in the same 2010-tax legislation that help millions of low-and moderate-income working families and students. Policymakers first enacted those improvements — to the Child Tax Credit (CTC), the Earned Income Tax Credit(EITC), and the American Opportunity Tax Credit — in the 2009 Recovery Act. The 2010 legislation extended them through 2012.The Institute on Taxation and Economic Policy estimates:b

- Failure to extend the CTC improvements — worth more than $800 on average per affected family — would affect 8.9 million working families (with 16.4 million children) in 2013.

- Failure to extend the EITC improvements — worth more than $500 on average per affected family — would affect 6.5 million working families (with 15.9 million children) in 2013.b

If the CTC and EITC improvements enacted in 2009 and extended in 2010 expire, a single mother with two children working full time at the minimum wage — and earning about $14,000 — will receive a CTC of $173 in 2013 — instead of $1,725. A married couple with three children with earnings equal to the estimated 2013 poverty line ($27,713) will receive $1,934 less in EITC and CTC benefits combined.

In addition, ending the American Opportunity Tax Credit improvements will mean that many students will face a reduction in federal financial assistance even as college costs continue to rise. (The Treasury Department estimates that failure to extend all of the refundable credit improvements in the 2010 legislation -- including American Opportunity Tax Credit improvements that helps defray a portion of higher education costs as well as the EITC and CTC improvements — would affect 25 million families with incomes below $250,000.c) .

It should be noted that the estate-tax windfall for the wealthiest estates was enacted in 2010 only as part of a compromise that also extended these tax-credit improvements for low- and moderate-income working families and students (and also boosted workers’ take-home pay through a payroll-tax cut and extended federal unemployment benefits for the long-term unemployed). In the 2010 negotiations, the Obama Administration initially rejected the big estate-tax reduction. It relented when Republican negotiators effectively took hostage the extensions of the tax-credit improvements for low- and moderate-income families and made clear they would block those extensions unless the estate-tax giveaway for the wealthiest 3/10 of 1 percent of estates was added to the package. d

Now, Senate Republican leaders are seeking to extend the estate-tax giveaway for the wealthiest Americans while terminating the tax-credit improvements for working-poor and near-poor families and students.

aTax Policy Center table T10-0132.

bInstitute on Taxation and Economic Policy Tax Model, July 2012, Citizens for Tax Justice, “The Debate over Tax Cuts: It’s Not Just About the Rich,” July 19, 2012. http://ctj.org/ctjreports/2012/07/the_debate_over_tax_cuts_its_not_just_about_the_rich.php.

cNational Economic Council, “The President’s Proposal to Extend the Middle Class Tax Cuts,” July 2012.

dGillian Brunet and Chuck Marr. “Unpacking the Tax Cut-Unemployment Compromise,” Center on Budget and Policy Priorities, December 10, 2010, https://www.cbpp.org/cms/index.cfm?fa=view&id=3342.

Estate Tax Weakened Considerably Between 2001 and 2009

The 2001 tax-cut legislation shrunk the estate tax dramatically between that year and 2009. By 2009, the first $3.5 million of the estate of an individual — effectively, the first $7 million for a couple — was exempt entirely from the tax. This was up from an exemption of $1 million for individuals (effectively $2 million for couples) under the pre-2001-law estate-tax rules.

A tax that had affected only the largest 2 percent of estates in 2001 touched fewer than three-tenths of 1 percent of estates by 2009. And by 2009, the tax rate applied to the portion of an estate’s value that exceeded the exemption level had declined to 45 percent, down from 55 percent under the prior law.

Due to the peculiarities of the 2001 tax-cut law, the estate tax expired altogether for one year in 2010, but was then scheduled to return in 2011 under the pre-2001 rules, with an individual exemption of $1 million and a top rate of 55 percent. That was forestalled by the tax-cut compromise enacted in December 2010 (P.L. 111-312), which temporarily raised the exemption level to $5 million for individuals (effectively $10 million for married couples), and lowered the statutory marginal tax rate to 35 percent, for 2011 and 2012.

In 2013, the estate tax is again scheduled to return to the levels prescribed under the pre-2001 law, but that outcome is certain not to occur; policymakers will not allow it. Hence, policymakers must decide where to set the estate-tax parameters for the years ahead. These decisions are coming at a time when policymakers face the most painful budgetary choices in modern American history.

