- Home

- How The Potential Across-the-Board Cuts ...

How the Potential Across-the-Board Cuts in the Debt Limit Deal Would Occur

The debt limit deal enacted on August 2 calls for about $900 billion in cuts in discretionary programs over the next decade and would impose further automatic, across-the-board spending cuts in many programs if Congress fails to enact an additional $1.2 trillion in deficit-reduction measures by January 15, 2012. Those across-the-board cuts would first take effect in January 2013, a year later than many people have mistakenly believed, and would represent approximately a 9 percent annual cut in affected non-defense programs, along with roughly a 9 percent cut in defense programs in 2013. (Reports that the percentage cut would be significantly higher in defense than in affected non-defense programs also are mistaken.) This report outlines how the 2013 cuts would occur. Cuts would also occur in the next eight years, 2014-2021.

Background: Main Elements of the Legislation

The new Budget Control Act, which implements the debt limit deal:

- raises the debt limit by at least $2.1 trillion (in steps), which is currently estimated to be sufficient through early 2013;

- establishes binding limits or "caps" on annual appropriations bills (which cover "discretionary" — or non-entitlement — programs such as defense, education, national parks, the FBI, the EPA, low-income housing assistance, medical research, and many others); the caps reduce projected funding for these programs by somewhat about $900 billion through 2021, relative to the existing 2011 funding levels adjusted for inflation;

- requires the House and Senate to vote this fall on an amendment to the Constitution that would require a balanced budget every year;

- establishes a Joint Select Committee to draft, vote on by November 23, and report by December 2 of this year, legislation that would reduce projected deficits by at least an additional $1.5 trillion through 2021 beyond the $900 billion generated by the discretionary caps, and creates a fast-track process for Congress to consider the Committee's bill without any amendments; and

- provides for automatic, across-the-board budget cuts in many programs if Congress fails to enact Joint Select Committee proposals achieving at least $1.2 trillion in deficit reduction over the next ten years. (The automatic cuts would be triggered if the Committee does not report the required legislation, if Congress defeats the legislation, if the President vetoes the legislation and the veto is sustained, or to the extent the legislation is enacted but reduces ten-year deficits by less than $1.2 trillion.) Those automatic cuts are known as "sequestration."

The Joint Committee can recommend any kind of deficit-reduction measures it wants: further cuts in the new discretionary caps, cuts in any entitlement program, and tax increases of any kind. There may be severe political constraints, but there are no legal constraints, contrary to what some congressional leaders are claiming.[1]

The debt limit increases whether or not Congress enacts the Joint Committee's bill or approves the Constitutional Balanced Budget Amendment. [2] Also, congressional approval of the Constitutional Balanced Budget Amendment would not eliminate the automatic sequestration that would occur if Congress fails to meet the $1.2 trillion target for additional savings.

How the 2013 Sequestration Would Work

If the Joint Committee process results in the enactment of less than $1.2 trillion in deficit reduction through 2021, the sequestration would generate sufficient savings to reach a total of $1.2 trillion over that period. (These budget cuts are in addition to the $900 billion in cuts generated by the enactment of discretionary caps as part of the Budget Control Act). If Congress enacts no deficit reduction, the sequestration would therefore be $1.2 trillion through 2021. For simplicity, we assume that result.

- Although the Joint Committee and Congress are supposed to consider legislation this year, the program cuts that would result from a failure to enact sufficient savings would first take effect in January 2013, a full year later.

- Under the formula that the Budget Control Act specifies, defense programs would be cut by a total of $54.7 billion each year from 2013 through 2021, with non-defense programs cut by the same amount. Together, these program cuts total $109.3 billion per year, or $984 billion through 2021. Although this is less than the $1.2 trillion target specified for the Joint Committee, the savings in interest payments that the sequestration would produce (which is estimated at $216 billion using a ratio specified in the legislation) would count toward the $1.2 trillion target. [3]

- The $54.7 billion in annual non-defense cuts would come from both mandatory (entitlement) and discretionary programs. The mandatory cuts would include:

- Cuts in Medicare payments to providers and insurance plans (those cuts are limited to 2 percent of such payments in any year, or about $10.8 billion in 2013).

- About $5.2 billion in cuts in the other mandatory programs that are subject to sequestration, the biggest of which is farm price supports. A number of key mandatory programs are exempt from sequestration, including Social Security, Medicaid, CHIP, SNAP (formerly known as the Food Stamp Program), child nutrition, Supplemental Security Income (SSI), refundable tax credits such as the Earned Income Tax Credit, veterans' benefits, and federal retirement.[4]

Thus, in 2013 about $16.1 billion of the $54.7 billion in annual non-defense cuts would come from mandatory programs. This share would grow from year to year, reaching $22 billion by 2021.

