- Home

- Federal TANF Funding Shrinking While Nee...

Federal TANF Funding Shrinking While Need Remains High

With unemployment high and millions of families in need, for the first time since 1996 when President Clinton and Congress created the Temporary Assistance for Needy Families (TANF) block grant as part of welfare reform, no additional TANF funds are available from the federal government to help states respond to the large increases in the number of impoverished families as a result of a recession.

Consequently, with the need for emergency and temporary assistance (including help finding work) at their highest levels in decades, more low-income parents will go without jobs, more homeless families will go without shelter, fewer low-wage workers will receive help with child care expenses, and fewer families involved with the child welfare system will receive preventive services.

The federal cut-off in recession-related help to states is due to two factors. First, legislation was recently enacted that will essentially end funding for fiscal year 2011 for the TANF Contingency Fund, which was specifically created in welfare reform to help states respond to increased need during hard economic times. Second, Congress failed to extend the TANF Emergency Fund, which was created in the 2009 Recovery Act to help families weather the current downturn, but which expired on September 30. Aggravating these problems, the 17 states that have received Supplemental Grants every year since TANF was created (most of them relatively poor states) will see those grants cut by 33 percent this year, unless Congress provides additional funding to restore them to their original level.

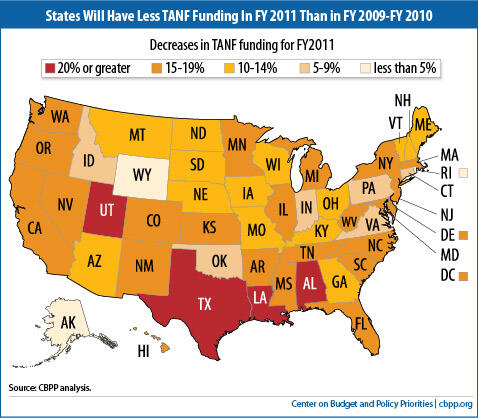

Due to these factors, states will have an average of 15 percent less federal TANF funding in fiscal year 2011 to help low-income families with children than they had on average in each of fiscal years 2009 and 2010, even though unemployment remains extremely high and record numbers of families are unable to meet basic needs such as housing and food.

The economic context in which these TANF cuts have come is striking: unemployment stands at 9.8 percent and is expected to remain roughly at or near this level for the foreseeable future; there is only one job opening for every four to five people looking for work; more than 40 percent of the 15 million unemployed Americans have been looking for work for more than half a year, one of the highest such percentages in the last 60 years; [1] the number of people in deep poverty (with incomes below half the poverty line) reached a record 19 million in 2009, up 2 million from 2008;[2] and the number of families who were homeless and spent some time in a shelter increased by 30 percent between 2007 and 2009.[3]

These TANF reductions come as states face large budget gaps. States closed $125 billion in shortfalls for fiscal year 2011 (which began July 1 in most states), and a number of states are already facing mid-year shortfalls; budget gaps for 2012 are likely to be even larger. [4] In developing their 2011 budgets, a number of states counted on an extension of the TANF Emergency Fund, as the House of Representatives had twice passed such an extension. Moreover, states that receive Supplemental Grants — which Congress has always fully funded — counted on these funds continuing fully in 2011. Now that states will receive less funding than they anticipated, some of them are already considering substantial cuts to programs for low-income families with children, including services to families at risk of entering the child welfare system, child care subsidies for working parents, and services to help address substance abuse, caring for a disabled child, and other challenges.

All States But One Will Be Subject to the Federal Funding Reduction

All states except Wyoming (which did not receive funding from the Supplemental Grants, Contingency Fund, or Emergency Fund) will experience some reduction in federal TANF funding this fiscal year, although some states will be hit harder than others (see Table 1). Some 28 states will experience a funding decline of 15 percent or greater, and four of these states will be subject to a reduction of 20 percent or greater. (see map)

Among the states hit hardest are those that have faced higher-than-average unemployment rates and significant state budget shortfalls.