The 2009 Rules

Under the 2009 estate-tax rules, very few estates would owe any estate tax. The Tax Policy Center estimates that 7,450 estates nationwide — the estates of 0.29 percent of people who die — would owe any estate tax in 2013, if the 2009 levels were reinstated. Some 99.71 percent of estates would be passed on to heirs tax-free.

As a result, the estates of 99.71 percent of people who die would receive no tax benefit from extending the lucrative estate-tax break enacted in 2010 because they would owe no estate tax anyway.[6]

Moreover, the small number of estates that would benefit from an extension of the 2010 estate-tax break would not owe particularly high taxes even under the 2009 rules. Because the estate tax applies only to the value of the estate that exceeds the exemption level — and because of other tax breaks built into estate tax law — the effective tax rates faced by estates that are taxable are generally much lower than the statutory estate-tax rate.

The above two points — that few estates would owe any tax under the 2009 rules and that taxable estates would pay relatively low rates — are even more pronounced insofar as small businesses and farms are concerned. Despite rhetoric from estate-tax opponents portraying small businesses and farms as being severely burdened by the estate tax, only 60 small farm and business estates in the entire country would owe any estate tax next year under the 2009 rules, TPC estimates.[9]

Furthermore, due to a number of special provisions targeted to farm and business estates, taxable small business and farm estates face lower effective tax rates than do other estates, whether under the 2009 rules or the current rules. If the 2009 rules were reinstated, the tiny number of small business and farm estates that would owe any tax at all would face an average effective tax rate of 11.6 percent in 2013, well below even the capital gains tax rate.[10]

Without the Estate Tax, Substantial Amount of Income Would Go Untaxed

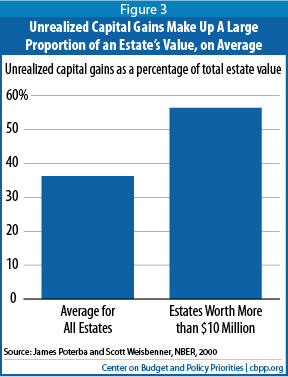

A common misconception about the estate tax is that all of the assets it affects have already been taxed. This is incorrect. A substantial proportion of most taxable estates consists of unrealized capital gains — i.e., investment income that has never been taxed. This is particularly true for very large estates. Another common misconception is that heirs pay income tax on the value of the estates they receive; they do not.

Estate Tax Serves as Backstop to Capital Gains Tax

Generally, when an investor sells an asset for more than it was worth when the investor acquired it (which generally is the amount that the investor paid for it), the increase in the asset’s value is counted as income and taxed as a capital gain. If the investor has held the investment for long enough (generally 18 months), the gain is taxed at a substantially reduced rate, currently 15 percent for taxpayers who are in an income-tax bracket higher than the 15-percent bracket.

Moreover, suppose Mr. Jones’ daughter inherits the stock, and that by 2012, it is worth $1,200. If she decides to sell the stock in 2012, she will owe capital gains taxes on only the $200 capital gain between 2009 and 2012 — not on the full $1,100 growth in the stock’s value since her father’s original purchase.

Unrealized capital gains account for a significant proportion of the assets held by taxable estates — a little more than one-third, according to a study by economists James Poterba and Scott Weisbenner.[11] For the largest estates, the proportion is higher: 56 percent of the value of estates worth more than $10 million comes from unrealized capital gains. (See Figure 3.)

Thus, the estate tax plays an important role as a backstop to the capital gains tax. In the example above, the appreciation in value of Mr. Jones’ stock is not subject to capital gains tax when he dies (because he did not sell the stock), but the stock (at its $1,000 value) may be taxed as part of Mr. Jones’ estate if the estate is large enough to be subject to the estate tax.

If there were no estate tax, unrealized capital gains would never be taxed. Among other things, that would create an incentive for people to avoid taxes by retaining capital gains until death, discouraging them from allocating their capital in the most economically efficient ways.