- The remaining non-defense cuts — about $38.6 billion in 2013 — would come from discretionary programs:

- For fiscal year 2013, the non-defense cuts would occur through across-the-board, proportional reductions in new funding for each discretionary program in the appropriations bills for the fiscal year, which Congress would already have enacted. (Veterans' medical care and Pell grants would be exempt from those cuts.)[5]

- For fiscal years 2014 through 2021, the cuts would occur through reductions in the statutory cap on total funding for non-defense discretionary programs for each of those years. The Appropriations Committees would then decide how to live within those newly reduced caps.

The $38.6 billion reduction in the non-defense discretionary caps would shrink from year to year, to $33 billion by 2021, because the mandatory cuts would grow and thus would account for somewhat more each year of the $54.7 billion in total non-defense cuts.

- A defense sequestration of $54.7 billion would be imposed in a similar manner. For 2013, the defense cuts would occur through across-the-board, proportional reductions in the funding provided in the appropriations bills including funding for war costs, and also including unobligated balances carried over from prior years. For 2014-2021, the cuts would occur through reductions in the statutory caps on total defense funding, with the Appropriation Committees deciding how best to allocate the allowed funding.

In 2013, the one year in which the cuts would affect already appropriated defense funding, the President can exempt some or all military personnel funding from the sequestration. To the extent he chooses that option, the cuts in other defense funding would increase.

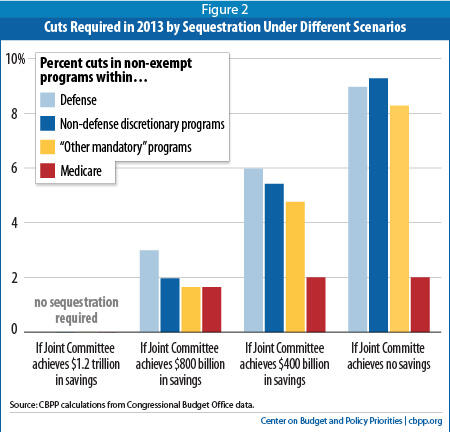

Our calculations show that a non-defense sequestration of $54.7 billion in 2013 would result in cuts of approximately 9.3 percent in non-exempt discretionary programs and 8.3 percent in non-exempt mandatory programs, as well as the 2 percent maximum cut in Medicare provider payments the law allows. A defense sequestration of $54.7 billion also would represent a cut of about 9.0 percent in defense programs, including war funding and unobligated balances, if military personnel funding is exempt from sequestration, and about a 7 percent cut if it is not exempt.

| TABLE 1: Sequestration in 2013 if appropriations match 2013 caps and Joint Select Committee process does not produce any further deficit reduction.1 (Dollars in billions) | |||

| Resources before sequestration | Sequestration | ||

| Dollar reduction | Percent reduction | ||

| Defense | $746 | $54.7 | |

| Military personnel funding, assumed to be exempt (est.) | 136 | 0 | 0.0% |

| Other non-war funding for 2013 | 410 | 36.7 | 9.0% |

| Subtotal, amount subject to caps | 546 | ||

| War funding, outside of caps (estimated) | 110 | 9.9 | 9.0% |

| Unobligated balances from prior years (estimated) | 90 | 8.1 | 9.0% |

| Non-defense Discretionary (NDD) programs | 501 | 38.6 | |

| Non-exempt programs | 415 | 38.5 | 9.3% |

| Veterans health and Pell grants, exempt (estimated) | 80 | 0 | 0.0% |

| Health centers and Indian Health, 2% limit (estimated) | 6 | 0.1 | 2.0% |

| Non-exempt mandatory programs | 605 | 16.1 | |

| Medicare payments to providers and plans, 2% limit | 542 | 10.8 | 2.0% |

| Other non-exempt mandatory programs | 63 | 5.2 | 8.3% |

| 1 The percentage cut in non-exempt NDD funding of 9.3 percent is deeper than the percentage cut in non-exempt mandatory funding of 8.3 percent. The two percentages would be identical if the basic sequestration had been allocated proportionally across all non-exempt programs, and if the additional cuts needed to offset the effect of the 2 percent limit on the sequestration of some health programs had also been allocated proportionally across all other non-exempt programs. But the Act does not work that way. To begin with, the 2 percent limit on the cut to health centers and Indian health is offset only by increasing the cut to NDD programs. More importantly, the exemption of Pell grants and VA medical care from sequestration must be offset entirely by deeper cuts in other NDD programs. Thus, non-exempt mandatory programs do not help offset the exemption for Pell grants and VA medical care nor the 2 percent limit on the cut to health centers and Indian health. (In contrast, the Act specifies that the 2 percent Medicare limit is offset by deeper cuts to both non-exempt mandatory programs and non-exempt NDD programs, and so does not contribute to a difference in the sequestration percentages that apply to those two categories of non-exempt programs.) | |||