For example:

- South Carolina and Oregon will both receive 16 percent less in federal TANF funding in 2011 than in 2009 and 2010. Oregon is facing an unemployment rate of 10.6 percent and had a biennial budget gap equal to 34 percent of its 2009-2011 budget. South Carolina has an unemployment rate of 11.0 percent and had a budget gap equal to 25.6 percent of its 2011 budget.

- Nevada, which is facing 14.4 percent unemployment and had a 2011 budget gap equal to 54 percent of its budget, will receive 17 percent less in federal TANF funding in 2011 than its average annual level for 2009 and 2010.

New Legislation Reduces Contingency Fund and Supplemental Grants

When it created the TANF block grant in 1996, Congress also created the TANF Contingency Fund and TANF Supplemental Grants to address some of the risks and hardships states would face as a result of the conversion of the former Aid to Families with Dependent Children program (an entitlement whose funding rose automatically in recessions) to a block grant with a fixed federal funding level. Over one-third of the states have relied on the Contingency Fund to help them respond to increases in need during the current economic downturn. Some 17 states qualify for Supplemental Grants, which were provided to states disadvantaged by the process used to determine the amount of funding each state would receive.

In recent weeks, Congress passed legislation extending the TANF block grant for the remainder of fiscal year 2011 and the President signed the legislation into law onto December 8, 2010. (Congress had previously extended the block grant through December 3 in the continuing resolution enacted in September and then extended it again through December 18.) The 2011 TANF extension contains two reductions in TANF funding that states received in past years:

- The new legislation eliminates funding for the Contingency Fund for the remainder of fiscal year 2011. The Contingency Fund was exhausted in fiscal year 2010; Congress appropriated a new $506 million for the fund for fiscal year 2011 and $612 million for fiscal year 2012 in the continuing resolution enacted in September. The recent legislation that extended TANF rescinded the balance of the 2011 amount and instead provided funding for 2011 only for the amount obligated through the date of enactment of the TANF extension.[5] Since Contingency Funds are given to states on a month-by-month basis, HHS awarded Contingency Funds in the amount of $334.2 million to 21 states through December 2010. No further contingency funds will be available to any state for the remainder of the fiscal year. [6]

Congress created the Contingency Fund as part of the 1996 TANF law because the conversion of what had been an entitlement program, in which federal funding rose during recessions as caseloads rose, into a block grant with a fixed federal funding level created a need for a funding mechanism to provide additional resources to states when need rose substantially. The $2 billion that Congress provided for the Contingency Fund lasted for a considerable period of time and provided an important source of funding during the 2007-2009 recession, as 19 states received $1.3 billion from the fund (see Table 3). [7] But the fund was exhausted in December 2009. - The new legislation extends the Supplemental Grants only through June rather than through the end of the fiscal year on September 30. However, the funding allocated in the legislation is not sufficient to cover the costs of the Supplemental Grants even through June 30, 2011. The new legislation allocates a maximum of $490 million to cover the costs of the Contingency Fund grants awarded to states before the bill is enacted (for October – December 2010 as long as the bill is enacted before the end of the year) and the Supplemental Grants from December 4, 2010 through June 2011. (The continuing resolution enacted in September covered the costs of the Supplemental Grants through December 3, 2010.) Since HHS has already awarded $334 million in Contingency Funds, only $163 million remains — $20 million less than is needed to cover the cost of the Supplemental Grants through June 30, 2011. With no additional funding, states that receive Supplemental Grants will receive only 66 percent of the funding they have received in previous years.

Congress created the Supplemental Grants along with the TANF block grant in order to provide additional funds to two groups of states potentially disadvantaged by the TANF block grant formula: states with high population growth and states that historically had provided relatively small welfare grants per poor person (most of which are poorer-than-average states).[8] Seventeen states receive Supplemental Grants. Congress has consistently renewed the grants since 1996; this is the first time it has not fully funded them (see Table 2). [9]

Elimination of Child Support Incentive Funding Adds to Federal Cutbacks

In addition to cuts in TANF funding, states face cuts in the child support matching funds they receive from the federal government. The Deficit Reduction Act of 2005 (DRA) reduced federal child support funding by 20 percent by eliminating longstanding incentive payments that states had earned and then reinvested in their child support programs based on their performance rates. The 2009 Recovery Act suspended this DRA provision for 2009 and 2010, providing states with $1 billion that helped prevent cutbacks in state child support programs. Those funds, however, expired on September 30, and the new TANF extension law does not continue them. As a result, states will receive an estimated $670 million less in federal child support funding in 2011 than in 2010.