This backstop function is especially important because the estates large enough to owe estate tax hold a disproportionate share of all unrealized capital gains. In 2006, the wealthiest 0.3 percent of households received 61 percent of capital gains income, according to TPC.[12]

Heirs Pay No Income Taxes on Bequests They Receive

Another common misperception is that heirs pay income taxes on the portion of the estate that they inherit. In reality, bequests are not subject to the income tax; the estate is subject to the estate tax, after which each heir receives his or her share of the estate without paying any further taxes on it.

This is a very good deal for the vast majority of estates, which are passed on tax-free. It’s also a good deal for most estates subject to the estate tax, because the effective tax rate on the estate is lower than what most heirs would pay if their inheritances were taxed as income.

Current Rules Provide Large and Unnecessary Windfalls — Especially to the Biggest Estates

Only the wealthiest 1 in 350 estates would benefit from an extension of the current lower estate-tax rate and more generous exemption level, compared to the Administration’s proposal, since they are the only estates that would owe any tax under a reinstatement of the 2009 rules. Office of Management and Budget estimates show that, over the decade from 2013 to 2022, extending the current rules would cost about $119 billion more (in forgone revenues) than reinstating the tax at its 2009 level. (This figure does not include the cost of the additional interest payments on the debt; when those payments are taken into account, the effect on deficits is even larger.) As noted, all of the $119 billion would go to benefit the wealthiest 0.29 percent of estates, which would get an average tax-cut windfall of more than $1.1 million apiece.[13] The largest estates — those worth more than $20 million — would benefit most handsomely, receiving an average tax-cut benefit of nearly $4.2 millionapiece.

Large Estates Also Benefit from Gift Tax Reunification

The 2010 legislation that set the current estate tax rules also included a change in the gift tax that will benefit large estates in particular. The gift tax, whose rate is equal to the estate tax rate, is levied on gifts from one individual to another that total more than a certain amount (an amount known as the “annual gift exclusion”) in any given calendar year. The gift exclusion is $13,000 in 2012.

For assets whose value grows over time, transferring them as gifts during the giver’s lifetime — rather than waiting to transfer them through the estate upon the giver’s death — can allow wealthy owners to transfer assets while they have a lower value. This can produce considerable tax savings, especially if the asset is gifted a decade or more before a wealthy giver’s death.

Individuals may exempt from the gift tax a certain amount of gifts given over their lifetime in excess of the annual gift exclusion. Prior to 2001, there was a single, combined lifetime exemption amount for the estate tax and gift taxes — in other words, individuals had a single amount that they could divide between gifts (in excess of the annual gift exclusion) given tax-free during their lifetime and assets transferred tax-free through their estate after their death. Any exemption amount not used for the gift tax could be used for the estate tax.

When Congress sharply limited the estate tax as part of the 2001 tax legislation, it decoupled the gift tax exemption (which remained at $1 million) from the estate tax-exemption (which increased gradually, to $3.5 million by 2009). This allowed individuals $1 million in lifetime gifts that were exempt from the gift tax, which counted toward the $3.5 million that could be bequeathed tax-free through an estate.

The 2010 tax legislation, however, reunified the estate and gift tax exemptions for 2011 and 2012 — at a $5 million level.[14] This means that individuals can now transfer $5 million tax-free through a combination of the gifts they give during their lifetime and the estate they leave at death.

This sharp increase in the gift-tax exemption is of particular value to the wealthiest individuals. People whose estates are only modestly larger than $5 million presumably will be less likely to take full advantage of this change, because doing so might make it more difficult for them to retain assets they wish to keep through the end of their lives. But people who expect to have estates worth $15 or $20 million or more can maximize their tax benefit from this change by gifting assets (while they are still alive) that are likely to appreciate in value quickly. By doing so, they will use up less of their $5 million exemption than if they let rapidly appreciating assets continue to grow for a number of years and then transfer those assets as part of their estate.

Another reason that the increase in the lifetime gift exemption is particularly useful to very wealthy individuals relates to the $13,000 annual gift exclusion. Consider Mr. and Mrs. Brown, a wealthy married couple with two children, Katie and John, both of whom are married. Every year, Mr. and Mrs. Brown can each give an amount up to the annual gift exclusion to each child and each child’s spouse, all tax-free. So in 2012, the Browns (between them) can give $26,000 to Katie and another $26,000 to Katie’s husband, for a total of $52,000. They can do the same for John and his wife. In total, that’s $104,000 that they can transfer to their children’s families without triggering the gift tax or using any of their exemption. If Mr. and Mrs. Brown expect to live for at least another ten years, they can plan on transferring more than $1 million tax-free without using any of their lifetime gift tax exemption, thereby reducing the amount of their assets that may ultimately be subject to the estate tax.

