Statement: Chad Stone, Chief Economist, on the October Employment Report

Today’s jobs report shows that although the economy turned up in the third quarter, the labor market did not. The unemployment rate crossed into double digits in October, and payrolls shrank for the 22nd straight month.

The economy is in a very deep hole and faces a long climb back to full employment. Policymakers can make that climb easier by extending or bolstering key provisions of the economic recovery legislation that the Administration and Congress enacted at the start of the year — particularly those related to unemployment insurance and state fiscal relief, whose scheduled expiration would otherwise exert a job-killing drag on the fragile recovery.

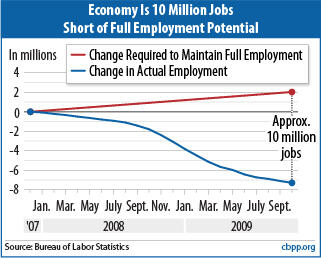

Since the recession began in December 2007, employers’ payrolls have shrunk by 7.3 million jobs. That figure is expected to swell to about 8 million when the Labor Department issues revised data in February. But the job shortfall is even larger than that because, with the U.S. population continuing to grow, the number of jobs needed for full employment has grown by about 2 million since the start of the recession. In other words, the economy is about 10 million jobs short of full employment.

As serious as it is, the jobs gap would have been substantially larger without the job-creating boost to the economy from this year’s economic recovery legislation. But, as noted above, two key components of that legislation are scheduled to expire at inopportune times. Congress should, at a minimum, take action on both of them.

Specifically, the emergency unemployment insurance measures providing relief to workers struggling to find jobs in a very tough labor market are scheduled to expire at the end of this year, even though the unemployment rate will likely still be rising and jobs will still be extremely scarce. In addition, fiscal assistance to cash-strapped state governments, which are required to balance their budgets even in the face of falling revenue and rising needs, is scheduled to expire at the end of next year. Facing looming budget shortfalls and the expiration of federal assistance, states will have to institute new rounds of steep budget cuts and tax increases when their next fiscal year starts (generally on July 1, 2010).

Policymakers should extend the UI provisions and provide additional state fiscal relief to promote a strong and sustainable economic recovery.

About the October Jobs Report

A host of data in today’s report illustrate the ongoing weakness in the labor market.

- Although the pace of job losses has slowed considerably since the start of the year, private and government payrolls combined have shrunk for 22 straight months, and net job losses since the start of the recession total 7.3 million. (Private sector payrolls have shrunk by 7.4 million jobs over the period.) Each February, the Labor Department’s Bureau of Labor Statistics issues revisions to its payroll employment statistics based on more complete information, and preliminary estimates indicate these revisions could add about another 800,000 job losses to these figures.

- Job losses of 190,000 in October (all in the private sector) are about the same as the average over the past three months of 188,000. That rate is less than a third of the 645,000 jobs per month lost over the November 2008 to April 2009 period.

- The unemployment rate, which was 4.9 percent at the start of the recession, rose to 10.2 percent in October, a rate last seen in April 1983. Potential job-seekers remained on the sideline as labor force participation edged down to 65.1 percent. It has not been lower since February 1986.

- With labor force participation falling in October and the unemployment rate rising, the percentage of the population with a job fell to 58.5 percent, its lowest level since October 1983.

- The Labor Department’s most comprehensive alternative unemployment rate measure — which includes people who want to work but are discouraged from looking and people working part time because they can’t find full-time jobs — jumped to 17.5 percent in October. That figure is 8.8 percentage points higher than when the recession began, and it is the highest on record in data that go back to 1994.

- Over a third (35.6 percent) of the 15.7 million people who are unemployed have been looking for work for 27 weeks or longer. That’s the same as September, which was the highest percentage on record in data going back to 1948. Regular unemployment insurance (UI) benefits typically run out after 26 weeks.

The Center on Budget and Policy Priorities is a nonprofit, nonpartisan research organization and policy institute that conducts research and analysis on a range of government policies and programs. It is supported primarily by foundation grants.