When the Contingency Fund was exhausted last year, states were still able to get additional federal help through the TANF Emergency Fund, created by the 2009 Recovery Act. For 2009 and 2010 combined, a state could receive up to 50 percent of one year’s TANF block grant amount from the Contingency Fund and the Emergency Fund together. The Emergency Fund expired on September 30, however, and with policymakers redirecting to other purposes all of the money remaining in the Contingency Fund, the federal government will fail — for the first time since TANF’s creation in 1996 — to provide any additional resources to states where poverty and need have climbed substantially as a consequence of hard economic times.

Emergency Fund Supported Jobs and Emergency Help But Ended Too Soon

The TANF Emergency Fund, which Congress created in 2009, provided $5 billion to states for 2009 and 2010 to help with the increased cost of serving needy families. With these funds, states provided emergency help (such as payments to avert utility shutoffs) and placed 250,000 low-income adults and youth in subsidized jobs. All states except Wyoming applied for and received Emergency Funds. Since the fund’s expiration, many states have shut down or drastically reduced their subsidized jobs programs and have discontinued initiatives they had developed in response to the recession to help families with emergency needs.

Non-Financial TANF Changes

In addition to extending the TANF block grant and limiting funding for the Supplemental Grants and the Contingency Fund for 2011, the new law also makes other temporary changes in TANF.

- Healthy marriage and responsible fatherhood fund . The legislation broadens the scope of “healthy marriage” activities and specifies that $75 million apiece is appropriated for marriage activities and for fatherhood activities for 2011 (for a total of $150 million). The total funding level for these activities remains the same as in previous years but is now allocated differently between the two activities.

- Additional data reporting requirements on work participation status. States are required to file two reports in 2011 — one by May 31 for the month of March and one by August 31 for the April-June period. The reports must include detail about the types of work-related activities that each work-eligible individual engages in during the reporting period, including specific reasons why the activities may not count toward the state’s work participation rate and reasons for non-participation for individuals who have no hours of participation.

- More detailed reporting on TANF spending. States are required to provide additional information on TANF and MOE spending for the months covered in the two new reports due in 2011. They will have to provide more detail on expenditures that are in the “other” category or that are provided in accordance with authority provided under pre-TANF law. HHS may also require states to report other spending information as the Secretary deems appropriate.

- Additional congressional reports. HHS must submit two reports to Congress summarizing the state reports. The reports are to include recommendations for legislative or administrative changes as the Secretary deems necessary to require states to report this information on a recurring basis.

- New penalties. A state that fails to submit required reports by the applicable deadlines is subject to a penalty of up to 4 percent of its block grant allocation. The penalty can be rescinded if the report is filed by an extension deadline, and limited penalty reduction may be available.

The initiatives that states implemented under the TANF Emergency Fund helped provide wages for subsidized jobs, as well as other types of short-term help to low-income families who were hit hard by the recession. Many of these state initiatives ended when the Emergency Fund ended on September 30. A number of states indicated that they would have continued these programs had the funding not expired and that they could restart them if Congress were once again to provide additional resources for the activities the fund supported.

Subsidized Jobs

When the TANF Emergency Fund expired on September 30, tens of thousands of people lost subsidized jobs supported by the fund; tens of thousands more will lose their jobs within the next four to six weeks as states that continued their programs on a short-term basis in hopes of a congressional extension reach the end of their funding capacity. Here are a few examples:

- Los Angeles County placed over 10,000 parents in subsidized jobs in 2009 and 2010 and served over 18,000 youth in a summer jobs program in 2010. When the Emergency Fund expired on September 30, the county stopped subsidizing the wages for 6,000 adults; while some of these people have moved into unsubsidized positions, the vast majority are now without work.