While death may be certain, its timing is not. Most individuals who expect to live at least several more years have little incentive to make gifts that exceed the annual gift exclusion, since they presumably will be able to gift additional amounts in future years without using up any of their exemption. Because of this, most people are unlikely ever to use up their full gift-tax exemption. In contrast, people who expect to have particularly large estates can gift up to the annual gift exclusion each year and also give gifts far beyond that amount that consist of more rapidly appreciating assets, thereby using the change in gift tax rules to further shrink their tax obligations. Returning the estate tax to its 2009 rules would avert the additional revenue losses that would result from extending the weakening of the gift tax that was included in the 2010 tax-cut legislation.

Current Estate Tax Rules Are Unaffordable

The current estate tax rules not only provide unnecessary largesse to the nation’s wealthiest estates but are quite costly. The Congressional Budget Office estimates that the cost of continuing the current estate-tax rules, as compared to allowing the pre-2001 rules to take effect as scheduled in January 2013, is $432 billion over the next ten years. (This does not include the additional interest costs.) Office of Management and Budget estimates show that reinstating the 2009 estate-tax rules would cost $119 billion less over ten years than extending the current rules.

Providing more than $100 billion in tax windfalls to the largest three out of 1,000 estates would be difficult to justify in the best of times. It would be particularly egregious in the current fiscal climate, when policymakers are starting to make substantial cuts in a range of government functions and are talking of deep cuts in areas ranging from education to infrastructure to Medicare to programs that help the poorest Americans meet basic necessities or have a better chance at lifting themselves out of poverty. And for some policymakers to propose providing this lavish tax windfall to the wealthiest Americans at the same time that they are proposing to allow tax credits for struggling working-poor and near-poor families with children to expire is all the more remarkable.

End Notes

[1] This is an update of a paper originally authored by Gillian Brunet.

[2] Senators Hatch and McConnell offered the proposal as an amendment (SA 2497) to the bill S. 2237 on July 10, 2012, http://www.gpo.gov/fdsys/pkg/CREC-2012-07-10/pdf/CREC-2012-07-10-pt1-PgS4825-2.pdf#page=5. They also introduced the proposal as part of S.3413, the Tax Hike Prevention Act of 2012. Representative Camp on July 24, 2012 has offered H.R. 8, the Job Protection and Recession Prevention Act of 2012, which has the same estate tax and refundable credit provisions as the Senate proposal.

[3] Tax Policy Center Tables T11-0161 and T11-0160.

[4] National Economic Council, “The President’s Proposal to Extend the Middle Class Tax Cuts,” July 2012.

[5] Institute on Taxation and Economic Policy Tax Model, July 2012, Citizens for Tax Justice, “The Debate over Tax Cuts: It’s Not Just About the Rich,” July 19, 2012, http://ctj.org/ctjreports/2012/07/the_debate_over_tax_cuts_its_not_just_about_the_rich.php.

[6] Tax Policy Center tables T11-0156 and T11-0161, June 2, 2011.

[7] Tax Policy Center table T11-0161.

[8] Tax Policy Center table T11-0160.

[9] Tax Policy Center table T11-0161. We follow the Tax Policy Center definition of a small business or farm estate as one in which more than half of the value of the estate is in a farm or business and the farm or business assets are valued at up to $5 million.

[10] Id.

[11] James Poterba and Scott Weisbenner, “The Distributional Burden of Taxing Estates and Unrealized Capital Gains At the Time of Death,” NBER, July 2000, p. 19.

[12] Eric Toder, “Who Pays the Capital Gains Tax?,” Tax Notes, August 4, 2008, http://www.taxpolicycenter.org/UploadedPDF/1001201_Capital_gains_tax.pdf.

[13] Tax Policy Center tables T11-0156 and T11-0161.

[14] The exemption was indexed for inflation from 2011 and stands at $5.12 million in 2012.

More from the Authors