Blog Post: Another Quarter-Million for Millionaires Under Ryan Tax Plan

Receive the latest news and reports from the Center

Our new report shows that House Budget Committee Chairman Paul Ryan’s tax plan would provide $265,000-a-year tax cuts to the nation’s highest-income households. Here’s an excerpt:

Even as House Budget Committee Chairman Paul Ryan’s budget would impose trillions of dollars in spending cuts, 62 percent of which would come from low-income programs, it would enact new tax cuts that would provide huge windfalls to households at the top of the income scale. New analysis by the Urban-Brookings Tax Policy Center (TPC) finds that people earning more than $1 million a year would receive $265,000 apiece in new tax cuts, on average, on top of the $129,000 they would receive from the Ryan budget’s extension of President Bush’s tax cuts. . . .

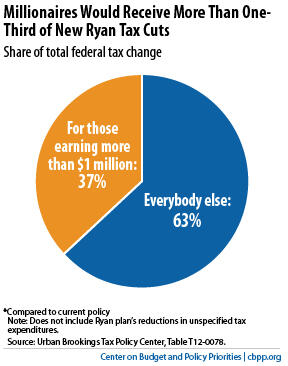

Underscoring how tilted the proposal is toward the top, the TPC figures show that people making more than $1 million a year would receive 37 percent of the new Ryan tax cuts even though they constitute less than one-half of one percent of U.S. households (see graph).

Click here for the full report.