- Illinois continued its subsidized jobs program, initially through November 30 and more recently through January 15, with state funds. The state is facing a large budget deficit, however, and cannot continue this successful program on a longer-term basis without renewed federal funding. When the state stops providing subsidies, about 17,000 persons will lose their jobs.

- Among the states that have completely ended their subsidized jobs programs are Florida, Mississippi, and Kentucky, which together provided jobs for over 10,000 adults (plus additional summer youth positions), thereby bringing tens of millions of dollars of earnings into families, local communities, and the state economy.

Short-Term, Non-Recurrent Benefits

The extra federal dollars available under the TANF Emergency Fund spurred at least 20 states to create new initiatives to help families facing hard times. States received over $2 billion in reimbursements for increased spending on short-term non-recurrent initiatives. Nearly all of the new initiatives have ended.

Many of these programs served a broader group of low-income families and were not limited to families receiving cash assistance. A number of states developed initiatives to help families with housing and utility expenses. For example, Georgia (in collaboration with the United Way and other local partner agencies) created a highly successful program that helped 23,000 families catch up on past-due housing-related debts, including rent, mortgage, and utility bills. Maine (in collaboration with three utility companies) created a program to pay off utility arrearages, preventing shut-offs to about 7,000 low-income families.

A number of states, including Texas and Oklahoma, also used TANF Emergency Funds to provide food to needy families. Other states used Emergency Funds for other types of new initiatives. For example, Mississippi created a new program (now ended) to provide grants of up to $5,000 to low-income people to start their own businesses.

Basic Assistance

TANF cash assistance provides a safety net for families that cannot find employment and do not qualify for unemployment insurance (or whose unemployment benefits have run out). While TANF’s responsiveness to the recession has been uneven across the states, it has provided critical support to families in a number of states where the economy is weak and jobs are scarce.

Without additional federal funding, states will now have a much harder time meeting the increased demand for assistance at a time when unemployment remains high and poverty continues to climb. (Historically, poverty continues to rise for at least a year after the unemployment rate begins to decline.) Several states are considering cutting the already-low amount of assistance they provide to very poor families with children, tightening eligibility rules so as to reduce or eliminate benefits for some groups of needy families with children, and cutting other services, such as child care, that are funded in part or in whole with state or federal TANF dollars.

Conclusion

Low-income families are especially vulnerable to economic downturns and generally lack significant savings to draw upon. Recognizing the shortcomings of a fixed block grant during economic downturns with high unemployment, the 1996 welfare reform law created the TANF Contingency Fund to help states respond to increased need during hard economic times. More recently, recognizing the extraordinary hardship created by the current downturn, policymakers created the TANF Emergency Fund to provide additional resources to states to help low-income families weather the economic slump.

Now, for the first time since TANF’s creation, states will have no extra federal resources to draw upon to respond to increased need. With less funding and few jobs available, there also is considerable risk of seriously weakening states’ abilities to maintain a strong work focus in their TANF programs.

This is not what Congress intended when it reformed the welfare system in 1996. Helping welfare recipients find work in this economy requires more help from the federal government, not less.

| Table 1: Decline in Federal TANF Funds Available to States in FY 2011 | |||

| Total Annual Average Federal TANF Funds (FY 2009 and FY 2010)a (in millions) | Total Estimated Federal TANF Funds FY 2011b (in millions) | Percent Decline in Federal TANF Funds From FY2009/2010 (Annual Average) to FY 2011 (Total Estimate)c | |