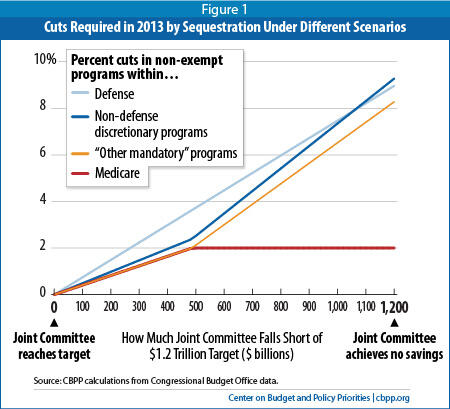

This memorandum and Table 1 show the automatic cuts that would occur if the Joint Select Committee process achieves no savings. As noted, if that process achieves some but not all of the targeted $1.2 trillion in savings, the dollar and percentage sequestrations would accordingly be smaller than shown in the table. Figure 1 below shows how the percentage cuts rise from zero up to the levels shown in the table as the Joint Committee shortfall grows.

Of note, using CBO estimates of sequestrable mandatory programs, we calculate that the overall mandatory cut reaches 2 percent – after which the Medicare cut does not grow – when the Joint Committee falls short of its $1.2 trillion target by $486 billion, i.e., if it achieves no more than $714 billion in savings, counting interest.

Shown another way, Figure 2 on page 6 illustrates the percentage cuts in each program category under four possible outcomes of the Joint Committee's deliberations.

Why Our 2013 Figures Differ from CBO's

We use CBO's estimates of 2013 mandatory funding that is subject to sequestration, from CBO's September 12 report, op cit. Nevertheless, in that report CBO portrays different percentage cuts from those in the table on page 4. CBO treats the 2013 sequestration base as though it were the $546 billion cap level for defense and the $501 billion cap level for non-defense discretionary programs; CBO does not take into account funding outside the caps that is subject to sequestration (war funding and defense unobligated balances) or funding within the caps that is exempt from sequestration (VA medical care, Pell grants, and potentially Military Personnel) or subject to a 2% limit (health centers and Indian health). In effect, CBO portrays the 2013 reductions as though they were the effect of cap reductions rather than sequestration of actual appropriations bills. This allows CBO's 2013 figures to be comparable to it 2014-2021 figures, which are in fact required by the Act to be cap reductions, but it oversimplifies the likely 2013 effects on non-exempt programs if they are funded at plausible levels.

End Notes

[1] See James R. Horney, "Contrary to Speaker Boehner's Claim, Budget Deal's 'Supercommittee' Can Consider Revenue Increases," Center on Budget and Policy Priorities, August 1, 2011.

[2] The debt limit increase would be $2.4 trillion rather than $2.1 trillion if Congress approves the Balanced Budget Amendment or if the Joint Committee's bill saves at least $1.5 trillion through 2021 and is enacted.

[3] In a recent memorandum, the Congressional Budget Office estimates that a sequestration of the size assumed in this report would actually reduce interest payments by $169 billion over ten years; CBO assumes lower interest rates than the drafters of the budget deal. See Estimated Impact of Automatic Budget Enforcement Procedures Specified in the Budget Control Act, CBO, September 12, 2011, at http://www.cbo.gov/ftpdocs/124xx/doc12414/09-12-BudgetControlAct.pdf .

[4] The exemptions occur because the Budget Control Act is drafted as a portion of the Balanced Budget and Emergency Deficit Control of Act of 1985 (BBEDCA), which contains a list of exemptions in section 255 and a list of special rules in section 256. Those two provisions of BBEDCA were most recently updated by the Statutory PAYGO Act of 2010, and are not changed in any way by the Budget Control Act.

[5] While not exempt from sequestration, funding for community and migrant health centers and for Indian health services and facilities cannot be cut more than 2 percent. For non-defense appropriations, "new funding" means new budget authority and includes advance appropriations that first become available for obligation in 2013. The term does not include unobligated balances carried over from prior years. If a part-year "continuing resolution" is in place at the time of the January 2013 sequestration, the sequestration is calculated as though that legislation extended for the entire fiscal year, and the cuts continue to apply when the temporary continuing resolution is replaced by year-long funding.