| Alabama | $125.8 | $100.6 | -20.0% |

| Alaska | $54.9 | $53.2 | -3.0% |

| Arizona | $257.1 | $226.0 | -12.1% |

| Arkansas | $75.0 | $63.7 | -15.1% |

| California | $4,286.6 | $3,659.9 | -14.6% |

| Colorado | $183.6 | $151.8 | -17.3% |

| Connecticut | $286.3 | $266.8 | -6.8% |

| Delaware | $40.4 | $33.9 | -16.0% |

| District of Columbia | $115.8 | $97.2 | -16.0% |

| Florida | $713.0 | $602.2 | -15.5% |

| Georgia | $409.7 | $355.3 | -13.3% |

| Hawaii | $123.6 | $103.9 | -16.0% |

| Idaho | $34.5 | $32.7 | -5.1% |

| Illinois | $711.5 | $585.1 | -17.8% |

| Indiana | $220.2 | $206.8 | -6.1% |

| Iowa | $148.2 | $131.0 | -11.6% |

| Kansas | $125.4 | $107.0 | -14.7% |

| Kentucky | $205.9 | $181.3 | -11.9% |

| Louisiana | $222.0 | $175.2 | -21.1% |

| Maine | $90.6 | $78.1 | -13.7% |

| Maryland | $286.4 | $240.5 | -16.0% |

| Massachusetts | $574.2 | $482.3 | -16.0% |

| Michigan | $969.2 | $814.1 | -16.0% |

| Minnesota | $308.4 | $263.4 | -14.6% |

| Mississippi | $109.7 | $92.7 | -15.5% |

| Missouri | $241.7 | $217.1 | -10.2% |

| Montana | $44.3 | $38.8 | -12.4% |

| Nebraska | $65.6 | $57.5 | -12.3% |

| Nevada | $58.6 | $48.6 | -17.1% |

| New Hampshire | $43.8 | $38.5 | -12.0% |

| New Jersey | $505.0 | $424.2 | -16.0% |

| New Mexico | $144.8 | $120.4 | -16.8% |

| New York | $3,053.7 | $2,565.1 | -16.0% |

| North Carolina | $413.9 | $341.2 | -17.6% |

| North Dakota | $29.3 | $26.4 | -9.8% |

| Ohio | $850.3 | $728.0 | -14.4% |

| Oklahoma | $158.7 | $145.3 | -8.4% |

| Oregon | $208.5 | $175.1 | -16.0% |

| Pennsylvania | $768.3 | $719.5 | -6.4% |

| Rhode Island | $99.1 | $95.0 | -4.1% |

| South Carolina | $125.0 | $105.0 | -16.0% |

| South Dakota | $24.7 | $21.3 | -13.9% |

| Tennessee | $261.0 | $215.3 | -17.5% |

| Texas | $660.5 | $521.0 | -21.1% |

| Utah | $101.0 | $81.4 | -19.5% |

| Vermont | $54.0 | $47.4 | -12.4% |

| Virginia | $174.2 | $158.3 | -9.1% |

| Washington | $476.2 | $400.0 | -16.0% |

| West Virginia | $135.2 | $110.2 | -18.5% |

| Wisconsin | $371.2 | $330.2 | -11.0% |

| Wyoming | $18.5 | $18.5 | 0.0% |

| Total | $19,765.0 | $16,854.2 | -14.7% |

| aThe average for Fiscal Years 2009 and 2010 is calculated by summing all funds received for the two years — TANF Block Grant + Contingency Funds + Supplemental Grants + TANF Emergency Fund for FY 2009 and FY 2010— and dividing by two. The TANF Block Grant and Supplemental Grant amounts that a given state received are the same for each of the two years. A state could have received Contingency Funds and TANF Emergency Funds in either FY 2009 or FY 2010 or in both years. (States received more of the TANF Emergency Funds in FY 2010 than in FY 2009.) To make the table simpler, however, we assume here that states received these funds equally across the two years. bEstimated Federal TANF Funds for FY 2011: TANF Block Grant + Contingency Funds + Supplemental Grants. cThe percentage decline is calculated as the difference between the annual average Federal TANF funding a state received in FY 2009/2010 and the estimated Federal TANF funding for FY 2011. | |||

| Table 2: Estimated FY 2011 Federal TANF Funds | ||||

| TANF Block Granta (in millions) | TANF Contingency Fundb (in millions) | TANF Supplemental Grantsc (in millions) | Total Estimated TANF Federal Funds FY 2011 (in millions) | |

| Alabama | $93.3 | $0 | $7.3 | $100.6 |

| Alaska | $46.4 | $2.3 | $4.5 | $53.2 |

| Arizona | $200.2 | $10.0 | $15.8 | $226.0 |

| Arkansas | $56.7 | $2.8 | $4.1 | $63.7 |

| California | $3,659.9 | $0 | $0 | $3,659.9 |

| Colorado | $136.1 | $6.8 | $9.0 | $151.8 |

| Connecticut | $266.8 | $0 | $0 | $266.8 |

| Delaware | $32.3 | $1.6 | $0 | $33.9 |

| District of Columbia | $92.6 | $4.6 | $0 | $97.2 |

| Florida | $562.3 | $0 | $39.9 | $602.2 |

| Georgia | $330.7 | $0 | $24.6 | $355.3 |

| Hawaii | $98.9 | $4.9 | $0 | $103.9 |

| Idaho | $30.4 | $0 | $2.3 | $32.7 |

| Illinois | $585.1 | $0 | $0 | $585.1 |

| Indiana | $206.8 | $0 | $0 | $206.8 |

| Iowa | $131.0 | $0 | $0 | $131.0 |

| Kansas | $101.9 | $5.1 | $0 | $107.0 |

| Kentucky | $181.3 | $0 | $0 | $181.3 |

| Louisiana | $164.0 | $0 | $11.2 | $175.2 |

| Maine | $78.1 | $0 | $0 | $78.1 |

| Maryland | $229.1 | $11.5 | $0 | $240.6 |

| Massachusetts | $459.4 | $23.0 | $0 | $482.3 |

| Michigan | $775.4 | $38.8 | $0 | $814.1 |

| Minnesota | $263.4 | $0 | $0 | $263.4 |

| Mississippi | $86.8 | $0 | $6.0 | $92.7 |

| Missouri | $217.1 | $0 | $0 | $217.1 |

| Montana | $38.0 | $0 | $0.7 | $38.8 |

| Nebraska | $57.5 | $0 | $0 | $57.5 |

| Nevada | $43.9 | $2.2 | $2.5 | $48.6 |

| New Hampshire | $38.5 | $0 | $0 | $38.5 |

| New Jersey | $404.0 | $20.2 | $0 | $424.2 |

| New Mexico | $110.6 | $5.5 | $4.3 | $120.4 |

| New York | $2,442.9 | $122.1 | $0 | $2,565.1 |

| North Carolina | $302.2 | $15.1 | $23.8 | $341.2 |

| North Dakota | $26.4 | $0 | $0 | $26.4 |

| Ohio | $728.0 | $0 | $0 | $728.0 |

| Oklahoma | $145.3 | $0 | $0 | $145.3 |

| Oregon | $166.8 | $8.3 | $0 | $175.1 |

| Pennsylvania | $719.5 | $0 | $0 | $719.5 |

| Rhode Island | $95.0 | $0 | $0 | $95.0 |

| South Carolina | $100.0 | $5.0 | $0 | $105.0 |

| South Dakota | $21.3 | $0 | $0 | $21.3 |

| Tennessee | $191.5 | $9.6 | $14.2 | $215.3 |

| Texas | $486.3 | $0 | $34.8 | $521.0 |

| Utah | $75.6 | $0 | $5.7 | $81.4 |

| Vermont | $47.4 | $0 | $0 | $47.4 |

| Virginia | $158.3 | $0 | $0 | $158.3 |

| Washington | $381.0 | $19.0 | $0 | $400.0 |

| West Virginia | $110.2 | $0 | $0 | $110.2 |

| Wisconsin | $314.5 | $15.7 | $0 | $330.2 |

| Wyoming | $18.5 | $0 | $0 | $18.5 |

| Total | $16,309.1 | $334.2 | $210.8 | $16,854.2 |

| aThe TANF Block Grant amount remains unchanged each year for all states. bThe amount of Contingency Funds allocated to each state by HHS as of December 3, 2010. States that qualify for Contingency Funds are eligible to receive an amount equal to 20 percent of their block grant, with 1/12 of this amount awarded on a monthly basis. As no funding will remain available for the Contingency Fund after the FY 2011 TANF extension is enacted, the maximum amount that a state can receive for 2011 is the three-month’s worth of Contingency Funds provided by the Continuing Resolution which was enacted at the end of federal fiscal year 2010. cAssumes states receive 66 percent of the amount they received in prior years. This is the amount of funding available to cover the cost of the Supplemental Grants for FY 2011 after eligible states receive the Contingency Funds awarded to them for the first quarter of FY 2011. | ||||

| Table 3: Federal TANF Funds, FY 2009 and 2010 | |||||

| TANF Block Grant (Per Year) (in millions) | Contingency Fund (Total FY 2009 & FY 2010) (in millions) | TANF Emergency Funds Approved (Total FY 2009 & FY 2010) (in millions) | Supplemental Grants (Per Year) (in millions) | Total Annual Average Federal TANF Funds (FY 2009 & FY 2010)a (in millions) | |

| Alabama | $93.3 | $0 | $42.9 | $11.1 | $125.8 |

| Alaska | $46.4 | $0 | $3.1 | $6.9 | $54.9 |

| Arizona | $200.2 | $61.6 | $4.4 | $23.9 | $257.1 |

| Arkansas | $56.7 | $17.5 | $6.6 | $6.2 | $75.0 |

| California | $3,659.9 | $0 | $1,253.5 | $0 | $4,286.6 |

| Colorado | $136.1 | $30.0 | $38.0 | $13.6 | $183.6 |

| Connecticut | $266.8 | $0 | $39.0 | $0 | $286.3 |

| Delaware | $32.3 | $7.7 | $8.5 | $0 | $40.4 |

| District of Columbia | $92.6 | $5.1 | $41.2 | $0 | $115.8 |

| Florida | $562.3 | $0 | $180.5 | $60.4 | $713.0 |

| Georgia | $330.7 | $0 | $83.4 | $37.3 | $409.7 |

| Hawaii | $98.9 | $22.2 | $27.3 | $0 | $123.6 |

| Idaho | $30.4 | $0 | $1.1 | $3.5 | $34.5 |

| Illinois | $585.1 | $0 | $252.9 | $0 | $711.5 |

| Indiana | $206.8 | $0 | $26.8 | $0 | $220.2 |

| Iowa | $131.0 | $0 | $34.3 | $0 | $148.2 |

| Kansas | $101.9 | $18.7 | $28.2 | $0 | $125.4 |

| Kentucky | $181.3 | $0 | $49.1 | $0 | $205.9 |

| Louisiana | $164.0 | $0 | $82.0 | $17.0 | $222.0 |

| Maine | $78.1 | $0 | $24.9 | $0 | $90.6 |

| Maryland | $229.1 | $46.7 | $67.8 | $0 | $286.4 |

| Massachusetts | $459.4 | $118.6 | $111.1 | $0 | $574.2 |

| Michigan | $775.4 | $155.1 | $232.6 | $0 | $969.2 |

| Minnesota | $263.4 | $0 | $90.0 | $0 | $308.4 |

| Mississippi | $86.8 | $0 | $27.8 | $9.0 | $109.7 |

| Missouri | $217.1 | $0 | $49.3 | $0 | $241.7 |

| Montana | $38.0 | $0 | $10.2 | $1.1 | $44.3 |

| Nebraska | $57.5 | $0 | $16.2 | $0 | $65.6 |

| Nevada | $43.9 | $6.6 | $15.4 | $3.7 | $58.6 |

| New Hampshire | $38.5 | $0 | $10.5 | $0 | $43.8 |

| New Jersey | $404.0 | $0 | $202.0 | $0 | $505.0 |

| New Mexico | $110.6 | $26.2 | $29.0 | $6.6 | $144.8 |

| New York | $2,442.9 | $498.4 | $723.0 | $0 | $3,053.7 |

| North Carolina | $302.2 | $71.7 | $79.4 | $36.1 | $413.9 |

| North Dakota | $26.4 | $0 | $5.7 | $0 | $29.3 |

| Ohio | $728.0 | $0 | $244.7 | $0 | $850.3 |

| Oklahoma | $145.3 | $0 | $26.8 | $0 | $158.7 |

| Oregon | $166.8 | $0 | $83.4 | $0 | $208.5 |

| Pennsylvania | $719.5 | $0 | $97.6 | $0 | $768.3 |

| Rhode Island | $95.0 | $0 | $8.1 | $0 | $99.1 |

| South Carolina | $100.0 | $30.9 | $19.1 | $0 | $125.0 |

| South Dakota | $21.3 | $0 | $6.9 | $0 | $24.7 |

| Tennessee | $191.5 | $45.5 | $50.3 | $21.6 | $261.0 |

| Texas | $486.3 | $0 | $243.1 | $52.7 | $660.5 |

| Utah | $75.6 | $17.9 | $15.5 | $8.7 | $101.0 |

| Vermont | $47.4 | $0 | $13.4 | $0 | $54.0 |

| Virginia | $158.3 | $0 | $31.8 | $0 | $174.2 |

| Washington | $381.0 | $76.1 | $114.3 | $0 | $476.2 |

| West Virginia | $110.2 | $0 | $50.1 | $0 | $135.2 |

| Wisconsin | $314.5 | $62.9 | $50.5 | $0 | $371.2 |

| Wyoming | $18.5 | $0 | $0 | $0 | $18.5 |

| Total | $16,309.1 | $1,319.5 | $4,953.4 | $319.5 | $19,765.0 |

| a The average for Fiscal Years 2009 and 2010 is calculated by summing all funds received for the two years and dividing by two. The TANF Block Grant and Supplemental Grant amounts that a given state received are the same for each of the two years. A state could have received Contingency Funds and TANF Emergency Funds in either FY 2009 or FY 2010 or in both years. (States received more of the TANF Emergency Funds in FY 2010 than in FY 2009.) To make the table simpler, however, we assume here that states received these funds equally across the two years. | |||||

Statement: Chad Stone, Chief Economist, on the November Employment Report

End Notes

[1] Statement: Chad Stone, Chief Economist, on the November Employment Report, Center on Budget and Policy Priorities, December 3, 2010.

[2] Arloc Sherman, “Deep Poverty Reaches Record High Nationwide” (podcast), Center on Budget and Policy Priorities, October 12, 2010.

[3] U.S. Department of Housing and Urban Development, Office of Community Planning and Development,The 2009 Annual Homeless Assessment Report to Congress, June 2010, http://www.hudhre.info/documents/5thHomelessAssessmentReport.pdf .

[4] For discussion of state budget gaps for 2011 and 2012, see Elizabeth McNichol, Phil Oliff, and Nicholas Johnson, “States Continue to Feel Recession’s Impact,” Center on Budget and Policy Priorities, updated October 7, 2010.

[5] It did not rescind the 2012 Contingency Fund amount.

[6] If a state qualifies for Contingency Funds for all 12 months of a fiscal year, it can receive an amount equal to up to 20 percent of its TANF block grant amount. Since the Contingency Funds are available only for three months of 2011 (October, November, and December), the maximum that a state can receive in 2011 will be one quarter of the 20 percent, or 5 percent of its TANF block grant amount.

[7] To receive Contingency Funds, a state must meet certain poor-economic-conditions requirements for each month for which it seeks Contingency Funds and meet special maintenance-of-effort (MOE) rules relating to state spending. While nearly all states have met the economic conditions requirements during many months of the recession, many states have indicated that the MOE rules make accessing these funds impossible for them. Thus, not all states facing high unemployment or increased demand for assistance have received assistance from the Contingency Fund during the recession.

[8] For background on the Supplemental Grants and the TANF Contingency Fund, see Gene Falk, “Temporary Assistance for Needy Families (TANF) Block Grant: FY 2007 Budget Proposals,” Congressional Research Service, March 3, 2006, http://www.nationalaglawcenter.org/assets/crs/RS22385.pdf.

[9] The 17 states that qualify for Supplemental Grants are set in law and do not change from year to year. They are: Alabama, Alaska, Arizona, Arkansas, Colorado, Florida, Georgia, Idaho, Louisiana, Mississippi, Montana, Nevada, New Mexico, North Carolina, Tennessee, Texas, and Utah. See Tables 2 and 3 for the amount that each state received in 2010 and will receive in 2011.

More from the Authors